Understanding the Limits of Credit Monitoring: What You Need to Know

Understanding the limits of credit monitoring is essential for safeguarding your financial health. Credit monitoring can alert you to changes in your credit report, but it can’t prevent fraud or identity theft. This article will explain what credit monitoring can and cannot do, so you can take the best steps to protect your credit.

Key Takeaways

Credit monitoring services provide alerts about changes to credit reports but cannot prevent identity theft or fraud.

Comprehensive coverage requires monitoring all three major credit bureaus, as each may have distinct information affecting your credit profile.

To enhance protection, individuals should consider additional steps such as implementing a credit freeze and fraud alerts, alongside using credit monitoring services.

What Credit Monitoring Can and Cannot Do

Credit monitoring services keep an eye on the activity reported by major credit bureaus, including credit reporting from Experian, Equifax, and TransUnion. These services notify users about changes made to their credit reports, including new accounts and drops in credit scores. Receiving these alerts allows you to swiftly identify and address potential fraud, minimizing the risk of long-term damage to your credit profile.

However, it is crucial to understand that credit monitoring services cannot stop someone from using your information to obtain credit. They do not protect you from phishing attacks or data breaches, which can still lead to identity theft. Credit monitoring is a reactive tool, alerting you to changes only after they occur.

Knowing the capabilities and limitations of credit monitoring allows you to take additional protective measures against identity theft. These services provide valuable alerts but should be part of a broader strategy that includes proactive steps to protect your personal information.

The Scope of Credit Monitoring Alerts

Credit monitoring services offer a range of alerts to keep you informed about changes to your credit profile. These alerts typically include notifications of new account openings, credit score modifications, and significant transactions. Users can also expect alerts for credit inquiries and changes in credit limits. Such notifications are essential for identifying unauthorized activity promptly.

The effectiveness of these alerts depends on their timeliness. Immediate notifications allow you to act quickly, preventing further unauthorized use of your information. Staying vigilant and responding promptly to alerts can mitigate the impact of potential identity theft.

Identity Theft Prevention Myths

A common misconception is that credit monitoring services can prevent identity theft. In reality, these services cannot stop fraud but only alert you when it may be occurring. No credit monitoring service can guarantee that your personal information will not be compromised.

Enhance protection by placing a credit freeze or a fraud alert on your credit report. A credit freeze ensures that no one can access your credit report to open new accounts, while fraud alerts notify creditors to verify your identity before issuing new credit. Together, these measures can provide a robust defense against identity theft.

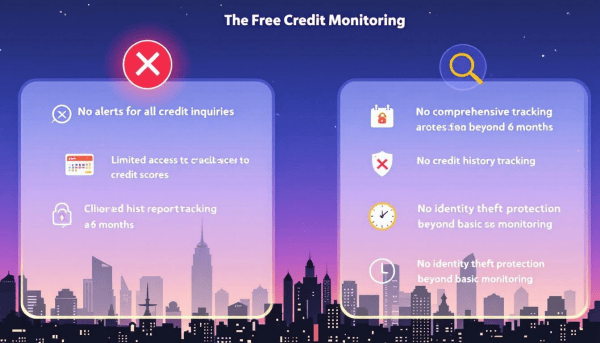

Limits of Free Credit Monitoring Services

Free credit monitoring services often come with limitations. They typically monitor only one or two of the three major credit bureaus, leaving gaps in coverage. Additionally, users of free services may encounter restrictions in the types and frequency of alerts they receive. Many credit monitoring services may focus primarily on significant updates to credit scores and reports, potentially missing smaller yet crucial changes. Free credit reports can provide additional insights into one’s credit history.

Moreover, free credit monitoring generally lacks extensive identity theft protection features found in paid options. While these services can provide basic alerts, they may not offer the comprehensive protection needed to safeguard your credit fully.

Paid Credit Monitoring Services: Are They Worth It?

Most paid credit monitoring services cost between $200 to over $300 annually. These services offer more comprehensive coverage, including monitoring all three major credit bureaus and providing extensive identity theft protection. However, it’s essential to be aware of potential limitations, such as arbitration clauses that can restrict your legal options.

For individuals who are unwilling or unable to monitor their credit independently, paid credit monitoring providers can be a worthwhile investment. They provide peace of mind by offering robust monitoring and protection features, ensuring that you are promptly alerted to any suspicious activity.

Importance of Monitoring All Three Major Credit Bureaus

Monitoring all three major credit bureaus—Experian, Equifax, and TransUnion—provides a comprehensive view of your credit profile. Each bureau may have different information, making it essential to check all three to ensure accuracy and completeness. Daily monitoring across all three bureaus can alert you to new inquiries and negative information added to your credit reports.

Relying on just one credit bureau can leave you unaware of critical changes or issues present in your records with the others. Opt for a service that includes monitoring all three major credit bureaus to achieve comprehensive protection. This approach ensures that you are fully informed about your credit status and can take timely action if needed.

Beyond Credit Monitoring: Additional Steps for Protecting Your Credit

Implementing a credit freeze is one of the most effective ways to protect your credit. A credit freeze ensures that no one can access your credit report to open new accounts, providing a strong layer of protection against identity theft. Combining a credit freeze with a fraud alert can further enhance your defense.

Fraud alerts notify creditors to verify your identity before issuing new credit, which can help prevent unauthorized accounts from being opened. An initial fraud alert is valid for one year and can be renewed, while extended fraud alerts can last for up to seven years.

Additionally, regularly reviewing your bank account and credit card statements can help you identify unauthorized transactions quickly. By taking these proactive steps, you can significantly reduce the risk of identity theft and protect your financial health.

How to Choose the Right Credit Monitoring Service

When choosing a credit monitoring service, consider your goals, needs, and budget. Evaluate the services included, cancellation policies, and any hidden fees. Some credit monitoring services offer free trials or money-back guarantees, allowing you to test their features before committing.

Customer reviews and ratings can provide valuable insights into the reliability of different credit monitoring services. Additionally, assess the level of customer support offered, including its availability and responsiveness. By considering these factors, you can select a service that best meets your needs and provides comprehensive protection.

Summary

Understanding the limits of credit monitoring services is crucial for protecting your financial health. These services can alert you to changes in your credit report, helping you respond quickly to potential fraud. However, they cannot prevent identity theft or stop fraud from occurring.

To achieve comprehensive protection, consider using a combination of credit monitoring, credit freezes, and fraud alerts. By staying vigilant and proactive, you can safeguard your credit and financial well-being. Choose a credit monitoring service that meets your needs and offers robust protection features to ensure peace of mind.

Frequently Asked Questions

What can credit monitoring services do?

Credit monitoring services track changes in your credit reports from major bureaus and alert you to new accounts or credit score fluctuations. This helps you stay informed and protect your credit health.

Can credit monitoring prevent identity theft?

Credit monitoring cannot prevent identity theft; it merely alerts you to potential fraud. It is essential to take additional security measures to protect your personal information effectively.

What are the limitations of free credit monitoring services?

Free credit monitoring services typically monitor only one or two of the three major credit bureaus, limiting the comprehensiveness of alerts. As a result, users may not receive timely notifications for all potential credit issues.

Are paid credit monitoring services worth the cost?

Paid credit monitoring services are worth the cost for individuals who prefer a more comprehensive solution and require assistance in monitoring their credit, providing added peace of mind.

Why is it important to monitor all three major credit bureaus?

It is crucial to monitor all three major credit bureaus to obtain a complete and accurate understanding of your credit profile, as inconsistencies can exist among them. This practice helps protect your creditworthiness and can prevent potential issues from affecting your financial health.