Understanding the Privacy Risks of Credit Monitoring Services

Credit monitoring services track your financial activity and alert you to any suspicious changes, but they may also expose you to privacy risks. These services collect extensive personal data, share it with third parties, and are vulnerable to data breaches. In this article, we’ll break down the key privacy risks of credit monitoring and how to minimize them.

Key Takeaways

Credit monitoring services can enhance identity theft protection but come with significant privacy risks, including extensive data collection and potential data sharing with third parties.

Users should carefully review the privacy policies and security measures of credit monitoring services to ensure their personal data is adequately protected and handled responsibly.

Legal protections, such as the Fair Credit Reporting Act and FTC guidelines, provide consumers with rights regarding their credit information and data privacy, which are essential for informed decision-making.

Privacy Risks of Credit Monitoring Services

Credit monitoring services track your credit profiles and alert you to suspicious activities such as new credit inquiries or changes in your credit score. While these services are primarily designed to prevent identity theft and provide peace of mind to users, they also pose significant privacy risks. Not all credit monitoring services are created equal, and some may present more substantial risks than others, according to the credit bureau.

Understanding these risks is key to protecting your personal information.

Data Collection Practices

Credit monitoring services collect extensive amounts of personal information to provide accurate monitoring. This data includes sensitive information such as social security numbers, financial history, and other personal identifiers. While this data collection is necessary for the services to function correctly, it also raises significant privacy concerns. The more data these services collect, the greater the potential impact if a data breach occurs.

Under the Fair Credit Reporting Act, consumers have the right to dispute incorrect information in their credit reports and to be informed about adverse actions based on their credit history. This means that while credit monitoring services collect and manage a wealth of personal information, there are legal protections in place to ensure that this data is used appropriately.

Users should stay vigilant about data handling and storage.

Data Sharing with Third Parties

One of the significant privacy risks associated with credit monitoring services is the sharing of personal data with third parties. These services often share users’ financial data and contact details with advertisers and financial institutions. While this data sharing can enhance the offerings and functionality of the service, it also opens up potential privacy breaches and misuse of personal information.

The risks are not just hypothetical. There have been instances where shared data has been misused or inadequately protected, leading to unauthorized access and exploitation. Users need to know what data is shared and with whom to make informed privacy decisions.

Risk of Data Breaches

The risk of data breaches is a significant concern for users of credit monitoring services. These breaches can expose sensitive personal information to identity thieves, leading to identity fraud and other financial crimes. Once your data has been compromised, you may face a lifelong risk of identity theft, as stolen information can be used and sold indefinitely.

Credit monitoring services cannot prevent unauthorized credit applications or phishing emails. While they provide alerts to potential fraud and unauthorized transactions, the effectiveness of these alerts in preventing identity theft is limited. Thus, combining these services with additional security measures is necessary for full protection of personal information.

How Credit Monitoring Services Handle Your Data

Credit monitoring services handle vast amounts of sensitive data, and how they manage and secure this data is crucial for user privacy. Consumer protection laws govern how personal data is handled by these services, ensuring privacy and security. These laws ensure that consumer reporting agencies cannot share information without a valid purpose, safeguarding your privacy.

Utilizing these services can enhance protection against identity theft by providing timely alerts about credit changes, as recommended by the Identity Theft Resource Center.

Storage and Security Measures

To protect user data from breaches, credit monitoring services employ various security measures. Encryption and secure servers are standard practices to ensure that sensitive data remains confidential and protected from unauthorized access. Encryption helps in safeguarding data by converting it into a format that is unreadable without a decryption key, making it difficult for hackers to exploit.

Opting for a credit monitoring service with clear privacy practices and strong security protocols is important. Services with strong security measures and clear privacy policies are more likely to protect your data effectively.

Verify the security measures of a credit monitoring service before subscribing to ensure data protection.

User Consent and Transparency

User consent and transparency are critical aspects of how credit monitoring services handle your data. Many services require explicit consent from users before sharing their personal information with third parties. This consent ensures that users are aware of how their data will be used and shared, fostering trust and accountability.

Clear disclosures about data usage are essential for building user trust. Credit monitoring services typically provide detailed information about their data handling practices, ensuring that users are fully informed about how their personal information is managed. By understanding these disclosures, users can make more informed decisions about their privacy and data security.

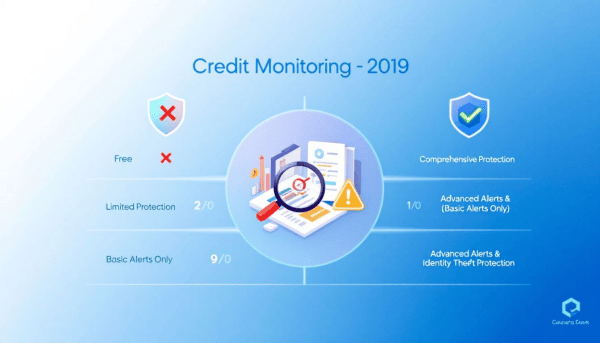

Comparing Free and Paid Credit Monitoring Services

Selecting between free and paid credit monitoring services requires considering the benefits, features, and privacy risks of each. While free services are cost-effective and easy to access, they often come with trade-offs in terms of privacy and data handling.

Paid services, on the other hand, offer more comprehensive coverage and features, but at a higher cost. Recognizing these differences is important for choosing the right service for your needs.

Free Credit Monitoring Services

Free credit monitoring services are popular due to their cost-effectiveness and accessibility. However, these services often require users to compromise on privacy, as they may involve sharing personal data with third parties for revenue generation. This data sharing can lead to an increase in targeted advertisements and potential privacy breaches.

Despite these trade-offs, free credit monitoring services provide basic monitoring and alerts that can help detect and prevent identity theft. They are a good option for those who want to monitor their credit without incurring additional costs. However, users should be aware of the privacy implications and carefully review the terms and conditions before signing up.

Paid Credit Monitoring Services

Paid credit monitoring services offer a more comprehensive credit monitoring service and coverage compared to free ones. These services typically include features like three-bureau monitoring, theft alerts, and identity theft insurance. Monitoring all three credit reports from major credit bureaus is recommended because information on each report can differ, providing a fuller picture of your credit health.

The cost of paid credit monitoring services can be significant, often exceeding $200 per year. However, the enhanced features and comprehensive coverage they offer can provide greater peace of mind and protection against identity theft.

Review your rights and the service’s effectiveness in data protection before committing to a paid service.

Mitigating Privacy Risks When Using Credit Monitoring Services

Mitigating the privacy risks associated with credit monitoring services involves a combination of selecting reputable providers, regularly reviewing privacy policies, and implementing additional security measures. By taking these steps, users can protect their personal information and reduce the risk of unauthorized access and identity theft.

Choosing Reputable Providers

Choosing a credit monitoring service with strong privacy policies can significantly reduce the risk of unauthorized data access. Reputable providers are more likely to have robust security measures and transparent data handling practices.

Researching and choosing a reliable service is a key first step in safeguarding your personal information.

Regularly Reviewing Privacy Policies

Consumers should routinely check and understand the privacy policies of their chosen credit monitoring services. Regular reviews of these policies keep users informed about data handling and protection. Privacy policies can change, and staying updated ensures that users are aware of any new data handling practices.

Consumers should frequently examine these policies to understand the scope of data sharing and storage. Proactively reviewing privacy policies helps maintain control over personal information and ensures appropriate use. This vigilance helps mitigate the risk of privacy breaches and unauthorized data usage.

Implementing Additional Security Measures

Employing unique passwords for different accounts significantly enhances personal data security against unauthorized access. Using unique, strong passwords, along with enabling two-factor authentication, provides a robust defense against potential data breaches and identity theft.

Combining these measures with a broader strategy of monitoring and safeguarding personal information can prevent unauthorized access and identity theft. Updating passwords regularly and staying vigilant about suspicious activity are key practices for data protection.

Legal Protections and Consumer Rights

Knowing the legal protections and consumer rights related to credit monitoring services is vital. These protections ensure that your personal information is handled appropriately and that you have recourse in the event of data misuse. Being aware of your rights helps navigate the complexities of credit monitoring with confidence.

Federal Trade Commission Guidelines

The Federal Trade Commission (FTC) oversees guidelines that mandate credit monitoring services to adhere to privacy and data protection standards. These guidelines require services to protect consumer data and ensure transparency in their practices. The FTC enforces regulations that ensure credit monitoring services provide clear disclosures about their practices and consumer rights.

These guidelines are designed to protect consumers by ensuring that credit monitoring services operate transparently and uphold privacy standards. Being aware of these guidelines helps consumers understand what to expect from their credit monitoring service and how to safeguard their personal information.

Rights Under the Fair Credit Reporting Act

The Fair Credit Reporting Act (FCRA) establishes important consumer rights regarding credit information and reporting. Consumers have the right to dispute incorrect information found in their credit reports and to be informed about adverse actions based on their credit history. Credit reporting agencies are legally obligated to investigate claims of inaccurate information raised by consumers.

These rights ensure that consumers have control over their credit information and can take action to correct any inaccuracies. Knowing your rights under the FCRA is vital for managing your credit and protecting your personal information.

Summary

Throughout this blog post, we have explored the privacy risks associated with credit monitoring services, how these services handle your data, and the differences between free and paid options. We also provided strategies for mitigating these risks and discussed the legal protections and consumer rights that safeguard your personal information.

Informed decisions are crucial in navigating the landscape of credit monitoring services. By understanding the privacy implications and taking proactive steps to protect your data, you can effectively safeguard your financial health and prevent identity theft. Stay vigilant, stay informed, and protect your identity.

Frequently Asked Questions

What are the primary privacy risks of using credit monitoring services?

The primary privacy risks of using credit monitoring services are extensive data collection, potential sharing of your information with third parties, and increased vulnerability to data breaches. Protecting your personal information is crucial, so it’s important to choose services that prioritize your privacy.

How do credit monitoring services protect my data?

Credit monitoring services protect your data by using encryption, secure servers, and ensuring user consent for data sharing while adhering to legal guidelines for consumer protection. This comprehensive approach helps maintain the confidentiality and security of your information.

What is the difference between free and paid credit monitoring services?

The main difference is that free credit monitoring services may compromise privacy for cost savings, while paid services provide more extensive features and security for a fee. Thus, choosing between them depends on your priorities regarding privacy and coverage.

How can I mitigate privacy risks when using credit monitoring services?

To mitigate privacy risks when using credit monitoring services, select reputable providers, review their privacy policies regularly, and enhance your account security with unique passwords and two-factor authentication. These steps will help protect your personal information effectively.

What legal protections do I have as a consumer using credit monitoring services?

As a consumer using credit monitoring services, you are protected under the Fair Credit Reporting Act, which allows you to dispute inaccuracies in your credit reports. Additionally, the FTC offers guidelines to ensure your data is handled transparently and safely.