***Essential Guide to Credit Monitoring and Retirement Planning: Protect Your Future***

Why integrate credit monitoring and retirement planning? Ensuring a secure financial future is vital. Credit monitoring protects against identity theft and fraud, key threats for retirees. This article will explore how to incorporate credit monitoring and retirement planning into your retirement strategy.

Key Takeaways

Credit monitoring is essential for detecting identity theft and fraud, offering timely alerts that enable swift action to protect financial health.

Retirees are particularly vulnerable to identity theft, making credit monitoring and identity theft protection services crucial for securing their finances during retirement.

Choosing the right credit monitoring service requires careful evaluation of features, including coverage across all credit bureaus and cancellation policies, to ensure comprehensive protection.

Understanding Credit Monitoring

Credit monitoring is the process of routinely checking credit reports and monitoring changes to safeguard against fraud. At its core, credit monitoring services track your credit profiles and flag any suspicious activity, offering a streamlined way to stay informed about your financial health. These services act as an early warning system, alerting you to significant changes that could indicate identity theft or fraud.

Credit monitoring primarily aims to shield individuals from identity theft and fraud through timely alerts. When changes occur on credit reports, such as new account openings or large transactions, credit monitoring services notify you, enabling quick action to mitigate potential damage. While these services are highly effective in detecting and alerting users to suspicious activity, it is important to note that they do not prevent identity theft or correct inaccuracies on credit reports.

Another significant advantage of credit monitoring is proactive financial management. Notifications about potential fraud enable you to quickly secure your accounts and personal information. Regular credit monitoring aids in maintaining a healthy credit score, facilitating access to financial products and services.

The Importance of Credit Monitoring for Retirees

Retirees often possess stable credit scores and savings, making them attractive targets for identity theft. The emotional and mental stress common in retirement can further increase vulnerability to scams and fraud. This makes credit monitoring an essential tool for safeguarding financial security during the retirement years.

The types of identity theft risks retirees face are varied and include Social Security fraud, medical identity theft, and financial fraud. Criminals can use a retiree’s Social Security number to collect benefits or file taxes in their name, leading to severe financial losses and legal complications. Additionally, retirees are commonly targeted by scams promising investment opportunities or fake lottery winnings, further emphasizing the need for vigilance.

Safeguarding identity is vital to prevent financial and legal issues, allowing retirees to enjoy their retirement fully. Subscribing to identity theft protection services with credit monitoring enables retirees to receive alerts about suspicious activity, facilitating swift action to prevent identity theft.

Key Features of Credit Monitoring Services

Credit monitoring services typically include access to your credit report and score, ongoing monitoring, and alerts for significant changes related to credit scoring. These services are designed to track credit applications, changes in your credit score, and large transactions, providing a comprehensive overview of your credit activity.

A crucial feature of credit monitoring services is alerting you to changes in your credit history, like new account openings or significant report alterations. This early detection is crucial for identifying potential identity theft or fraud. Some services even go a step further by scanning the dark web for your personal information, adding an extra layer of security.

Paid services typically offer comprehensive coverage across all three major credit bureaus, providing broader protection and detailed monitoring. These services can help detect potential identity theft and fraud by tracking various changes in consumer behavior, offering peace of mind and proactive financial management.

Free vs. Paid Credit Monitoring Services

Consumers can choose between free and paid credit monitoring services. Free services usually track credit scores on a limited basis and may lack the comprehensive scans across the internet that paid services offer. Nevertheless, they can still offer valuable insights and alerts, particularly for individuals with fewer assets at risk.

Conversely, paid services offer extensive monitoring and additional features like identity theft insurance and restoration assistance. Researching and comparing features, limitations, and pricing differences between free and paid options is essential before selecting a service.

Free Credit Monitoring Services

Numerous banks and credit card companies offer free monitoring services as part of their customer benefits. These services, tied to a bank account or credit card, provide basic monitoring and alerts, serving as a valuable perk. Free credit monitoring services might suffice for individuals with few accounts and limited assets at risk.

Individuals can also receive free credit reports from the three major credit bureaus via Annualcreditreport.com. These free services offer a basic level of identity theft protection, helping consumers stay informed about changes to their credit bureau without incurring additional costs.

Paid Credit Monitoring Services

Premium credit monitoring services usually cost between $200 and $300 annually. These services provide a more comprehensive view by monitoring from all three major credit bureaus, tracking a wider range of threats, and offering additional features like identity theft insurance.

Opt for paid credit monitoring services that offer three-bureau monitoring and theft alerts for enhanced protection. Some include identity theft insurance and restoration assistance, invaluable in case of identity theft. Additionally, you can easily apply for credit online to complement your monitoring efforts.

Review the included services, cancellation policies, and your rights before committing to a service.

How to Choose the Right Credit Monitoring Service

Evaluating the specific services provided is crucial, as features can vary widely among credit monitoring services. Opt for services offering comprehensive monitoring from all three major credit bureaus to ensure full coverage.

Scrutinize cancellation policies and associated fees before committing to a service. Customer reviews and ratings can offer valuable insights into the reliability and effectiveness of a credit monitoring service. This thorough approach helps you select a service that best fits your needs and provides the required protection.

Integrating Credit Monitoring into Retirement Planning

Including credit monitoring in your retirement planning is crucial for financial security. Safeguarding your identity during retirement keeps your financial standing intact, enabling smooth access to financial products and services.

Credit monitoring is vital for protecting against identity theft, crucial for retirees’ financial health. Seeking advice from financial advisors, attorneys, or other professionals can further strengthen your identity and asset protection strategies. This section will explore how to protect your Social Security numbers, manage medical identity theft, and guard against financial fraud.

Protecting Social Security Numbers

Safeguarding your Social Security number is vital to prevent identity theft and maintain financial security. Keeping this information secure and sharing it only when necessary can significantly reduce the risk of identity theft for retirees.

Credit monitoring services can detect unauthorized use of your Social Security number, adding an extra layer of protection.

Managing Medical Identity Theft

Medical identity theft occurs when someone uses your personal information to obtain medical care or prescriptions in your name. Such fraud can affect your healthcare access and history, so monitoring medical records and being vigilant about who accesses your personal information is essential.

Credit monitoring services can also detect suspicious activities related to medical identity theft.

Guarding Against Financial Fraud

Retirees frequently become targets because of their perceived vulnerability and potential for substantial financial losses. Elder fraud and online schemes are common scams targeting seniors. Vigilance against phishing emails and fake websites is crucial. Such threats can lead to identity theft and significant financial losses.

Strengthening online security is a practical step to protect personal information. Use strong, unique passwords and manage personal documents effectively. Report any suspicious activity related to identity theft promptly to authorities like the Federal Trade Commission (FTC).

Being aware of social engineering tactics used by fraudsters can enhance the effectiveness of credit monitoring services.

Additional Tools for Credit and Identity Protection

Besides credit monitoring, several other tools and measures can help protect against identity theft. Monitoring credit reports is essential for early detection of unauthorized activity. A fraud alert on your credit reports can prevent criminals from opening new accounts in your name.

Freezing your credit can prevent unauthorized access to your credit file, thereby protecting against identity theft. Identity theft protection services provide additional layers of protection, including identity theft insurance, restoration assistance, and dark web surveillance.

Proactively safeguarding personal and financial information is essential for maintaining financial security.

Regularly Reviewing Credit Reports

Regular credit report reviews are crucial for spotting errors, fraud, and potential identity theft early. Continuous credit monitoring during retirement helps identify inaccuracies or incomplete data, ensuring correct account reporting. This practice helps you understand what lenders see and maintain an accurate credit history.

Regular credit report reviews can help identify and dispute errors that may negatively impact your credit score. Correcting accounts that aren’t yours and erroneous late payments is crucial to avoid lowering your credit score. This proactive approach keeps your financial information accurate and up-to-date.

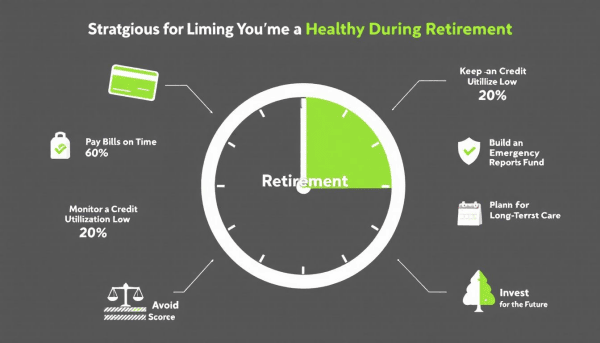

Maintaining a Healthy Credit Score in Retirement

A healthy credit score in retirement is crucial for managing financial emergencies and accessing better credit card rewards. A low credit utilization ratio indicates less risk to lenders, helping improve your credit score. Making at least one transaction every six months on a credit card keeps your credit score active.

Payment history, accounting for 35 percent, is the most significant factor in determining your FICO score. Staying vigilant and managing your credit wisely can maintain a healthy credit score throughout retirement.

Summary

In summary, credit monitoring and retirement planning are essential components of securing your financial future. By understanding the importance of credit monitoring, especially for retirees, and knowing how to choose the right services, you can protect your identity and financial health. Integrating credit monitoring into your retirement strategy, along with additional tools for identity protection, ensures a comprehensive approach to safeguarding your finances.

Taking proactive steps to maintain a healthy credit score and regularly reviewing credit reports will help you stay informed and prepared for any potential threats. By following the guidelines outlined in this guide, you can enjoy a worry-free retirement with peace of mind.

Frequently Asked Questions

What is credit monitoring and why is it important?

Credit monitoring is the process of regularly reviewing your credit reports for any changes that might indicate fraud or identity theft. It's crucial as it enables early detection of suspicious activity, allowing you to promptly address potential threats to your financial well-being.

Why is credit monitoring crucial for retirees?

Credit monitoring is crucial for retirees as it helps safeguard against identity theft and fraud, which they are often targeted for due to their stable finances. By actively monitoring their credit, retirees can enhance their financial security and peace of mind.

What are the key features of credit monitoring services?

Credit monitoring services provide access to credit reports and scores, continuous monitoring, alerts for significant changes, and may include dark web scanning to help identify potential identity theft and fraud. These features are essential for maintaining financial security and awareness.

How do free and paid credit monitoring services differ?

Free credit monitoring services provide basic alerts, whereas paid services offer comprehensive features including identity theft insurance and coverage across all three credit bureaus. Therefore, for enhanced protection and resources, opting for a paid service is advisable.

How can I choose the right credit monitoring service?

To choose the right credit monitoring service, evaluate the specific services offered, ensure comprehensive coverage from all three major credit bureaus, and review customer feedback to ensure reliability. Prioritize services that also have transparent cancellation policies for added flexibility.