Does Credit Monitoring Improve Credit Score? What You Need to Know

Thinking does credit monitoring improve credit score? Credit monitoring doesn’t directly increase your score, but it helps you manage your credit better. This article will explain how credit monitoring works and its role in credit management.

Key Takeaways

Credit monitoring alerts users to significant changes in their credit reports, helping detect fraud and correct inaccuracies that could harm credit scores.

While credit monitoring does not directly influence credit scores, it enables proactive management of credit health through timely notifications and error corrections.

Users have options for free or paid credit monitoring services; paid services typically offer enhanced features like identity theft protection and quicker alerts.

Understanding Credit Monitoring

Credit monitoring plays a vital role in managing your financial health by offering a centralized view of your credit activities and simplifying the tracking of changes in your credit reports and credit scoring.

What Is Credit Monitoring?

Credit monitoring is a service designed to track changes in your credit reports to safeguard against fraud and identity theft. It involves routine checks of your credit reports and account information, alerting you to potential fraudulent activities and important updates. The primary function of credit monitoring is to notify users of any significant changes, such as new credit applications, changes in credit scores, large transactions, and more.

Receiving regular updates about changes to your credit scores and reports enables you to swiftly identify any inaccuracies or unauthorized activities. This proactive method helps catch early signs of identity theft, allowing for prompt corrective actions and ensuring your credit profile remains accurate and secure.

How Credit Monitoring Works

Credit monitoring services operate by making soft inquiries on your credit reports from major credit bureaus and the credit bureau. These inquiries do not affect your credit score but allow the service to pull your credit data regularly.

Most credit monitoring services track your credit reports from the three major credit bureaus—Experian, Equifax, and TransUnion—and provide alerts for any changes that might impact your credit score, according to major credit reporting agencies.

The Role of Credit Monitoring in Protecting Your Credit Score

Credit monitoring services are essential for safeguarding your credit score, finances, and identity. They help ensure the accuracy of your credit reports and facilitate timely actions, thus significantly enhancing your credit health.

Early Detection of Fraudulent Activity

A major benefit of credit monitoring is the early detection of fraudulent activity. Timely alerts enable you to address unauthorized accounts quickly and minimize credit damage. Active monitoring identifies changes in your credit report, such as new credit accounts or large transactions, allowing you to act swiftly to prevent potential damage to your credit rating.

Quick responses to alerts can prevent significant harm to your credit score. For instance, if an identity thief opens a new credit account in your name, a prompt alert lets you contact the creditor and credit bureaus immediately to dispute the fraudulent account. This proactive approach can save you from long-term financial repercussions.

Correcting Errors on Credit Reports

Regularly monitoring your credit reports helps identify inaccuracies that could hinder your ability to secure loans or favorable interest rates. Consistent checks allow you to spot and correct errors, positively impacting your credit score.

Disputing inaccurate items on your credit report ensures that your credit profile accurately reflects your financial behavior, contributing to improved credit health.

Limitations of Credit Monitoring

While credit monitoring offers numerous benefits, it also has inherent limitations.

Understanding these limitations is crucial for making informed decisions about your credit management strategy.

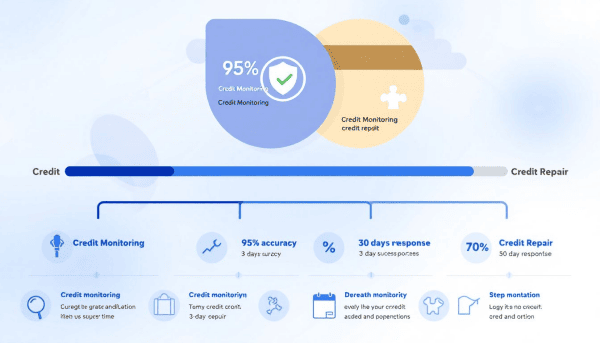

Credit Monitoring vs. Credit Repair

Credit monitoring and credit repair are often confused but serve different purposes. While credit monitoring provides alerts about changes to your credit reports, it does not fix issues.

Credit monitoring cannot remove inaccuracies or repair credit; it only notifies you of changes, leaving the responsibility of addressing those issues to you.

No Direct Impact on Credit Scores

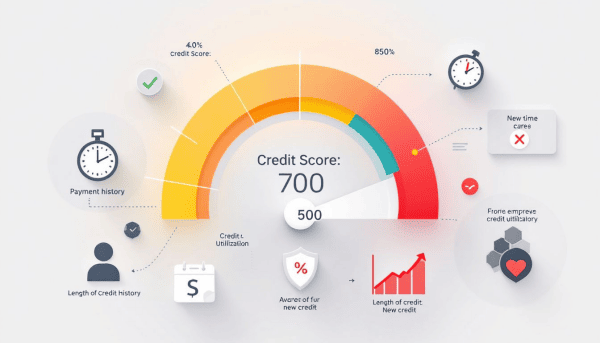

Credit monitoring does not directly influence your credit scores. While it doesn’t guarantee an improved credit score, it helps you stay informed and proactive in managing your credit health. By providing tools to track your credit activity, credit monitoring aids in managing factors that impact your credit score, such as payment history and credit utilization.

Users should understand that while credit monitoring alerts them to issues, it doesn’t directly repair or alter credit scores. Instead, it helps manage your financial behavior more effectively, leading to better credit health over time.

Free vs. Paid Credit Monitoring Services

When it comes to credit monitoring, you have the option to choose between free and paid services. Each has its own set of features, benefits, and limitations that can impact your decision.

Free Credit Monitoring Services

Free credit monitoring services offer basic alerts for significant changes in your credit reports. They typically track your credit scores and reports, alerting you to major changes such as new credit inquiries or significant drops in your credit score through a credit monitoring service. Additionally, you can obtain free credit reports to stay informed about your credit status.

While helpful, free services may lack comprehensive identity theft protection and advanced features offered by paid services. However, they provide a basic level of protection without any cost.

Paid Credit Monitoring Services

Paid credit monitoring services offer enhanced features, including identity theft protection and quicker alerts. These services often include access to all three major credit bureaus, identity theft insurance, and the ability to lock and unlock your credit reports conveniently. They provide more timely updates, often updating your credit scores daily, giving you more immediate insights into your credit health.

Additionally, paid services use advanced technologies like machine learning to analyze your purchases and send alerts for any unfamiliar transactions. This comprehensive coverage and advanced protection make them a valuable investment for those looking to safeguard their financial health more robustly.

Best Practices for Using Credit Monitoring to Improve Your Credit Score

Following best practices is crucial to maximize the benefits of credit monitoring and effectively improve your credit score.

Regularly Review Alerts and Reports

Consistently reviewing alerts and reports is essential for staying informed about your credit activity. Credit monitoring services offer automated monitoring, real-time updates, error detection, and early identity theft detection. Regularly reviewing these alerts helps quickly identify discrepancies or unauthorized activities, ensuring your credit reports remain accurate.

Take Immediate Action on Alerts

Immediate action on alerts can prevent negative impacts on your credit score. Upon receiving an alert, promptly investigate the issue, whether it’s potential identity theft or an error on your credit report.

Timely actions can prevent damage to your credit and help maintain a healthy credit score.

Combine with Other Credit-Building Strategies

Integrating credit monitoring with other credit-building strategies can enhance your overall credit health. Maintaining low credit utilization, making timely payments, and keeping a diverse credit mix can complement your credit monitoring efforts.

Adopting these practices ensures a more robust approach to improving and maintaining your credit score.

Summary

Credit monitoring services offer invaluable tools to help you manage your credit health proactively. While they do not directly improve your credit scores, they provide essential alerts and insights that can help you take timely actions to protect and enhance your credit profile. By understanding how credit monitoring works, its benefits, and its limitations, you can make informed decisions about which services best meet your needs.

Ultimately, credit monitoring should be part of a broader strategy for maintaining good financial health. Combining it with other credit-building practices, such as maintaining low credit utilization and making timely payments, can lead to a more secure and robust credit profile. Stay vigilant, stay informed, and take charge of your credit journey.

Frequently Asked Questions

Can credit monitoring improve my credit score directly?

Credit monitoring does not directly improve your credit score; however, it helps you stay informed and manage factors that can positively affect your credit health. Being aware of your credit status allows you to address issues proactively.

Are free credit monitoring services effective?

Free credit monitoring services can effectively alert you to significant changes in your credit reports, but they often do not offer comprehensive identity theft protection. Therefore, while they can be a useful tool, it's advisable to consider additional security measures for complete protection.

What should I do if I receive an alert from my credit monitoring service?

Take immediate action to investigate the alert from your credit monitoring service, as it may indicate identity theft or an error on your credit report. Address any issues you uncover as soon as possible.

Do I need paid credit monitoring services?

Yes, paid credit monitoring services can provide enhanced features like identity theft protection and quicker alerts, making them a valuable option for comprehensive coverage.

How often should I review my credit monitoring alerts and reports?

You should regularly review your credit monitoring alerts and reports to stay informed about your credit activity and ensure the accuracy of your credit profile. This proactive approach helps protect your financial health.