Maximize Your Financial Health: The Benefits of Credit Monitoring and Financial Wellness

Want to improve your financial health? Credit monitoring is key. This article shows how credit monitoring and financial wellness interconnect. Learn how to safeguard your finances, stay informed about your credit status, and take steps towards better financial well-being.

Key Takeaways

Credit monitoring is essential for safeguarding against identity theft and maintaining financial wellness by providing real-time alerts and educational resources.

Understanding key terms, such as credit reports and identity theft insurance, enhances awareness of how credit monitoring can protect your financial health.

Improving your credit score requires ongoing effort, including managing credit utilization, making timely payments, and regularly reviewing credit reports for errors.

The Role of Credit Monitoring in Financial Wellness

Credit monitoring plays a crucial role in safeguarding against identity theft and helping individuals make informed financial decisions. Routinely checking your credit status allows you to quickly identify and rectify potential errors or fraudulent activities, promoting better financial stability. In an era where financial fraud is rampant, having a proactive approach to managing your credit can prevent significant long-term financial consequences.

Using credit monitoring services provides real-time alerts for any significant changes or suspicious activities on your credit report. These alerts keep you informed. They enable you to take immediate action to protect your financial well-being. Such proactive management not only protects your credit health but also alleviates financial stress and anxiety, leading to improved overall financial wellness.

These services do more than just monitor credit scores. They also offer educational resources and tools to help you comprehend the factors influencing your credit profile. This comprehensive approach ensures that you are not only aware of your current credit status but also know how to improve it. Regular credit monitoring helps you identify areas for improvement and work towards achieving a good credit score.

Understanding the broader financial picture, including regular checks of your credit status and financial planning, can significantly enhance your financial well-being. Credit monitoring helps you stay on top of your finances, making it an indispensable tool for anyone looking to maintain or improve their financial health.

How Credit Monitoring Works

Credit monitoring evaluates your current and past credit behavior to provide a comprehensive view of your credit status. Routinely checking credit reports for accuracy, unauthorized activity, and signs of identity theft helps safeguard your financial health. This process relies heavily on external credit reports and credit scores to assess your credit risk and profile integrity.

One of the most critical features of credit monitoring is the real-time alerts that notify you of suspicious activities affecting your credit. These alerts allow you to take immediate action, preventing potential identity theft and protecting your credit profile. With real-time financial tracking, you can make informed decisions based on up-to-date data, ensuring your credit health remains intact.

Consistent credit monitoring allows you to track changes in your credit score and stay informed about your overall credit health. This proactive approach not only helps in maintaining a good credit score but also in identifying areas that need improvement, thereby fostering better credit management practices.

Key Terms to Know

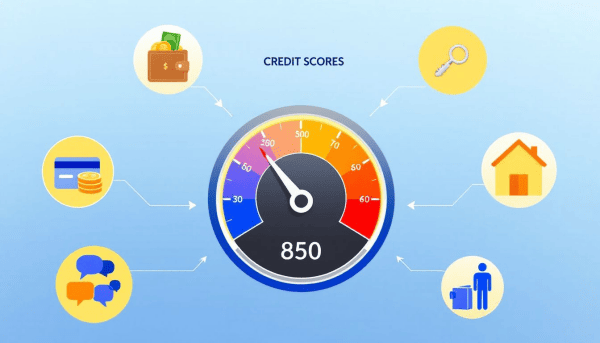

Understanding key terms is essential for grasping the full benefits of credit monitoring. A credit report is a detailed account of your credit history, including information on credit accounts, payment history, and outstanding debts. Credit scores, which range from 300 to 850, indicate your creditworthiness, with higher scores leading to more favorable loan terms.

Identity theft insurance is another critical term to know. This form of protection covers costs related to identity theft, helping you recover from its financial impacts.

Real-time alerts are notifications that inform you of suspicious activity on your credit accounts, allowing for immediate action to prevent fraud. These terms provide a comprehensive view of what credit monitoring entails and how it can protect your financial health.

Benefits of Using Credit Monitoring Services

Credit monitoring services offer numerous benefits that contribute to improved financial health. One of the primary advantages is the early warning system that alerts you to potential identity theft or credit issues. Monitoring your credit reports and scores enables these services to quickly spot fraudulent activity, so you can take immediate action.

These services also inform you of significant changes to your credit, such as new accounts or large purchases, ensuring you are always aware of your credit status. This level of monitoring helps ensure the accuracy and up-to-date information of your credit reports, which is crucial for maintaining a good credit score.

Additionally, many credit monitoring services come with identity theft insurance, providing financial protection against losses resulting from identity theft incidents. This added layer of security can give you peace of mind, knowing that you are protected against potential financial harm.

Choosing the Right Credit Monitoring Service

Selecting the right credit monitoring service is essential for maximizing the benefits of credit monitoring. It’s important to evaluate the level of control you have over alerts and notifications. Not all services provide access to reports from all three major credit bureaus, which can affect the comprehensiveness of the monitoring.

The cost of credit monitoring services varies widely depending on the features and level of access provided. Some services offer free trials, allowing you to assess their effectiveness before committing financially. User experience can also differ between app-based and web-based services, impacting how you interact with your monitoring tools.

When choosing a service, consider whether it includes dark web monitoring, which can provide an additional layer of security by alerting you if your personal information is found on the dark web. This feature can be crucial for protecting against identity theft and ensuring the overall security of your credit profile.

Alternative Ways to Monitor Your Credit

While credit monitoring services offer comprehensive protection, there are alternative ways to keep track of your credit. You can obtain free credit reports once a week from the three major credit bureaus, providing a cost-effective way to monitor your credit status. Additionally, you can access one free credit report per year from AnnualCreditReport.com, along with free credit monitoring services free.

Many financial institutions offer free tools that allow you to access your credit scores and reports without negatively affecting your credit score. Regularly reviewing your credit reports can help you identify potential identity theft and inaccuracies, allowing you to take corrective action promptly.

Disputing inaccuracies on your credit report is crucial, as erroneous data can significantly harm your score. Staying vigilant and regularly checking your credit reports ensures your credit profile remains accurate and up-to-date.

Impact of Credit Scores on Financial Decisions

Credit scores are crucial indicators for lenders, influencing decisions on loan approvals and terms based on perceived risk. Borrowers with higher credit scores benefit from lower interest rates, significantly affecting the total cost of loans over time. Maintaining an accurate credit score is essential for accessing advantageous financial opportunities, such as lower mortgage rates.

A strong credit score leads to better loan terms, ultimately impacting the total cost of borrowing. Payment history, which accounts for 35% of the credit score calculation, is the most significant factor influencing your score. Credit utilization, or the amount of credit used compared to available credit, should be kept as low as possible, as it adversely affects scores if it exceeds 30%.

Credit history, which constitutes 15% of your score, also plays a vital role. Maintaining a good credit score helps you secure better interest rates and terms on loans, positively impacting your overall financial health.

Steps to Improve Your Credit Score

Improving your credit score takes time and effort, but the benefits are well worth it. Regularly reviewing your credit report helps identify errors that may lower your score. Establishing automatic payments can ensure your bills are paid on time, positively influencing your credit score.

Reducing credit card balances is crucial for maintaining a healthy credit utilization ratio, which is an essential factor in your credit score. Diversifying credit types can also enhance your score, as credit mix influences 10% of your credit profile. Patience is key, as significant changes to your credit score may take time to manifest.

Following these steps and staying vigilant helps you work towards a better credit score, opening up more financial opportunities and improving your overall financial health.

Emotional and Psychological Aspects of Credit Health

It is common to feel stressed about poor credit, and these feelings are normal. Achieving better credit can lead to a reduction in financial stress and improved sleep. A stable financial foundation from good credit can enhance overall relationship harmony and security.

Managing your credit effectively can initiate progress toward better financial well-being. Financial self-efficacy, or the belief in your ability to manage financial challenges, significantly contributes to financial confidence. Improving credit health can enhance self-esteem, as individuals may feel more accomplished with their financial decisions.

Focusing on both the emotional and financial aspects of credit health helps achieve a more balanced and secure financial life.

Tools to Enhance Financial Wellness

Financial health tracking tools are essential for individuals trying to maintain and improve their financial stability. These tools provide early warnings for potential issues and guide users in making informed financial decisions. Using simulators, you can explore ‘what-if’ scenarios regarding actions that could impact your credit score, helping you make more informed decisions about your finances.

Incorporating these tools into your financial planning allows for a proactive approach to managing your finances and achieving better credit health.

Summary

Credit monitoring is an indispensable tool for maintaining financial health and security. By understanding how credit monitoring works, the benefits it offers, and how to choose the right service, you can take control of your credit profile and safeguard your financial future.

Incorporating regular credit checks, using monitoring services, and leveraging financial wellness tools will help you stay on top of your finances. Take charge of your credit health today and pave the way for a more secure and prosperous financial future.

Frequently Asked Questions

How often should I monitor my credit report?

You should monitor your credit report at least once a year, but checking it more frequently can help you catch changes or issues early. This proactive approach ensures you maintain a healthy credit status.

Can credit monitoring services prevent identity theft?

Credit monitoring services cannot prevent identity theft but can alert you to suspicious activities, enabling you to take prompt action to minimize potential harm.

What is the most significant factor affecting my credit score?

Payment history is the most significant factor affecting your credit score, making up 35% of the total. Consistently making on-time payments is crucial for maintaining a healthy credit score.

Are there free credit monitoring services available?

Yes, there are several free credit monitoring services available from financial institutions and websites that can help you track your credit score and receive alerts. It’s advisable to take advantage of these resources for better financial awareness.

How can I improve my credit score?

To improve your credit score, regularly review your credit report, set up automatic payments, reduce credit card balances, and diversify your credit types. These steps will help you build a stronger financial profile.