Top Tools to Track Credit Building Progress

Need to track credit building progress? Discover the best tools and strategies to monitor your credit score improvements and address issues promptly.

Key Takeaways

Tracking credit building progress is essential for maintaining a good credit score, which affects financial health and loan eligibility.

Regularly checking credit reports from all three major bureaus is crucial to identify discrepancies and manage credit health effectively.

Understanding credit scores and the factors that influence them, such as payment history and credit utilization, is vital for setting realistic improvement goals.

The Importance of Tracking Credit Building Progress

Monitoring your credit building efforts is critical for ensuring that these efforts are effective. A good credit score is not just a number; it is a reflection of your financial health and can significantly influence your ability to secure loans and obtain favorable interest rates. Starting to build a good credit score now will prepare you for future credit needs, such as loans and mortgages.

Celebrating small achievements, like reaching a specific credit score milestone, can be incredibly motivating. These milestones remind you of your progress and encourage continued financial improvement.

Regular credit monitoring helps identify and address discrepancies or issues promptly, maintaining an accurate and positive credit history. Consistent tracking and maintenance of your credit health lay the foundation for long-term financial success.

Regularly Check Your Credit Reports

Checking your credit reports from Equifax, the three credit bureaus, Experian credit report, and TransUnion, the major credit bureaus, is crucial for managing your credit health. You can obtain one free credit report from each of these bureaus annually through AnnualCreditReport.com. For a more proactive approach, consider reviewing your credit report quarterly to catch and correct any potential errors.

When reviewing your credit reports, pay close attention to personal information, account balances, and any negative information that could be affecting your credit scores. Due to varied collection methods, each bureau might have different data, making it important to check all three reports for accuracy and completeness.

Understand Your Credit Scores

Credit scores, typically expressed as a three-digit number, are crucial indicators of your creditworthiness. FICO scores, which range from 300 to 850, are the most widely used scoring model in lending, with around 90% of lenders relying on them for credit decisions. Each major credit bureau—Equifax, Experian, and TransUnion—can calculate your FICO score differently based on the information they have, which is also considered in credit scoring.

A good credit score is generally considered to be 700 or higher. Knowing the different types of credit scores, like FICO and VantageScore, and their ranges helps in setting realistic improvement goals.

Credit scores are influenced by five main factors: payment history, amounts owed, length of credit history, credit mix, and new credit inquiries. Understanding these factors allows you to take proactive steps to maintain and improve your credit health.

Utilize Credit Monitoring Services

Credit monitoring services are invaluable tools for anyone serious about maintaining a good credit score. These services provide alerts about changes to your credit report, helping you manage issues promptly and efficiently. For example, Experian offers a free credit monitoring service that notifies users of changes in their credit report, which can help identify suspicious activity early.

By using credit monitoring services, you can receive notifications about new inquiries, changes in your credit information, and any unauthorized accounts that might appear on your report. These alerts help you stay vigilant and take immediate action to protect your credit.

Monitor Key Credit Factors

Before:

Evaluating the factors that influence your credit score is essential for developing effective strategies to improve it. The five key factors that affect your FICO score include payment history, credit utilization, length of credit history, credit mix, and new credit inquiries. Understanding and monitoring these factors can guide you towards maintaining a healthy credit profile.

After:

The five key factors that affect your FICO score include:

Payment history

Credit utilization

Length of credit history

Credit mix

New credit inquiries

Understanding and monitoring these factors can guide you towards maintaining a healthy credit profile.

Payment History

Tracking your payment history is crucial, as it constitutes a significant portion of your credit score, making up about 35% of it. Making timely payments is the most significant factor in building your credit score. A single late payment can cost you substantial points, so it’s vital to avoid late payments to maintain a good credit score.

Submitting all payments in full and on time payments ensures a positive payment history. Resolve delinquencies by catching up on past due payments. Making at least the minimum payment by the due date ensures positive payments are reported, crucial for maintaining a good credit score.

Credit Utilization Ratio

Knowing your credit utilization ratio is important because it significantly impacts your credit score. Credit utilization follows payment history in importance for FICO score calculations. It is the second most significant factor considered. An optimal credit utilization ratio is below 30%, with the best results at 10% or less.

Improve your credit utilization ratio by paying down revolving credit and considering a credit limit increase. Resist the urge to increase spending after securing a higher credit limit.

Paying off credit card balances in full each month positively impacts your credit score the most.

Length of Credit History

The age of your oldest credit account and the average age of all your accounts play a crucial role in determining your credit score, accounting for 15% of it. A higher credit age indicates a longer history of borrowing, which lenders view positively.

Maintain and improve your credit history length by keeping old credit accounts open. A longer credit history is particularly important if you have a ‘thin’ credit file.

Paying off a loan might hurt your credit score if it’s your oldest credit line or only loan.

Credit Mix

A credit mix is a variety of different types of credit accounts, including revolving and installment accounts. Having a diverse credit mix is beneficial because it shows a history of obtaining and managing different types of credit.

Having a range of credit types positively affects your credit score, making up 10% of the overall calculation. A new credit card can strengthen your score in the long term by adding to your credit mix.

New Credit Inquiries

Avoid excessive new credit applications, as recent hard inquiries impact your score by approximately 10%. Each hard inquiry typically lowers your score by 5 to 10 points. Avoid frequent hard inquiries to maintain a good credit score.

Avoiding hard inquiries may not drastically improve your score but remains beneficial in the long run.

Use Technology to Track Progress

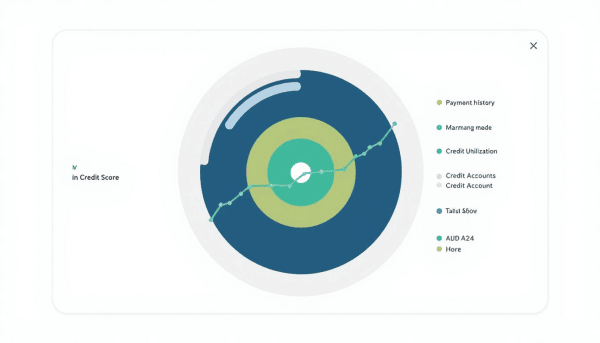

Technology can significantly enhance how you monitor your credit building progress. Tools like Experian’s free credit monitoring tool and the NerdWallet app provide monitoring dashboards that help you track your credit scores and reports effectively.

These technological tools offer visual representations of your credit score progression over time, making it easier to identify trends and areas for improvement. Leveraging these tools helps you stay on top of your credit health more efficiently.

How Often Should You Check Your Credit Score?

Regularly checking your credit score helps gauge improvements and identify factors affecting your creditworthiness. Monitoring dashboards in credit apps enable users to visually track their credit score progression over time. Setting reminders for credit report checks aids in consistent monitoring and timely addressing of discrepancies.

Checking your credit score does not affect it, as this action is classified as a soft inquiry. Regular monitoring helps maintain a good credit score and prevents potential issues from going unnoticed.

Addressing Errors on Your Credit Report

Monitoring your credit report helps spot inaccuracies or fraudulent activities that may harm your credit score. Common mistakes on credit reports include late payments inaccurately marked or the same debt reported multiple times.

You have the right to dispute any mistakes found with credit reporting agencies. The Fair Credit Reporting Act requires credit bureaus to investigate disputes within 30 days. Filing a dispute can be done via mail, online, or by phone, and each method has its own submission guidelines.

Successful disputes can improve your score if corrected errors were negatively impacting it.

Leveraging Credit Building Tools

Credit-builder loans, typically ranging from $300 to $1,000, require payments over a specified term. These loans build credit by reporting payment history to credit bureaus, and a credit builder loan can be an effective option for those looking to improve their credit score.

A secured credit card, requiring an upfront cash deposit, can also help build credit. Responsible use of secured credit cards can eventually qualify you for unsecured credit cards. Becoming an authorized user allows you to benefit from the primary cardholder’s credit habits without financial responsibility for the account.

Summary

In summary, tracking your credit building progress is essential for maintaining and improving your credit scores. Regularly checking your credit reports, understanding your credit scores, utilizing credit monitoring services, and monitoring key credit factors are all crucial steps in this journey.

By leveraging technology and credit building tools, you can stay on top of your credit health and work towards achieving a good credit score. Remember, the journey to financial empowerment is ongoing, but with diligence and the right tools, you can achieve your goals.

Frequently Asked Questions

How often should I check my credit report?

You should check your credit report at least once a year, but conducting quarterly checks is advisable for more effective management of your financial health.

What is a good credit score?

A good credit score is considered to be 700 or higher, indicating responsible credit management and increasing your chances for favorable loan terms.

How can I improve my credit utilization ratio?

To improve your credit utilization ratio, maintain it below 30% by paying down existing revolving credit and requesting a credit limit increase while refraining from increasing your overall spending. This approach will enhance your credit health effectively.

What should I do if I find an error on my credit report?

You should dispute the error with the credit reporting agency, as the Fair Credit Reporting Act requires them to investigate such disputes within 30 days. This action will help ensure your credit report is accurate.

Can using a secured credit card help build my credit?

Yes, responsibly using a secured credit card can effectively build your credit history and improve your chances of qualifying for unsecured credit cards in the future.