Effective Tips on How to Prevent Credit Fraud

Worried about credit fraud? This guide offers practical steps on how to prevent credit fraud and protect your finances.

Key Takeaways

Understanding common credit fraud tactics, such as phishing scams and card skimming, is crucial for prevention.

Regularly monitoring credit reports and statements helps in early detection of unauthorized activities.

Utilizing strong passwords, two-factor authentication, and credit monitoring services significantly enhances account security.

Recognize Common Credit Fraud Tactics

Credit fraud involves the unauthorized use of your credit card information for purchases, leading to significant financial harm. Understanding the various tactics fraudsters use helps in protecting yourself.

Physical theft of credit cards is one of the oldest methods of fraud. Thieves can make fraudulent purchases or even sell the card details. Another common tactic is the use of small test charges to verify stolen card details before making larger, more damaging purchases.

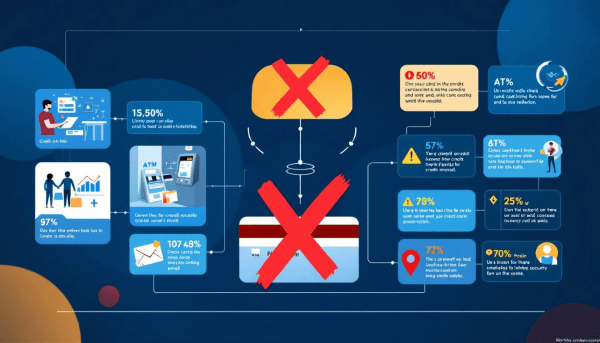

Card cloning and skimming devices are also prevalent. Skimmers are hidden devices that capture card details during legitimate transactions, often leading to card cloning, where data is replicated to create counterfeit cards. These counterfeit cards can then be used for fraudulent transactions, often facilitated by credit card skimmers.

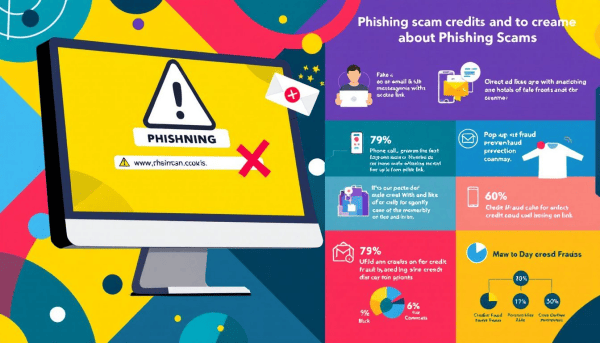

Phishing scams are another significant threat. Fraudsters use deceptive emails to trick victims into revealing sensitive information. These emails often appear legitimate, using familiar logos and company names to gain trust. Account takeovers, where fraudsters impersonate you to gain control of your credit accounts, are also a growing concern related to data breaches.

Awareness and vigilance can help you avoid becoming a victim of credit fraud. Early recognition of fraud signs is vital for safeguarding your financial health.

Monitor Your Credit Reports Regularly

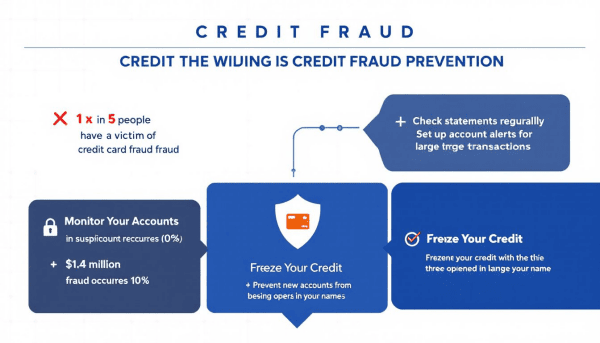

Frequently reviewing your credit reports helps in spotting unauthorized accounts or suspicious activities. Your credit report contains vital information, including credit accounts, balances, and payment history. Monitoring these details allows for quick identification of unauthorized changes or fraudulent activities.

Checking your credit report at least four times a year is advisable. This frequency keeps you informed about any financial changes and allows prompt addressing of potential issues. Credit monitoring services can also help, offering real-time alerts for any suspicious activity, new accounts, or inquiries.

Examining your credit card and bank account statements regularly is equally important. This practice helps in identifying unauthorized transactions quickly. Early detection of suspicious activity allows you to take immediate action, such as disputing charges or closing compromised accounts.

Implement Strong Passwords and Two-Factor Authentication

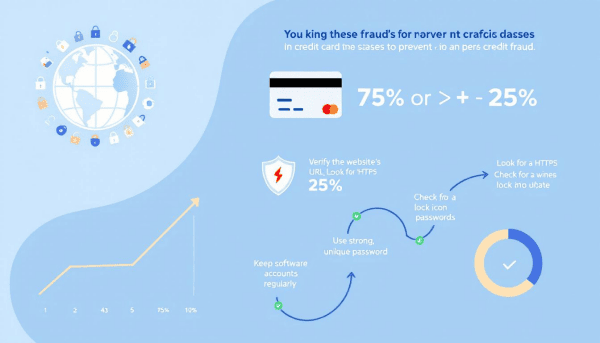

Strong passwords are fundamental in securing your accounts. Use random combinations of letters, numbers, and special characters, and ensure each account has a unique password. A password manager can help you keep track of these complex passwords without compromising security.

Two-factor authentication (2FA) significantly enhances your account security by requiring two types of credentials for access. This method makes it much harder for fraudsters to gain access to your accounts, even if they have your password. Enable 2FA on sensitive accounts like banking and credit card services.

Authenticator apps provide a more secure way to generate verification codes compared to text messages or emails. Security keys, physical devices that use encryption for confirmation, offer an advanced method of two-factor authentication, ensuring an extra layer of protection.

Use Fraud Alerts and Credit Freezes

Fraud alerts provide a valuable tool in combating credit card fraud. They inform businesses to verify your identity before opening new accounts in your name. An initial fraud alert lasts for one year and is renewable. For those who have experienced identity theft, an extended fraud alert lasting up to seven years is available.

A credit freeze restricts access to your credit report, preventing new accounts from being opened without your permission. Both fraud alerts and credit freezes are free to place and lift, making them accessible to everyone.

It’s also crucial to close any accounts that have been compromised or opened fraudulently. Reporting credit fraud to the Federal Trade Commission helps place your information in a national database used for law enforcement investigations.

Be Cautious of Phishing Scams

Phishing scams involve sending fraudulent messages or emails designed to deceive individuals into revealing personal information. These scams often use familiar logos and company names to gain trust and may direct victims to fake websites that closely resemble legitimate ones.

To avoid falling victim to phishing scams, it’s crucial to independently verify the legitimacy of any requests for personal information. Never share sensitive data in response to unsolicited communication and always verify the source before providing any financial information.

Secure Your Physical Credit Card

Securing your physical credit card is crucial in preventing credit card fraud. Keep your card safe and avoid using unattended terminals. EMV chip cards provide enhanced security by generating a unique transaction code that is useless if duplicated. All credit cards now include EMV chips, which help alleviate fraud from device skimmers.

Before using ATMs or payment terminals, check for any signs of tampering. If you see anything unusual in the card slot, do not use it. Instead, inform an employee immediately. Contactless credit cards, which use RFID technology to transmit data securely, offer an additional layer of protection against cloning.

Securing your card, using advanced technologies, and being vigilant about tampering can significantly reduce credit card fraud and prevent credit card fraud while enhancing fraud prevention risk.

Conduct Online Transactions Safely

Ensure the website uses HTTPS when conducting online transactions for enhanced security. Look for visible security indicators like a padlock symbol before entering any payment information. Websites should use SSL encryption to protect your data during transactions.

Avoid making transactions over public Wi-Fi networks, as they are often unsecured and can be intercepted by hackers. Using smartphone-based payment services can enhance payment security through tokenization technology and often require device unlock, adding another layer of protection.

Regularly Review Credit Card Statements

Reviewing your credit card statements regularly is key to preventing credit card fraud. Examining your account statements closely allows for quick identification of unauthorized transactions that may indicate fraud.

Take immediate action if you see any suspicious transactions. Contact your credit card issuer immediately to dispute those charges. A card issuer’s smartphone app and text notifications can help you stay updated on financial transactions, catching any issues early.

Utilize Credit Monitoring Services

Credit monitoring services offer real-time alerts for suspicious activity, enabling immediate action to mitigate potential damage. These services notify you of new accounts, inquiries, or changes to your credit report, keeping you on top of your financial health.

You can also sign up for transaction alerts with your card issuer to track changes to your credit card account efficiently. Many services, such as IdentityForce® CreditWise®, offer early notice of potential fraud, giving you a head start in addressing any issues with your credit card company.

Shred Sensitive Documents and Protect Mail

Identity thieves often rummage through trash to find personal information that can lead to identity theft. Prevent this by shredding sensitive documents like ATM receipts, paid credit card statements, and junk mail with personal details.

If a shredder isn’t available, alternatives include tearing documents by hand, burning them safely, or soaking them in water and bleach. Professional shredding services can securely destroy large amounts of sensitive documents if personal shredders are unavailable.

Choose Credit Cards with $0 Liability on Unauthorized Charges

Most major credit card issuers provide zero liability for unauthorized charges, meaning consumers are not responsible for fraudulent transactions. Many issuers, including American Express, Bank of America, and Chase, offer policies that ensure $0 liability on unauthorized purchases.

Select a credit card that offers $0 liability on unauthorized charges to protect yourself from credit fraud. If a credit card is reported stolen before any fraudulent charges occur, the consumer has no liability for those charges.

What to Do if You Become a Victim of Credit Fraud

If you suspect credit fraud, prompt action is necessary. Report any suspicious charges to your credit card issuer immediately to prevent further financial loss. Initiate a fraud alert or credit freeze to protect your accounts from further unauthorized access.

The Fair Credit Billing Act provides zero liability for consumers on fraudulent purchases, limiting your maximum liability to $50 if the fraud is reported within 60 days. It’s also important to save contact information for your credit card issuer to ensure secure communication regarding fraudulent activity.

Summary

Recapping the main tips covered, it’s clear that a proactive approach to credit fraud prevention is essential. By recognizing common fraud tactics, regularly monitoring your credit reports, implementing strong passwords and two-factor authentication, using fraud alerts and credit freezes, securing your physical credit card, conducting online transactions safely, reviewing credit card statements, utilizing credit monitoring services, shredding sensitive documents, and choosing credit cards with $0 liability on unauthorized charges, you can significantly reduce your risk of credit fraud.

Taking these steps not only protects your financial health but also provides peace of mind. Don’t wait until it’s too late—start implementing these strategies today to safeguard your credit.

Frequently Asked Questions

How often should I check my credit report?

You should check your credit report at least four times a year to stay informed about any changes and promptly address potential issues. Regularly monitoring it helps maintain your financial health.

What is two-factor authentication, and why is it important?

Two-factor authentication enhances account security by requiring two forms of credentials for access, effectively reducing the risk of unauthorized access. It is essential for protecting sensitive information from potential fraudsters.

What should I do if I notice unauthorized transactions on my credit card statement?

If you notice unauthorized transactions on your credit card statement, contact your credit card issuer immediately to dispute the charges and consider initiating a fraud alert or credit freeze to safeguard your accounts.

How can I protect my physical credit card from fraud?

To protect your physical credit card from fraud, ensure you keep it secure, avoid unattended payment terminals, and regularly check for any signs of tampering. Opting for contactless payment methods can also enhance your security.

What are the benefits of using credit monitoring services?

Using credit monitoring services offers the benefit of real-time alerts for suspicious activity, helping you stay informed about your financial health and preventing potential fraud. This proactive approach allows you to quickly address any issues that may arise.