How to Monitor Your Credit: Essential Tips and Tools

Monitoring your credit is key to protecting your finances. Learn how to monitor your credit, the best tools available, and the difference between free and paid services in this comprehensive guide.

Key Takeaways

Credit monitoring is essential for detecting identity theft and maintaining informed financial decisions by providing real-time alerts for changes in credit reports.

Both free and paid credit monitoring services offer valuable tools, with paid options providing more comprehensive features such as identity theft insurance and advanced digital security.

Proactive measures, including regular credit report checks and implementing credit freezes, enhance credit protection and help quickly identify unauthorized activities.

Understanding Credit Monitoring

Credit monitoring is a service that keeps an eye on your credit reports and alerts you to any changes or suspicious activities. Its primary purpose is to help prevent identity theft and fraud, ensuring you can make informed financial decisions. Not using credit monitoring can expose you to significant risks, such as identity theft and credit bureau fraud, which collectively result in billions of dollars in losses every year.

Using credit monitoring as part of your financial routine serves as an early warning system, alerting you to potential issues before they escalate.

Understanding how credit monitoring works and familiarizing yourself with essential terms can highlight its importance.

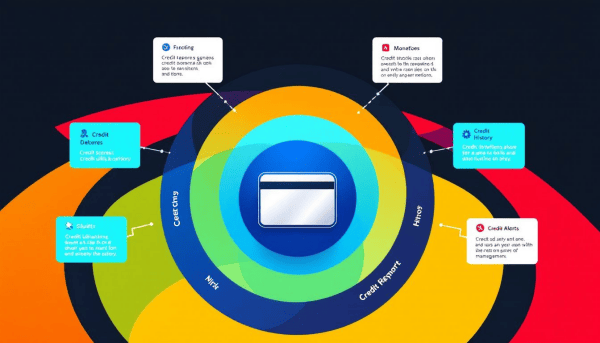

How credit monitoring works

Credit monitoring automates the process of checking your credit reports for changes in account details, inquiries, or signs of identity theft, providing alerts via email, text, or phone. This real-time notification system keeps you informed of any new developments in your credit profile.

One of the most reliable services is Experian, which offers real-time alerts about inquiries, account changes, and suspicious activities. Users can access their credit reports and updates every 30 days, helping them consistently monitor their credit status. Additionally, free credit reports from each bureau are available weekly, which can aid in the early detection of identity theft.

Credit monitoring services can provide tracking for reports from one, two, or all three major credit bureaus. These bureaus include Equifax, Experian, and TransUnion, which ensures comprehensive coverage. This three-bureau monitoring is especially beneficial as it provides a holistic view of your credit status, making it easier to spot discrepancies and unauthorized activities.

Key terms in credit monitoring

Familiarizing yourself with key terms in credit monitoring can enhance your ability to manage and protect your credit. Important terms include “credit reports” and “credit scores,” which are derived from factors like payment history and credit utilization.

“Identity theft protection” involves services to prevent and detect identity theft. “Credit alerts” notify you of changes to your credit report, while “fraud alerts” warn creditors of potential identity theft.

These terms are fundamental to credit monitoring and aid in making informed financial decisions.

Free Credit Monitoring Services

Free credit monitoring services help you maintain your credit health without extra costs by providing essential tools and alerts to detect changes or inconsistencies in your credit reports and to obtain a free credit report.

One popular option is Credit Karma, which offers free monitoring of credit scores and tools to manage credit effectively. Additionally, many banks and credit card companies provide free credit monitoring services to their customers as part of their account benefits. These services are accessible and can be a crucial part of your financial toolkit.

Top free credit monitoring providers

Several top free credit monitoring providers offer robust tools and features to help you keep an eye on your credit. Credit Karma is a standout, providing free ID monitoring tools, access to credit reports from Equifax and TransUnion, and helpful tips to manage your credit. They also assist in contacting credit bureaus to dispute any errors detected on your report.

Another excellent provider is CreditWise from Capital One, which offers real-time updates from TransUnion and Experian. This service includes features like dark web scanning, which can notify you if your personal information appears in illicit online forums. Such comprehensive monitoring can be invaluable in protecting your credit.

Evaluate the types of alerts and sources of credit report data when selecting a free credit monitoring service. Services like Credit Karma and CreditWise offer reliable features, making them top choices for monitoring credit at no cost.

Benefits of free credit monitoring

Free credit monitoring services offer numerous benefits, primarily through their alert systems and push notifications that keep you informed about key changes in your credit reports. Quick notifications for new inquiries, changes in your credit accounts, and updates to your personal information are critical in maintaining a healthy credit profile.

A key advantage of free services is accessibility. For instance, Experian provides alerts for changes to your credit report at no charge, helping you maintain your credit health without extra costs.

However, it’s important to note that free services often come with limited features compared to paid options. However, they still offer a valuable baseline for credit monitoring.

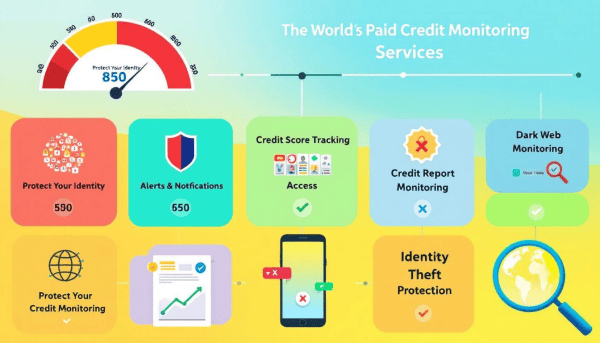

Paid Credit Monitoring Services

Paid credit monitoring services provide more extensive features and protections, safeguarding personal information and protecting financial data from hackers and identity theft. Companies like Aura focus on safeguarding personal finances and credit, providing comprehensive coverage for their clients.

The cost of top paid credit monitoring plans typically ranges from $9 to $40 per month, with some plans costing over $300 per year. Despite the higher costs, these services often provide three-bureau credit monitoring, identity theft insurance, and advanced digital security tools. For those seeking thorough protection, paid services can be a worthwhile investment.

Best paid credit monitoring providers

Several paid credit monitoring providers stand out for their comprehensive features and robust protection. IdentityForce, for instance, offers a suite of security features, including identity and credit protection, credit advice, activity alerts, and three-bureau credit monitoring. Their plans range from $19.90 to $39.90 per month, providing solid value for the protection offered.

Experian IdentityWorks is another top provider, offering credit monitoring, dark web surveillance, Social Security number alerts, address change alerts, and identity theft insurance up to $1 million. Their plans range from free to $34.99 per month, catering to various budget levels.

Aura also offers competitive plans, with prices ranging from $9 to $30 monthly, depending on the billing cycle. Identity Guard features dark web monitoring, Social Security number tracking, and identity recovery services. PrivacyGuard provides daily triple-bureau monitoring and dark web scanning, with identity theft insurance coverage up to $1 million.

These providers offer extensive protection and monitoring, making them some of the best credit monitoring services for paid credit monitoring.

What you get with paid services

Paid credit monitoring services offer several additional features that free services typically do not. Most paid plans include identity theft insurance, with coverage up to $1 million, providing financial protection in case of identity theft. Services like Experian IdentityWorks and FICO Advanced include this coverage as part of their packages.

In addition to insurance, paid services offer comprehensive monitoring across all three major credit bureaus, ensuring no aspect of your credit profile goes unnoticed. Features like dark web scans, 24/7 access to identity theft experts, and tailored security features for kids are also common among standout paid services. These advanced features provide a higher level of security and peace of mind.

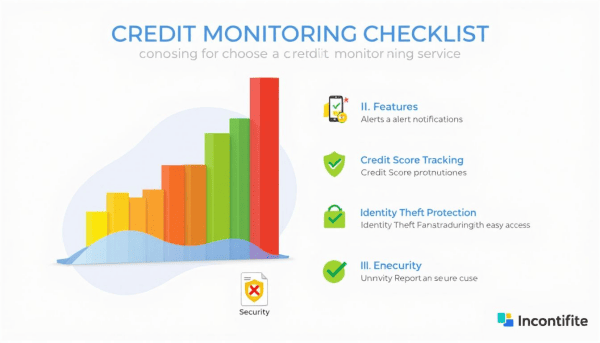

How to Choose a Credit Monitoring Service

Choosing the right credit monitoring service involves considering several factors to ensure it meets your specific needs. The three major credit bureaus—Equifax, Experian, and TransUnion—are often monitored by these services, and comprehensive monitoring usually requires coverage from all three. It’s important to understand the differences in pricing and features between free and premium services.

Free services usually have limited coverage. In contrast, premium services offer more comprehensive protection. Some services may include dark web scanning, identity theft insurance, and alerts for unauthorized transactions.

Assess your personal financial needs and understand the available options to choose a service that offers appropriate support and protection.

Factors to consider

Review the included services, cancellation policies, and your rights when selecting a credit monitoring service. Consider the types of monitoring (free vs. fee-based) and the level of coverage, including features like dark web surveillance and major credit bureau coverage.

Evaluate your personal financial needs to select a service that provides relevant support. For instance, if you face a higher risk of identity theft, a service with comprehensive identity theft protection and insurance might be needed. Careful evaluation helps you choose the best fit for your situation.

Comparing free vs. paid services

Free credit monitoring services offer basic protection and are a good starting point for anyone looking to monitor their credit. However, they may not include all essential services like credit freeze capabilities or frequent updates. Paid services, on the other hand, often provide more comprehensive coverage and alerts across all three major credit bureaus.

While free services might limit the frequency of credit report updates, paid options typically offer more extensive features, such as identity theft insurance and comprehensive alerts.

Your specific needs and required level of protection determine whether free or paid services are suitable. Comparing these options helps you make an informed decision.

Setting Up Credit Monitoring

Setting up credit monitoring services involves a systematic approach to ensure you get the most out of your chosen provider. The process typically includes creating an account, verifying your identity, and customizing alert preferences. Whether you choose a free or paid service, the setup process is straightforward and essential for enabling effective credit monitoring.

Establishing credit monitoring involves providing personal information and creating an account with the service provider. Some services might require contacting customer service for assistance. Following these steps ensures your credit monitoring service is set up correctly to protect your financial health.

Signing up for free services

Signing up for free credit monitoring services is usually a simple process. For example, with Credit Karma, you just need to create a free account or log in to an existing one to enable their monitoring service. Many free services, like Experian, require you to register online and confirm your identity before you can access the monitoring features.

Most free credit monitoring services have a simple online signup process that requires minimal information. After creating your account, customize your alert preferences to receive notifications about changes to your credit report.

Activating paid services

Activating paid credit monitoring services involves selecting a subscription plan and providing payment details. After choosing your plan, you’ll need to confirm your account to complete the activation process. This typically includes verifying your identity and setting up your preferences for receiving alerts and notifications.

Paid services typically offer more comprehensive monitoring and additional features. Subscribing to a paid service provides enhanced protection and support, ensuring effective credit monitoring.

The activation process is user-friendly, making it easy to begin using your chosen service.

What Credit Monitoring Can and Cannot Do

Credit monitoring services provide a valuable tool for tracking changes to your credit reports and alerting you to any modifications. For instance, Experian offers alerts for any changes or suspicious activity on your credit report, ensuring you stay informed. These notifications can include new inquiries, changes to your personal information, and key updates affecting your credit status.

However, it’s important to understand the limitations of credit monitoring. While these services can help detect early signs of identity theft or inaccuracies in your credit reports, they cannot prevent fraud or correct errors.

Users must rectify any issues found in their credit reports by disputing errors with the relevant credit bureau. Credit monitoring provides awareness and alerts, but taking action remains your responsibility.

Detecting errors and fraud

Credit monitoring services play a crucial role in detecting errors and fraud by keeping you informed about changes in your credit status. They can help identify potential errors before they negatively impact your credit scores. If you notice discrepancies in your credit report, it’s vital to dispute these errors with the credit bureau to ensure your credit file remains accurate.

These services notify users of inaccuracies and unauthorized activities, indicating potential fraud. Close monitoring allows you to catch mistakes early and take corrective steps, safeguarding your financial health and preventing long-term damage.

Limitations of credit monitoring

Credit monitoring services effectively provide alerts and updates but have limitations. They cannot prevent identity theft or correct errors; they only alert you to potential issues. Acting quickly on alerts can minimize long-lasting damage.

Credit monitoring cannot stop fraudulent activity but can notify you of suspicious activities. Understanding these limitations sets realistic expectations and underscores the importance of proactive credit management.

Additional Ways to Monitor Your Credit

Besides credit monitoring services, regularly checking your credit reports and using various tools can help detect potential issues early, offering a more comprehensive approach to maintaining financial health.

For example, reviewing your credit reports annually can help you spot discrepancies and unauthorized activities. Using credit score simulators can forecast how different financial decisions might impact your credit scores.

Additionally, setting up bank account alerts can notify you of unusual transactions, further protecting your financial interests.

Regularly checking credit reports

Accessing free credit reports from each bureau once weekly is crucial for monitoring your financial health. These reports detail your credit history, helping you verify accuracy and spot unauthorized activities.

Obtaining free credit reports ensures the accuracy of your credit history and keeps you aware of credit profile updates. Regular reviews help detect potential issues early and take corrective action.

Using credit score simulators

Credit score simulators help users visualize how different financial actions might affect their credit scores by forecasting potential changes based on various financial decisions, such as credit scoring, paying off debt or opening new accounts.

By using these tools, you can make more informed choices about your financial actions and manage your credit more effectively.

Setting up bank account alerts

Bank account alerts are crucial for monitoring transactions and protecting against fraud. Log into your online banking account and customize the types of notifications you want to receive.

Regularly reviewing your bank alerts keeps you informed and enables timely action against suspicious activities.

Protecting Your Credit

Safeguarding your credit involves proactive measures to secure personal information and monitor financial activities. Consider the level of identity theft protection offered by different services, as more comprehensive options may include alerts for unauthorized transactions. Using strong and varied passwords, multi-factor authentication, and regularly monitoring your online accounts are essential for maintaining financial security.

Locking or freezing your credit significantly reduces the risk of identity theft by preventing creditors from accessing your credit report and blocking unauthorized account approvals.

Implementing these strategies helps protect your credit and financial health.

Implementing credit freezes

A credit freeze protects your credit from unauthorized access by preventing creditors from accessing your credit report, making it difficult for identity thieves to open new accounts. You can freeze or unfreeze your credit report for free by contacting the major credit bureaus; the process is quick and straightforward.

Online or phone requests for a credit freeze are processed within one business day, while mail requests take up to three business days. This proactive step enhances credit protection and provides peace of mind knowing your credit file is secure.

Monitoring online credit card statements

Regularly examining credit card statements is essential for maintaining financial security. Frequent checks help identify unauthorized charges quickly, ensuring accurate credit card activity and prompt detection of suspicious transactions.

Regularly checking your online credit card statements can reveal unauthorized transactions and prevent further fraud. Vigilance with credit card statements is a simple yet effective way to protect financial health.

Utilizing identity theft protection services

Identity theft protection services enhance credit security by monitoring personal data and providing insurance against identity-related losses, safeguarding individuals from financial loss due to identity theft.

Many identity theft protection services monitor personal information on the dark web, court records, and address change requests, notifying users of suspicious changes. They serve as a first line of defense against identity fraud, alerting users about suspicious activity and fraudulent transactions, especially if they exceed set limits.

Using these services adds an extra layer of protection for your credit.

Summary

Monitoring your credit is an essential practice for maintaining your financial health and protecting against identity theft. Whether you choose free or paid credit monitoring services, the key is to stay vigilant and proactive about your credit status. Free services offer valuable baseline protection, while paid services provide more comprehensive coverage and additional features.

By understanding how credit monitoring works, knowing the key terms, and using additional tools like credit score simulators and bank account alerts, you can take control of your financial future. Implementing credit freezes and utilizing identity theft protection services further enhance your security. Remember, the responsibility for protecting your credit ultimately lies with you. Stay informed, stay vigilant, and take action to safeguard your financial health.

Frequently Asked Questions

What is credit monitoring?** **?

Credit monitoring is a vital service that keeps you informed about changes to your credit reports, alerting you to potential identity theft and fraud. This proactive approach helps safeguard your financial health.

Are free credit monitoring services effective?** **?

Free credit monitoring services are effective for tracking your credit health and providing alerts, but they may have fewer features than paid services. Therefore, while they are useful, consider your needs when choosing a service.

What are the benefits of paid credit monitoring services?** **?

Paid credit monitoring services provide extensive monitoring of all three major credit bureaus, identity theft insurance, and enhanced security features, ensuring greater protection against fraud and credit score changes. This level of protection offers peace of mind and proactive management of your credit health.

How do I set up a credit monitoring service?** **?

To set up a credit monitoring service, create an account and verify your identity, then customize your alert preferences to suit your needs. This ensures you stay informed about any changes to your credit report.

Can credit monitoring prevent identity theft?** **?

Credit monitoring cannot prevent identity theft; however, it can alert you to suspicious activities, enabling you to respond quickly and mitigate potential damage.