How Long Does It Take to Get a Credit Score? Explained

Wondering how long does it take to get a credit score? Typically, it takes about 3 to 6 months of recorded credit activity. This article will explain what steps you need to take and what factors can influence the timing.

Key Takeaways

Establishing your first credit score takes about 3 to 6 months and requires consistent credit activity.

Common reasons for not having a credit score include no credit history or lack of recent credit activity.

Using secured credit cards, being an authorized user, and taking credit-builder loans are effective ways to start building your credit.

Understanding Credit Scores

A credit score is a three-digit number reflecting your overall credit health. Ranging from 300 to 850, credit scores are a critical factor that lenders consider when evaluating the risk of lending money to you. The higher your credit score altogether, the more likely you are to receive favorable terms on loans and credit products, which can lead to significant savings over time.

Two major credit scoring models dominate the landscape: FICO® and VantageScore®. The FICO® score, in particular, is the most recognized and widely used by lenders. Most lenders rely on the FICO® model to make lending decisions. These scores are calculated based on your credit activity, including your payment history, amounts owed, length of credit history, credit mix, and new credit inquiries.

It’s important to note that you and your spouse maintain individual credit scores, even when co-signing loans. This means that each person’s credit actions directly impact their own credit score, regardless of joint financial activities.

How Long It Takes to Get Your First Credit Score

Establishing your first credit score generally takes between 3 to 6 months. This timeframe applies not only to FICO scores but also to other scoring models like VantageScore. During this period, your credit activity needs to be consistently recorded and reported to the credit bureaus to generate a reliable credit score.

Building credit requires patience. A minimum of 6 months of credit activity is necessary to accurately reflect your financial behavior and habits. Although it may seem like a long wait, this time helps establish a solid foundation for your credit profile, opening up numerous financial opportunities in the future.

Why You Might Not Have a Credit Score Yet

Several common reasons might explain why you don’t have a credit score yet. One primary reason is being new to credit. If you’ve never opened a credit account or taken out a loan, there’s no credit history for the credit bureaus to evaluate.

Another reason could be a lack of recent credit activity. Even if you’ve had credit accounts in the past, not using them recently can result in your credit score becoming inactive.

In short, little or no credit history and minimal recent credit activity are primary reasons for not having a credit score.

Activities That Help Generate a Credit Score

Opening a credit card account is an effective way to start building your credit history. If you’re new to credit, consider applying for a department store or gasoline credit card, which are often easier to obtain than traditional credit cards. Using a credit card responsibly and making on-time payments will help generate a credit score within 3-6 months.

Becoming an authorized user on someone else’s credit card allows you to build credit history based on the primary cardholder’s usage and payment habits. It’s a great way to start building credit without the responsibility of managing your own credit card account.

Reporting rent and utilities, and linking a bank account can also help build credit quickly. These activities show consistent financial responsibility and can help improve your credit score over time.

Factors Affecting Credit Score Generation

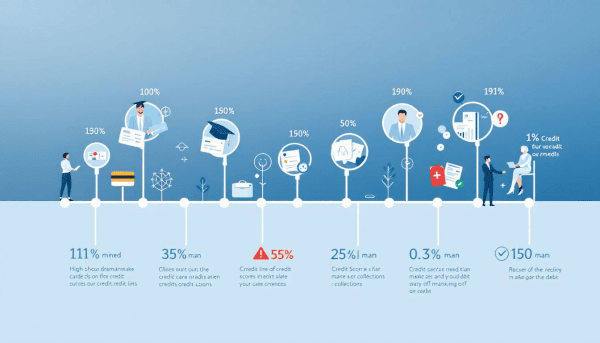

Various factors influence how quickly your credit score is generated. Payment history, accounting for 35% of your FICO score, is the most significant factor. Consistently making on-time payments demonstrates to lenders that you are a responsible borrower.

Credit utilization, or the amount of available credit you are using, makes up 30% of your FICO credit score. Keeping your credit utilization below 30% of your credit limit is recommended to maintain a healthy credit score.

The length of your credit history impacts 15% of your FICO score, meaning a longer history can positively affect credit ratings. Your credit mix, comprising different types of credit accounts, makes up 10% of your FICO score. New credit inquiries also influence 10% of your score, and multiple new accounts in a short period can pose a higher risk.

Methods to Establish Credit

Effective methods to establish credit include secured credit cards, becoming an authorized user, and credit-builder loans. These methods help individuals start building their credit history and receive their first credit scores.

Each method has its unique benefits and requirements, so it’s important to choose the one that best suits your financial situation and goals.

Secured Credit Cards

Secured credit cards are a great starting point for establishing credit. These cards require a cash deposit equal to the credit limit, lowering the risk for the lender. Responsible use of a secured credit card can help build your credit history by reporting payment activity to major credit bureaus. The deposit ensures that you’re less likely to overspend, and consistent, on-time payments can improve your credit score over time.

Becoming an Authorized User

Another effective way to establish credit is by becoming an authorized user on someone else’s credit card. This allows you to benefit from the primary cardholder’s credit history without taking on financial responsibility yourself.

Credit-Builder Loans

Credit-builder loans are designed to help individuals build their credit scores. These loans typically hold the borrowed funds in a savings account until the loan is fully paid off. Timely payments on a credit-builder loan can significantly improve your credit score.

Ensure that the lender reports your payments to all three major credit bureaus to effectively build your credit score.

Monitoring Your Credit Progress

Monitoring your credit progress helps you stay on top of your credit status and catch issues early. Regularly checking your credit can help you spot identity theft or errors before they cause severe damage.

Credit monitoring tools provide insights into your credit health, aiding in better financial planning and helping you understand your Experian credit report.

Using Credit Monitoring Tools

Regularly reviewing your credit reports helps identify potential issues early. Credit monitoring tools can alert you to changes in your credit report, allowing for quicker resolutions. These tools enable timely detection of inaccuracies, crucial for maintaining a good credit score.

Correcting Errors on Your Credit Report

Regularly tracking your credit reports can help identify errors that may affect your score. Disputing inaccuracies on your credit report is necessary, as the Fair Credit Reporting Act mandates investigations of claimed errors.

To dispute an error, send supporting documents along with a letter to the credit reporting agency. Promptly addressing these inaccuracies can help improve your credit score.

Summary

Building a good credit score is a journey that requires patience, consistency, and informed decision-making. From understanding what a credit score is to knowing how long it takes to get your first score, every step is crucial.

By following the methods outlined in this guide and monitoring your progress, you can establish a solid credit foundation and unlock numerous financial opportunities. Remember, good credit habits today pave the way for excellent credit scores in the future.

Frequently Asked Questions

How long does it take to get a credit score?

It usually takes around 3 to 6 months to build a credit score, especially if you're regularly using credit. So, staying active with your credit activities can speed up the process!

Why might I not have a credit score yet?

You might not have a credit score yet because you're new to credit or simply haven't used credit recently. It's important to start building your credit history to develop a score.

What activities help generate a credit score?

To boost your credit score, consider opening a credit card, becoming an authorized user on someone else's card, and making sure your rent and utility payments are reported. These activities can significantly improve your credit standing!

What factors affect my credit score generation?

Your credit score is mainly influenced by your payment history, credit utilization, length of credit history, credit mix, and new credit inquiries. Keeping these factors in check can help you maintain a good score.

How can I correct errors on my credit report?

To correct errors on your credit report, dispute the inaccuracies by sending a letter along with supporting documents to the credit reporting agency. It's straightforward and can help you improve your credit score!