Effective Steps on How to Build Credit from Scratch

If you’re starting with no credit history, here’s how to build credit from scratch. This guide covers secured credit cards, credit-builder loans, and other methods to help you establish your credit. Let’s get you started on the path to a strong financial future.

Key Takeaways

Establish a solid credit foundation using secured credit cards and credit-builder loans to kickstart your credit journey.

Regularly check your credit reports to correct errors and improve your credit score for better financial opportunities.

Practice good credit habits, such as timely payments and managing credit utilization, to ensure long-term success in building your credit history.

Understanding Credit History

Imagine your credit history as a financial report card. It’s a summary of your past borrowing, including loans and credit cards, that lenders use to assess your creditworthiness. A strong credit history can lead to better interest rates and eligibility for loans or credit cards, making it easier to achieve financial goals. On the flip side, having no credit history can make it difficult to qualify for loans, leaving you ‘credit invisible’.

For individuals who have established credit in another country, it’s important to note that this credit history does not automatically transfer to U.S. systems. However, international banking programs can assist in obtaining U.S. credit cards, helping to establish credit in the new country.

Think of your credit score as a snapshot derived from your credit history. This score, a crucial factor in credit scoring, helps lenders determine the risk of lending to you. Whether you’re applying for a loan or a credit card, your credit history and score play pivotal roles in the decision-making process.

Keeping your credit utilization low is vital for maintaining a good credit history.

Check Your Credit Report

Your credit report is like a financial mirror, reflecting your credit usage and personal information. Checking your credit reports regularly helps identify and correct errors that could affect your credit history. Free copies of your Experian credit report are available from the major bureaus at AnnualCreditReport.com. This proactive step ensures that your credit history accurately represents your financial behavior.

Finding and disputing errors in your credit report can significantly boost your credit score. Catching a mistake can boost your credit score overnight. Regularly reviewing your credit report is key to building and maintaining a healthy credit profile.

Begin with a Secured Credit Card

A secured credit card is one of the most effective ways to build credit from scratch. A secured credit card requires a cash deposit that typically matches your credit limit and serves as collateral. This setup makes secured credit cards easier to qualify for than traditional credit cards, especially for those with no credit history.

Credit card companies often offer secured credit cards designed for individuals new to credit or those rebuilding their credit. These companies may also provide free credit reports and other tools to help you monitor your credit-building progress.

While secured credit cards often have lower credit limits at the start, responsible use can lead to credit limit increases over time. Ensure that the secured credit card issuer reports to all three credit bureaus for effective credit building. Consistently making on-time payments on a secured credit card can significantly improve your credit score.

However, some secured cards may impose high interest rates and annual fees, so compare options before applying. Choosing the right secured credit card and using it responsibly can lay a strong foundation for your credit history.

Utilize a Credit-Builder Loan

A credit-builder loan is another excellent tool for building or rebuilding your credit history. Unlike traditional loans, the funds from a credit-builder loan are held by the lender until you have made all repayment obligations. This unique setup ensures that your payments are reported to credit bureaus, helping you establish a positive credit history through a loan or credit card.

Credit-builder loans have several advantages. At the end of the loan term, the borrowed money is returned to you, demonstrating responsible payment behavior and improving your credit score.

Securing a credit-builder loan typically requires providing documentation such as proof of income and ID. Comparing offers from credit unions and community banks can help you find better terms.

Become an Authorized User

Becoming an authorized user on someone else’s credit card account is a strategic way to build credit. As an authorized user, you are added to the account without being responsible for the balance, allowing you to benefit from the primary account holder’s good credit habits, such as making on-time payments.

Establishing clear spending guidelines between the authorized user and the primary cardholder helps avoid financial misunderstandings.

Becoming an authorized user can be especially beneficial if you have a prior negative credit record, as it helps build a positive credit history for authorized users.

Report Rent and Utility Payments

Did you know that your rent and utility payments can contribute to your credit history? Services like Experian Boost can report on-time rent and utility payments to credit bureaus, helping improve your credit score. This alternative method can be particularly useful for those without traditional credit accounts.

Some rent-reporting services do not require landlord verification, while others may charge fees for reporting rent payments. Reporting these payments can help establish a positive payment history by demonstrating responsible credit history behavior.

Apply for a Store Credit Card

Store credit cards often have less strict approval processes, making them an accessible option for building credit. These cards typically come with benefits like account-opening bonuses and discounts for loyal shoppers, making them an attractive option for frequent shoppers.

However, store credit cards usually have higher interest rates that can exceed 30%, making them challenging to manage if balances are carried. Deferred interest plans associated with these cards can result in hefty charges if the balance isn’t fully settled by the deadline.

Using store credit cards for small purchases and paying off the balance each month helps avoid high-interest charges.

Use Student Credit Cards if Eligible

If you’re a student, leveraging student credit cards can be an excellent way to build credit. Designed for young adults, these cards offer perks suited for their lifestyle. Many student credit cards come with reward programs that allow cardholders to earn cash back on purchases.

To qualify, students must demonstrate enrollment in an eligible institution. These credit cards often have lower credit limits and higher approval rates for applicants with minimal credit history. The combination of tailored benefits and easier approval processes makes student credit cards an attractive option for college students.

Using a Co-signer

Using a co-signer can be a viable option for building credit, especially if you have a thin credit file or no credit history. A co-signer is someone who agrees to take on the responsibility of paying off a loan or credit card if you default. This can be a family member, friend, or spouse. When you apply for a loan or credit card with a co-signer, the lender will consider both your credit history and the co-signer’s credit history when making a decision.

To use a co-signer effectively, make sure to:

Choose a co-signer with a good credit history.

Understand the terms of the loan or credit card, including the interest rate and repayment terms.

Make on-time payments to avoid damaging the co-signer’s credit score.

Consider a co-signer release clause, which allows the co-signer to be removed from the loan or credit card after a certain period of time.

Keep in mind that using a co-signer can be a double-edged sword. While it can help you establish credit, it also puts the co-signer’s credit score at risk if you default on the loan or credit card. Therefore, it’s crucial to manage the account responsibly and make all payments on time.

Using a Credit-Building Debit Card

A credit-building debit card is a type of debit card that can help you build credit without going into debt. These cards typically require a security deposit, which is used to fund your debit card account. When you make purchases with the card, the payment is deducted from your account, and the transaction is reported to the credit bureaus.

To use a credit-building debit card effectively, make sure to:

Choose a card that reports to all three major credit bureaus (Experian, TransUnion, and Equifax).

Make regular purchases and payments to demonstrate responsible credit behavior.

Keep your account balance low to avoid overspending.

Monitor your credit report to ensure that the card issuer is reporting your payments accurately.

Some popular credit-building debit cards include the Experian Smart Money Digital Checking Account & Debit Card and the Discover it Secured Credit Card. By using these cards responsibly, you can build your credit history and improve your credit score over time.

Establishing Credit with Experian Go

Experian Go is a free program offered by Experian that allows consumers with no credit report to establish credit. The program creates an Experian credit report for you and allows you to begin building credit by reporting on-time payments and other credit-related activities.

To establish credit with Experian Go, follow these steps:

Sign up for an Experian Go membership account.

Provide personal and financial information to create your credit report.

Make on-time payments on any credit accounts you have, such as a credit-builder loan or secured credit card.

Monitor your credit report to ensure that your payments are being reported accurately.

Experian Go is a great option for those who have no credit history or a thin credit file. It can help you establish credit and improve your credit score over time, setting you on the path to a strong financial future.

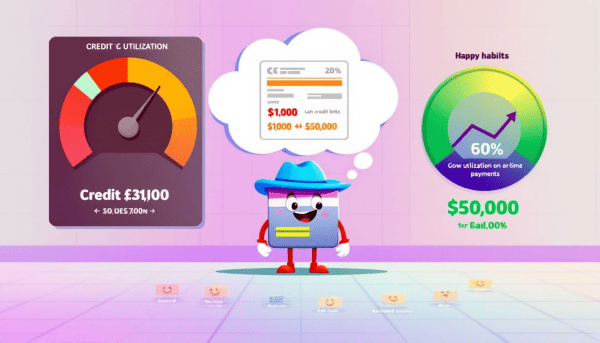

Monitor Your Credit Utilization

Maintaining a low credit utilization ratio is crucial for your credit health. Your credit utilization ratio reflects how well you manage your debts and is a critical factor in credit score calculations. Keeping your balance below 30% of your credit limit is advised to maintain a healthy credit score.

Managing your credit utilization effectively involves reducing your outstanding debt and considering an increase in your available credit limits. Timely payments can help keep your credit utilization low, especially if you pay off balances before your lender reports to credit bureaus. Budgeting to allocate funds for debt repayment is a practical approach to improve your credit utilization ratio.

Store credit cards typically have lower credit limits, affecting credit utilization ratios. By managing your credit utilization effectively, you can positively influence your ability to secure loans and achieve favorable interest rates.

Practice Good Credit Habits

Good credit habits are the cornerstone of building and maintaining a strong credit profile. Consistently paying your bills on time is crucial, as it impacts the largest portion of your credit score. Keeping credit card accounts open helps maintain credit utilization and average account age.

Limiting new credit applications reduces the impact of hard inquiries on your credit score. Regularly checking your credit score helps you understand the effects of your financial actions and spot potential issues.

Sticking to good credit habits sets you up for long-term financial success.

Avoiding Common Credit Mistakes

Building credit requires responsible credit behavior, and avoiding common credit mistakes is crucial to maintaining a good credit score. Here are some common credit mistakes to avoid:

Missing payments: Late payments can significantly lower your credit score. Make sure to make on-time payments on all credit accounts.

High credit utilization: Keeping your credit utilization ratio low (below 30%) can help improve your credit score. Avoid maxing out your credit cards or using too much of your available credit.

Applying for too many credit accounts: Applying for multiple credit accounts in a short period can negatively affect your credit score. Only apply for credit when necessary, and space out your applications if you need to apply for multiple accounts.

Closing old accounts: Closing old accounts can hurt your credit utilization ratio and reduce your average account age. Consider keeping old accounts open, even if you don’t use them regularly.

By avoiding these common credit mistakes, you can maintain a good credit score and continue to build credit over time. Practicing responsible credit habits is key to long-term financial success.

Credit Education and Resources

Building credit requires a solid understanding of credit concepts and strategies. Here are some resources to help you learn more about credit and improve your credit score:

Credit Karma: A free online platform that provides credit scores, credit monitoring, and credit education resources.

Experian: A credit reporting agency that offers credit scores, credit monitoring, and credit education resources.

Federal Trade Commission (FTC): A government agency that provides information on credit and consumer protection.

National Foundation for Credit Counseling (NFCC): A non-profit organization that provides credit counseling and education resources.

By taking advantage of these resources, you can improve your credit knowledge and make informed decisions about your credit. Understanding how credit works and staying informed about your credit status are essential steps in building and maintaining a strong credit profile.

Regularly Review Your Credit Scores and Reports

Regularly reviewing your credit scores and reports keeps your credit-building journey on track. Frequent checks help you spot inaccuracies and track your progress effectively. A credit monitoring app can help you stay informed about changes in your credit score.

Paying all bills on time is the most significant factor in establishing a strong credit score. Regular monitoring ensures your credit history accurately represents your financial behavior and allows for informed decisions.

Summary

Building credit from scratch may seem challenging, but with the right steps, it’s entirely achievable. From starting with secured credit cards and credit-builder loans to leveraging rent payments and becoming an authorized user, there are numerous strategies to establish and build your credit history. Remember, maintaining good credit habits and regularly monitoring your credit scores and reports are key to long-term financial health.

Frequently Asked Questions

What is a secured credit card, and how does it help build credit?

A secured credit card is a great tool for building credit, as it requires a cash deposit that acts as your credit limit. By making consistent on-time payments, you can improve your credit score and pave the way for better financial opportunities!

How can I check my credit report for free?

You can check your credit report for free by visiting AnnualCreditReport.com, where you can get copies from the major credit bureaus. Take control of your financial health today!

What is a credit-builder loan, and how does it work?

A credit-builder loan is a fantastic tool to enhance your credit score by securing funds in a savings account while making regular payments that are reported to credit bureaus. By the end of the term, you not only improve your credit but also receive the money back, empowering your financial journey!

How can becoming an authorized user help build my credit?

Becoming an authorized user can significantly boost your credit history by allowing you to share in the primary account holder's positive credit behavior. This is a smart step towards establishing a strong credit profile!

Why is maintaining a low credit utilization ratio important?

Maintaining a low credit utilization ratio is crucial for your credit health, as it demonstrates responsible debt management and positively impacts your credit score. Aim to keep your balance below 30% of your credit limit to maximize your financial potential!