Best Tips on How to Build Credit Without a Job

Building credit without a job is challenging but possible. This guide will show you how to build credit without a job by improving your credit score using strategies like secured credit cards, becoming an authorized user, and more practical tips.

Key Takeaways

Understanding the indirect effects of unemployment on credit scores is crucial for maintaining good credit health during financial challenges.

Using a secured credit card and becoming an authorized user can help build credit without a job, provided that payments are made on time.

Timely payment of bills and utilizing services that report rent payments to credit bureaus can significantly enhance your credit profile.

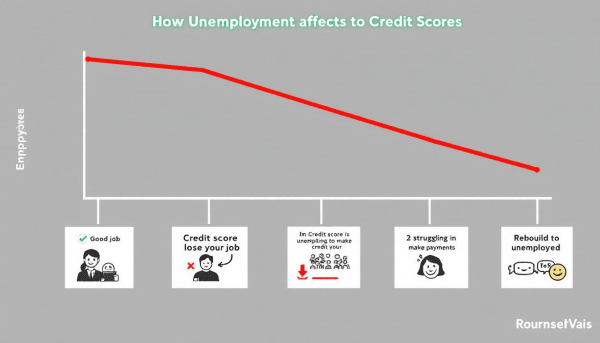

Understand How Unemployment Affects Credit Scores

Unemployment doesn’t directly impact your credit score, but the financial challenges that come with a lack of income certainly can. Without a steady paycheck, it’s easy to fall behind on bills or accrue debt, both of which can negatively affect your credit score. Understanding the indirect effects of unemployment on your credit is important.

When income is scarce, late payments or increased debt are common pitfalls that can significantly decrease your credit score. Careful financial management during unemployment is vital. Adjusting your spending habits and prioritizing payment obligations can prevent credit damage. Missing payments can have severe consequences, making it even harder to recover financially.

Keeping a close eye on spending and working proactively with creditors helps maintain good credit health during unemployment. Tracking expenses and communicating with creditors can help you navigate this challenging period without derailing your credit score.

Use a Secured Credit Card

One of the most effective ways to build credit without a job is by using a secured credit card. A secured credit card requires a refundable security deposit, which typically serves as your credit limit. This makes secured credit cards more accessible for those without a steady income, as they often do not require a credit check.

The key to benefiting from a secured credit card is responsible use. Keeping your credit utilization ratio low and making on-time payments builds a positive credit history. Responsible use over time can result in converting your secured card to an unsecured one with better terms.

Many secured credit card issuers report to the major credit bureaus, ensuring that your responsible usage is reflected in your credit reports. Consistent, on-time payments can improve your credit score and eventually allow you to transition to an unsecured card, recovering your security deposit.

Become an Authorized User on a Credit Card Account

Becoming an authorized user on someone else’s credit card account is another excellent strategy for building credit without a job. This allows you to benefit from the primary cardholder’s good credit history, helping you establish or improve your own credit. Young individuals or those with limited credit history find this approach particularly beneficial.

Becoming an authorized user is generally a straightforward process and does not require a credit check. Ensure that the card issuer reports authorized user activity to the credit bureaus. This makes sure the positive payment history and low credit utilization of the primary cardholder are reflected in your credit report.

Remember that the primary cardholder is responsible for the bill. Any late payments or high balances can negatively affect your credit score. Communication with the primary cardholder and ensuring responsible credit card use are crucial.

Leverage Rent Payments

Your rent payments can also be a valuable tool for building credit. Services like Bilt Rewards and Fannie Mae’s Positive Rent Payment program allow renters to report their on-time rent payments to the credit bureaus, helping to establish a good credit history. Many of these services are free if your landlord participates in the program.

Regularly reporting on-time rent payments can significantly enhance your credit profile. Some newer versions of the FICO score even consider rental payment information when calculating credit scores. Consistent, timely payments can help improve your credit score over time.

Utilize Free Credit Monitoring Tools

Regularly monitoring your credit scores helps you understand your overall financial health. Many banks provide free credit reports to their customers, including information from the three major credit bureaus. This service is typically available at least once a year. Additionally, services like Experian Boost can help improve your credit score by adding eligible utility, phone, and streaming service payments to your credit report.

Free credit monitoring tools help you track progress and ensure the accuracy of information on your credit reports. Identifying and addressing issues early through this proactive approach makes it easier to improve and maintain your credit score. Additionally, you can obtain a free credit report to further assist in monitoring your financial health.

Apply for a Credit Builder Loan

Credit builder loans are designed specifically to help individuals build or improve their credit scores.

These loans work by:

Holding the loan amount in a savings account until it is fully repaid

Promoting savings

Ensuring that the borrower demonstrates a positive payment history.

These loans typically have lenient eligibility requirements, making them accessible to those with low or no credit history. Once the loan is paid off, the funds are released to the borrower, and the credit bureaus are notified of the positive payment history, which can help improve your credit score.

Pay Bills on Time

Paying your bills on time consistently is crucial for maintaining a good credit score. Even if you can only make the minimum payments, doing so punctually can significantly enhance your credit score and avoid late fees. Establishing reminders or setting up automatic payments can help ensure that you never miss a due date.

Creating a budget that includes all your monthly bills can also help you stay on top of your monthly payment. Prioritizing timely payments helps maintain essential services and build a positive payment history that benefits your credit score in the long run.

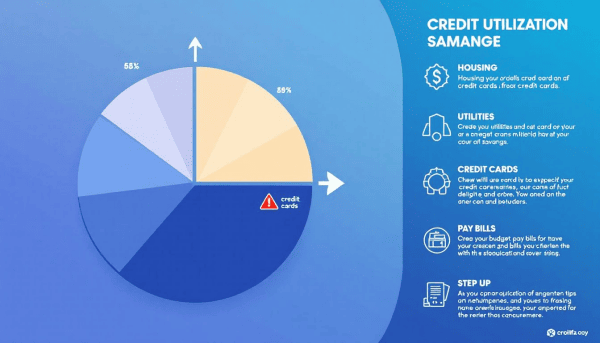

Keep Credit Utilization Low

Credit utilization, the ratio of your credit card balances to your credit limits, significantly impacts your credit scores. Keeping this ratio below 30% is ideal for optimal credit score management. Using a high percentage of your available credit can lead to a decrease in your credit score, especially if your utilization exceeds 30%.

Paying down balances and using multiple credit cards responsibly are key strategies to keep credit utilization low. Effective management of your credit utilization helps maintain a healthier credit score, even during unemployment.

Maintain Old Credit Accounts

Keeping old credit accounts open helps maintain a long credit history, benefiting your credit score. A longer credit history gives lenders a better understanding of your financial behavior and positively impacts your credit score.

Retaining old accounts prevents an increase in your credit utilization ratio, which can happen when accounts with high credit limits are closed. Even if you’re not actively using these accounts, they contribute to your total available credit and enhance your credit profile.

Avoid Multiple Credit Applications

Submitting multiple new credit applications in a short period can negatively impact your credit score. Each application results in a hard inquiry on your credit report, which can slightly lower your score. Multiple hard inquiries can compound this effect, making it more challenging to improve your credit score.

Hard inquiries remain on your credit report for up to two years, but their impact diminishes after a few months. To minimize negative impact, apply for new credit sparingly, ideally waiting at least six months between applications.

Strategic applications for new credit help avoid unnecessary hard inquiries and maintain a healthier credit score.

Seek Professional Help if Needed

Struggling with managing credit during unemployment might require seeking professional help. Credit counselors assist with budgeting, debt management, and creating personalized personal finance plans.

Many nonprofit credit counseling agencies offer free initial consultations, providing valuable guidance without impacting your credit score.

Summary

Building and maintaining good credit without a job is challenging but achievable. By understanding how unemployment affects your credit, using secured credit cards, becoming an authorized user, leveraging rent payments, and utilizing free credit monitoring tools, you can improve your credit score even during tough times.

Remember to pay your bills on time, keep your credit utilization low, maintain old credit accounts, and avoid multiple credit applications. If needed, seek professional help to stay on track. These strategies will help you build a solid credit foundation and secure a more stable financial future.

Frequently Asked Questions

Can I build credit without a job?

Yes, you can build credit without a job by using secured credit cards, becoming an authorized user, and paying rent. These strategies can help you establish and improve your credit profile effectively.

What is a secured credit card?

A secured credit card is a type of credit card that requires a refundable security deposit and can aid in building credit when used responsibly. It serves as a valuable tool for those looking to improve their credit score.

How can rent payments help my credit score?

On-time rent payments can significantly boost your credit score when reported to credit bureaus via rent reporting services. This practice helps build your credit history, demonstrating your reliability as a borrower.

What is a credit builder loan?

A credit builder loan allows individuals to improve their credit score by making regular payments, with the loan amount being held in a savings account until fully repaid. This structured approach helps establish a positive credit history.

Should I close old credit accounts?

Keeping old credit accounts open is advisable as it helps maintain a longer credit history and improves your credit utilization ratio. This ultimately supports a healthier credit score.