Build Credit While Paying Off Debt: Effective Strategies

Paying off debt while building credit can seem challenging, but it’s possible with the right strategies. In this article, you’ll learn how to build credit while paying off debt by understanding your credit report, making on-time payments, managing credit utilization, and more. These steps will help you improve your financial health.

Key Takeaways

Understanding your credit report is essential for building a good credit score; review it regularly to correct inaccuracies.

Prioritize on-time payments and manage your credit utilization ratio to enhance your credit profile.

Consider strategies like using secured credit cards or becoming an authorized user to boost your credit score effectively.

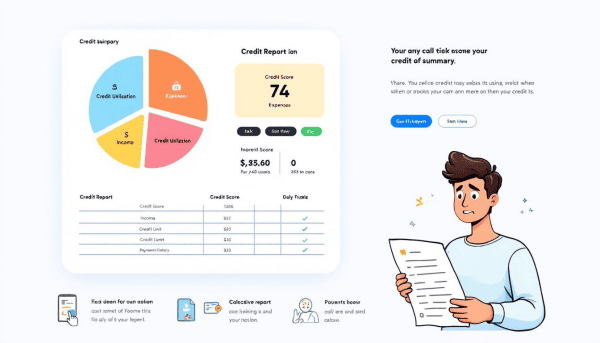

Understand Your Credit Report

The foundation of building and maintaining a good credit score starts with understanding your credit report. Your credit report is a detailed summary of your credit history, encompassing personal information, credit accounts, payment history, and any public records like bankruptcies. This report is crucial as it feeds into your credit score, typically ranging from 300 to 850, which lenders use to assess your creditworthiness and credit scoring.

Knowing what’s on your credit report is crucial for making informed decisions about improving your credit. Elements contributing to your credit scores come directly from these reports, including your loans and credit card activities. Thankfully, you can obtain free annual credit reports from AnnualCreditReport.com. The three major credit bureaus — Equifax, Experian, and TransUnion — provide these reports. Reviewing these reports allows you to identify areas for improvement and spot any inaccuracies that need correction.

Correcting inaccuracies, such as wrongly marked late payments or high credit card balances, can lead to significant improvements in your credit score. Downloading and thoroughly reviewing your free credit reports is a key step in your credit-building journey. With accurate information, you can start crafting a strategy to improve your credit score.

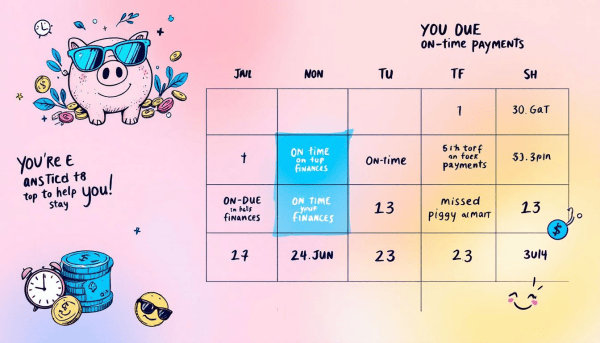

Make On-Time Payments a Priority

One of the most critical factors influencing your credit scores is your payment history, which accounts for 35% of your FICO score. Consistently making on-time payments is non-negotiable if you want to maintain or improve your credit score. Even a single late payment can substantially reduce your score and stay on your credit report for seven years.

Setting up autopay or reminders can help ensure you never miss a payment. These tools can significantly reduce the likelihood of missed payments by automating the process or providing timely alerts. Missing a payment not only impacts your credit score but can also take several months of on-time payments to recover from the damage. Making at least the minimum payment each month builds a positive credit history, essential for long-term financial health.

However, merely making the minimum payment isn’t enough. To genuinely improve your credit score, pay more than the minimum whenever possible. This approach not only reduces your credit card debt faster but also demonstrates to lenders that you are a responsible borrower. Prioritizing on-time payments is a straightforward yet powerful strategy to enhance your credit profile.

Manage Credit Utilization Ratio

Your credit utilization ratio — the amount of credit you’re using compared to your credit limits — plays a significant role in your credit score. Ideally, this ratio should be below 30% to improve your credit score significantly. Keeping your credit card balances well below their limits helps avoid drops in your credit scores and demonstrates responsible credit use.

Prioritize paying off high credit card balances to manage your credit utilization effectively. Paying before the billing cycle ends helps maintain a low credit card balance on your credit cards. If full repayment isn’t possible, aim to keep your total outstanding balance at or below 30% of your credit limit. This practice can lead to noticeable improvements in your credit score within a few months.

Additionally, consider asking for a credit limit increase. This can lower your overall credit utilization by increasing your available credit. However, be cautious about closing credit card accounts once the debt is paid off, as this can lower your available credit and increase your utilization ratio in the long run.

Managing your credit utilization ratio is a balancing act but essential for improving your financial health.

Use a Secured Credit Card

A secured credit card can be a valuable tool for building or rebuilding credit. Unlike traditional credit cards, a secured credit card is backed by a cash deposit that acts as collateral, reducing the risk for lenders. This setup makes secured cards accessible for those with poor or no credit history.

Choose a secured credit card that reports to all three major credit bureaus and make on-time payments to build your credit. Responsible use of a secured credit card can lead to improvements in your credit score within several months. This means making timely payments and keeping your credit utilization low.

Eventually, as your credit improves, you may want to transition from a secured credit card to an unsecured one. Closing a secured credit card account may be necessary to retrieve your security deposit. Using a secured credit card wisely helps build a solid credit foundation and paves the way for better financial opportunities.

Become an Authorized User

Becoming an authorized user on someone else’s credit card account can quickly boost your credit score. If the primary account holder has a good credit history, being added as an authorized user can immediately improve your credit profile.

Ask a relative or friend with a strong credit history and a high credit limit to add you as an authorized user to maximize the benefits. This strategy requires minimal effort but can yield significant results in a short period.

Diversify Your Credit Mix

A diverse credit mix, which includes different types of credit accounts like revolving credit and installment loans, constitutes about 10% of your FICO score. Lenders prefer seeing a variety of credit types because it demonstrates your ability to manage different forms of debt responsibly.

Having a varied credit mix can positively impact your credit score by showing that you can handle multiple forms of credit. Consider adding installment credit or retail accounts strategically to diversify your credit portfolio. However, avoid unnecessary applications as they can result in hard inquiries on your credit report.

A balanced credit mix is key to a robust credit profile and can make you more appealing to lenders.

Dispute Inaccurate Information

Regularly checking your credit report ensures the accuracy of the information it contains. The Fair Credit Reporting Act mandates that credit bureaus ensure the accuracy of the data they collect and report. If you find inaccuracies, both the credit bureau and the reporting entity are responsible for correcting them.

Provide a clear explanation and supporting documents with your dispute letter when disputing errors on your credit report. You can submit disputes online, by mail, or by phone to the three major credit reporting agencies: Experian, Equifax, and TransUnion. Sending your dispute letter via certified mail provides proof of receipt for your records.

Look for mistakes such as late payments marked incorrectly, mixed credit activity, or old negative information. Typically, disputes are resolved within 30 days, ensuring your credit report accurately reflects your financial behavior. Promptly addressing inaccuracies can lead to a more accurate and potentially higher credit score.

Consider Debt Consolidation

Debt consolidation can simplify your payments and potentially lower your interest rates, making it easier to manage your debts. Consolidating credit card debt into a personal loan enhances your credit utilization ratio, positively impacting your credit score.

Making consistent and timely payments on a debt consolidation loan can improve your overall credit profile over time. This approach simplifies financial management while contributing to a stronger credit history.

Avoid New Credit Applications

While paying off debt, it’s crucial to avoid applying for new credit. New credit applications account for about 10% of your overall credit score. Each new hard inquiry can temporarily lower your credit score and remain on your credit report for two years.

Avoiding new credit applications while focusing on managing existing debt is crucial. This approach improves your credit score without the setbacks of new hard inquiries.

Monitor Your Progress

Regularly monitoring your credit progress keeps you informed about changes in your credit score and helps detect potential fraud. Many banks offer free credit monitoring services, providing an easy way to keep track of your credit status. Using these services can help prevent identity theft and ensure your financial health is safeguarded.

You are eligible to receive one free credit report each year. This offer applies to each of the three major credit bureaus. To quickly improve your credit, utilize credit monitoring, make on-time payments, and limit new credit applications. Regularly tracking your progress helps you stay on top of your credit-building journey.

Summary

In summary, building credit while paying off debt requires a balanced approach and a commitment to responsible financial management. Understanding your credit report, making on-time payments, managing your credit utilization ratio, and using tools like secured credit cards are all part of the strategy. Becoming an authorized user, diversifying your credit mix, disputing inaccuracies, considering debt consolidation, avoiding new credit applications, and monitoring your progress round out the comprehensive plan.

By following these strategies, you can achieve a good credit score while managing your debt effectively. Take control of your financial future today and watch your credit score soar as your debt diminishes.

Frequently Asked Questions

How often should I check my credit report?

It's a good idea to check your credit report at least once a year to catch any errors and keep your finances in check. Staying on top of it helps ensure your credit health remains strong.

Will making only the minimum payment on my credit card improve my credit score?

Making only the minimum payment won't significantly improve your credit score; it's best to pay more whenever you can. Boosting your score requires reducing your overall debt and showing responsible credit usage.

Can becoming an authorized user on someone else’s credit card account help my credit score?

Absolutely, becoming an authorized user on someone else's credit card can improve your credit score, particularly if they have a strong credit history. It’s a smart move if you’re looking to enhance your credit standing!

What is a good credit utilization ratio?

A good credit utilization ratio is below 30%, as this can boost your credit score significantly. Keeping it low shows you're managing your credit responsibly.

Is it beneficial to use a secured credit card to build credit?

Absolutely, using a secured credit card responsibly can significantly help you build or rebuild your credit over time. It's a smart way to enhance your credit profile!