Top Strategies on How to Build Credit Fast

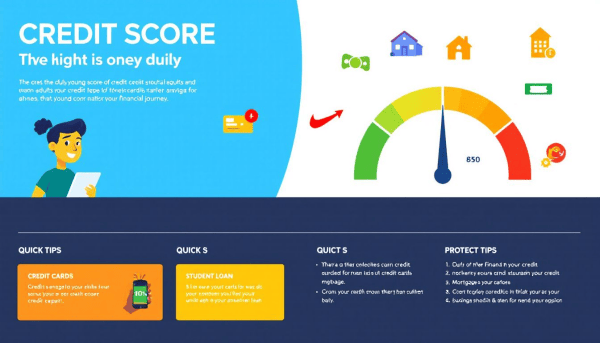

If you need to improve your credit score quickly, you’re in the right place. In this article, we’ll cover effective strategies on how to build credit fast. Expect practical tips that you can start implementing today.

Key Takeaways

Consistently making on-time payments is crucial for improving credit scores, as it constitutes about 35% of the FICO score.

Lowering your credit utilization ratio by paying down high balances and requesting credit limit increases can significantly enhance your credit profile.

Regularly monitoring your credit report for errors and becoming an authorized user on a positive account can help establish or rebuild credit effectively.

Make On-Time Payments a Priority

Consistently making on-time payments is the golden rule for enhancing your credit score. Your payment history accounts for approximately 35% of your FICO score, making it the most significant factor in credit scoring models. Each on-time payment you make contributes to a positive credit history, reflecting your reliability to lenders. This reliability can lead to lower interest rates on loans, as improved credit scores are associated with better financial terms.

One effective way to ensure on-time payments and avoid the pitfalls of missed payments is to set up autopay for your credit card bills. Automatic payments help you stay on track, prevent scores from declining due to late payments, and simplify budgeting by reducing the worry of late fees. Additionally, creating calendar reminders for your bills can serve as an extra safeguard against forgetting due dates.

Moreover, the benefits of making on-time payments extend beyond just improving your credit score. Paying your bills promptly can alleviate financial stress and foster a sense of control over your finances. Prioritizing timely payments quickly and effectively builds a robust credit profile, paving the way for a stable financial future.

Lower Your Credit Utilization Ratio Immediately

Lowering your credit utilization ratio is another powerful strategy to boost your credit scores quickly. This ratio, calculated by dividing your total credit card balances by your total credit limits, is a crucial factor in credit scoring. Ideally, you should aim to keep your credit utilization below 30%, but a ratio of 10% or less is even better.

Let’s dive into two effective methods to achieve this.

Pay Down High Credit Card Balances

Paying down high credit card balances should be a top priority in your credit improvement plan. This approach directly lowers your credit utilization ratio, which is vital for a good credit score. Credit card companies report balance data at the end of each billing cycle, so making early payments can significantly reduce the balances reported to the credit bureaus.

Consider using the avalanche method to tackle your credit card debt strategically. Prioritize payments on balances with the highest interest rates first, saving you money and accelerating debt reduction. By efficiently managing your payments and reducing high balances, you can quickly improve your credit utilization and overall credit health.

Request a Credit Limit Increase

Requesting a credit limit increase is another effective way to lower your credit utilization ratio without increasing your debt. A higher credit limit allows for a lower utilization ratio, which can positively impact your credit scores. Contact your credit card issuer to request an increase and provide any updated income information they might need.

While a credit limit increase can be beneficial, it should be used wisely. Avoid accumulating more debt, as this could negate the positive effects of the increased limit. Instead, maintain low balances and use this strategy to enhance your credit profile responsibly.

Dispute Errors on Your Credit Reports

Regularly monitoring your credit reports for errors is essential for maintaining an accurate credit history and improving your credit score. Inaccuracies, such as incorrect account information or erroneous late payments, can significantly impact your credit scores. Understanding what lenders might see allows you to take proactive steps in credit reporting to correct any discrepancies.

You have the right to dispute inaccuracies on your credit report at no charge. Disputes can be submitted online, by mail, or by phone to the credit bureaus. Once a dispute is submitted, the credit bureau has 30 days to investigate the claim. If the dispute is found valid, the incorrect information will be amended or removed from your report.

Regular monitoring of your credit ensures that removed inaccuracies do not reappear. If a dispute remains unresolved, you can request a statement of the dispute to be added to your file. Taking these steps not only helps to correct errors but also demonstrates to lenders that you are diligent about maintaining a positive credit history.

Become an Authorized User on a Positive Account

Becoming an authorized user on someone else’s credit card account is a great way to build credit without needing your own credit history. As an authorized user, you’re added to another person’s credit card account, and the payment history of that account is reported to the credit bureaus under your name.

It’s crucial to choose a primary cardholder with a healthy credit history and a positive payment record. Communication between you and the primary cardholder is key to ensuring that payments are made on time and credit utilization ratios are kept low.

This strategy can help you establish or improve your credit score quickly by leveraging someone else’s good credit behavior.

Use a Secured Credit Card Wisely

Secured credit cards are a valuable tool for building or rebuilding credit, especially if you have a thin credit file or poor credit history. These cards require an upfront security deposit, which typically equals your credit limit. Using a secured credit card responsibly can demonstrate to lenders that you can manage credit effectively.

Maximize the benefits of a secured credit card by paying your bills in full and on time each month. This practice helps you avoid interest charges and establishes a positive payment history, which is reported to the major credit bureaus.

Over time, using a secured credit card wisely can help you transition to an unsecured card and further improve your credit score.

Diversify Your Credit Mix

Maintaining a diverse credit mix can enhance your credit score by demonstrating your ability to manage different types of credit responsibly. A varied credit profile typically includes both revolving credit accounts, like credit cards, and installment loans, such as auto loans or mortgages.

Such diversity shows lenders that you can handle various credit obligations.

Apply for a Credit-Builder Loan

Credit-builder loans are designed specifically to help individuals establish a positive credit history through consistent payments. These loans work by holding the loan amount in an account until it is fully repaid, ensuring that you build a history of on-time payments.

Payments on these loans are reported to the credit bureaus, establishing a positive payment history. This approach benefits those with no credit history or those looking to rebuild their credit profile.

Mix Revolving and Installment Loans

A balanced credit profile includes both revolving credit accounts and installment loans. Revolving credit, such as credit card accounts, allows you to borrow up to a limit and repay based on your usage. Installment loans, on the other hand, involve borrowing a fixed amount and repaying it over a set period.

Maintaining both types of credit demonstrates to lenders that you can manage different credit obligations effectively. A diverse credit mix contributes to a higher credit score and better financial opportunities.

Limit New Credit Inquiries

Limiting new credit inquiries is crucial when trying to improve your credit score. Multiple applications for new credit accounts in a short time can cause a temporary drop in your credit score due to hard inquiries. These inquiries can signal financial difficulties to lenders, potentially making it harder to secure new credit.

Hard inquiries stay on your credit report for two years. However, only inquiries from the past 12 months affect your FICO Score. Refrain from applying for new credit while working on improving your credit score to avoid unnecessary inquiries.

Monitoring your own credit report does not affect your score, enabling you to track your progress without consequences.

Monitor Your Credit Regularly

Regularly monitoring your credit is essential for tracking your progress and catching any mistakes or inaccuracies that could impact your credit score. Using free credit monitoring services can provide alerts about changes to your credit report, helping you stay aware of potential identity theft or fraudulent activities.

These services typically provide access to at least one credit score updated monthly, allowing you to see how your credit behaviors influence your score over time. By keeping a close eye on your credit scores and reports, you can make informed decisions and take timely actions to improve your credit profile.

Summary

In summary, building your credit score fast involves a combination of consistent on-time payments, managing your credit utilization ratio, disputing errors, becoming an authorized user, using secured credit cards wisely, diversifying your credit mix, limiting new credit inquiries, and monitoring your credit regularly. By following these strategies, you can pave the way to a stronger credit profile and better financial opportunities. Start implementing these tips today and watch your credit score soar.

Frequently Asked Questions

Why is making on-time payments important for my credit score?

Making on-time payments is essential as they constitute around 35% of your FICO score, the most influential component of credit scoring models. Consistent on-time payments positively impact your creditworthiness and overall financial health.

How can I lower my credit utilization ratio quickly?

To quickly lower your credit utilization ratio, focus on paying down high credit card balances and consider requesting a credit limit increase. These actions will effectively reduce your ratio and improve your credit score.

What should I do if I find an error on my credit report?

If you find an error on your credit report, you should dispute it at no charge by contacting the credit bureaus online, by mail, or by phone. They are required to investigate your claim within 30 days.

How can becoming an authorized user help improve my credit score?

Becoming an authorized user on a credit card with a positive payment history can enhance your credit score by incorporating that account's favorable payment history into your credit report. This strategy leverages the responsible credit usage of the primary account holder to benefit your credit profile.

Why should I monitor my credit regularly?

Monitoring your credit regularly is essential for tracking your financial progress, identifying inaccuracies, and safeguarding against identity theft. Being proactive in this manner provides you with greater control over your financial health.