Top Tips on How to Monitor Your Identity Effectively

Keeping your personal information safe is crucial in the digital age. So, how to monitor your identity to prevent theft and misuse? This guide will walk you through the necessary steps, from checking credit reports and setting up alerts to using identity protection services. Stay informed and take control of your security.

Key Takeaways

Identity monitoring services can alert you to suspicious activities and provide support in case of identity theft, making them crucial for personal information protection.

Regularly checking your credit reports and setting up alerts with financial institutions are essential steps in early detection of identity theft and unauthorized transactions.

Utilizing password managers, implementing two-factor authentication, and keeping personal information secure can significantly enhance online security and reduce the risk of identity theft.

Understanding Identity Monitoring

Identity monitoring is an indispensable tool in the fight against identity theft. It involves tracking your personal information across various platforms, from credit reports to social media accounts, to detect any unusual activities that may indicate identity theft. This proactive approach is essential in protecting your personal information from identity thieves who are constantly devising new ways to steal your identity.

Many identity monitoring services offer comprehensive protection features. For instance, they can alert you to suspicious activities, such as new accounts being opened in your name or unauthorized transactions on your existing accounts. These alerts are crucial in identifying potential threats early, allowing you to take swift action to prevent further damage.

One of the significant advantages of using identity monitoring services is the assistance they provide if identity theft occurs. Many services include identity theft insurance, which can help cover the costs associated with resolving identity theft issues. Additionally, they offer support in navigating the complex process of restoring your identity, which can be both time-consuming and stressful.

The cost of identity monitoring services varies, typically ranging from a few dollars to over $15 per month, depending on the level of protection offered. This investment can be invaluable in providing peace of mind and ensuring that your personal information remains secure. It’s a small price to pay for the protection and support these services offer in the event of identity theft.

Now that we understand the importance and benefits of identity monitoring, let’s explore the next crucial step in safeguarding your identity: regularly checking your credit reports.

Regularly Check Your Credit Reports

Regularly checking your credit reports is a crucial step in detecting identity theft early. Review your credit reports to spot new accounts or inquiries, common indicators of identity fraud. It’s important to scrutinize your credit report for any accounts you don’t recognize, as these could indicate that an identity thief has gained access to your personal information.

One of the best ways to monitor your credit files without incurring costs is to take advantage of the free credit report you can request annually from each of the three major credit bureaus: Experian, TransUnion, and Equifax. Stagger these requests to monitor your credit throughout the year at no cost.

If you suspect that your identity has been compromised, placing a security freeze on your credit report can prevent identity thieves from opening new accounts in your name. Additionally, you can request a fraud alert, which prompts lenders to take extra steps to verify your identity before opening any new credit accounts.

Using credit monitoring services can also enhance your ability to detect suspicious activities. These services monitor your credit files and notify you of any unusual activities, such as new account openings or significant changes to your credit score. This proactive approach can help you address potential issues before they escalate into more significant problems.

Now that we’ve covered the importance of regularly checking your credit reports, let’s move on to the next step: setting up alerts with your financial institutions.

Set Up Alerts with Financial Institutions

Setting up alerts with your financial institutions is a critical step in protecting your bank accounts and financial information from identity theft. These alerts can notify you of significant transactions or unusual account activities, enabling you to take immediate action if something seems amiss.

Most banking apps allow you to customize mobile alerts, giving you control over your alert preferences. You can set up alerts for various activities, such as transactions over a certain amount, withdrawals, or changes to your account information. This customization ensures that you receive timely notifications for activities that are most relevant to you.

Credit card issuers often send fraud alerts for suspicious charges, even without user opt-in, providing an additional layer of security. These alerts can help you catch unauthorized charges quickly, reducing the risk of financial identity theft. Mobile notifications can also help monitor credit card activities, including purchases and fraud alerts, giving you real-time updates on your account status.

Timely alerts allow account holders to address unauthorized charges promptly, thereby reducing the risk of identity theft. Set up alerts with your bank or credit union to closely monitor your financial accounts and react swiftly to any suspicious activities.

With alerts in place, let’s discuss how utilizing identity theft protection services can further enhance your security.

Utilize Identity Theft Protection Services

Identity theft protection services offer a robust defense against various forms of identity theft, including financial, medical identity theft, and criminal identity theft. These services provide a range of features designed to monitor and protect your personal information from identity thieves. Additionally, an id theft protection service can enhance your security measures.

One of the primary benefits of identity theft protection services is their ability to monitor your credit files from the three major credit bureaus and alert you to suspicious activities. This includes monitoring for new accounts opened in your name, changes to your credit report, and other signs of identity fraud. Receive these alerts to take immediate action against potential threats.

In addition to credit monitoring, many identity theft protection services offer dark web monitoring, wallet recovery assistance, and high-risk transaction monitoring. These features provide comprehensive protection against sophisticated identity theft tactics, ensuring that your personal information remains secure.

For those seeking the best identity theft protection, recommended services include NortonLifeLock, IdentityIQ, Identity Guard, and McAfee. These services are known for their extensive protection features and excellent customer support, making them a reliable choice for safeguarding your identity with identity theft protection software.

With identity theft protection services in place, it’s also essential to monitor your online accounts and social media to ensure comprehensive security.

Monitor Online Accounts and Social Media

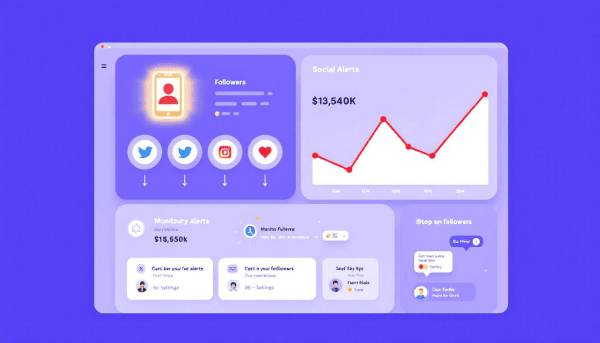

Monitoring your online accounts and social media is a vital aspect of protecting your identity. Unauthorized access or changes to these accounts can be early indicators of identity theft. Regularly checking your social media accounts for any unusual activities can help you catch potential threats before they escalate.

Receiving notifications from financial institutions about unrecognized actions or transactions can also signal an account takeover. These alerts are crucial in identifying and addressing unauthorized access to your online accounts promptly.

Before sharing personal information online, always ask questions to ensure that it’s necessary and secure to do so. This precaution can help protect you from potential identity theft risks associated with oversharing on social media platforms.

Various tools and services can assist in monitoring your online accounts and social media. For example, some identity monitoring services include social media monitoring features, which can alert you to any suspicious activities on your accounts. Leverage these tools to keep a vigilant watch over your online presence.

Monitoring your online accounts is a crucial step, but it’s equally important to use a password manager to enhance your overall security.

Use a Password Manager

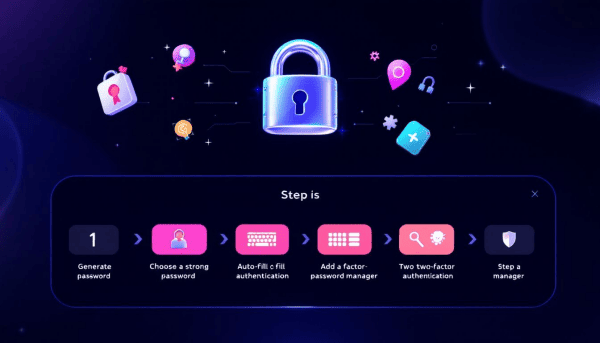

Using a password manager is one of the most effective ways to enhance your online security and prevent identity theft. A password manager creates and stores robust, unique passwords for all your accounts, ensuring that you don’t fall victim to the common vulnerability of password reuse.

A password manager generates strong, unique passwords for each account, significantly reducing the risk of hackers accessing your personal information. This is especially important in the event of a data breach, as unique passwords limit the potential damage to just one account.

Password managers also offer secure storage for sensitive information, such as personal data and digital wallet details. Many password managers, like LastPass, provide additional features such as Secure Notes, allowing you to safeguard even more sensitive information.

Regular use of a password manager can mitigate the impact of data breaches and ensure that your personal information remains secure. With your passwords protected, let’s explore another critical security measure: implementing two-factor authentication.

Implement Two-Factor Authentication

Two-Factor Authentication (2FA) adds an essential layer of security to your online accounts by requiring two different forms of identification during the login process. This additional step significantly reduces the risk of unauthorized access, as it adds an extra barrier for identity thieves to overcome.

2FA helps protect against various threats, including phishing, social engineering, and brute-force attacks, by ensuring that even if your password is compromised, an attacker would still need the second form of authentication to gain access. This makes it a critical security measure for both individuals and businesses.

Government agencies often mandate the use of 2FA for accessing sensitive data, highlighting its importance in enhancing security. The rise in online fraud has made the adoption of 2FA crucial for protecting personal and financial information.

Push notifications are a user-friendly way to approve login attempts within 2FA systems, making it easier for users to secure their accounts without much hassle. With 2FA in place, let’s discuss the importance of reviewing your financial and medical statements regularly.

Review Financial and Medical Statements

Regularly reviewing your financial and medical statements is crucial in detecting unauthorized activities promptly. Scrutinize your bank account and credit account statements to identify unauthorized transactions or withdrawals indicating identity theft.

Inspecting your credit card receipts can also help prevent potential fraud. Ensure that receipts only display the last four digits of your account number to avoid exposing sensitive information. Additionally, monitoring your IRS and Social Security accounts is essential to detect any discrepancies or fraudulent changes that could signal identity theft.

Being aware of the usual arrival times of your financial statements can help you notice any irregularities, such as missing statements, which could indicate that someone has tampered with your mailing address. This awareness can prompt you to take immediate action to secure your accounts and personal information.

By regularly reviewing your financial and medical statements, you can stay vigilant and quickly address any signs of unauthorized activities. The next step in protecting your identity is to keep your personal information secure.

Keep Personal Information Secure

Keeping your personal information secure is a fundamental aspect of preventing identity theft. One crucial tip is to avoid accessing sensitive accounts when using public Wi-Fi, as these networks are often insecure and can be easily exploited by hackers. Instead, use a secure, private network whenever possible.

Employing a virtual private network (VPN) can significantly enhance your internet security, especially when you’re on public networks. A VPN encrypts your internet connection, making it much harder for identity thieves to intercept your data. This added layer of protection is essential for safeguarding your personal information.

Another effective measure is to invest in a shredder to dispose of documents containing personal or financial information. Shredding sensitive documents before discarding them can prevent identity thieves from retrieving information from your trash. This simple step can go a long way in protecting your identity.

Using a locked mailbox is also advisable to prevent mail theft. A locked mailbox ensures that your mail, which often contains sensitive information, is not accessible to identity thieves. Secure your mail to reduce the risk of your personal information being stolen.

With your personal information secure, it’s crucial to know how to respond quickly if you detect any suspicious activity, as prompt action can minimize the damage caused by identity theft.

Respond Quickly to Suspicious Activity

Responding quickly to suspicious activity is vital in minimizing the damage caused by identity theft. One of the first steps is to monitor your credit reports regularly to identify any unauthorized activities promptly. If you notice any unusual transactions or accounts, it’s essential to act immediately.

If you notice that your bills or statements are arriving late, it could be a sign that someone has tampered with your mailing address. In such cases, contacting your financial institutions immediately to secure your accounts is crucial. Changing passwords for your online accounts, especially those containing sensitive information, can also enhance your security.

Requesting a fraud alert on your credit report from all three major credit bureaus can help prevent further unauthorized activities. A fraud alert prompts lenders to take extra steps to verify your identity before opening any new accounts. Additionally, filing a police report can support disputes against fraudulent activities.

Reporting the identity theft to the Federal Trade Commission at IdentityTheft.gov is another important step. The FTC provides resources and assistance in resolving identity theft issues. Consider freezing your credit to prevent new accounts from being opened in your name.

Take swift actions to mitigate the impact of identity theft and protect your personal information from further harm. Now, let’s summarize the key points and conclude our discussion on effective identity monitoring.

Summary

Monitoring your identity effectively involves a multi-faceted approach, including regularly checking your credit reports, setting up alerts with financial institutions, utilizing identity theft protection services, monitoring online accounts and social media, using a password manager, implementing two-factor authentication, reviewing financial and medical statements, and keeping personal information secure. By taking these proactive steps and responding quickly to any suspicious activity, you can safeguard your identity and protect yourself from the devastating consequences of identity theft. Remember, vigilance and prompt action are your best defenses against identity thieves.

Frequently Asked Questions

What are the best identity theft protection services available?

NortonLifeLock, IdentityIQ, Identity Guard, and McAfee are among the best identity theft protection services, providing essential features like dark web monitoring, credit monitoring, and identity theft insurance for comprehensive security. Opting for any of these services can significantly enhance your protection against identity theft.

How often should I check my credit reports?

You should check your credit reports at least once a year, and you can obtain a free report from each of the three major credit bureaus: Experian, TransUnion, and Equifax. This regular check helps ensure your credit information is accurate and up-to-date.

What is the benefit of using a password manager?

Using a password manager significantly enhances your online security by generating and storing strong, unique passwords for each account, thereby reducing the risk of unauthorized access and minimizing the impact of data breaches. This makes managing your passwords more efficient and secure.

Why is two-factor authentication important?

Two-factor authentication is crucial for enhancing the security of your online accounts by requiring an additional verification step, which greatly diminishes the likelihood of unauthorized access even if your password is leaked. Implementing 2FA is a proactive measure to protect your sensitive information.

What should I do if I detect suspicious activity on my accounts?

If you detect suspicious activity on your accounts, promptly report it to your financial institutions, change your passwords, and file a fraud alert on your credit report. Additionally, consider filing a police report and reporting the identity theft to the Federal Trade Commission at IdentityTheft.gov.