Best Steps on How to Set Up Credit Monitoring Alerts

Credit monitoring alerts notify you of changes to your credit report. This guide will show you how to set up credit monitoring alerts to protect against fraud.

Key Takeaways

Credit monitoring alerts provide timely notifications of suspicious activities on your credit report, helping detect identity theft and fraud early.

Setting up credit monitoring involves creating an account with a service, enabling alerts, and customizing notification preferences for optimal monitoring.

Choosing a comprehensive credit monitoring service that covers all three major bureaus and offers additional features like identity theft insurance is crucial for effective credit protection.

Understanding Credit Monitoring Alerts

Credit monitoring alerts are vital tools in the fight against identity theft, providing timely notifications of suspicious activities that could indicate fraud. These services, offered by companies like Credit Karma, provide free credit reports and ID monitoring, alerting you to exposed passwords and other vulnerabilities. However, not all fraudulent activities will trigger these alerts; for example, unauthorized bank withdrawals or tax returns may go unnoticed.

Credit monitoring services work by keeping a vigilant eye on your credit reports from the three major credit bureaus – Equifax, Experian, and TransUnion. When any significant change occurs, such as a new account opening or a change in your credit score, you’ll receive an alert on your credit, enabling you to take immediate action to protect your financial identity. Additionally, you can review your Experian credit report to stay informed about your credit status.

How to Set Up Credit Monitoring Alerts

Setting up credit monitoring alerts is a straightforward process that can significantly enhance your financial security. By enabling these alerts, you ensure that you’ll be notified of any changes in your credit report, allowing you to detect potential identity theft or fraudulent activities early. The process involves creating an account with a credit monitoring service, enabling the alerts, and customizing your preferences to suit your needs.

Whether you’re concerned about unauthorized credit inquiries or changes in your credit file, setting up monitoring alerts can provide peace of mind. Let’s dive into the specific steps needed to get started with credit monitoring alerts.

Creating an Account with a Credit Monitoring Service

Creating an account with a credit monitoring service is the first step in setting up alerts. You’ll need to provide personal information, including your Social Security number and address, to verify your identity. Most services will also require a valid email address and the creation of a secure password. During this process, you may be asked to answer security questions to enhance account protection.

Once your identity is verified, you’ll gain access to your credit reports and the ability to enable monitoring alerts. Using a reputable service that offers comprehensive monitoring across all three major credit bureaus ensures full protection.

Enabling Alerts

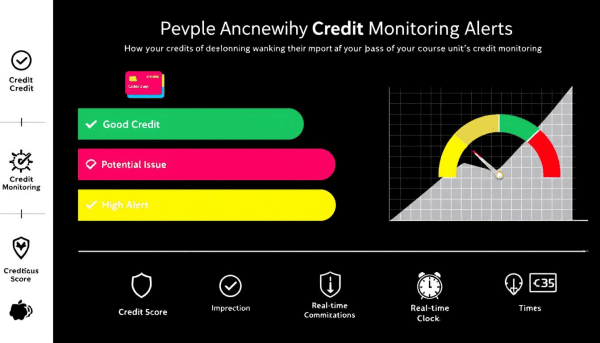

After setting up your account, the next step is enabling alerts. This is typically done through the account settings, where you can choose the types of notifications you wish to receive. Credit monitoring services offer various alert types, including email and mobile push notifications, to keep you informed about significant changes in your credit status.

Verify your preferred contact methods and the frequency of notifications to make sure your alerts are set up correctly. This way, you’ll be promptly informed about essential changes, such as new credit inquiries or alterations in your credit score, helping you detect and respond to potential fraud quickly.

Customizing Alert Preferences

Adjusting your alert preferences is an important part of the setup process. This allows you to specify which types of active duty alerts you want to receive and how you want to be notified. For example, you might prefer email alerts for all activities or push notifications for high-priority issues.

You can also set preferences for the timing and frequency of these notifications to avoid being overwhelmed by too many alerts. The ability to tailor notifications ensures that you stay informed about your credit activity in a way that suits your lifestyle and needs.

How Credit Monitoring Alerts Work

Credit monitoring alerts are triggered by various activities that could indicate potential fraud or identity theft. These activities include new credit inquiries, the opening of new accounts, or significant changes to your credit file. When such an event occurs, the monitoring service sends notifications via email or push notifications to inform you of initial fraud alerts immediately.

These alerts serve as an early warning system for identity theft, enabling you to take prompt action to protect your credit. Staying informed about unusual activities on your credit reports allows identity theft victims to address issues before they escalate, potentially saving you from significant financial harm.

Types of Changes Monitored by Alerts

Credit monitoring alerts cover a wide range of changes that can affect your credit status. For instance, they can notify you when new credit accounts are opened in your name, which is a common indicator of identity theft. Additionally, alerts can signal hard inquiries made by lenders when you apply for credit, providing you with timely information about your credit applications.

These services also monitor changes in personal information, such as address changes, which can be a red flag for identity fraud. Alerts may also inform you of dormant account activity or updates to your personal information, ensuring that you are aware of any potential threats to your credit.

Benefits of Credit Monitoring Alerts

The benefits of credit monitoring alerts are manifold, making them an indispensable tool for anyone concerned about their financial security. Receiving timely notifications of changes to your credit report allows you to take immediate action to prevent fraud and minimize damage. Ignoring these alerts can lead to serious financial consequences, such as unauthorized charges or identity theft.

Credit monitoring services also help track changes in your credit utilization ratio, offering insights into unusual spending patterns that might indicate fraudulent activity. Regular updates on your credit score enable you to actively work on improving your credit, ensuring you maintain a healthy financial profile.

Furthermore, comprehensive monitoring from all three major credit bureaus provides a complete overview of your credit status, enabling you to detect potential fraud from multiple angles. Timely and accurate alerts are essential, and services that provide near real-time notifications can help you address issues sooner, protecting your credit more effectively.

Choosing the Right Credit Monitoring Service

Selecting the right credit monitoring service is crucial for ensuring comprehensive protection of your credit. Three-bureau monitoring is highly recommended, as different bureaus collect diverse credit data, which can help identify potential fraud more effectively. While paid services often exceed $20 monthly, there are also free options available, though they may come with limitations.

When selecting a service, consider the different scoring models used, such as FICO® and VantageScore®, which can affect the credit scores you receive. Comparing these models can help you choose a service that provides the most accurate and useful information for your needs.

Additionally, evaluate the extra features offered by the service, such as identity theft insurance or recovery assistance, which can provide extra peace of mind. By carefully considering these factors, you can select a credit monitoring service that best fits your requirements and budget.

Additional Steps for Protecting Your Credit

Beyond setting up credit monitoring alerts, there are other measures you can take to protect your credit. For example, to place a fraud alert or an extended fraud alert on your credit report can add an extra layer of security, making it harder for identity thieves to open new accounts in your name. A credit freeze is another effective tool, preventing unauthorized access to your credit reports and stopping new credit accounts from being opened.

When sharing sensitive information online, always check for secure website indicators, such as ‘https’ and a padlock icon, to protect against identity theft. Using unsecured websites can significantly increase risks, leading to data breaches and identity fraud.

Regularly reviewing your credit reports for errors and promptly disputing any inaccuracies can also help maintain your credit health. By taking these additional steps, you can further safeguard your financial well-being.

Common Issues and Troubleshooting

Even with the best credit monitoring services, issues can arise. If you find errors on your Equifax credit report, you can file a dispute directly with Equifax through their app or website. Similarly, if a credit bureau has made a mistake, you can dispute errors with Equifax or TransUnion to have them corrected.

If you want to renew a fraud alert, you need to reach out to the credit bureaus. They can also assist you if you wish to remove the alert. These alerts typically last for one year and can be extended or removed as needed. Staying proactive and addressing these issues promptly will help ensure your credit remains accurate and secure.

Summary

Credit monitoring alerts are essential tools for anyone looking to protect their financial health. By setting up these alerts, you can receive timely notifications of changes to your credit report, helping to detect and prevent fraud before it causes significant damage. Choosing the right credit monitoring service and taking additional protective measures can further enhance your security.

In conclusion, taking control of your credit through monitoring alerts and additional protective steps can provide peace of mind and financial stability. Don’t wait until it’s too late – start safeguarding your credit today.

Frequently Asked Questions

How can I set up credit monitoring alerts?

To establish credit monitoring alerts, create an account with a reliable credit monitoring service, verify your identity, and enable alerts in your account settings tailored to your preferences. Taking these steps helps ensure that you stay informed about any changes to your credit profile.

What types of changes will I be alerted to?

You will be alerted to changes such as new credit accounts opened in your name, hard inquiries, modifications in personal information, and any unusual account activities. These alerts are crucial for monitoring your credit health effectively.

Are there free credit monitoring services available?

Yes, free credit monitoring services like Credit Karma provide credit reports, ID monitoring, and alerts, though they may offer fewer features than paid services.

What should I do if I find an error on my credit report?

If you discover an error on your credit report, promptly file a dispute with the relevant credit bureau, such as Equifax or TransUnion. They are obligated to investigate and rectify any inaccuracies.

How do I choose the right credit monitoring service?

To choose the right credit monitoring service, evaluate options based on three-bureau monitoring, associated costs, scoring models, and additional features like identity theft insurance. This comparison will help you find the service that aligns with your specific requirements and budget.