Is Credit Monitoring and Financial Independence Worth the Investment?

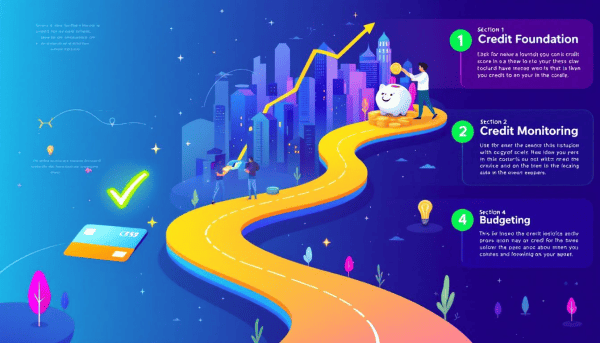

How can Credit Monitoring and Financial Independence help you achieve your goals? By keeping track of your credit, you can catch issues early, maintain a strong credit profile, and make better financial decisions. This article dives into the benefits of credit monitoring and financial independence, exploring if it’s a worthwhile investment.

Key Takeaways

Credit monitoring is essential for maintaining a strong credit profile, allowing for early detection of identity theft and enabling informed financial decisions.

Free and paid credit monitoring services offer different levels of protection; individuals should assess their financial needs before selecting a service.

In addition to credit monitoring, individuals should implement further measures such as establishing a budget, understanding their debt-to-income ratio, and considering credit freezes to enhance financial security.

Understanding Credit Monitoring and Its Role in Financial Independence

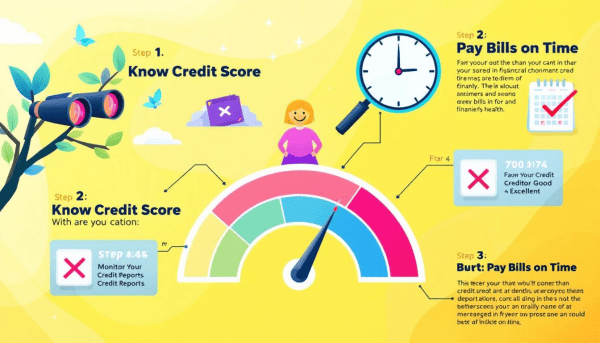

Credit monitoring is the regular tracking of your credit report and credit scores to identify any changes or suspicious activity. This practice is crucial for maintaining a strong credit profile, which significantly influences your ability to achieve financial goals such as buying a home, securing a loan, or even getting a job. Monitoring your credit regularly ensures that you are promptly alerted to any significant changes, allowing you to take swift action if something looks amiss. Credit reporting is an essential part of this process.

Identity theft is a growing concern, with over 1.1 million cases reported by the Federal Trade Commission in 2022. The financial impact of such theft is staggering, with losses estimated at $8.8 billion that year, and median losses around $650 per case. Regularly monitoring your credit allows for early identification and swift response to potential identity theft.

Credit monitoring also provides alerts for significant changes in personal information, such as new accounts being opened or new credit inquiries, which helps in maintaining financial security. Regularly checking your credit reports, especially before making major purchases, is recommended to ensure financial security. Free credit monitoring can be done by obtaining your credit reports weekly and potentially freezing your credit to enhance security.

The lifelong risk of identity theft arises if your data is compromised, impeding financial independence. Thus, credit monitoring is not just about maintaining a good credit score but about making informed financial decisions that align with your long-term financial goals.

Benefits of Credit Monitoring for Financial Health

Credit monitoring services provide automated tracking of your credit scores, enabling you to stay updated on significant changes in your credit profile. Real-time alerts from these services can help you identify and respond swiftly to potential identity theft or fraudulent activities.

One of the key benefits of credit monitoring is early detection of identity theft. Regularly examining your credit reports helps identify unauthorized activity, allowing you to address it promptly and protect against fraud. This proactive approach can save you from the financial and emotional toll that identity theft can inflict.

Moreover, credit monitoring services assist in detecting errors on your credit reports. These errors, if left unaddressed, can negatively impact your credit scores and hinder your financial goals. By promptly addressing discrepancies, you can maintain a healthy credit score and a strong credit profile.

Look for credit monitoring services that offer alerts in near real-time to ensure you are promptly informed of any suspicious activities. This level of vigilance is essential for maintaining your financial health and achieving long-term financial independence.

Free vs. Paid Credit Monitoring Services: Which Is Right for You?

When it comes to credit monitoring services, you have the option of choosing between free and paid services. Each type has its own set of features and benefits, making it important to assess what services are included before making a decision.

Selecting a credit monitoring service should involve considering what features are essential for you. Free services can provide basic monitoring, but if you require more comprehensive coverage, especially from all three credit bureaus, a paid service might be more suitable. It’s crucial to choose a service that offers three-bureau monitoring to track reports from all major credit bureaus and reduce the risk of missing identity theft early.

The cost of credit monitoring services can vary widely, impacting your budget. Weighing the benefits against the monthly fees will help you determine which option aligns best with your financial needs.

Features of Free Credit Monitoring Services

Free credit monitoring services are typically offered by banks, employers, or credit card issuers. These services allow users to access their credit reports weekly without any charges, including a free credit report and free credit reports. While they provide a basic level of protection and insight into credit health, the features are often limited compared to paid options.

Despite their limited features, free monitoring services can still be valuable for individuals looking to keep an eye on their credit without incurring additional costs. They provide essential alerts and updates that can help you stay informed about significant changes in your credit profile.

Overall, free credit monitoring services provide a foundational level of security, making them a suitable option for those who want to monitor their credit without any financial commitment.

Advantages of Paid Credit Monitoring Services

Paid credit monitoring services typically offer comprehensive monitoring across all three major credit bureaus, providing a more holistic view of your credit profile. These services often include theft alerts and a broad range of premium features for enhanced protection.

Consumers should examine included services and cancellation policies before committing to a paid monitoring plan. The premium features of paid services can include advanced identity theft protection, more frequent updates, and access to detailed credit reports, all of which contribute to a more robust defense against fraud.

Investing in a paid credit monitoring service can provide peace of mind and enhanced security for those focused on protecting their financial health and achieving independence.

How to Choose the Best Credit Monitoring Service

Choosing the best credit monitoring service involves considering several factors to ensure it aligns with your financial goals and needs. Look for services that provide alerts for any changes in your credit report, such as new accounts or alterations in personal information. This feature is crucial in detecting and addressing potential fraud early.

Paid credit monitoring services are especially useful. They provide theft alerts and monitor credit across all three bureaus. Premium features like access to reports from all three credit bureaus can make a significant difference in comprehensive credit monitoring.

When selecting a service, consider your goals, needs, budget, and the service’s terms. Review the included services, cancellation policy, and your rights before signing up for a paid service. For free services, it’s important to examine potential hidden fees or cancellation prerequisites.

Leveraging Credit Monitoring to Achieve Financial Goals

Credit monitoring can play a pivotal role in achieving your financial goals. Implementing strategies like loan consolidation or the snowball method can facilitate faster debt repayment. Utilizing credit accounts wisely—by keeping charges below 20% of your limit and paying balances in full—can help improve your credit score and manage credit utilization.

Credit monitoring can also lead to better loan terms for borrowers who demonstrate consistent financial reliability. Maintaining a healthy credit score and strong profile enables you to secure favorable interest rates and terms from lenders, aiding in the achievement of long-term financial goals. Additionally, effective credit scoring can enhance your overall financial profile.

Furthermore, credit monitoring can facilitate early intervention by lenders if you face financial difficulties, offering supportive options to help you manage your debt. This proactive approach can enhance trust and communication between borrowers and lenders, ultimately improving financial relationships.

Additional Steps to Protect Your Credit and Financial Independence

Beyond credit monitoring, there are additional measures you can take to protect your credit and maintain financial independence. A credit freeze is a security measure that restricts access to your credit reports, preventing new accounts from being opened in your name. This can significantly reduce the risk of identity theft.

Understanding your debt-to-income ratio is crucial for effective debt management and achieving financial goals. Differentiating between good and bad debt is essential; good debt can enhance your financial standing, while bad debt can hinder it. Establishing a cash reserve can prevent further indebtedness when unexpected expenses arise.

Establishing and following a household budget is vital for managing debt and saving for financial goals. Setting up alerts on financial accounts and your bank account can help quickly identify and address suspicious transactions. Educating loved ones about common fraud types can enhance their ability to recognize and avoid scams.

Lastly, evaluate whether the credit monitoring service provides bundled identity theft protection and recovery support to enhance your financial security.

Summary

Credit monitoring is an invaluable tool in maintaining a strong credit profile and safeguarding your financial health. By regularly monitoring your credit, you can detect and address potential fraud early, correct errors, and make informed financial decisions. Whether you choose a free or paid service, the key is to remain vigilant and proactive in protecting your credit.

In conclusion, investing time and resources into credit monitoring and additional protective measures can pave the way to financial independence. By taking control of your credit health, you can achieve your financial goals and enjoy peace of mind knowing that your financial future is secure.

Frequently Asked Questions

What is credit monitoring?

Credit monitoring is the process of consistently reviewing your credit reports and scores to detect any changes or potentially fraudulent activities. This proactive approach helps safeguard your financial health.

How can credit monitoring help prevent identity theft?

Credit monitoring helps prevent identity theft by sending real-time alerts for any significant changes in your credit profile, enabling you to take immediate action against suspicious activity. This proactive approach is essential for protecting your financial identity.

What is the difference between free and paid credit monitoring services?

The primary difference lies in the level of service; free credit monitoring offers basic features and limited protection, while paid services provide thorough monitoring of all three major credit bureaus along with premium features for greater security. Thus, for more extensive credit protection, a paid service is recommended.

How do I choose the best credit monitoring service?

To choose the best credit monitoring service, prioritize your financial goals and budget while seeking services that provide alerts for changes in your credit report and comprehensive monitoring from all three credit bureaus. This approach ensures you receive thorough protection and timely updates on your credit health.

Are there additional steps I can take to protect my credit?

You can further protect your credit by implementing a credit freeze, monitoring your debt-to-income ratio, and setting up alerts on your financial accounts. Additionally, educating others about fraud and maintaining a budget will enhance your credit security.