Top 7 Mistakes When Building Credit and How to Fix Them

Building credit is vital, but mistakes can harm your score. This article covers common mistakes when building credit and how to avoid them.

Key Takeaways

Regularly monitor your credit reports to catch inaccuracies and prevent potential damage to your credit score.

Prioritize timely payments and keep your credit utilization below 30% to maintain a healthy credit score.

Diversify your credit mix and avoid overspending to strengthen your credit profile and build financial stability.

Neglecting Credit Reports

One common mistake people make is neglecting their credit reports. Regular monitoring helps catch inaccuracies or fraudulent activities that could harm your credit standing. Checking your credit reports ensures reported accounts are accurate and outdated negative information is removed.

Failing to monitor your credit reports allows errors or fraud to persist, damaging your creditworthiness. Ignoring your reports can result in inaccurate information, making it hard to maintain a good credit score.

You can access free credit reports from major credit bureaus through AnnualCreditReport.com. Regularly reviewing and disputing errors keeps your credit report accurate and your credit score healthy.

Missing Bill Payments

Missing bill payments significantly impacts your credit score as payment history accounts for 30% of it. A late payment reported after 30 days can decrease your score substantially, sometimes by up to 100 points.

Set up automatic payments or reminders to avoid missing bill payments. Partial payments won’t prevent late payments from being reported. If you miss a payment, pay the balance promptly and consider asking the issuer to waive late fees.

Paying bills on time and keeping track of your payment history helps maintain a healthy credit score. Even one missed payment can have a lasting impact on your credit report and scores.

Only Making Minimum Payments

Making only minimum payments on credit cards can lead to increased credit card debt and a higher credit utilization ratio. Keeping your credit utilization below 30% is recommended to maintain a good credit score. Carrying a balance often incurs hefty interest fees, increasing overall debt.

If you’re only able to make minimum payments, reevaluate your budget. Look for ways to cut expenses or earn extra income to pay off your cards in full each month. Avoid making purchases you can’t repay within one month to prevent accumulating debt.

Creating a debt payoff plan helps stop carrying a credit card balance. Prioritizing debt repayment and paying more than the minimum reduces total debt over time and improves your credit score.

Applying for Too Many Credit Accounts

Applying for too many credit accounts in a short period can negatively impact your credit score. Multiple credit applications result in hard inquiries, leading to a significant drop in your credit scores. Applying for multiple credit cards simultaneously triggers multiple hard inquiries, lowering your credit score.

To avoid negative impacts, wait at least six months between new credit applications. Spacing out applications between 90 days to six months helps minimize the impact on your credit score.

Prequalification options from lenders help gauge potential credit offers without impacting your credit score. Using these options, you can assess your chances of approval without triggering a hard inquiry.

Closing Old Credit Accounts

Closing old credit accounts might seem like a good idea, but it can lower your credit score. Closing an old account reduces the average age of your credit accounts, affecting 15% of your FICO score. Additionally, closing credit card accounts in good standing reduces available credit, increasing your credit utilization ratio and negatively impacting your score.

To maintain the benefits of old credit accounts, keep them open and active by making occasional small purchases. This helps maintain a lower credit utilization ratio and a longer credit history, both beneficial for your credit score.

Maxing Out Credit Limits

Maxing out your credit limits damages your credit score. Credit utilization accounts for nearly 33% of your score, making it a critical factor in your credit health. It’s recommended to maintain a credit utilization ratio below 30% to support your credit score optimally.

Maxing out your credit cards negatively affects your credit utilization ratio, signaling risk to lenders and resulting in a lower credit score. Exceeding your credit limit may also lead to fees, penalties, and potential account cancellation.

To manage your credit utilization, regularly monitor your credit card statement and spending habits, including your credit card balances. Aim to maintain your credit utilization ratio accounts under 30%. Additionally, pay off your balances before the reporting date whenever possible.

Ignoring Credit Mix

Ignoring your credit mix can hinder your credit score. Diverse credit types, such as credit cards, auto loans, and personal loans, contribute positively to your score. Limiting yourself to one type of credit can prevent a favorable credit mix.

To improve your credit profile, consider diversifying with installment loans like a personal loan or auto loan. This helps build a more robust credit mix and improves your overall credit score.

Overspending Due to High Credit Limits

High credit limits can be tempting, but they often lead to overspending and accumulating debt. Overspending can result in missed payments and increased debt, which negatively impact your credit score.

To avoid this trap, only apply for unnecessary credit when necessary. Creating and sticking to a budget helps avoid overspending and maintain responsible financial habits.

Not Building an Emergency Fund

Not building an emergency fund can lead to financial instability. An emergency fund helps you avoid relying on credit during unforeseen situations, protecting your credit score. It’s recommended to have three to six months’ worth of living expenses in an emergency fund.

Only 43% of Americans can afford a $1,000 emergency expense, indicating most lack sufficient savings for unexpected challenges. Start small and gradually build your emergency fund to prepare for financial surprises.

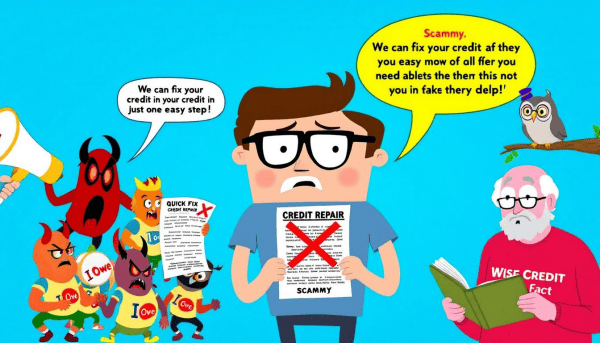

Falling for Quick Fix Credit Repair Scams

Falling for quick fix credit repair scams can have serious consequences. Many scams promise rapid fixes that sound too good to be true, often including promises of quick fixes and illegal removal of negative information.

To avoid these scams, monitor your credit reports for errors and discrepancies. Report fraudulent credit repair companies to the Federal Trade Commission if you suspect a scam.

Summary

Building and maintaining a healthy credit profile requires avoiding common mistakes like neglecting credit reports, missing bill payments, and only making minimum payments. By understanding these pitfalls and taking proactive steps, you can achieve a strong credit score and financial stability.

Remember, taking control of your credit is a journey, not a destination. Stay vigilant, make informed decisions, and you’ll be well on your way to a bright financial future.

Frequently Asked Questions

How can I dispute errors on my credit report?

Disputing errors on your credit report is straightforward! Simply file a dispute with the credit bureau, include supporting documentation, and stay on top of it to ensure those errors get corrected.

What is the best way to set up payment reminders?

The best way to set up payment reminders is by using automatic payment options from your credit card company and setting calendar reminders on your devices. This proactive approach will help you stay on top of your payments and avoid any late fees!

How can I maintain a good credit mix?

To maintain a good credit mix, diversify your credit by balancing different types of accounts such as credit cards and installment loans. This strategy not only enhances your credit profile but also boosts your overall credit score!

How often should I check my credit reports?

You should check your credit reports at least once a year to stay informed about your financial health. Take advantage of free reports from the major credit bureaus to empower yourself and safeguard your credit!

What should I do if I fall for a credit repair scam?

If you fall for a credit repair scam, act quickly by reporting the company to the Federal Trade Commission and monitor your credit closely. Remember, you can cancel any credit repair contract within three business days without facing penalties!