Top Factors: What Will Negatively Affect Your Credit Score

Wondering what will negatively affect your credit score? Key factors include late payments, high credit card balances, and too many credit applications. Read on to understand these pitfalls and how to avoid them.

Key Takeaways

Late payments can drastically reduce credit scores, with a 30-day delay potentially lowering scores by over 100 points.

High credit utilization ratios, especially above 30%, negatively impact credit scores; maintaining a ratio around 7% is ideal.

Defaulting on loans and filing for bankruptcy significantly harm credit scores, with bankruptcy records remaining on reports for 7 to 10 years.

Late Payments and Their Impact

Late payments can be a nightmare for your credit score. When you miss a payment, your credit score can drop significantly. A late payment reported after 30 days can reduce your credit score by approximately 100 points or more. This is because payment history constitutes about 35% of the FICO score and around 40% of the VantageScore.

The impact worsens with the length of the delay. Missing payments by 60 days can have a more severe impact than a 30-day delay, and waiting more than 90 days can lead to significant damage to your credit score. These late payments typically show up on your credit report after 30 days and can remain there for up to seven years. The longer the late payment goes unpaid, the more it negatively affects your credit score.

Setting up automatic payments or reminders can help ensure bills are paid on time. On-time payments significantly impact credit scores, making them a crucial priority.

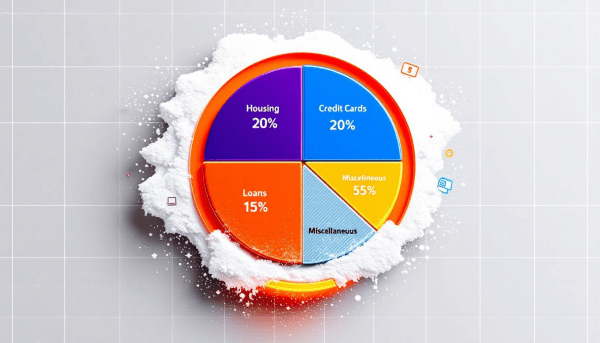

High Credit Utilization Ratio

High credit utilization is another major factor that can drag your credit score down. Credit utilization refers to the ratio of your outstanding credit card balances to your credit limits. This ratio is a significant factor in credit scoring models, making up about 30% of FICO scores.

Experts recommend maintaining a credit utilization ratio below 30% for a good credit score. Utilization rates exceeding 30% can indicate potential financial stress and negatively impact credit scores. Individuals with exemplary credit scores often maintain a utilization ratio of around 7%.

Managing credit utilization can be achieved by paying off balances, increasing credit limits, and applying for new credit, such as a secured credit card. Spending within your means and avoiding maxing out credit cards can protect your credit score.

Closing a credit card can increase your credit utilization ratio and negatively impact your credit score. Maintaining some utilization on credit lines is advisable, as 0% utilization can indicate a lack of credit usage.

Frequently Applying for New Credit

Frequently applying for new credit can also harm your credit score. Each time you apply for credit, a hard inquiry occurs, where the lender checks your credit report. Each hard inquiry can lower your score slightly, with each inquiry potentially reducing it by fewer than five points.

However, applying for multiple new credit lines in a short period can lead to a significant reduction in your credit score due to the cumulative effect of these hard inquiries. Frequent new credit applications have long-term implications on your credit score.

Closing Old Credit Accounts

Closing old credit accounts might seem like a good idea, but it can negatively impact your credit score. When you close a credit card account, your available credit decreases, which can lead to a higher credit utilization ratio. This higher ratio can negatively affect your credit score.

Additionally, closing an old account shortens your length of credit history, which can also lower your credit score. Keeping an older credit card open, even if not used regularly, can positively influence the length of your credit history. Keeping old accounts open can help maintain a good credit score.

Defaulting on Loans

Defaulting on loans can lead to a significant decline in your credit score, making it harder to secure new loans or credit. The impact is severe because it indicates a high level of credit risk to lenders.

If you co-sign on loans, be aware that it can negatively impact your credit if the primary borrower fails to make payments. Understanding the responsibilities and risks of co-signing a car loan is vital for protecting your credit score.

Bankruptcy and Its Long-Term Effects

Filing for bankruptcy can lead to a drastic reduction in your credit score, potentially lowering it by up to 200 points depending on your credit profile. The immediate impact is severe and can significantly damage your creditworthiness.

The long-term effects of bankruptcy are also profound. A Chapter 7 bankruptcy record stays on credit reports for a decade, while Chapter 13 remains for seven years. This prolonged presence on your credit report can affect your creditworthiness for up to a decade.

Ignoring Credit Report Errors

Ignoring errors on your credit report can prolong the duration of negative impacts on your credit score. Errors can stem from clerical mistakes, fraudulent accounts, or outdated information.

Regular credit report checks help identify and correct errors. Filing a dispute with the three major credit bureaus can correct any errors found. Fixing errors on your credit report can quickly boost your score.

Lack of Credit Mix

Having only one type of credit, such as solely credit cards, can hinder your credit profile. Credit mix constitutes 10% of the overall FICO® Score, and a limited credit mix negatively impacts your credit score.

A balanced mix of credit accounts, including both revolving and installment loan types, can enhance your credit score. A healthy credit mix includes both installment loans and credit card accounts.

Inactive Credit Accounts

Inactive credit accounts can lead to small negative impacts on your credit score. Accounts that remain unused for an extended period may be considered inactive and closed, which negatively impacts credit scores.

Regular, responsible usage of credit cards can prevent credit account closure. Small purchases or recurring charges on a credit card can maintain account activity.

Overdue Collections

Debts sent to collections severely damage credit scores. When payments are more than six months late, debts may be turned over to collections. Overdue collections severely damage credit scores, so it’s crucial to avoid letting debts reach this stage.

Unpaid overdrafts can harm your credit score.

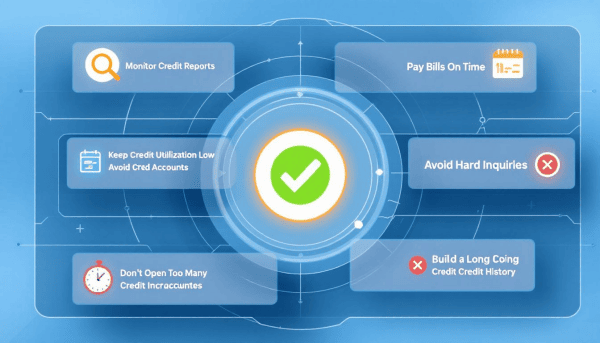

How to Avoid Negative Impacts on Your Credit Score

Paying off high-balance credit cards can boost your credit score. Low balances and paying down debt help keep credit utilization low.

Good credit habits, such as timely payments, are key to improving credit scores. Free credit monitoring keeps you informed about your credit score progress and alerts you to potential issues early.

A good understanding of your credit score enhances financial decisions and opens loan opportunities. Following these tips helps maintain a good credit score and avoid negative impacts.

Summary

Understanding the factors that negatively impact your credit score is crucial for maintaining good financial health. From late payments and high credit utilization to frequent credit applications and bankruptcy, these elements can significantly affect your creditworthiness.

By adopting good credit habits, regularly checking your credit report, and managing your credit accounts wisely, you can protect and improve your credit score. Take control of your financial future by staying informed and proactive.

Frequently Asked Questions

How much can a late payment affect my credit score?

A late payment can significantly impact your credit score, potentially reducing it by around 100 points or more if reported after 30 days. It is crucial to make payments on time to maintain a healthy credit profile.

What is the recommended credit utilization ratio for a good credit score?

To achieve a good credit score, it is advisable to maintain a credit utilization ratio below 30%. This practice can significantly benefit your overall credit health.

How long does bankruptcy stay on my credit report?

Bankruptcy can significantly impact your credit report, with Chapter 7 remaining for ten years and Chapter 13 for seven years. It is essential to understand these timelines as you work towards rebuilding your credit.

How can I correct errors on my credit report?

To correct errors on your credit report, you should file a dispute with the credit bureaus. This process will enable you to rectify any inaccuracies effectively.

What is the impact of closing old credit accounts on my credit score?

Closing old credit accounts can negatively impact your credit score by increasing your credit utilization ratio and reducing your credit history length. It is advisable to keep these accounts open to maintain a healthier credit profile.