Top Credit Score Plateau Solutions: Boost Your Score Today

Is your credit score stuck at the same number despite your efforts? Feeling frustrated? You’re not alone. Many face this issue, but there are credit score plateau solutions. This article will reveal key strategies to break through the plateau, including identifying root causes, implementing effective improvement strategies, correcting report errors, avoiding common pitfalls, and maintaining long-term credit health.

Key Takeaways

Identify key factors affecting your credit score, such as payment history, credit utilization, and credit mix, to effectively address plateaus.

Implement actionable strategies like paying down high balances, setting automatic payments, and becoming an authorized user to boost your score.

Regularly check credit reports for errors and monitor your credit behavior to maintain long-term credit health and avoid common pitfalls.

Identify the Root Causes of Your Credit Score Plateau

Before:

Before you can solve a problem, you need to understand it. The same goes for your credit score. Understanding why your credit score has plateaued is the initial step. Factors like lack of bureau updates, poor credit utilization, serious negative items, and errors on your credit report could be the culprits.

After:

To understand why your credit score has plateaued, consider the following factors:

Lack of bureau updates

Poor credit utilization

Serious negative items

Errors on your credit report

Understanding these factors is the initial step in addressing your credit score issues.

We’ll break down the major factors that influence your credit score, including payment history, credit utilization, and the diversity of your credit accounts. Pinpointing these issues will provide a clear path for improvement.

Review Your Payment History

Payment history is the bedrock of your credit score, accounting for 35% of your FICO score. Even a single late payment can cause a significant drop and remain on your credit report for up to seven years. Making sure all your payments are timely is key to maintaining a positive payment history.

Missed payments create a long-lasting negative impact on your credit history. Regularly checking your credit reports for any missed or late payments and addressing them promptly helps in maintaining a healthy credit score.

Analyze Your Credit Utilization Ratio

Your credit utilization ratio, which is the amount of credit used compared to your total credit limit, is another crucial factor. High credit card balances indicate poor debt management and can negatively impact your score. To maintain a good score, aim to keep your credit utilization ratio below 30%.

Reducing your credit card balances before the billing cycle closes helps report a lower utilization ratio to the credit bureaus. Refrain from closing credit card accounts since it can raise your credit utilization rate, which harms your score.

Evaluate Your Credit Mix

A diverse credit mix can positively impact your credit score, accounting for 10% of your FICO score. Credit mix refers to the variety of credit accounts you have, such as mortgages, auto loans, personal loans, and revolving credit accounts. A mix of installment credit and revolving credit can enhance your score.

Having a longer credit history is also beneficial. Hence, maintaining a variety of credit types can improve your overall credit mix and score.

Effective Strategies to Improve Your Credit Score

Now that you’ve identified the root causes of your credit score plateau, it’s time to take action. Improving your credit score not only helps you qualify for loans and credit cards but also secures better interest rates and lower insurance premiums.

Focus on specific, actionable strategies that can make a swift impact. Actions such as paying down high balances, setting up automatic payments, and becoming an authorized user will help raise your credit score.

Pay Down High Balances

High credit card balances can be a major drag on your credit score. Make it a habit to pay down your balances frequently. This habit helps keep your credit utilization rate low. Lowering the balance reported to the credit bureaus can greatly enhance your score.

Prioritize paying down high-interest credit card debt to free up more available credit and positively impact your credit utilization ratio. This is a surefire way to give your credit score a boost.

Set Up Automatic Payments

Setting up automatic payments ensures that your bills are paid on time every month, preventing missed payment penalties. This method directly contributes to a positive payment history, crucial for a good credit score.

Become an Authorized User

Becoming an authorized user on someone else’s credit card can significantly boost your credit score. As an authorized user, you benefit from the primary cardholder’s positive payment history and increased available credit without a hard inquiry affecting your score.

Verify that the credit card issuers report you as an authorized user to gain the benefits. This strategy is particularly useful for those with limited credit history looking to improve their scores.

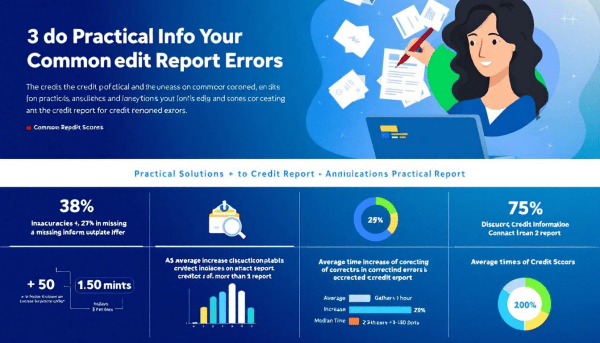

Correcting Errors on Your Credit Reports

Errors on your credit reports can be a hidden obstacle to improving your credit score. Regularly checking and correcting these errors is crucial. Inaccuracies in personal information, accounts that don’t belong to you, and incorrect payment histories can all negatively impact your score.

Addressing these issues promptly ensures your credit report accurately reflects your financial behavior, paving the way for a higher credit score, improved credit scores, and better credit scoring.

Obtain Your Free Credit Report

Frequently obtaining your free credit report from the three major credit bureaus and the credit bureau is vital. This allows you to catch and correct errors and fraudulent activities promptly. Regular reviews help you stay informed about your credit status and understand what lenders see.

Dispute Inaccuracies

If you find inaccuracies in your credit reports, it’s crucial to dispute them immediately. Look for specific errors such as derogatory marks, incorrect late payments, and unauthorized accounts.

Dispute these errors directly with the credit reporting agencies or the original creditors. Correcting these inaccuracies can significantly improve your credit score.

Avoid Common Pitfalls that Affect Your Credit Score

Avoiding common mistakes is as important as implementing good practices. Having only one type of credit account can negatively impact your score. Monitoring your credit report for signs of identity theft is also crucial.

We’ll discuss how to limit new credit applications, keep old accounts open, and monitor for identity theft to maintain a healthy credit score.

Limit New Credit Applications

Applying for too many credit applications results in multiple hard inquiries, which can lower your score. Each hard inquiry can reduce your score by a few points.

Spread out your credit applications to avoid appearing as a risky borrower to lenders. This approach helps in maintaining a stable credit score.

Keep Old Accounts Open

Closing old credit accounts can shorten your credit history and decrease your average account age, negatively impacting your score. Keeping these accounts open contributes to a longer credit history. This, in turn, positively impacts your credit score.

Monitor for Identity Theft

Identity theft can significantly lower your credit score. Regularly monitor your credit reports for any suspicious activity and report it to your credit card company immediately. Adding a Cifas note to your report can signal potential fraud after you report it.

This measure can help protect your credit score from further damage.

Long-Term Habits for Sustained Credit Health

Building and maintaining credit health requires ongoing commitment and consistent practices. Regularly reviewing your credit reports and managing your credit-related behaviors are essential for long-term credit health.

Developing good habits, like maintaining low credit card balances and diversifying your credit types, will help you keep a healthy credit score over time.

Regularly Check Your Credit Reports

Consistently reviewing your credit reports is crucial to stay informed about your credit status. It’s advised to review your credit report at least three times a year.

Verifying all details in your credit report helps prevent potential issues from inaccuracies.

Maintain Low Credit Card Balances

Keeping your credit card balances low is essential for improving and sustaining a healthy credit score. This habit helps maintain a low credit utilization ratio, positively impacting your score.

Diversify Your Credit Types

Having a mix of different credit types can positively influence your credit profile and score. Incorporating various types of credit accounts, like loans and credit cards, can enhance your credit score by improving your credit mix. Managing a diverse credit portfolio responsibly showcases reliability and improves overall creditworthiness.

Summary

In conclusion, understanding why your credit score has plateaued and implementing effective strategies can significantly improve your score. Regularly reviewing your credit reports, maintaining low credit card balances, and diversifying your credit types are essential for long-term credit health.

Take these steps today to break through your credit score plateau and achieve financial success. Consistent effort and smart management are the keys to a higher credit score.

Frequently Asked Questions

Why is my credit score not improving despite my efforts?

Your credit score may not be improving because of factors like outdated information, high credit utilization, unresolved negative items, or mistakes on your credit report. Focus on correcting errors and managing your credit wisely, and you'll start seeing progress!

How can I quickly improve my credit score?

To quickly boost your credit score, pay down high credit card balances and set up automatic payments. Additionally, consider becoming an authorized user on a responsible person's credit card to enhance your credit profile!

How often should I check my credit report for errors?

Checking your credit report at least three times a year is essential to catch and correct any errors quickly. Stay proactive and keep your financial health in check!

Why should I keep old credit accounts open?

Keeping old credit accounts open can enhance your credit score by maintaining a longer credit history. This simple step can boost your financial health and open doors to better opportunities!

What should I do if I suspect identity theft?

If you suspect identity theft, act quickly by notifying your credit card company and adding a Cifas note to your report to alert them of potential fraud. Taking these steps can help protect your financial future!