Best Ways to How to Clean Up Credit Report Effectively

Looking for “how to clean up credit report”? This guide gives you direct, practical steps to fix errors and boost your credit score efficiently.

Key Takeaways

Understanding and ensuring the accuracy of your credit report is essential for maintaining a healthy credit score and securing favorable financial opportunities.

Cleaning up your credit report involves disputing inaccuracies, correcting personal information, addressing negative items, and regularly obtaining credit reports to monitor for issues.

Maintaining a strong credit file requires consistent efforts such as timely payments, lowering credit utilization ratios, and avoiding new debt, which can lead to better loan terms and lower interest rates.

Understanding Your Credit Report

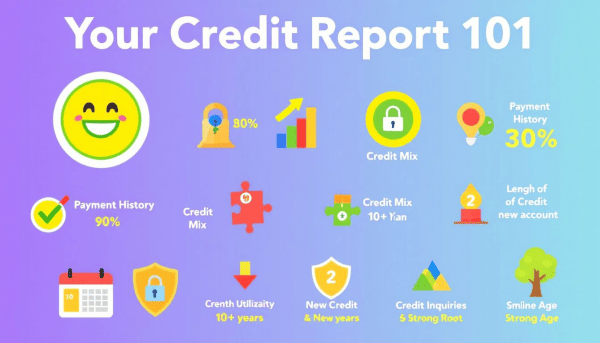

Grasping your credit report is crucial for financial empowerment. It is a comprehensive record that includes your payment history, account balances, and personal information. Key components of a credit report include your payment history, the amount of debt you owe, the length of your credit history, and any inquiries made into your credit. These details collectively contribute to your credit score, which significantly influences your ability to secure loans and obtain favorable interest rates.

Accuracy in your credit report is paramount. Even minor errors can have major impacts on your credit score, affecting your financial opportunities. Ensuring your credit report’s accuracy helps maintain better financial health and enhances your chances of loan and credit card approval.

What Is a Credit Report?

A credit report is a summary of an individual’s credit history prepared by a credit bureau. It includes personal information, payment history, amounts owed, and any bankruptcies. Furthermore, it details open and closed credit accounts, records of timely and late payments, collections, and credit applications.

Inaccurate personal details like name or address can lead to identity theft, so it’s important to review and correct any errors promptly.

Why Accuracy Matters

Inaccurate information on your credit report can lower your credit score, which negatively affects personal and financial goals. Such inaccuracies can increase the amount of interest you pay on loans, making borrowing more costly.

Correcting inaccuracies and keeping your credit report accurate is vital for achieving and maintaining financial health.

Steps to Clean Up Your Credit Report

Cleaning up your credit report involves improving your credit profile to be seen as a trustworthy borrower by lenders. This process includes correcting errors and improving your credit score. Beginning the cleaning process early can enhance your creditworthiness and open up better financial opportunities.

Key steps include dispute credit report errors in your credit report and addressing legitimate negative information. Seeking help from credit counseling agencies or credit repair companies can provide additional guidance.

Remember, credit repair services can help identify issues and assist in challenging inaccuracies within your report, but they cannot remove accurate negative information.

Obtain Your Free Credit Reports

You can obtain a free copy of your credit report by requesting it through AnnualCreditReport.com or by calling 1-877-322-8228. The process for requesting your credit reports is straightforward and involves filling out basic information on the website or through a phone call.

Each of the three credit bureaus offers a free credit report annually; rotating these requests allows you to secure a report every four months. Through 2026, Equifax allows for access to six free credit reports per year.

Regular monitoring of your credit reports helps identify inaccuracies or fraudulent activities promptly.

Review Your Credit Reports Thoroughly

Once you have your credit reports, thoroughly check them for accuracy and any errors. Key elements to review include loan statuses, account balances, payment history, recent credit inquiries, and personal information.

Document each error or derogatory mark and the reporting bureau. This thorough review ensures that any inaccuracies can be promptly addressed, safeguarding your credit score.

Dispute Inaccurate Information

The Fair Credit Reporting Act provides consumers the right to dispute inaccurate information on their credit reports. Upon discovering errors in your credit report, initiate the dispute process immediately. Understanding each agency’s dispute process is crucial. You can file a dispute by mail by submitting a detailed letter to the credit bureau. You can also initiate disputes online via the credit bureau’s website. A dispute letter should identify the disputed accounts, explain the inaccuracies, and include supporting documentation.

The investigation process for disputes can last up to 30 days. Credit bureaus must inform you of the resolution within five business days. If resolved in your favor, the credit bureau must update the information. They must then report the corrected information to the other two bureaus.

If your dispute is denied, you have options available. You can file a written statement for your credit report or pursue further action with the FTC or the CFPB. Credit bureaus have a responsibility to ensure the accuracy of your credit report. Lenders also share this duty.

Correct Personal Information Errors

Correct personal information in your credit report is crucial as it affects your credit score and lending decisions. Carefully review each section of your credit report to spot errors in your personal information.

To correct errors, gather necessary documentation and follow the dispute process outlined by the credit reporting agencies. Accurate personal information prevents identity theft and maintains your credit file’s integrity.

Address Negative Items

Accurate negative information usually can’t be removed, but you can take steps to mitigate its impact. Get accounts out of delinquency or collections by communicating with creditors and possibly using goodwill letters to request forgiveness. Creditors may prefer lending to those who have paid off collections, as it demonstrates responsibility.

Consistent customers might find creditors more willing to forgive past-due payments, especially with polite requests. Paid collections might still appear on reports, though newer scoring models may treat them less harshly.

Improving your credit score is instrumental in enhancing your chances of getting better financial opportunities.

Effective Strategies for Maintaining a Healthy Credit File

Consistent effort and strategic financial management are key to maintaining a healthy credit file. Timely, consistent payments significantly enhance your credit score over time. Regularly reviewing your credit reports helps to identify issues that need to be addressed timely. Consulting a professional can help you create a personalized plan to maintain a healthy credit file.

Paying off credit card balances, considering a secured credit card, or using credit-builder loans can also help maintain a healthy credit file. Following these strategies ensures your credit report remains accurate and reflective of your financial responsibility, resulting in more favorable terms and lower costs on loans and credit cards.

Pay Bills on Time

Automating bill payments or setting reminders ensures you never have missed payments. Timely payments significantly contribute to a positive credit history, which is a key component of your credit report and on time payments.

A clean credit report fosters overall financial wellness, enabling better budgeting and financial planning.

Lower Your Credit Utilization Ratio

The credit utilization rate, the percentage of total debt compared to the total credit limit, is a key factor in credit scores. Maintaining low credit card balances is essential for improving your credit over time.

Paying off large balances and avoiding new debt can reduce your credit utilization ratio. A balance transfer card can help you pay off credit card debt faster without accruing interest, improving your credit utilization. Experts recommend keeping credit usage below 30% of your total credit limit.

Avoid New Debt

Avoiding new debt is crucial for maintaining a healthy credit score. Disputing errors like late payments can protect your credit score. Focusing on paying down existing debt and avoiding unnecessary new debt helps maintain a healthy credit file and improve financial stability.

Professional Help: When and How to Seek It

If you’re in debt and need assistance, seeking help from a reputable credit counseling organization can be beneficial. When seeking credit counseling, ensure they don’t promise to fix all problems or request large upfront payments.

Non-profit credit counseling programs are available and provide services without a profit motive. Credit repair companies must not misrepresent their services, cannot charge before helping, and must explain your legal rights in writing.

Credit Counseling Services

Credit counseling services offer valuable support for improving financial situations. They help individuals create personalized budgets and debt management plans. By offering personalized advice, credit counseling can help you navigate through financial challenges and work towards a healthier credit file.

Credit Repair Companies

Credit repair companies investigate mistakes on credit reports and offer services like credit counseling and error disputes. However, they cannot legally remove accurate negative information from credit reports. Signs of a credit repair scam include promises to create a new credit identity, hide bad credit history, or use stolen Social Security numbers.

If you encounter issues with a credit repair company, report it directly to them.

Legal Rights Under the Fair Credit Reporting Act

The Fair Credit Reporting Act (FCRA) is a federal law promoting the accuracy, fairness, and privacy of information in consumer credit reporting agency files. Consumers have the right to access their credit reports and dispute inaccuracies, ensuring all information is correct and fairly represented.

The FCRA protects consumers by prohibiting the reporting of inaccurate or outdated information, which helps prevent unfair credit reporting practices. Understanding and exercising these rights can significantly impact financial health and credit opportunities.

Benefits of a Clean Credit Report

A clean credit report opens up financial opportunities, enhancing your chances of approval for credit cards, loans, and mortgages. Having a clean credit report allows individuals to access better financial opportunities.

Accurate credit reports often lead to better credit scores, resulting in lower interest rates on loans and credit cards. Your credit report’s accuracy is critical in determining the interest rates lenders offer.

A clean credit report enhances financial health by mitigating errors that could negatively impact borrowing options.

Improved Loan Approval Chances

A clean credit report greatly increases the likelihood of loan approval. Lenders see an accurate and positive credit history as a sign of financial responsibility, boosting your chances of credit approval.

Maintaining a clean credit report ensures higher approval rates for loans and other credit, aiding in achieving your financial goals.

Better Interest Rates

Higher credit scores correlate with lower interest rates on loans and credit cards, reducing borrowing costs. Cleaning up your credit report and improving your credit score can save significant amounts on interest payments over time.

Higher credit scores from a clean credit report can lead to lower interest rates, reducing borrowing costs. Therefore, maintaining a good credit history translates into financial savings and better loan terms.

Enhanced Financial Health

A credit report summarizes an individual’s credit history, detailing aspects like the number of opened credit accounts and timely bill payments. A clean credit record can lead to better credit opportunities and financial options. The effects of negative information diminish over time, and a pristine credit report fosters better financial conditions, enhancing loan security.

Continuously improving and maintaining your credit report ensures a stable and healthy financial future.

Summary

Cleaning up your credit report is not just a one-time task but an ongoing commitment to financial health. By understanding your credit report, disputing inaccuracies, correcting personal information, and adopting strategies to maintain a healthy credit file, you can significantly improve your credit score and financial opportunities. Remember, the benefits of a clean credit report are manifold – from improved loan approval chances to better interest rates and enhanced financial health. Take control of your financial future today by starting the journey to clean up your credit report. You’ve got this!

Frequently Asked Questions

How often can I get a free credit report?

You can obtain a free credit report from each of the three major credit bureaus once a year, allowing you to access a report every four months by rotating your requests. Moreover, Equifax permits six free credit reports annually through 2026.

What should I do if I find an error on my credit report?

If you find an error on your credit report, it is crucial to initiate the dispute process immediately by submitting a detailed letter or filing a dispute online with the credit bureau. Acting swiftly ensures that your credit report is accurate and reflects your true financial standing.

Can credit repair companies remove accurate negative information from my credit report?

Credit repair companies cannot legally remove accurate negative information from your credit report. They may assist in disputing inaccuracies, but they cannot change truthful data.

How can I improve my credit utilization ratio?

To improve your credit utilization ratio, prioritize paying off large balances and maintain low credit card balances. Additionally, consider using a balance transfer card to consolidate your debts.

What are the benefits of maintaining a clean credit report?

Maintaining a clean credit report significantly improves your chances of loan approval and secures better interest rates. This proactive measure fosters overall financial health and opens doors to numerous financial opportunities.