The Best Way to Dispute Credit Report Errors and Boost Your Score

Credit report errors can lower your credit score and limit financial opportunities. This guide explains how to dispute credit report errors, helping you fix your credit and regain financial stability.

Key Takeaways

Regularly check your credit report to identify and dispute errors promptly, as inaccuracies can severely affect your credit score and financial opportunities.

Gather comprehensive documentation, including a government-issued ID and supporting financial statements, to streamline the dispute process and enhance your chances of success.

Disputing inaccuracies can lead to temporary changes in your credit score, but correcting errors typically results in long-term improvements and better financial opportunities.

Understanding Credit Report Errors

Errors on your credit report can disrupt your financial stability and are more common than you might think. From simple clerical mistakes to identity theft, these inaccuracies can damage your credit score and limit your financial opportunities. An error on your credit can have significant consequences.

Errors on your credit report can lead to higher interest rates, loan denials, or rental issues. Therefore, regularly checking your credit report is essential to catch and correct mistakes early, maintaining your creditworthiness.

The Fair Credit Reporting Act allows you to dispute and correct errors on your credit report, providing a systematic defense against inaccuracies that could hinder your financial progress.

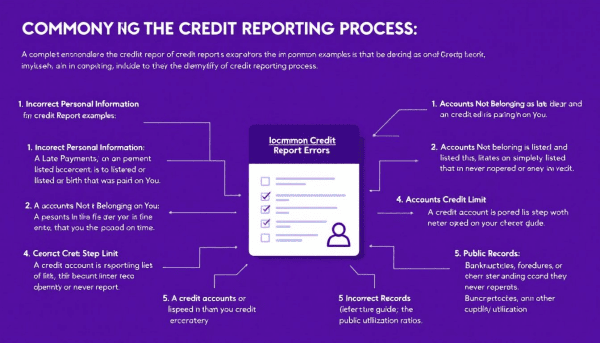

Common types of errors on your credit report

Credit reports can contain various errors that negatively impact your credit score. Incorrect personal information, such as an ex-spouse mistakenly listed as a co-signer, should be disputed promptly to reflect your true financial situation.

Incorrect payment reporting is another frequent issue, such as a timely payment being marked late. Unrecognized accounts should be disputed immediately, as they could indicate identity theft or clerical errors.

How credit report errors occur

Understanding how credit report errors occur can help you prevent and address them more effectively. Simple data entry mistakes, like a misplaced digit in a Social Security number, can result in someone else’s information appearing on your credit report.

Identity theft can also cause credit report errors, as criminals may open fraudulent accounts in your name. Additionally, creditors might incorrectly report account statuses or other details, adding to the inaccuracies.

Checking Your Credit Reports for Errors

Regular credit report checks ensure smooth financial management and catch issues before they escalate. Experian, Equifax, and TransUnion, which are credit reporting companies, each maintain your credit history, and errors can appear on any of these reports.

You can obtain free annual copies of your credit reports from these bureaus through AnnualCreditReport.com. Reviewing your report at least once a year helps catch and correct errors early.

Avoid waiting until you apply for a loan or mortgage to check your credit reports. Regular reviews prevent last-minute surprises and provide time to dispute and fix inaccuracies.

Using AnnualCreditReport.com

AnnualCreditReport.com offers free access to your credit reports from Experian, Equifax, and TransUnion. It provides a straightforward way to maintain accurate credit records through a credit reporting agency and the three major credit bureaus.

Identifying discrepancies

When reviewing your credit reports, watch for common discrepancies like incorrect personal information, errors in account statuses, or payment histories. Mixing up similar names or Social Security numbers can also cause errors.

Negative information can stay on your credit report for up to seven years, even if accurate. Some errors, like incorrect names or addresses, may not be fixable online. Thoroughly check every detail and be prepared to take corrective steps.

Gathering Materials for Your Dispute

Assembling the right materials ensures you’re prepared to dispute credit report errors effectively. Comprehensive documentation, such as your Social Security number, date of birth, and proof of address, is crucial.

Detailed and organized documentation makes the dispute process smoother. This preparation helps present a clear and compelling case to the credit bureaus, increasing the chances of success.

Required documentation

To dispute a credit report error effectively, you need a government-issued ID to verify your identity and recent financial statements that support your claim, along with relevant correspondence.

Having all these documents ready will streamline the dispute process and help avoid unnecessary delays.

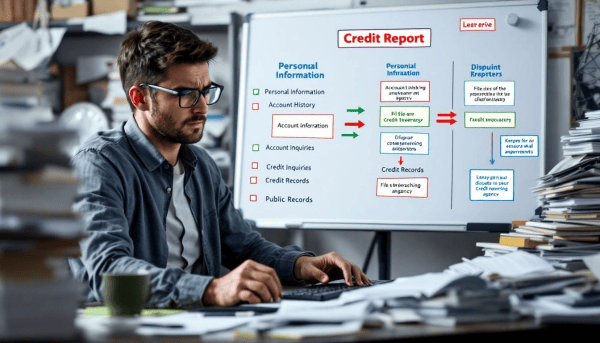

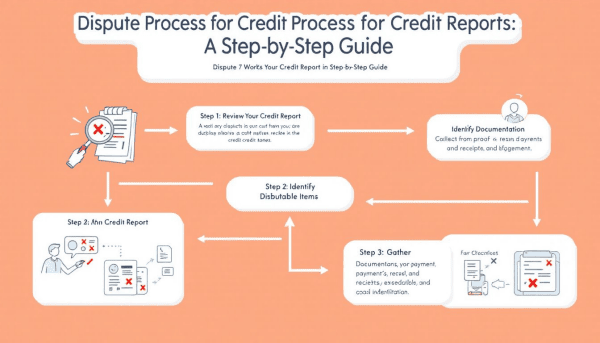

Initiating a Credit Report Dispute

Initiating a credit report dispute is key to correcting errors and protecting your financial health. The process can be complex and may not always yield favorable results, but understanding it thoroughly increases your chances of success. Carefully review your credit report and gather supporting documents before submitting a dispute.

Not all disputes require supporting documents, but having them can prevent delays. Supporting documentation can include emails or letters verifying account details. Informing the data furnisher in writing when you file your dispute ensures they are aware of the issue.

Disputes can be submitted via mail, online, or phone. Each method has benefits, but written documentation is often preferred for clarity. Credit bureaus generally take 30 to 45 days to investigate and respond.

Online dispute process

Submitting a dispute online is typically the fastest option. For Experian, use the Dispute Center for swift submission and tracking. However, some information like incorrect names or addresses may need other methods.

Mailing your dispute

Disputing a credit report error by mail involves writing a detailed letter outlining the error and including supporting documents. Send your dispute letter to the appropriate address for the credit bureau. Use certified mail with a return receipt for proof of receipt.

Including supporting documents with your dispute letter enhances your claim’s credibility. Certified mail ensures proof of receipt, which can be crucial if there are delays or issues in processing your request.

Calling the credit bureaus

You can dispute errors on your credit report by calling the credit bureaus. This method allows you to speak directly with a specialist who can guide you through the dispute process and address issues like name/address errors, identity theft, and credit report disputes.

While phone disputes offer immediate interaction, you may not complete the dispute during the call and may need to follow up with written documentation.

What Happens After You Submit a Dispute

After submitting a dispute, the credit bureau contacts the data furnisher to verify the information. You may receive updates via email if you’ve disputed through Experian. The bureau generally takes 30 to 45 days to investigate and respond.

The investigation can result in the disputed information being verified, updated, or deleted from your credit report. If the credit bureau’s agrees there is an error, the erroneous item will be removed.

To monitor your dispute status, log into your Experian account and check the Alerts section for updates. Submitting a dispute does not harm your credit score, and correcting errors could potentially increase it.

Investigation timeline

The investigation timeline for a credit report dispute typically ranges from 30 to 45 days. Credit bureaus must notify you of their findings within five days after the investigation concludes.

If the disputed information is found incorrect, the furnisher must inform the credit bureau to correct the entry.

Reviewing the results

Once the investigation is complete, the credit bureau must provide the results in writing, including a free copy of the updated report if changes are made, and the contact information of the furnisher. Updates may take several months to appear, so patience is key.

If the disputed information remains unchanged and still appears incorrect, contact both the credit bureaus and the furnisher. If the furnisher insists the information is correct, you can request to add a statement to your credit file explaining your dispute.

If Your Dispute Is Unsuccessful

If your dispute is unsuccessful, don’t lose hope. You can request the credit bureau to include your statement of the dispute in your file, which can help when creditors review your credit report. Additionally, contacting the Consumer Financial Protection Bureau (CFPB) with proof of your claim can provide further assistance.

If the initial investigation doesn’t yield the desired results, consider filing an additional dispute with supplemental information to strengthen your case. If all else fails, hiring a lawyer may be necessary to resolve persistent inaccurate information.

Filing an additional dispute

To improve your chances of a different outcome, gather additional documents and evidence to reinforce your case and include any new discrepancies or relevant information previously overlooked.

This can strengthen your appeal and increase the likelihood of a successful resolution.

Escalating the issue

If your dispute remains unresolved, escalate the issue by contacting the Consumer Financial Protection Bureau (CFPB) for additional support.

Seeking legal advice is also an option if you feel your dispute has not been handled properly.

Monitoring Your Credit Reports

Regular credit report monitoring is essential for maintaining a healthy credit score and detecting identity theft. Frequent reviews help you spot unauthorized actions and errors that could negatively impact your credit history.

Instead of waiting for major financial decisions to check your credit report, make it a habit to review it periodically. Tools and services, like Experian’s free credit monitoring, can help you track changes and alert you to suspicious activities.

Free credit monitoring services

Many banks and credit card companies offer complimentary credit monitoring services that provide real-time notifications about significant changes to your credit file. For example, CreditWise from Capital One offers free monitoring without requiring credit card information, and Experian’s free service includes real-time alerts for suspicious activities.

Using free credit monitoring services can significantly enhance your ability to manage and protect your credit. These services are essential for maintaining awareness of any changes to your credit profile and taking prompt action if needed.

How Disputing Credit Report Errors Affects Your Credit Score

Disputing credit report errors can have both temporary and long-term effects on your credit score. While the dispute is being processed, your credit score may experience temporary changes. These effects can vary and may result in positive, negative, or neutral changes to your score.

Correcting errors on your credit report can create long-lasting improvements in your overall credit health. An improved credit score can make it easier to secure credit at lower interest rates and obtain more favorable terms on loans, reducing overall financial costs.

Temporary effects during investigation

Disputing errors on your credit report can lead to changes in your credit score while the dispute is being processed. It’s crucial to continue monitoring your credit score throughout the dispute investigation for any changes, as the outcomes can result in positive, negative, or neutral changes to your score.

Long-term benefits

Correcting errors on your credit report not only improves your credit score but also enhances your financial opportunities and increases your financial literacy over time.

With a better credit score, individuals can secure more favorable terms on loans, reducing overall financial costs and improving their credit scores.

When to Consider Professional Help

Sometimes, the complexity and time required to manage credit repairs can be overwhelming. If you experience multiple inaccuracies on your credit report, it might be beneficial to hire a credit repair agency. These agencies can handle disputes on your behalf, although they typically charge fees for their services.

Before choosing a credit repair agency, check online reviews and the agency’s track record to assess their reliability and service quality. Be cautious of companies that pressure you to pay upfront or guarantee the removal of negative information sooner than allowed.

Choosing a reputable credit repair agency

Selecting a reputable credit repair agency is crucial to ensure you receive effective services without falling victim to scams. Compare fees and services among different agencies to avoid overpaying or receiving inadequate service.

Watch out for companies that refuse to give a contract or guarantee the removal of accurate negative information from your credit file. By choosing a reliable agency, you can ensure your credit repair process is handled professionally and effectively.

Summary

In summary, maintaining an accurate credit report is crucial for your financial health. Regularly checking your credit reports, identifying and disputing errors, and monitoring your credit can help protect your credit score and open up better financial opportunities. Whether you handle disputes yourself or seek professional help, taking action is key to ensuring your credit report accurately reflects your financial history.

Remember, the journey to a perfect credit score is ongoing. Stay vigilant, proactive, and informed to safeguard your financial future. Take control of your credit today and secure a brighter financial tomorrow.

Frequently Asked Questions

How often should I check my credit report?

It's advisable to check your credit report at least once a year to identify and rectify any mistakes promptly. Regular monitoring helps maintain your credit health.

What are common types of errors on a credit report?

Common errors on a credit report include incorrect personal information, payment mistakes, and unfamiliar accounts. It is essential to review your report regularly to ensure accuracy and address any discrepancies promptly.

How long does a credit bureau have to investigate a dispute?

A credit bureau has 30 to 45 days to investigate a dispute and respond to you. It's essential to keep track of this timeline for effective follow-up.

Can disputing an error hurt my credit score?

Disputing an error will not hurt your credit score; instead, correcting inaccuracies can potentially improve it. It's important to ensure your credit report reflects accurate information.

When should I consider hiring a credit repair agency?

Consider hiring a credit repair agency if you encounter multiple inaccuracies on your credit report or find managing the repair process too complicated or time-consuming. This can help simplify your efforts and improve your credit standing.