The Best Ways on How to Respond to Identity Theft

If you suspect identity theft, immediate action is essential to limit potential damage. In this article, we’ll guide you on how to respond to identity theft effectively. You’ll learn the crucial steps to take, from contacting financial institutions to securing your online accounts, and understand what detailed actions to follow for full recovery and protection.

Key Takeaways

Act quickly by notifying financial institutions, placing fraud alerts, and securing online accounts to limit damage from identity theft.

Report identity theft to the FTC, local police, and the IRS if necessary, to aid recovery and establish a solid foundation for legal action.

Continually monitor credit reports, dispute fraudulent charges, and implement strong online security practices to protect against future identity theft.

Immediate Steps to Take When You Suspect Identity Theft

Suspecting identity theft and the actions of an identity thief demands immediate attention to limit potential damage.

Notify financial institutions, place fraud alerts on credit reports, and secure online accounts to prevent unauthorized access.

Notify Financial Institutions

Contact the fraud department of your bank or credit union to report the identity theft and request account freezes or closures. Also, ask for new cards to replace the compromised ones.

Follow up with written documentation to provide a record and formal evidence of your report. Prompt collaboration with financial institutions helps prevent further misuse of your accounts.

Place a Fraud Alert with Credit Bureaus

Contact one of the three major credit bureaus—Equifax, Experian, or TransUnion—to place an initial fraud alert on your credit report, signaling creditors to verify your identity before issuing new credit. This alert lasts for one year and can be renewed if needed.

The initial fraud alert entitles you to a free credit report from each of the three bureaus. Review these reports in detail for signs of unauthorized activity.

Placing a fraud alert is a preventive measure to avoid future financial issues.

Secure Online Accounts

Change the passwords on all your online accounts immediately, making sure each new password is strong and unique to enhance security.

Enable two-factor authentication (2FA) to add an extra layer of protection, requiring a second form of verification before access is granted. These steps reduce the risk of further identity theft and unauthorized access.

Reporting Identity Theft

Promptly report identity theft to the appropriate authorities aids in recovery and helps track and apprehend identity thieves.

Here’s how to file reports with the Federal Trade Commission (FTC), your local police department, and the IRS if your Social Security number is compromised.

File a Report with the Federal Trade Commission (FTC)

File an identity theft report online at IdentityTheft.gov, the official Federal Trade Commission (FTC) site. This site helps create a personal recovery plan tailored to your situation. Filing online provides an official identity theft report, crucial for further steps.

You can also obtain free credit reports from the three credit reporting agencies via AnnualCreditReport.com. Filing a report with the FTC supports your claims with creditors.

Report to Your Local Police Department

File a report with your local police department to bolster claims with creditors and gain additional legal support for recovery. Keep a copy of this report for records and future disputes.

Notify the IRS if Your Social Security Number is Compromised

If you suspect misuse of your Social Security number, contact the IRS at 800-908-4490 and submit IRS Form 14039, the Identity Theft Affidavit, to officially report the misuse.

The IRS typically halts fraudulent tax returns and notifies you by mail regarding concerns. If your e-filed return is rejected or you receive a fraud notice, file your tax return using paper forms. These steps help mitigate the impact of tax-related identity theft.

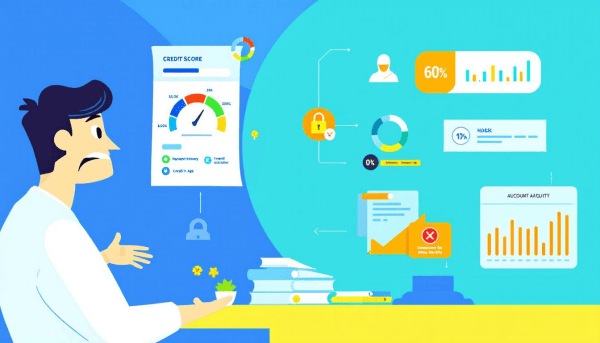

Protecting Your Credit

Protecting your credit after identity theft involves placing security freezes on credit reports, regularly reviewing them for unauthorized activity, and disputing any fraudulent information.

These actions secure your financial future and prevent further damage.

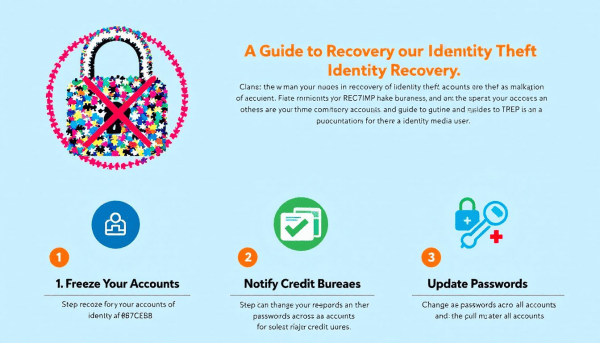

Place a Security Freeze on Your Credit Reports

A security freeze restricts access to your credit file, preventing new creditors from issuing credit without your approval. Contact each of the three major credit reporting agencies individually to place a freeze—online, by phone, or by mail.

Credit reporting agencies must process freeze requests made online or by phone within one business day. While it doesn’t prevent identity thieves from taking over existing accounts, a security freeze is effective against fraudulently opening new ones.

Review Your Credit Reports for Unauthorized Activity

Regularly review your credit reports to catch unauthorized activity early. Obtain free annual copies from Equifax, Experian, and TransUnion via AnnualCreditReport.com. This helps identify and address inaccuracies promptly.

Dispute Fraudulent Information

Dispute fraudulent information on your credit report immediately by notifying each credit bureau in writing and providing supporting documents like your FTC identity theft report and police reports.

Credit reporting companies must block fraudulent information within four business days and have 30 days to respond to your dispute. Use FTC templates to write dispute letters and follow up as needed.

Handling Fraudulent Accounts and Charges

Dealing with fraudulent accounts and charges requires prompt and thorough action. Here’s how to contact creditors, close fraudulent accounts, and monitor financial statements for unauthorized activity.

Contact Creditors and Debt Collectors

Provide creditors with a copy of your FTC identity theft report to support your claims when dealing with fraudulent debts. Communicate verbally and in writing, keeping detailed records of all interactions.

Proving that you’re a victim of identity theft enhances protection against further fraudulent charges. An identity theft report helps creditors understand and take appropriate actions.

Close Fraudulent Accounts

Contact the fraud department of the creditor to close fraudulent accounts. Explain the accounts were opened fraudulently and request they be reported as identity theft.

Close these accounts promptly to prevent further unauthorized transactions. Follow up with written documentation and confirm accurate closure and reporting.

Monitor Bank Statements and Credit Card Statements

Monitor your bank and credit card statements regularly to catch unauthorized transactions early. Contact your banks and credit card issuers immediately to freeze accounts and request new cards if suspicious activity is noticed.

Inform creditors and debt collectors about fraudulent charges, providing necessary information to support your case. Work with financial institutions to close fraudulent accounts and ensure accurate reporting as identity theft.

Repairing the Damage

Repairing identity theft damage is a long process. Here’s how to correct inaccurate information on your credit report, rebuild your credit score, and consider identity theft insurance for related expenses.

Correct Inaccurate Information on Your Credit Report

File disputes with each credit bureau to correct errors on your credit report, providing supporting documentation like your identity theft report and police report.

Request written confirmation from creditors that the fraudulent account has been closed and ensure all related information is removed from your credit report. Thorough documentation supports your case in disputes.

Rebuild Your Credit Score

Rebuild your credit score by consistently paying bills on time and maintaining low credit card balances. These strategies are essential for improving your score over time.

Consider Identity Theft Insurance

Identity theft insurance can cover expenses associated with restoring your identity and dealing with fraudulent activities. Policies vary in coverage, including legal fees, lost wages, and identity restoration costs.

When choosing a policy, consider coverage limits, deductibles, and the insurance provider’s reputation. Careful evaluation of options ensures you select the best identity theft insurance for your financial situation and needs.

Preventing Future Identity Theft

Preventing future identity theft requires ongoing vigilance and proactive measures. Key actions include guarding against data breaches, strengthening online security practices, and educating yourself about phishing scams.

Stay Vigilant Against Data Breaches

Regularly check bank account statements and credit card statements for unauthorized transactions and report suspicious activity immediately to minimize damage. Obtain free credit reports from Equifax, Experian, and TransUnion, and review them for inaccuracies or fraud.

This vigilance catches potential breaches early, allowing for swift action.

Strengthen Online Security Practices

Strengthen online security by using a password manager to create and manage strong, unique passwords for all accounts. Enable two-factor authentication (2FA) for an extra layer of security, making it harder for identity thieves to access your accounts.

Educate Yourself About Phishing and Scams

Phishing scams, often in the form of deceptive emails or texts from seemingly reputable companies, trick individuals into providing personal information.

Protect yourself by using strong, unique passwords, enabling two-factor authentication, and considering a password manager. Vigilance against phishing attempts and scams safeguards your personal information.

Summary

Responding to identity theft quickly and efficiently is crucial to minimize damage and begin the recovery process. Start by notifying financial institutions, placing fraud alerts, and securing your online accounts. Reporting the theft to the FTC, local police, and the IRS is essential for official documentation and support. Protect your credit by placing security freezes, regularly reviewing your credit reports, and disputing any fraudulent information. Handle fraudulent accounts promptly and monitor your financial statements to catch any further unauthorized activity.

Repairing the damage involves correcting inaccuracies on your credit report, rebuilding your credit score, and considering identity theft insurance. Preventing future identity theft requires vigilance, strong online security practices, and awareness of phishing scams. By following these steps, you can protect your identity and financial future. Stay proactive and informed to safeguard against identity theft.

Frequently Asked Questions

What should I do first if I suspect identity theft?

If you suspect identity theft, notify your financial institutions immediately to report the fraud, freeze any affected accounts, and request new cards. Taking swift action is crucial in protecting your financial information.

How do I place a fraud alert on my credit report?

To place a fraud alert on your credit report, simply contact one of the three major credit reporting agencies—Equifax, Experian, or TransUnion. This initial alert will remain active for one year and can be renewed as needed.

Why is it important to file a report with the FTC?

It's important to file a report with the FTC as it generates an official identity theft report, essential for supporting your claims with creditors and facilitating further steps in addressing identity theft.

How can I correct inaccurate information on my credit report?

To correct inaccurate information on your credit report, file a dispute with each credit bureau and include supporting documentation, such as a police report. Request written confirmation of the resolution to ensure the erroneous account is closed.

What measures can I take to prevent future identity theft?

To prevent future identity theft, regularly check your financial statements, use strong and unique passwords, and enable two-factor authentication for your online accounts. Additionally, staying informed about phishing scams can further enhance your protection.