Top Tips for Budgeting and Credit Building

Trying to build your credit while staying on a budget? This article will show you how effective budgeting and credit building can boost your credit score. Learn about payment history, managing credit utilization, and choosing the right budgeting method. Get ready to take control of your financial future.

Key Takeaways

Effective budgeting is crucial for managing personal finances and can significantly improve your credit score through timely debt payments.

Selecting the right budgeting method, such as the 50/30/20 rule or zero-based budgeting, is essential for meeting individual financial goals.

Building an emergency fund and regularly monitoring your credit report are key components of financial stability and achieving long-term financial success.

How Budgeting Impacts Your Credit Score

Budgeting is the cornerstone of effective financial management. It helps you track your income and expenses, ensuring that you live within your means. More importantly, a structured budget can significantly impact your credit score. Treating debt repayments as fixed expenses ensures timely payments, preventing negative entries on your credit report. This practice not only keeps your credit score stable but can also improve it over time.

Effective budgeting helps manage debt payments and ensures timely bill payments, both of which are critical to improving credit scores. When you budget regularly, you are less likely to miss payments, which is essential for maintaining good credit health. Over the long term, careful budgeting keeps your credit score on track, helping you achieve and maintain financial stability.

A well-planned budget allows you to prioritize savings and debt repayment, reducing financial strain and improving your overall financial situation. Effective personal finance management helps you avoid overspending and ensures you have enough funds for monthly bills, rent or mortgage payments, and other essential expenses.

Payment History and Credit Health

Payment history is a major factor in determining your credit score, accounting for a substantial 35% of your FICO score. This means that consistently making on-time payments is crucial for maintaining a healthy credit score. A single missed payment can cause your credit score to drop significantly, signaling to lenders that you are a higher risk.

An effective budget helps ensure that funds are available by the bill’s due date, minimizing the risk of non-payment. Keeping track of your finances through a budget ensures consistent on-time payments, maintaining a positive credit history. This practice not only helps build good credit but also contributes to your financial stability in the long run.

Incorporating debt repayments into your budget can also be beneficial. Treating these as fixed monthly bills ensures that you prioritize them, reducing the chances of missed payments. This strategy helps improve your credit score over time, making it easier to achieve your financial goals and secure better financial opportunities.

Credit Utilization Ratio

The credit utilization ratio is another critical factor that impacts your credit score. It represents the amount of credit you are using compared to your total credit limit. Maintaining a low credit utilization ratio is essential for enhancing your credit scores. Ideally, you should aim to keep your credit utilization below 30%.

Budgeting plays a significant role in managing your credit utilization ratio. Allocating funds specifically for bill payments ensures you are not using too much of your available credit. This practice helps you keep your credit card balances low, which is crucial for maintaining a healthy credit score.

Setting aside money to cover bills through careful budgeting helps manage your credit utilization effectively. This strategy not only improves your credit health but also provides a clearer picture of your financial situation, allowing you to make informed decisions about your spending habits and financial goals.

Choosing the Right Budgeting Method

Selecting the right budgeting method is crucial for managing your personal finances effectively. There isn’t a one-size-fits-all solution, so it’s essential to choose a method that suits your lifestyle and financial goals. Starting your budget by listing your income helps you understand your available funds and set realistic goals.

Realistic goals are crucial for avoiding overspending and keeping motivation high. Evaluating the effectiveness of a budgeting method over three to four months can help you determine if it works for you. Finding ways to save money can release additional funds for debt repayments, making personal budgeting strategies highly individualized.

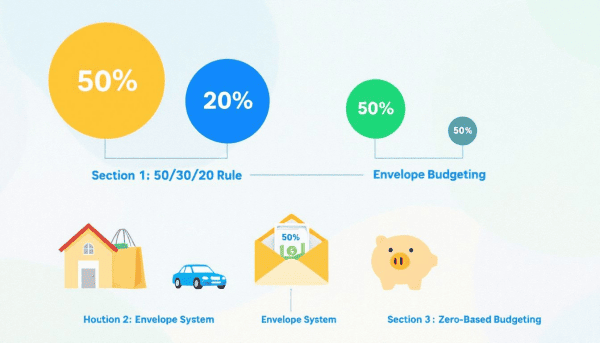

Different budgeting methods offer various approaches to managing debt and expenses. Whether you choose the 50/30/20 rule, zero-based budgeting, the envelope system, or the pay-yourself-first budget, the key is to find a method that helps you manage your finances effectively and achieve your financial goals.

50/30/20 Rule

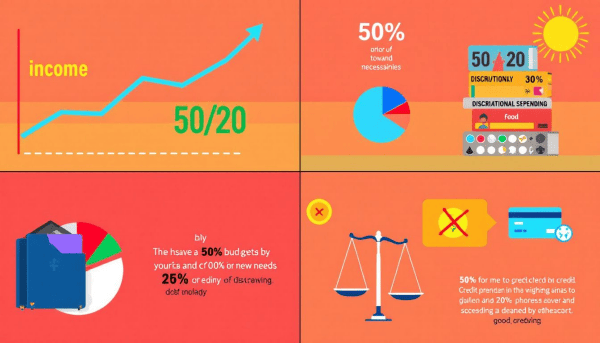

The 50/30/20 rule is a popular budgeting method that categorizes your income into three main categories: 50% for necessary expenses, 30% for discretionary expenses, and 20% for savings and debt repayment. This simple yet effective method helps you allocate your income efficiently, ensuring that you cover your essential expenses while saving money and paying off debts.

Necessary expenses in the 50/30/20 budget may include housing, food, and transportation costs. The method also allows for flexibility, enabling you to adjust the percentages based on your unique circumstances and financial goals. Following this rule helps you maintain a balanced budget that supports your financial health and goals.

Zero-Based Budgeting Method

Zero-based budgeting is a method where every dollar of your income is assigned a purpose, leaving no unassigned funds. This approach ensures that you account for every penny, making it easier to track your discretionary spending and identify areas where you can cut back or save more.

One of the main advantages of the zero-based budgeting method is that it helps you maintain detailed financial control. Allocating every dollar to a specific expense or savings goal helps create an effective budget aligned with your financial goals and overall financial health.

Envelope System

The envelope system is a cash-based budgeting method that helps enforce spending limits by using physical cash for different spending categories. By allocating a set amount of cash to each envelope, you can control your spending and avoid overspending in specific categories.

While the envelope system reduces credit card usage, it may not be suitable for everyone, especially in a cashless society. Additionally, carrying large amounts of cash can be inconvenient and risky.

However, digital versions of the envelope system, available through budgeting apps, can offer a modern solution to this traditional method.

Pay-Yourself-First Budget

The pay-yourself-first budgeting method focuses on saving. It encourages you to set aside a portion of your income for savings goals before dealing with other expenses. This approach ensures that you consistently contribute to your savings and debt repayment goals, treating these contributions like recurring bills.

Focusing on saving first helps build a financial cushion, crucial for long-term financial health and stability. With a structured plan in place, you can manage your finances effectively and avoid the pitfalls of living paycheck to paycheck.

Prioritize Debt Repayment in Your Budget

Prioritizing debt repayments is essential for maintaining financial stability and improving your credit health. Incorporating debt repayment into your budget allows you to repurpose savings from other expenses towards paying off debts, reducing financial strain and avoiding further debt accumulation.

Itemizing and prioritizing all expenses when budgeting for debt repayment helps you manage your finances effectively and ensures that you make timely payments. This approach not only helps avoid accruing more debt but also positively impacts your credit score over time.

Incorporating debt repayment plans into your budget can lead to better financial stability and improved credit health. Managing debt responsibly and making consistent payments helps you achieve your financial goals and build a solid financial foundation.

Debt Snowball vs. Debt Avalanche

Two popular debt repayment strategies are the debt snowball and debt avalanche methods. The debt snowball method focuses on paying off the smallest debt first, providing psychological motivation by eliminating smaller debts quickly. In contrast, the debt avalanche method targets high-interest debts first, aiming to reduce overall interest costs. By focusing on the debt with the highest interest rate, this method can save you money in the long run, even if it takes longer to see significant progress.

Both methods have their strengths: snowball for quick wins and avalanche for cost savings. Choosing the right strategy depends on your financial situation and personal preferences. The key is to stay committed to your debt repayment plan, whether you prioritize psychological wins or interest savings.

Managing Credit Card Balances

Effectively managing credit card balances is crucial for avoiding excessive debt and maintaining a healthy credit score. High credit card balances can negatively impact your credit utilization ratio, which in turn affects your credit score.

Keeping your credit card balances low and making timely payments improves your credit health and avoids financial strain. Allocating funds specifically for credit card payments in your budget helps ensure that you do not accumulate too much debt and can maintain a positive credit history.

A positive credit score can open doors to better financial opportunities, such as lower interest rates on loans and credit cards. Managing credit card balances responsibly is a critical aspect of maintaining financial health and achieving your financial goals.

Building an Emergency Fund

An emergency fund acts as a financial buffer against unexpected expenses, preventing reliance on credit and ensuring financial stability. Experts recommend that an emergency fund cover three to six months of expenses, with at least $500 as a minimum starting point.

Budgeting helps you set aside money for emergencies, ensuring you live within your means and avoid overwhelming debt. Incorporating an emergency fund into your budget prepares you for unexpected financial difficulties and protects your long-term savings goals.

Having an emergency fund provides peace of mind and financial security, allowing you to handle unexpected expenses without derailing your financial plans. It’s an essential component of a healthy financial strategy.

Setting Up an Emergency Fund

Setting up an emergency fund requires a structured approach to budgeting. Setting aside a specific amount of money each month gradually builds your emergency fund, ensuring preparedness for unexpected expenses.

Tracking your progress towards quantified goals helps you stay motivated and ensures that you are consistently contributing to your emergency fund. After using your emergency fund, it’s vital to replenish it as soon as possible to maintain readiness for future emergencies.

Maintaining Your Emergency Fund

Regularly monitoring the growth of your emergency fund helps you maintain and optimize your savings. It’s crucial to adjust your contributions based on changes in your financial situation, ensuring that your emergency fund remains robust and ready for any unexpected expenses.

Maintaining an emergency fund is essential for financial stability and long-term financial health. By regularly contributing to and monitoring your emergency fund, you can ensure that you are prepared for unexpected financial challenges.

Tracking and Adjusting Your Spending

A budget primarily functions to track income and expenses, helping you maintain control over your finances. Understanding your spending habits through categorized expenses can help you stay on track and achieve your financial goals.

If you exceed your budget, it’s important to review what happened and make necessary adjustments for the next month. Including due dates for recurring bills in your budget helps manage payments effectively and ensures that you do not miss any important payments.

Categorizing expenses provides a clearer picture of where your money is going each month. Regularly comparing your actual spending to your budget helps identify areas where you might need to cut back and make informed financial decisions.

Using Budgeting Apps

Budgeting apps can be incredibly helpful tools in tracking spending and ensuring that sufficient funds are available to cover bills. These apps can automate the tracking process, making it easier to monitor your expenses over time and stay on top of your financial goals.

Using online banking tools in conjunction with budgeting apps can simplify the management of credit card payments and overall budgeting. Leveraging technology provides better control over your finances and ensures consistent progress towards your financial goals.

Many budgeting apps offer features that allow you to set financial goals, categorize your expenses, and track your progress. These tools can help you create an effective budget that aligns with your financial situation and supports your long-term financial health.

Reviewing Bank and Credit Card Statements

Regularly reviewing your bank statements and credit card statements is crucial for identifying unnecessary expenses and areas for improvement in your budgeting. Closely monitoring your financial transactions ensures you stay within your budget and make informed financial decisions.

Efficient management of credit card balances not only aids in maintaining a healthy financial state but also contributes positively to your credit score. Continuously monitoring your credit report helps you spot discrepancies and track your financial progress over time, ensuring that you maintain good credit health.

Regularly reviewing your financial statements helps identify spending patterns and allows necessary budget adjustments. This practice helps you stay on top of your financial goals and maintain a healthy financial situation.

Monitoring Your Credit Report and Score

Regularly reviewing your credit reports is essential for understanding your credit position and what lenders may see when they assess your creditworthiness. This practice helps you identify potential inaccuracies and track your credit health over time.

Checking your credit report can reveal inaccuracies or incomplete information that could impact your credit score. Regular monitoring of your credit report allows you to spot discrepancies and take corrective action to maintain a healthy credit score.

Maintaining good credit health is crucial for achieving your financial goals and securing better financial opportunities. Understanding your credit report and taking steps to improve your credit score helps build a solid foundation for your financial future.

Accessing Free Credit Reports

Consumers are entitled to one free credit report annually from each of the major credit bureaus. You can obtain these reports through AnnualCreditReport.com, providing a valuable resource for monitoring your credit health.

Creating an account with credit bureaus can provide ongoing access to your credit reports and scores for free. Accessing your credit report regularly is crucial for monitoring your credit health and identifying errors that could impact your credit score.

Disputing Errors on Your Credit Report

If you find incorrect information on your credit report, you can file a dispute with the reporting credit bureau to have it investigated. Identifying fraudulent activity requires immediate reporting to both the lender and the credit bureau to protect your credit score.

To dispute inaccuracies, provide a detailed written explanation along with supporting documents to the credit reporting company. Regularly checking your credit report helps you identify any inaccuracies that could affect your credit score and take necessary steps to rectify them.

Achieving Financial Goals Through Budgeting

Budgeting enables individuals to allocate funds towards their long-term objectives effectively. By managing your finances effectively, you can maintain control over your finances, know your spending limits, ensure bill payments, and find room for savings.

Having an emergency fund helps protect your long-term savings goals against unexpected financial difficulties. By incorporating debt repayment into your budget, you can avoid additional interest costs and improve your credit score, contributing to your overall financial stability.

Adjusting your budget periodically ensures it reflects your current financial situation and spending patterns. Regularly comparing your actual spending to your budget helps identify areas where you might need to cut back and make informed decisions about your financial future.

Setting Financial Goals

Setting specific and achievable financial goals is crucial for effective budgeting and financial health. Starting with a small savings goal, such as $25 a week, can make building an emergency fund more achievable and keep you motivated.

Writing down your financial goals enhances commitment and accountability. Incorporating these practices into your budgeting process fosters a clear path toward financial success, helping you achieve your financial goals and maintain financial stability.

Allocating Funds Towards Goals

Allocating funds effectively towards your financial goals is an essential part of successful budgeting. Many budgeting apps offer features that allow users to set financial goals and track their progress towards those goals.

Any unexpected income, like a tax refund, can be added to your emergency fund to boost your savings. After allocating funds for savings or debt repayment in the pay-yourself-first budget, you can use the remaining funds freely, ensuring that you stay on track with your financial goals.

Summary

Effective budgeting and smart financial planning are vital for maintaining financial health and achieving your financial goals. By choosing the right budgeting method, prioritizing debt repayment, building an emergency fund, and monitoring your credit report and score, you can take control of your finances and improve your credit health.

A well-structured budget allows you to track your income and expenses, ensuring that you live within your means and avoid the pitfalls of debt. Regularly reviewing and adjusting your budget helps you stay on track and make informed decisions about your financial future.

By following the strategies outlined in this guide, you can build a solid foundation for your financial future, achieve your financial goals, and maintain a healthy credit score. Take control of your finances today and start building a brighter financial future.

Frequently Asked Questions

How does budgeting impact my credit score?

Budgeting positively impacts your credit score by ensuring you make timely debt and bill payments, which are essential for maintaining and improving your credit rating. Effective financial management through budgeting leads to a stronger credit profile.

What is the 50/30/20 rule in budgeting?

The 50/30/20 rule effectively allocates your income by designating 50% for necessary expenses, 30% for discretionary spending, and 20% for savings and debt repayment. This simple framework can help you achieve financial stability and manage your budget effectively.

How can I effectively manage my credit card balances?

To effectively manage your credit card balances, allocate funds for payments in your budget, maintain a low credit utilization ratio, and make timely payments. This approach will help you maintain a healthy credit score and avoid debt.

Why is it important to have an emergency fund?

Having an emergency fund is crucial as it provides financial protection against unexpected expenses, helping you avoid debt and maintain stability. Aim to save enough to cover three to six months of your living expenses to ensure you are well-prepared.

How often should I review my credit report?

You should review your credit report at least once a year from each of the major credit bureaus to stay informed about your credit status and catch any inaccuracies. Doing this regularly will help you maintain good credit health.