5 Best Budgeting Methodologies to Maximize Your Savings

Want to save more and manage your money better? This article explores five effective budgeting methodologies to help you do just that. Find the right approach for your financial goals and get started on a better financial path.

Key Takeaways

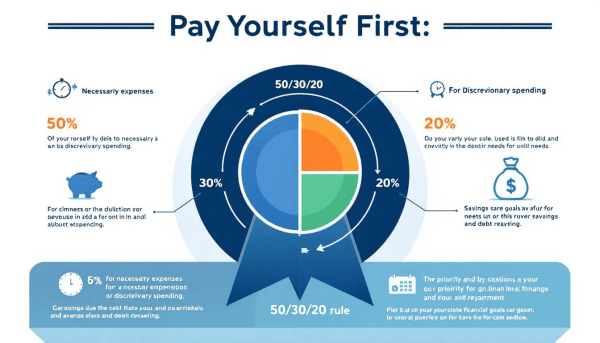

Proportional budgeting divides your income into categories like needs, wants, and savings, usually following the 50/30/20 rule but can be adjusted to fit personal goals.

The Pay Yourself First method emphasizes saving a portion of your income first, helping you prioritize savings with minimal effort through automation.

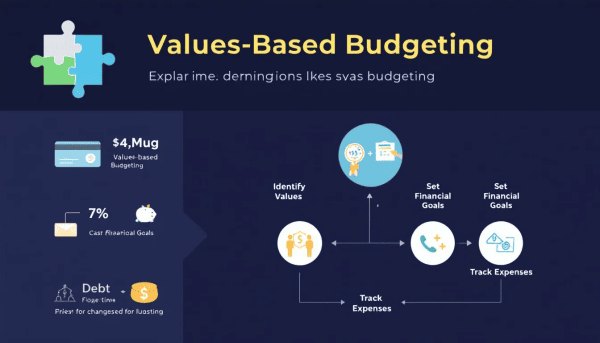

Values-based budgeting aligns your spending with your personal values, ensuring that your financial decisions reflect what matters most to you.

Proportional Budgeting

Proportional budgeting is a straightforward yet powerful technique where your income is divided into fixed categories such as needs, wants, and savings. This popular budgeting method typically follows the 50/30/20 rule: 50% of your income goes to necessities, 30% to discretionary wants, and 20% to savings and debt repayment. This system lets you modify proportions to suit your personal circumstances and financial goals, including proposition budgeting.

What makes proportional budgeting appealing is its simplicity and adaptability. You can adjust the percentages to save more, pay off debt, or manage your finances better, fitting your unique situation. The clear framework of this method simplifies fund allocation without overcomplicating the budgeting process.

Example of Proportional Budgeting

Let’s put proportional budgeting into practice with a concrete example. Suppose you have a monthly income of $5,000. According to the 50/30/20 rule, you would allocate $2,500 for needs like rent, groceries, and health care, $1,500 for wants such as dining out and entertainment, and $1,000 for savings and debt repayment.

While the 50/30/20 split is a common approach, you can adjust these percentages based on your financial goals. For instance, if you’re focused on building an emergency fund or saving for a big purchase, you might allocate 40% to needs, 20% to wants, and 40% to savings.

This flexibility makes proportional budgeting one of the most popular budgeting strategies for managing your money effectively.

Pay Yourself First Method

The Pay Yourself First budgeting method flips the traditional budgeting process on its head. Instead of saving what’s left after expenses, you prioritize your savings goals by setting aside a portion of your income first. This approach ensures that you consistently meet your savings goals, whether it’s for an emergency fund, retirement savings, or other financial objectives. By implementing a pay yourself first budget, you can enhance your financial stability.

One of the main benefits of the Pay Yourself First method is its low-maintenance nature. Automating transfers to savings accounts reduces the risk of overdrafting and makes saving a habit with little effort. This method suits those who aim to save more with minimal effort.

How to Implement Pay Yourself First

Implementing the Pay Yourself First method starts with analyzing your finances to determine how much you can save. Consider using sub-savings accounts to separate money for different financial goals, such as a vacation fund or an emergency fund. This helps you stay organized and focused on your objectives.

Set up automatic withdrawals from your checking bank account to your savings accounts to make the process seamless. Regularly review and adjust your budget to keep it aligned with your evolving financial goals.

This method is about prioritizing your future by making savings a non-negotiable part of your budgeting process.

Zero-Based Budgeting

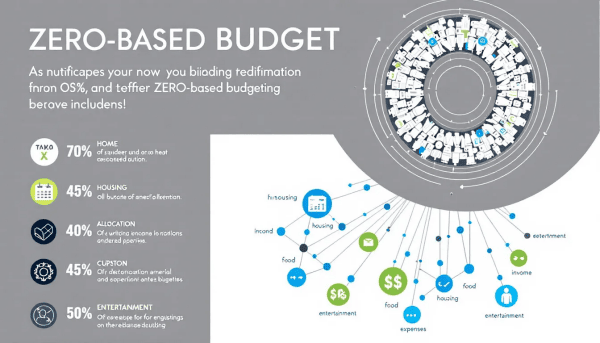

Zero-based budgeting is a meticulous approach where every dollar of your income is assigned a specific purpose. Unlike traditional budgets that may carry over expenses from one period to the next, a zero based budget starts from scratch each period, ensuring every expense is justified. This method ensures that your income minus your savings and expenses equals zero.

This budgeting method is particularly beneficial for those who want to ensure every dollar is accounted for within a budget system, making it a popular choice among freelancers and service industry workers. By assigning every dollar a purpose, you avoid unnecessary spending and can better align your expenses with your financial goals.

Zero-Based Budgeting Example

Consider the example of a construction equipment firm that used zero-based budgeting to evaluate its manufacturing expenses. By scrutinizing every aspect of their expenditures, they discovered that in-house production of certain parts was more cost-effective than outsourcing. This highlights how zero-based budgeting can reveal cost-saving opportunities that traditional methods might overlook.

For individuals, zero-based budgeting works similarly. Suppose you have a monthly income of $3,000. You would allocate funds for various categories, including debt repayment and leisure activities, ensuring every dollar is accounted for and your budget balances to zero by the end of the month. This method helps you stay disciplined and focused on your financial priorities.

Envelope System

The envelope system is a practical budgeting method that uses cash-filled envelopes for different spending categories within an envelope budget. This approach helps control discretionary spending and prevent overspending by limiting you to the cash available in each envelope. It’s particularly effective for managing variable expenses and enhancing awareness of your spending habits.

Withdraw cash for specific expenses and place it in labeled envelopes. If an envelope runs out of cash, reallocate funds from other envelopes or wait until the next budgeting period. This tangible approach makes it easier to track available funds and stay within your budget.

Digital Alternatives to the Envelope System

In the digital age, traditional envelope budgeting has evolved. Apps like Goodbudget and Mvelopes provide digital versions of the envelope system, allowing you to track expenses without using cash. These apps integrate envelopes into existing financial tools, making it easier to manage your budget digitally.

Digital alternatives provide the convenience of automated budgeting, categorizing expenses with minimal manual input. By using these tools, you can efficiently manage your finances while avoiding the hassle of carrying cash, making the envelope system more accessible and organized.

Values-Based Budgeting

Values-based budgeting is a personalized approach that aligns your spending with your personal values and long-term financial goals. This approach helps you distinguish between wants and needs, ensuring your financial decisions reflect your priorities. It’s about prioritizing life’s priorities and making choices that support your values.

For example, a values-based budgeter might prioritize saving for travel by choosing to live in a more affordable place. This approach not only helps you manage your finances but also brings more money by spending on things that truly matter to you.

Setting Up a Values-Based Budget

The first step in setting up a values-based budget is identifying your personal financial values. Understanding what is important to you helps guide your budget decisions and ensures your spending aligns with your priorities. This could include specific short-term and long-term savings goals such as buying a home or saving for retirement.

Allocate funds in your budget to reflect these values and meet your savings goal. Focusing on what matters most creates a budget that helps you save and enhances your overall financial planning well-being.

Tips for Maintaining Your Budget

Staying on track with your budget can be challenging, but there are strategies to help you succeed. Address common issues like frustration, boredom, or feeling overwhelmed. Prioritizing personal values over mere saving can lead to a more fulfilling financial experience.

Selecting and committing to the best budgeting method for you is crucial. Finding a system that resonates with your lifestyle and financial goals increases your chances of sticking to your budget and achieving your savings goals.

Tracking Progress and Adjusting

Regularly review and adjust your budget to stay on track with your financial goals. Monitor your expenses and compare them against your identified values to ensure your spending aligns with your priorities. This ongoing process helps you recognize spending behaviors and make necessary adjustments.

Setting specific financial targets aids in tracking your progress more effectively. Regularly evaluating your budget helps inform necessary changes to stay on track with your financial objectives. This proactive approach ensures that your budget remains relevant and effective.

How to Choose the Right Budgeting Methodology for You

Selecting the right budgeting methodology depends on your financial condition and objectives. Some budgeting methods require regular maintenance, while others are more flexible. If you’re comfortable with your finances, a less frequent review might suffice, but if you’re still learning, more frequent check-ins might be necessary.

Experimenting with different budgeting methods can help you find one that resonates with you. If one method doesn’t feel right, don’t hesitate to try another or even create your own. A good budget method aligns with your priorities. It should also be manageable for you.

Understanding your financial goals and narrowing down your options can guide you in selecting a budgeting method that aligns with your needs. Values-based budgeting encourages managing your money in alignment with what you truly value in life. Finding the right fit can make budgeting more effective and enjoyable.

Summary

We’ve explored five powerful budgeting methodologies: Proportional Budgeting, Pay Yourself First, Zero-Based Budgeting, the Envelope System, and Values-Based Budgeting. Each method offers unique advantages and can be tailored to fit your lifestyle and financial goals. By understanding and implementing these strategies, you can maximize your savings and achieve financial freedom.

Start your budgeting journey today by choosing a method that resonates with you. Remember, the key to successful budgeting is finding a system that aligns with your values and sticking to it. With dedication and the right approach, you can take control of your finances and build a secure future.

Frequently Asked Questions

What is the best budgeting method for beginners?

Proportional budgeting is a fantastic choice for beginners because it's simple and flexible, making it easy to adapt as your financial situation changes. Give it a try to take control of your finances!

How often should I review my budget?

You should review your budget regularly; aim for at least once a month or every two weeks if that feels better for you. Staying on top of it helps keep your finances in check!

Can I combine different budgeting methods?

Absolutely, you can mix and match different budgeting methods to create a plan that fits your lifestyle and goals perfectly! Just take what works for you from each method and make it your own.

What tools can help with digital envelope budgeting?

Goodbudget and Mvelopes are fantastic tools for digital envelope budgeting, helping you stay organized and effortlessly track your expenses. Give them a try to simplify your budgeting process!

How do I stay motivated to stick to my budget?

To stay motivated with your budget, regularly remind yourself of your financial goals and celebrate small milestones along the way. Keeping track of your progress makes the journey rewarding and helps maintain focus!