Digital Envelope Budgeting: The Best Modern Approach to Classic Money Management

Digital envelope budgeting is a modern approach to managing your money by using virtual categories to allocate your income. Instead of dealing with physical cash, this method leverages technology to track and control your spending. In this article, you’ll learn how digital envelope budgeting works, its advantages, and how to choose the right app for your needs.

Key Takeaways

Digital envelope budgeting modernizes traditional cash envelope systems by using technology for efficient spending tracking and financial management.

Choosing the right budgeting app is crucial; look for user-friendly interfaces, customization options, real-time tracking, and strong security features.

Advanced strategies like zero-based budgeting and the pay-yourself-first method can enhance digital budgeting, ensuring all income is allocated and savings are prioritized.

Understanding Digital Envelope Budgeting

Digital envelope budgeting is a modern twist on the traditional cash envelope system. Instead of using physical envelopes filled with cash, this envelope budgeting method allocates your income into virtual envelope categories to track and control spending. This approach retains the principles of the traditional envelope system but utilizes technology to make the process more efficient and user-friendly. The envelope budget system enhances the effectiveness of budgeting.

One of the significant advantages of digital envelope budgeting is its ability to integrate seamlessly with your bank accounts and electronic transactions. This integration offers a comprehensive view of your finances, making it easier to manage your money without the hassle of handling physical cash. The visual representation of digital envelopes can significantly enhance financial comprehension and decision-making, providing a clear picture of where your money is going.

Moreover, digital envelope systems allow for real-time tracking and adjustments, ensuring that you stay on top of your budget at all times. This modern approach not only simplifies budgeting but also helps in developing better financial habits and achieving your financial goals. Embracing digital envelope budgeting allows you to benefit from traditional methods while leveraging technology to enhance financial management.

Choosing a Digital Envelope Budgeting App

Choosing the right digital envelope budgeting app is key to effectively managing your finances. An effective best app should have a user-friendly interface that allows for easy navigation and quick access to various features. Look for an app that offers detailed insights and reports to help you understand your spending habits and make informed financial decisions.

Customization is another critical factor. A good budgeting app should allow you to create and customize envelopes for various spending categories according to your personal needs. Real-time expense tracking is essential, as it updates your spending and remaining funds instantly, helping you stay within your budget.

Security is paramount when dealing with financial data. When choosing an app, consider the following:

Strong encryption and privacy protections, including password protection and two-factor authentication.

Affordability; assess whether the app’s features justify its cost.

Availability of a free version with basic features, allowing you to try the app before committing to a paid plan.

Setting Up Your Digital Envelopes

The first step in setting up your digital envelopes is building your budget. Start by:

Determining your monthly income and total monthly income and total average monthly expenses. This will help you create a realistic budget that aligns with your financial situation.

Tailoring your budget by defining categories based on your personal spending habits.

Using recent bank statements to guide your category selection.

Once you have established your budget category, determine the budget allocations for each specific categories by averaging past spending. This ensures that each category is accurately funded, preventing overspending in any area. Next, create virtual envelopes for each spend category. These envelopes will help you organize your budget and track your expenses more effectively.

Regularly tracking your expenditures within each category is crucial to staying on budget. Make necessary adjustments as needed, especially for irregular expenses that may occur throughout the month’s expenses. By diligently managing your digital envelopes, you can maintain financial discipline and achieve your financial goals while spending money wisely.

Tracking and Adjusting Your Digital Envelopes

Consistently tracking your expenditures is essential for understanding your spending habits and making informed financial decisions. Digital envelope systems streamline this process, allowing for easier tracking of spending patterns and helping you stay on top of your budget. Money that has been spent wisely contributes to better financial health.

To effectively manage your digital envelopes and budget:

Review your digital envelopes weekly to ensure you are staying on track with your budget.

Make adjustments to your digital envelopes monthly to reflect any changes in your spending patterns or financial goals.

If unexpected expenses arise, adjust your budget as necessary to ensure it remains functional.

Using digital tools for tracking can simplify the process and reduce the chances of human error. These tools often provide analytical insights that help you understand your financial habits better and make more informed decisions. By regularly reviewing and adjusting your digital envelopes, you can adapt to changing financial circumstances and maintain control over your finances.

Integrating Credit Cards with Digital Envelope Budgeting

One of the advantages of digital envelope budgeting is its ability to integrate with credit cards while maintaining financial control. You can use a debit card or debit cards within the digital envelope budgeting system, allowing for more flexibility in your spending. Many budgeting apps enable you to track credit card spending within digital envelopes, ensuring that you stay within your budget.

To manage credit card debts effectively:

Create a dedicated budgeting category for credit card debt to capture all related expenses and ensure they are accounted for in your budget.

Use your checking account linked to your budgeting app to make credit card bill payments.

Open savings accounts for each envelope to help in transferring funds for credit card payments.

It’s important to strive to pay off your credit card balance in full each month to avoid accruing interest. Avoiding reliance on credit cards while using digital envelopes reinforces budget adherence and promotes better financial health. By integrating credit cards with your digital envelope budgeting system, you can manage your finances more effectively and avoid falling into debt.

Advanced Strategies for Digital Envelope Budgeting

For those looking to take their budgeting to the next level, advanced strategies such as zero-based budgeting and the pay-yourself-first method can be highly effective. Zero-based budgeting requires that all income is allocated to specific expenses, savings, or debt repayments, ensuring that every dollar is accounted for. This method provides financial clarity and helps you achieve your financial goals.

The pay-yourself-first budgeting method prioritizes saving before addressing any expenses. This strategy ensures that your obligations and savings goals are funded first, helping you build a strong financial foundation. To incorporate saved savings goals effectively, include line items for these goals in your budget plan while paying attention to your overall financial health. Additionally, it’s essential to set aside funds for unexpected expenses.

By adopting these advanced strategies, you can enhance your financial management and achieve your financial objectives. Zero-based budgeting and the pay-yourself-first method are practical ways to ensure that your finances are in order and that you are making informed decisions about your spending. Effective money management can further support these efforts.

Overcoming Common Challenges in Digital Envelope Budgeting

While digital envelope budgeting offers many benefits, it also comes with its challenges. One significant hurdle is the difficulty of tracking electronic transactions, which can disrupt the visualization of spending within the designated envelope system. The rigidity of the envelope system can also become problematic for those with variable expenses, as unexpected costs may require shifting funds between envelopes.

Common issues with budgeting apps include:

The learning curve associated with becoming familiar with the app’s features.

Technical problems such as app glitches or syncing issues that can disrupt the budgeting process.

Dependency on technology, where app downtime may hinder access to budget information.

To overcome these challenges, it’s important to manually input cash transactions to ensure accurate budget tracking. Familiarize yourself with the app’s features and take advantage of customer support if needed. By addressing these challenges head-on, you can make the most of your digital envelope budgeting system and achieve your financial goals.

Security Considerations for Digital Envelope Budgeting Apps

When dealing with financial data, security is paramount. Budgeting apps should feature robust security measures, including data encryption and fraud protection. Financial data transmitted through these apps is typically protected using 256-bit encryption standards, ensuring that your information is secure.

To enhance the security of your budgeting app, consider the following practices:

Enable two-factor authentication.

Regularly update your passwords.

Carefully examine the privacy policies of budgeting apps to understand how your personal data is handled.

Researching the reputation of budgeting apps is important to ensure they have a trustworthy security track record. Apps like Monarch and PocketGuard utilize industry-leading security practices to protect user data. By prioritizing security, you can confidently use digital envelope budgeting apps to manage your finances.

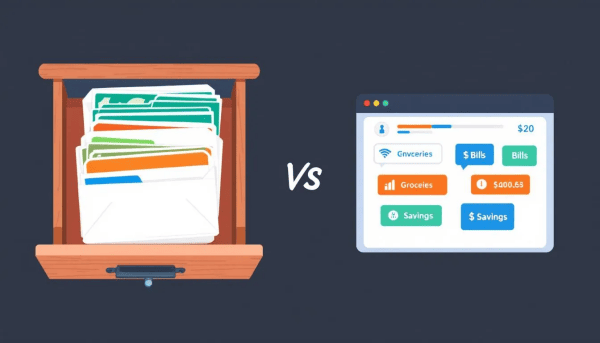

Transitioning from Cash to Digital Envelopes

Transitioning from physical cash to digital envelopes can be a significant change, but it comes with numerous benefits:

Setting aside funds for irregular expenses can prevent financial strain and enhance preparedness for large bills.

Embracing a digital envelope system helps modernize budgeting.

It offers enhanced tracking capabilities.

Employ specific techniques to facilitate the transition. For instance, gradually shifting from physical cash to digital envelopes can help save in a practical way next month ease the adjustment. The improvement in financial management and better control over spending habits are well worth the effort.

Transitioning allows you to enjoy the convenience and efficiency of digital envelope budgeting.

Benefits of Using Digital Envelopes Over Physical Cash

Using digital envelopes instead of physical cash offers numerous advantages. Physical cash envelopes can introduce convenience issues and security risks, making it cumbersome and potentially unsafe to handle cash. In contrast, digital envelopes enhance safety by reducing the risk associated with carrying large amounts of cash.

With digital envelopes, users can quickly adjust their budgets in real-time without needing to physically rearrange cash. This flexibility allows for more money accurate and efficient budgeting, helping you stay on top of your finances.

By adopting a digital approach in this digital age, you can enjoy the benefits of traditional budgeting methods while leveraging the power of technology and budgeting tools to enhance your financial management.

Summary

In summary, digital envelope budgeting is a powerful tool that combines the classic principles of the traditional cash envelope system with the convenience and efficiency of modern technology. By choosing the right budgeting app, setting up digital envelopes, and tracking and adjusting your spending, you can take control of your finances and achieve your financial goals. Embrace the benefits of digital envelope budgeting and experience a new level of financial freedom and security.

Frequently Asked Questions

What is digital envelope budgeting?

Digital envelope budgeting is an effective method for managing your finances, allowing you to allocate your income into virtual categories to control spending. This approach combines the structure of envelope budgeting with digital convenience for better tracking.

How do I choose the right digital envelope budgeting app?

To choose the right digital envelope budgeting app, prioritize features like a user-friendly interface, customization options, real-time tracking, strong security, and affordability. Additionally, reading user reviews can provide valuable insights.

How do I set up my digital envelopes?

To set up your digital envelopes, begin by establishing your budget and defining your spending categories. Allocate funds accordingly, create virtual envelopes for each category, and consistently monitor and adjust your expenditures.

Can I use credit cards with digital envelope budgeting?

Yes, you can use credit cards with digital envelope budgeting, but it's crucial to track credit card debt in a specific category and aim to pay off the balance in full each month.

What are the benefits of using digital envelopes over physical cash?

Using digital envelopes provides significant benefits such as convenience, improved security, real-time budget tracking, and the elimination of risks tied to carrying cash. These advantages make digital envelopes a safer and more efficient option for managing finances.