The 50 20 30 Rule: A Simple Guide to Budgeting and Saving Money

The 50 20 30 rule is a popular personal finance strategy that helps you manage your money by splitting your income: 50% for needs, 20% for savings, and 30% for wants. This guide will show you how to apply this simple rule to balance your budget and achieve your financial goals.

Key Takeaways

The 50/30/20 rule divides after-tax income into three categories: 50% for necessities, 30% for wants, and 20% for savings or debt repayment, including credit card debt.

Regularly tracking expenses and automating savings can enhance budgeting effectiveness and ensure adherence to the 50/30/20 framework.

This budgeting method is flexible and can be adapted based on individual circumstances, allowing for adjustments to better fit specific financial situations.

Understanding the 50/30/20 Rule for Net Income

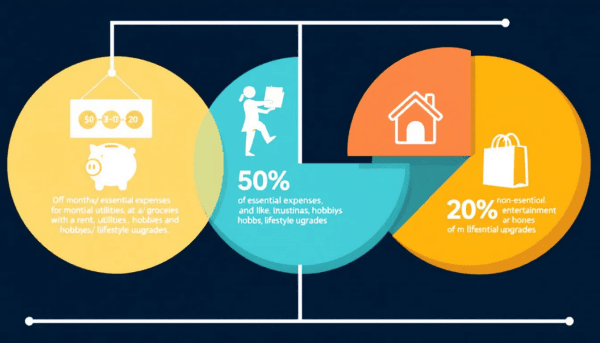

The 50/30/20 rule divides your after-tax income into necessities, wants, and savings. This straightforward method helps manage money and reach financial goals by offering clear allocation guidelines.

According to the 50/30/20 rule, you should allocate 50% of your after-tax income to necessities, 30% to wants, and 20% to savings or debt repayment. Understanding the difference between wants and needs is crucial for prioritizing your expenditures and ensuring that your budget aligns with your financial priorities.

This savings can be directed towards various financial goals, such as building an emergency fund, saving for retirement, or accumulating a down payment for a home.

Following this framework helps create a balanced budget that supports immediate needs and long-term financial well-being.

Calculating Your Income

Calculating your income is a crucial step in creating a budget that works for you. To effectively manage your finances, you need to determine your after-tax income, also known as your net income or take-home pay. This is the amount of money you have available for expenses, savings, and debt repayment.

To calculate your after-tax income, follow these steps:

Determine Your Gross Income: This is the total amount of money you earn before any taxes or deductions are taken out. It includes your salary, bonuses, and any other sources of income.

Calculate Your Taxes: Use a tax calculator or consult with a tax professional to determine how much you owe in taxes. This includes federal, state, and local taxes, as well as any other deductions like Social Security and Medicare.

Subtract Your Taxes from Your Gross Income: This will give you your after-tax income, which is the amount you have available to spend, save, and invest.

For example, let’s say you earn $50,000 per year and you owe 25% in taxes. Your after-tax income would be:

$50,000 (gross income) - $12,500 (taxes) = $37,500 (after-tax income)

Understanding your after-tax income is essential because it helps you determine how much you can afford to spend on essential expenses, savings, and debt repayment. By knowing your net income, you can create a realistic budget that aligns with your financial goals and ensures you are living within your means.

Allocating 50% of Your Income to Necessities

Essential expenses should ideally not exceed half of your take-home pay.

For example, if your monthly after-tax income is $5,000, you should allocate $2,500 for necessities.

These necessities include critical components such as:

housing costs

utilities

food

transportation

health care

Housing costs, including rent and utilities, are typically the largest part of necessary expenses. Food budgeting should focus more on groceries rather than dining out to stay within the budget. Transportation costs, such as car payments, fuel, and insurance, also fall under this category. Regularly review these fixed expenses to identify potential savings opportunities and ensure affordability.

If spending on necessities exceeds 50% of your income, consider cutting down on wants or finding ways to reduce living expenses, like opting for a more affordable living arrangement or refinancing to save money. Small adjustments can help maintain the 50% threshold and keep your budget balanced.

Spending 30% of Your Income on Wants

In the 50/30/20 rule, wants represent non-essential spending, such as dining out, travel, entertainment, and hobbies. For instance, typical examples of wants include dinners out, gifts, and luxury items. Allocating 30% of your after-tax income to these wants allows for enjoyment while maintaining financial discipline.

Allocating a portion of your income to spend money on discretionary spending allows you to enjoy activities that enhance your lifestyle without compromising financial stability. For instance, with an after-tax income of $5,000, you would spend $1,500 on wants.

This balanced approach promotes enjoyment while maintaining responsible money management, enhancing overall financial freedom and well-being.

Saving 20% of Your Income for the Future

Saving 20% of your income is a crucial aspect of the 50/30/20 rule, as it helps build financial security for future needs and goals. This portion of your income should be allocated to savings or debt repayment to ensure long-term financial wellness. Consider setting up multiple savings accounts for different goals, such as an emergency fund, retirement, and other long-term financial objectives. By consistently setting aside 20% of your after-tax income, you can achieve significant savings over time, putting you on track to meet your financial goals.

For a monthly income of $5,000, setting aside $1,000 corresponds to the 20% rule for savings. This saving can be directed towards building an emergency fund, contributing to retirement accounts, or other future financial goals.

The following subsections will delve into building an emergency fund and contributing to retirement accounts.

Building an Emergency Fund for Unexpected Expenses

An emergency fund covers unexpected expenses like medical bills or job loss. Ideally, it should cover three to six months of essential expenses, offering a financial safety net during unforeseen circumstances. The recommended starting amount for an emergency fund is $500, which you can gradually build upon.

If your emergency fund is depleted, prioritize replenishing it before other savings goals. This fund prevents financial stress and provides peace of mind, ensuring you are prepared for unexpected expenses.

A dedicated savings account for your emergency fund can help keep these funds separate and easily accessible when needed.

Contributing to Retirement Accounts

Regular contributions to retirement accounts can significantly enhance your financial stability during retirement. If your employer offers a match, it’s wise to contribute enough to take full advantage of this benefit, as it effectively doubles your savings.

Consistent contributions to a retirement account like 401(k)s or IRAs are vital for long-term financial security. Automating these contributions ensures regular investment in your future without extra effort.

By prioritizing retirement savings, you can work towards achieving financial freedom and security in your later years.

Benefits of the 50/30/20 Budget

The 50/30/20 rule gained widespread recognition through the book ‘All Your Worth: The Ultimate Lifetime Money Plan’ by Elizabeth Warren and Amelia Warren Tyagi, published in 2005. This budgeting framework simplifies financial planning by breaking down income into three clear categories, making it easier to manage your money and achieve your financial goals.

The advantages of using the 50/30/20 rule include guidance towards financial prosperity, simplicity, clarity, and improved financial well-being. By promoting solid money management basics, this rule helps individuals make better financial decisions, leading to greater financial peace of mind and freedom.

Clear financial goals can motivate and guide your budgeting process, enhancing financial well-being.

Adapting the 50/30/20 Rule to Your Personal Finance Situation

The 50/30/20 rule is a flexible framework that can be adapted to fit different financial situations. Experts note that this rule is best suited for those with stable incomes and minimal high-interest debt. However, high living costs or fluctuating incomes may require adjustments to the percentages allocated to necessities, wants, and savings.

Adjust budget percentages based on personal circumstances like family responsibilities or financial changes. If your current system isn’t effective, try a different strategy, such as zero-based budgeting, to better align with your goals.

By adapting the 50/30/20 rule to your financial situation, you can create a more realistic and effective budget.

Tracking Your Expenses

Tracking expenses is crucial for understanding spending habits and ensuring alignment with the 50/30/20 rule. Track your expenses for one to two months for a clear picture of your spending. Reviewing bank and credit card statements can help identify discretionary spending areas and provide insights into where you can cut costs.

This budgeting approach encourages mindful spending, helping individuals distinguish between essential expenses and discretionary spending. Many individuals overlook irregular costs such as annual fees or maintenance, which can impact their budgeting accuracy.

Diligently tracking expenses allows you to make informed decisions that support your financial goals.

Automating Savings and Payments

Automating savings and payments reduces missed payments, lowers stress, and improves the budgeting experience. Automatic deposits ensure a portion of your income goes directly into savings, helping you build your savings effortlessly. You can start implementing automated contributions by setting up recurring transfers from your checking account to your savings account.

Various budgeting apps, such as YNAB and PocketGuard, can help manage your finances by automating budgeting and tracking expenses. Goodbudget allows for manual allocation of monthly income into designated spending envelopes, promoting mindful budgeting without automatic bank syncing.

EveryDollar offers a zero-based budgeting system, simplifying the process of automating budgeting and staying on track with financial goals.

Maintaining a Healthy Budgeting System

Maintaining a healthy budgeting system requires discipline, commitment, and regular monitoring. Here are some tips to help you keep your budget on track and achieve your financial goals:

Track Your Expenses: Keep a detailed record of every transaction you make, including small purchases like coffee or snacks. This will help you identify areas where you can cut back and make necessary adjustments to your budget.

Prioritize Your Expenses: Ensure that you are prioritizing essential expenses, such as housing, food, and transportation, over discretionary expenses like entertainment and hobbies. This will help you stay within your budget and avoid overspending.

Automate Your Savings: Set up automatic transfers from your checking account to your savings or investment accounts. This makes saving easier and ensures that you consistently set aside money for your financial goals without having to think about it.

Review and Adjust Regularly: Regularly review your budget to ensure you are on track to meet your financial goals. Make adjustments as needed to accommodate changes in your income or expenses.

Avoid Impulse Purchases: Be mindful of your spending habits and avoid making impulse purchases, especially on big-ticket items. Take time to consider whether a purchase is necessary and fits within your budget.

Build an Emergency Fund: Having an emergency fund in place can help you avoid going into debt when unexpected expenses arise. Aim to save three to six months’ worth of essential expenses to provide a financial safety net.

Monitor Your Credit Report: Regularly check your credit report to ensure there are no errors or surprises that could affect your credit score. This will help you maintain good credit and secure better interest rates on loans and credit cards.

By following these tips, you can maintain a healthy budgeting system that supports your financial goals and helps you achieve financial freedom. Consistent money management and regular monitoring will ensure that you stay on track and make informed financial decisions.

Practical Example of the 50/30/20 Rule

Consider a practical example with a monthly after-tax income of $8,000 to illustrate the 50/30/20 rule. According to this method, $4,000 (50%) goes to necessities like housing, utilities, food, and transportation.

Next, $2,400 (30%) can be allocated to wants, including dining out, travel, and entertainment. Finally, $1,600 (20%) should be set aside for savings or debt repayment. This allocation helps maintain financial balance and ensures both immediate needs and future goals are adequately addressed.

Common Mistakes to Avoid

A common mistake when applying the 50/30/20 rule is categorizing non-essential expenses as essentials, which can distort the budget. It’s important to accurately distinguish between necessities and wants to ensure your budget remains balanced. If you notice overspending in any category, consider cutting costs and redirecting funds towards debt repayment or savings.

The 50/30/20 rule can be rigid for fluctuating expenses. Allow some flexibility to accommodate unexpected costs or financial changes. Regularly review and adjust your budget to stay on track and achieve financial goals.

Tools and Resources for Effective Budgeting

Effective budgeting requires the right tools and resources to track expenses and maintain discipline. Budgeting apps like YNAB, PocketGuard, and EveryDollar can help manage your finances by automating budgeting and tracking expenses. Empower Personal Dashboard is primarily an investment tool but also provides useful budgeting features to track spending across various accounts.

Spreadsheet solutions like Microsoft Excel are also effective tools for tracking expenses and creating a customized budget. By leveraging these tools, you can gain better control over your finances and ensure your budget aligns with your financial goals.

Summary

The 50/30/20 rule offers a simple yet powerful approach to budgeting that divides your after-tax income into necessities, wants, and savings. By following this framework, you can achieve financial balance, make informed spending decisions, and work towards your long-term financial goals. This method promotes financial well-being and peace of mind, allowing you to enjoy life today while saving for the future.

Incorporating the 50/30/20 rule into your financial routine can transform your money management habits and set you on the path to financial freedom. By understanding and adapting this rule to fit your unique financial situation, you can create a realistic and effective budget that supports your financial aspirations.

Frequently Asked Questions

What is the 75 15 10 rule?

The 75/15/10 rule suggests allocating 75% of your paycheck to essential needs, 15% to long-term investments, and 10% to short-term savings, ensuring a balanced financial approach. This method helps you manage your finances effectively while preparing for the future.

What is the 50/30/20 rule?

The 50/30/20 rule is an effective budgeting strategy that allocates 50% of your after-tax income to necessities, 30% to wants, and 20% to savings or debt repayment. This approach helps create a balanced financial plan.

How do I determine what counts as a necessity?

To determine what counts as a necessity, focus on essential expenses like housing, utilities, food, transportation, and health care. Ensure these costs do not exceed 50% of your after-tax income.

What should I do if my necessities exceed 50% of my income?

If your necessities exceed 50% of your income, it's essential to reevaluate your spending habits and reduce discretionary expenses. Additionally, look for opportunities to lower fixed costs to bring them within a more manageable range.

How can I start building an emergency fund?

To build an emergency fund, begin by saving a modest amount, like $500, and aim to gradually grow it to cover three to six months of essential expenses. Make it a priority to replenish the fund if you ever need to draw from it.