Mastering Your Budget with the Wants vs Needs Matrix: Practical Tips and Insights

Are you struggling to manage your budget and distinguish between essential and non-essential expenses? The wants vs needs matrix can help. This tool categorizes your expenses, making it easier to allocate your budget effectively. In this article, we’ll break down how to use the wants vs needs matrix to take control of your financial planning.

Key Takeaways

The Wants vs Needs Matrix is essential for effective budgeting, helping to categorize expenditures into essential needs and discretionary wants.

Identifying basic needs, such as food, rent, and healthcare, is vital for financial stability and should always be prioritized in your budget.

Employing tools like the Eisenhower Matrix and practical budgeting methods, such as the 50/30/20 rule, enhances financial planning by ensuring essential expenses are covered while balancing savings and lifestyle wants.

Understanding the Wants vs Needs Matrix

Distinguishing between needs and wants is fundamental to sound financial planning. This differentiation forms the foundation of the Wants vs Needs Matrix, a tool designed to help allocate your budget wisely and manage finances efficiently. Categorizing your expenditures clarifies spending decisions and highlights the differences that allow for more effective resource allocation.

Visualize your budget as a pie. Needs represent the essential slices—key expenses like rent, utilities, and groceries. Wants, conversely, are the enjoyable extras—dining out, new gadgets, or concert tickets. Assessing needs vs wants with a tailored approach for each category helps align your budget for needs with your financial goals, ensuring necessary expenses are covered without overly sacrificing the cost of the extras to pay for the extras.

Begin by listing all your purchases and categorizing them into broad categories of needs and wants to use the Wants vs Needs Matrix effectively. This classification helps align your budget with your financial goals. Understanding and correctly categorizing each expense allows you to take control of your finances and work towards financial security.

Identifying Your Basic Needs

Identifying basic needs is crucial for a robust budget. These essentials, required for survival and well-being, include:

Food

Rent

Healthcare

Transportation. These non-negotiables must be prioritized to maintain your health and quality of life, as identified. To effectively manage your resources, it is essential to identify these basic needs, which are an important part of your overall strategy.

Basic needs often include:

Utilities

Basic clothing

Groceries

Shelter

These essentials should be the first items in your budget, ensuring you meet necessary expenses without undue financial strain. Career changes and living arrangements can affect what constitutes your basic needs, so regularly review and adjust your budget as needed.

Failing to meet your basic needs can jeopardize your health and well-being, leading to serious consequences. If you struggle to afford these essentials, review your budget for potential spending cuts to survive your job. This is crucial for maintaining financial stability and covering necessary expenses, including insurance.

Recognizing Your Wants

Wants are non-essential expenses that enhance your lifestyle and enjoyment for a person. Unlike basic needs, they are not critical for survival but significantly contribute to overall happiness and quality of life. Examples include dining out, concerts, weekend trips, and luxury items.

Effectively managing your wants involves:

Listing this desire and allocating varying amounts for each.

After covering needs, assigning remaining income to your outlined wants.

Ensuring you enjoy life’s finer things without compromising financial stability.

Carefully considering impulse purchases to avoid financial strain.

If you overspend on unnecessary items, adjust your budget accordingly. Recognizing and effectively managing your wants allows you to balance enjoying life with maintaining financial health.

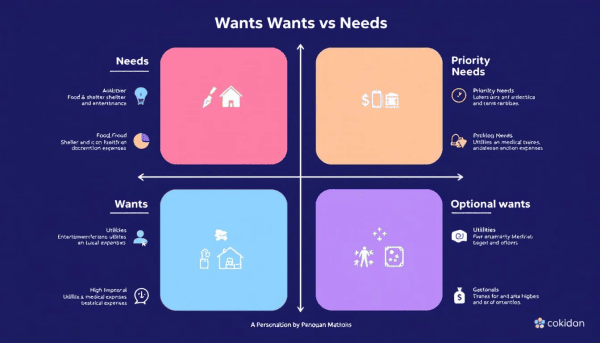

Creating Your Own Wants vs Needs Matrix

Creating a personalized Wants vs Needs Matrix is a powerful step towards financial mastery. This matrix helps organize and prioritize your financial choices. Adding associated costs to the analysis highlights the importance of quality and investment in essential items to create a better financial future.

A visual representation of your needs and wants aids in making informed spending decisions. Regularly updating the matrix ensures it reflects changes in your financial circumstances, aligning your budget with your current situation and evaluating the impact on overall financial health.

Categorizing your expenses with the matrix reveals which areas need more financial focus. This step is crucial for effective budgeting and efficient allocation of resources.

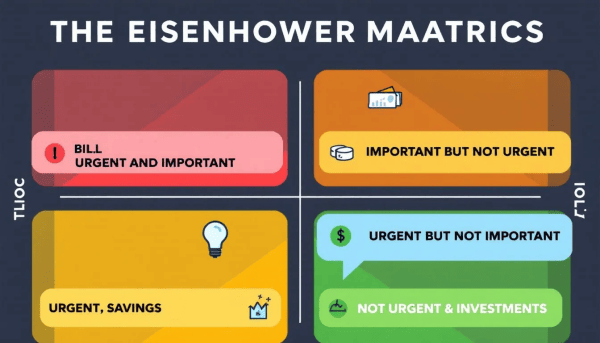

Using the Eisenhower Matrix for Budgeting

The Eisenhower Matrix, typically used for priority tasks, is also useful for budgeting. It helps by:

Distinguishing between urgent and non-urgent expenses

Enabling effective spending prioritization

Categorizing expenses to ensure both essential and unexpected financial needs are covered.

Employing the Eisenhower Matrix for budgeting enhances your financial strategy by allocating your budget according to priorities. This method covers critical expenses like transportation and healthcare and sets aside funds for emergencies.

Evaluating expenses through the Eisenhower Matrix allows you to evaluate more effective money allocation, ensuring your budget aligns with financial goals and needs. This structured approach helps manage finances and maintain budget control.

Practical Tips for Managing Your Budget

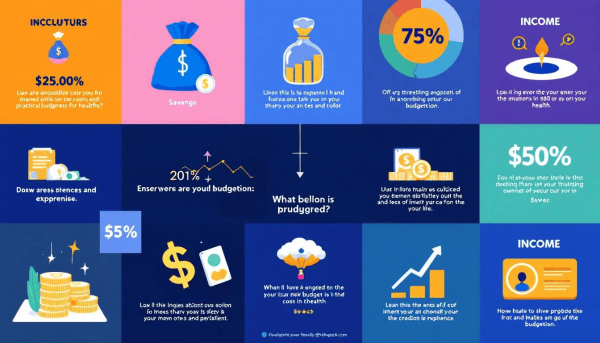

Effective budget management involves practical tips and strategies. One popular method is the 50/30/20 rule, allocating 50% of income for needs, 30% for wants, and 20% for savings, offering a balanced approach to cover all essential areas.

Another helpful tool is zero-based budgeting, where every dollar of income is assigned to specific expenditures, ensuring total expenses match total income. The envelope budget method, dividing cash into envelopes for each budget category and stopping spending when an envelope is empty, is useful for those preferring a tangible way to manage paid money.

Creating a detailed list of monthly needs helps differentiate between fixed expenses like rent and variable expenses like groceries, including monthly bills on a monthly basis. Categorizing purchases into needs and wants allows for a more nuanced financial strategy. Periodically revisiting your budget ensures proper money usage and necessary adjustments.

Tracking and Adjusting Your Spending Habits

Tracking and adjusting spending habits is vital for maintaining financial health. Regularly reviewing categorized expenses reveals opportunities for paying cut back on non-essential purchases and reallocate funds to save money on critical needs, prioritizing how to spend based on current needs and wants. Additionally, it is important to track these adjustments to ensure continued progress.

Several tools assist in tracking expenses:

Monarch Money: syncs various financial accounts and offers detailed budgeting options tailored to personal needs.

YNAB (You Need a Budget): promotes proactive financial planning by requiring users to allocate every dollar to specific budget categories.

Goodbudget: uses an envelope budgeting method, assigning portions of income to designated categories without syncing bank accounts.

If current spending is disproportionate, review your categories, move items between needs and wants, and trim spending where necessary. Regularly reassessing your financial situation keeps you aligned with financial goals and ensures an effective budget.

Building an Emergency Fund

An emergency fund is crucial for financial health. This cushion helps prevent reliance on credit, reducing the risk of accumulating debt. Building it involves allocating money specifically for unexpected expenses like car repairs and medical bills.

Keep emergency savings in a safe, easily accessible account to avoid impulse spending. Consistently contributing to this fund ensures preparedness for financial surprises, maintaining financial stability while saving for the future.

Balancing Financial Goals with Daily Life

Balancing financial goals with daily life is crucial for a healthier budgeting approach. Spending on wants while meeting financial goals is possible if balance is maintained. Cutting back on wants can help meet long-term financial goals.

Regularly reviewing and adjusting the wants vs needs matrix reflects changing priorities and maintains balance. This practice lets you enjoy life while working towards financial goals. Balancing immediate desires with long-term objectives creates a sustainable financial plan supporting both present and future needs, with a keen interest in achieving financial stability.

Ultimately, managing finances is about finding a balance that works for you. Regularly reviewing your budget, making necessary adjustments, and prioritizing financial goals help achieve a harmonious balance between financial responsibilities and lifestyle, including understanding how payments are accounted for in your bill payments.

Summary

Mastering your budget with the Wants vs Needs Matrix involves understanding the critical distinction between needs and wants, identifying and prioritizing your basic needs, recognizing your wants, and creating a personalized matrix to organize your financial priorities. Utilizing tools such as the Eisenhower Matrix, practical budgeting methods, and tracking your spending habits are key steps in maintaining financial health.

Remember, building an emergency fund and balancing your financial goals with daily life are essential for long-term financial stability. By implementing these strategies and regularly reviewing your financial situation, you can take control of your finances and work towards a secure and prosperous future.

Frequently Asked Questions

What is the Wants vs Needs Matrix?

The Wants vs Needs Matrix is a valuable tool for categorizing and prioritizing your expenses, helping you clearly distinguish between essential needs and non-essential wants. By using this matrix, you can make more informed financial decisions.

Why is it important to differentiate between needs and wants?

It is crucial to differentiate between needs and wants to ensure that your budget prioritizes essential expenses and aligns with your financial goals. This clarity helps prevent overspending and supports better financial decision-making.

How can I create my own Wants vs Needs Matrix?

Create your Wants vs Needs Matrix by listing all your purchases, categorizing them into needs and wants, and including their associated costs. Regularly update the matrix as your financial circumstances change to maintain an accurate reflection of your spending priorities.

What is the Eisenhower Matrix, and how is it used for budgeting?

The Eisenhower Matrix is a prioritization tool that categorizes tasks and expenses as urgent or non-urgent, enabling you to allocate your budget effectively based on these priorities. By focusing on what truly matters, you can manage your finances more efficiently.

What are some practical tips for managing my budget?

To effectively manage your budget, consider using the 50/30/20 rule, zero-based budgeting, or the envelope method. Regularly reviewing your budget and tracking expenses will help you stay aligned with your financial goals.