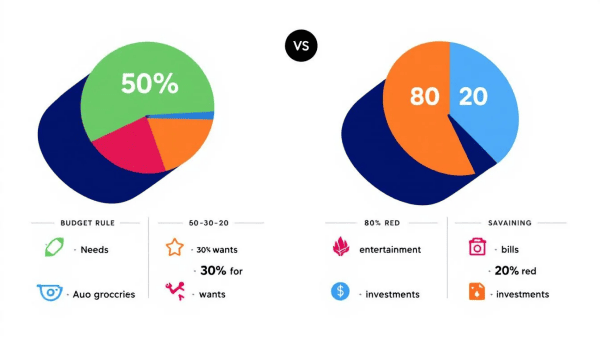

50 30 20 Rule vs 80 20 Rule: Which Budget Fits You Best?

Are you trying to decide between the 50/30/20 rule and the 80/20 rule for your budget? This article will help you understand both budgeting methods and determine which one fits your financial situation best. We’ll compare the advantages and challenges of each rule, including the “50 30 20 rule vs 80 20 rule which budget fits you,” so you can make an informed decision.

Key Takeaways

The 50/30/20 rule divides your after-tax income into needs, wants, and savings, promoting balanced financial management.

The 80/20 rule allows for 80% spending on personal expenses and 20% for savings, offering flexibility and simplicity.

Choosing the right budgeting method depends on your spending habits, financial goals, and living expenses, so self-assessment is key.

Understanding the 50/30/20 Rule

The 50/30/20 rule is a budgeting method. It divides your after-tax income into three main categories: needs, wants, and savings or debt repayment. The primary purpose of this budgeting rule is to provide a structured way to manage your income, balance your spending, and prioritize your savings. This approach ensures you cover essential expenses while also setting aside money for future financial goals and discretionary spending.

Start by listing some forbidden forms of the keyword “broad categories” according to the rule 5. Then, find out if there’s a chance to incorporate the keyword without making any extra assumptions, according to the rule 2. Keep it short.

Begin implementing the 50/30/20 rule by calculating your monthly after-tax income. Then, categorize your expenses into needs, wants, and savings or debt repayment, which can be understood as income into three categories, or broad categories. Needs typically include rent or mortgage payments, utilities, groceries, and other necessary expenses. Wants cover non-essential spending like dining out, entertainment, and hobbies. The final 20% is allocated to savings or debt repayment, which includes building an emergency fund, contributing to retirement accounts, and paying off loans.

While the 50/30/20 rule provides a solid foundation for budgeting, it may not fit all financial circumstances. For example, in areas with high living costs, sticking to the 50% limit for needs can be challenging. Therefore, adjustments might be necessary to accommodate individual financial situations, especially when considering the budget rule.

Reviewing your expenses regularly and adjust spending as needed can help you stay on track and achieve financial discipline, especially when accounting for unexpected expenses.

Breaking Down the 80/20 Rule

The 80/20 rule, also known as the Pareto Principle, is another popular budgeting method that suggests allocating 80% of your income to cover personal expenses while reserving 20% for savings or investments. This budgeting rule is praised for its straightforwardness and adaptability to different financial circumstances.

One of the primary advantages of the 80/20 rule is its simplicity. It doesn’t require detailed tracking of expenses, focusing instead on the overall allocation of income. For instance, a single individual earning $2,500 a month would allocate $2,000 to essential expenses and nonessential expenses and $500 to savings or debt reduction. This approach allows for flexibility in spending, as long as the 20% savings goal is met.

Families can also benefit from the 80/20 rule. For example, a family with a monthly income of $6,000 might reserve $4,800 for living expenses and commit $1,200 to long term savings. This method makes it easier to manage finances without the need for detailed budgeting categories, making it a suitable option for those who prefer a more flexible approach to money management.

Comparing the Two Budgeting Methods

When comparing the 50/30/20 rule and the 80/20 rule, it’s essential to consider how each method addresses the cost of living and financial goals. High living costs can make adhering to the 50% limit for needs quite challenging, impacting discretionary spending. The 80/20 rule, on the other hand, provides more flexibility in managing both essential and non-essential expenses.

Both budgeting methods support different financial goals. The 50/30/20 rule is ideal for those who want to balance their balanced spending across various categories while still prioritizing savings and debt repayment. It encourages balanced spending, building an emergency fund, paying off debt, and investing for the future. Conversely, the 80/20 rule prioritizes saving, letting individuals spend the remaining income as they see fit.

Flexibility is another key difference between the two methods. The 50/30/20 rule allows for adjustments to fit personal financial priorities, enhancing savings goals. Significant loan payments can be categorized under needs until minimum payments are reached, after which additional payments can be allocated to savings.

The 80/20 rule’s inherent flexibility eliminates the need for detailed expense tracking, making it easier to adapt to changing financial situations.

Regularly assessing your financial situation is crucial in determining the most suitable budgeting method. Recognizing how you spend money enables more informed decisions about which strategy to implement. By evaluating your expenses and financial goals, you can choose the method that best aligns with your lifestyle and objectives.

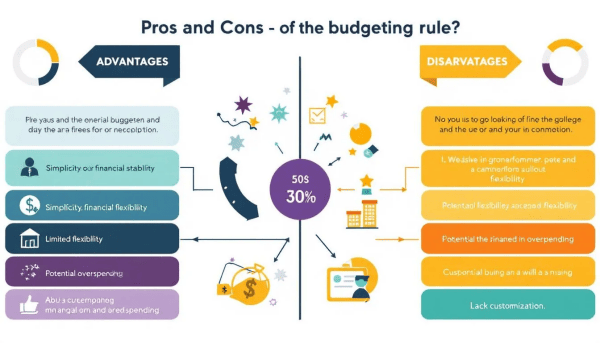

Pros and Cons of the 50/30/20 Rule

The 50/30/20 rule offers several advantages, including:

Improved financial awareness and discipline

Balancing both needs and desires

Simplifying financial management

Being simple to follow

Promoting balanced money management, ensuring controlled spending.

The 50/30/20 rule does come with some drawbacks. These disadvantages should be considered when applying the rule:

It may be unrealistic for individuals with high living expenses, as most people’s needs could surpass 50% of their income.

People may find the rule less effective when focusing on specific savings goals.

The rule can feel restrictive and may impede effective debt repayment, especially when dealing with significant high interest debt.

Despite these challenges, the 50/30/20 rule can be tailored to fit specific financial situations, offering some flexibility. It is particularly suitable for those with steady income and average expenses, offering a structured yet flexible approach to money management.

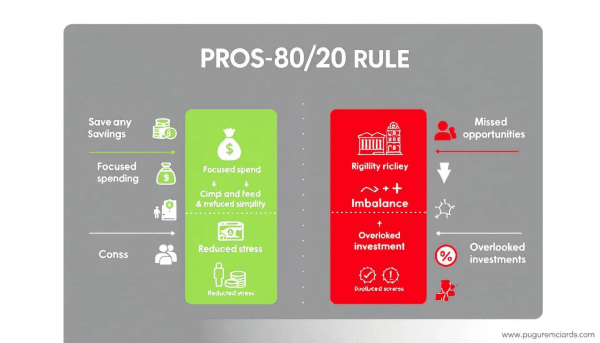

Pros and Cons of the 80/20 Rule

The 80/20 budgeting method emphasizes saving first, allocating at least 20% of income to savings and allowing 80% for all other expenditures. This simple method requires minimal tracking of expenses, focusing solely on savings and overall spending. Flexibility is a key advantage, allowing individuals to spend their remaining money on both essential and non-essential items after meeting their savings goal.

However, the 80/20 rule has its drawbacks. The lack of detailed structure might not suit those who prefer a more precise tracking system for their finances. Additionally, concentrating too much on high-impact areas can lead to neglecting essential tasks that may not seem impactful but are necessary for overall functionality.

The 80/20 rule may also overlook complex financial scenarios where a simple 80/20 division does not apply effectively. Despite potential issues, this method can enhance efficiency and clarify priorities, simplifying the planning and execution of effective strategies.

How to Choose the Right Budgeting Method for You

Choosing the right budgeting method starts with:

Understanding your spending habits by tracking expenses for a month or two.

Gaining insights into where your money goes and identifying areas for improvement.

Exploring alternative budgeting strategies, including a budgeting approach that may better fit your financial situation than the 50/30/20 rule. Start budgeting today to take control of your finances.

Prioritizing your financial goals is crucial. Tackle them one by one, whether it’s pay off debt, saving for a large purchase, or building an emergency fund. Many financial advisors recommend the 80/20 rule as a foundational guideline for effective money management. This approach helps prioritize saving while maintaining flexibility in spending.

Valuing both major and minor contributions in a holistic approach can reveal new growth opportunities. Allocating 20% of your income towards savings can promote higher savings rates and guide retirement savings planning. Considering these factors can help you choose the budgeting method that best suits your financial situation and goals.

Real-Life Examples of Each Budgeting Method

Here are some practical examples of each budgeting method to illustrate their application. For instance, a couple earning $3,541 a month could allocate approximately $1,770.50 for essential expenses, $708.20 for savings, and $1,062.30 for wants using the 50/30/20 rule.

Another couple with a monthly income of $5,000 would allocate $2,500 for needs, $1,500 for wants, and $1,000 for savings or debt repayment. Continuing with the 50/30/20 framework, someone with a $4,000 monthly income might set aside $2,000 for living costs, $1,200 for discretionary spending, and $800 for savings and debt payments.

Similarly, an annual salary of $60,000 translates to monthly expenses of $2,500 for needs, $1,500 for wants, and $1,000 for savings.

There are no specific examples provided for the 80/20 rule. However, the principle remains the same: allocate 80% of your income to personal expenses and 20% to savings or investments. This method can be easily adapted to various financial situations, making it a versatile option for many.

Tips for Implementing Your Chosen Budget

Simplify implementing your chosen budget by automating bill payments and direct deposit into your automatic savings account to help you save money. This ensures consistency, reduces the temptation to overspend, and keeps your financial goals on track. This approach helps maintain discipline and ensures your savings goals are met without constant manual effort.

Tracking expenses over three months can provide valuable insights into your spending habits. To help manage your budget effectively, consider the following:

Use a budget calculator to visualize your standings relative to your budgeting goals.

Set clear financial goals to motivate you to stay on track with your budget.

Regularly review and adjust your budget to stay aligned with your financial objectives.

Tools like a budget app, personal finance software, and a budgeting book can simplify tracking and adjusting your budget. Identifying areas to reduce costs can help maintain balance in your budget. Following these tips can help you successfully implement and stick to your chosen budgeting method and budgeting systems, leading to improved financial health and stability.

Summary

Choosing the right budgeting method is a crucial step towards achieving financial stability and reaching your financial goals. Both the 50/30/20 rule and the 80/20 rule offer unique advantages and can be adapted to fit different financial situations. The 50/30/20 rule provides a structured approach to managing income and expenses, while the 80/20 rule offers flexibility and simplicity.

By understanding the pros and cons of each budgeting method, you can make an informed decision on which one suits your lifestyle and financial goals. Regularly assessing your financial situation, tracking your expenses, and making necessary adjustments will help you stay on track. With the right budgeting method in place, you can take control of your finances and work towards a more secure financial future.

Frequently Asked Questions

What is the 50/30/20 rule?

The 50/30/20 rule is a simple way to budget your after-tax income by allocating 50% for needs, 30% for wants, and 20% for savings or paying off debt. It's a straightforward approach to managing your finances effectively!

How does the 80/20 rule work in budgeting?

The 80/20 rule in budgeting means you should spend 80% of your income on living expenses while saving or investing the remaining 20%. It’s a simple way to help you prioritize your finances!

Which budgeting method is better for high living expenses?

The 80/20 rule is often a better fit for those facing high living expenses since it offers more flexibility in spending while ensuring you still save. This balance makes it easier to manage your budget effectively.

Can I adjust the 50/30/20 rule to fit my financial situation?

Absolutely, you can tweak the 50/30/20 rule to better suit your financial needs. Just remember, the goal is to create a budget that works for you!

What are the main advantages of the 80/20 rule?

The main advantages of the 80/20 rule are its simplicity and flexibility, allowing you to easily prioritize your savings and focus on what really matters without getting bogged down by detailed tracking. It's a practical approach that can help you manage your resources more effectively!