Mastering the Debt and Credit Relationship: Tips for Financial Health

The debt and credit relationship directly impacts your financial health. High debt can lower your credit score, while good debt management can improve it. In this article, we’ll explore how debt affects your credit and share practical tips to manage both effectively.

Key Takeaways

Understanding the link between debt and credit is crucial for maintaining financial health; high debt can harm credit scores, while good debt can be beneficial.

Keeping a low credit utilization ratio, ideally below 30%, is essential as it significantly impacts your credit score; strategies include paying down balances and asking for credit limit increases.

Payment history accounts for 35% of your credit score, making timely payments critical; automatic payments and reminders can help ensure on-time payments.

Understanding the Connection Between Debt and Credit

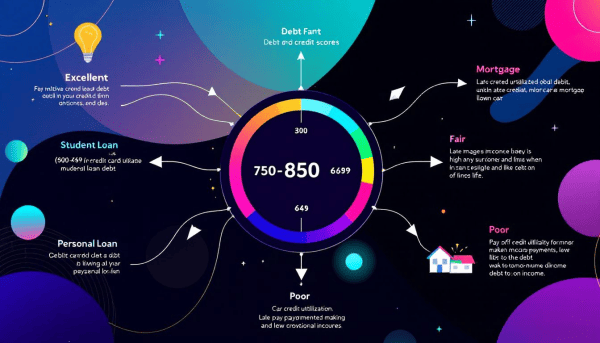

Grasping the link between debt and credit is vital for maintaining financial health. Credit card balances, especially high ones, can significantly hurt your credit score. Maxing out your credit cards or carrying substantial credit card debt signals to lenders that you may be living beyond your means. This perception can lead to higher interest rates and even loan denials. Moreover, excessive debt can erode your savings and deplete your financial reserves, further damaging your credit profile.

On the flip side, not all debt is detrimental. Good debt, such as educational loans or mortgages, is often seen as an investment that can create value over time. Paying down debt is one of the most effective ways to improve your credit score. Reducing your debt not only enhances your credit profile but also frees up cash flow for saving, investing, and other purchases.

The Role of Credit Utilization Ratio in Credit Scoring

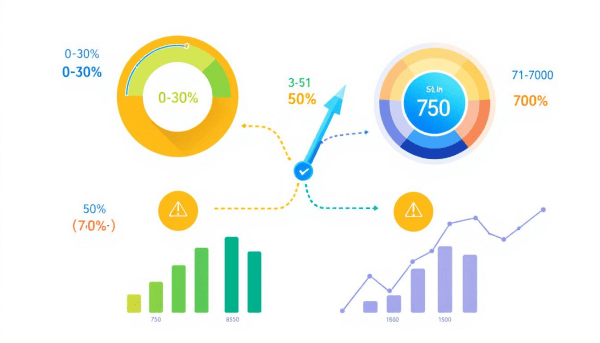

The credit utilization ratio, a key factor in credit scoring, measures your used credit against your available credit. This ratio makes up 30% of your fico credit score. Keeping it low, ideally below 10%, is important for excellent credit scores. High utilization rates can signal risk to lenders, reflecting how much of your available credit is used.

To stay financially healthy, try to keep your credit utilization ratio below 30%. This means if you have a credit limit of $10,000, you should aim to keep your credit card balances below $3,000. This demonstrates responsible credit management, positively impacting your credit score.

Tips to Manage Your Credit Utilization

Effective management of your credit utilization ratio involves strategic actions. One straightforward way to keep your utilization ratio low is by paying down revolving credit balances in full each month. If full payment isn’t feasible, try to keep balances below 30% of your credit limits. This not only maintains a good credit score but also reduces interest on outstanding balances.

Requesting a credit limit increase is another effective strategy. A higher credit limit, combined with unchanged spending habits, naturally lowers your utilization ratio. Combining balance payments and credit limit increases helps maintain a healthy credit profile.

How Payment History Influences Your Credit Score

Payment history, which accounts for at least 35% of your credit score in most models, is the cornerstone of credit scoring. Timely payments are crucial, as a single late payment can cost valuable points. Late or missed payments can linger on your credit report for up to seven years, negatively impacting your score. However, older negative information tends to have a lesser impact compared to more recent late payments.

A positive payment history is essential for building and preserving a good credit score. Partial repayments on installment loans can positively influence your credit profile by demonstrating responsible debt management. Over time, the impact of older negative records diminishes, particularly with consistent current payments.

Strategies for On-Time Payments

On-time payments are key to maintaining a healthy payment history. Setting up automatic payments for your bills is an effective strategy. This ensures on-time payments, regardless of your schedule or memory. Creating payment reminders through your bank or personal calendar is another useful tactic. These reminders help you stay on top of due dates and avoid late payments.

If automatic payments aren’t an option, making at least the minimum payment can keep your accounts in good standing. This practice helps maintain a positive payment history and prevents late fees and additional interest charges.

Consistently making on-time payments is highly effective for improving your credit score.

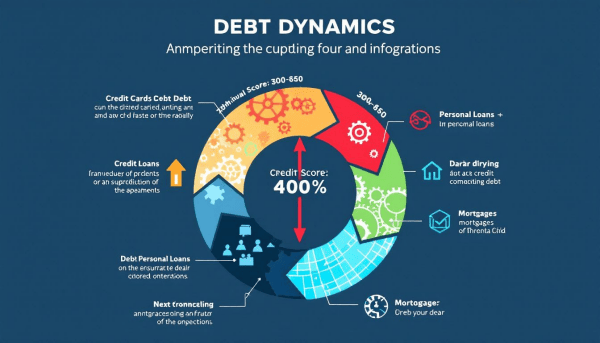

The Impact of Different Types of Debt on Credit Scores

Different types of debt can impact your credit score in various ways. The levels of outstanding debt determine approximately 30% of a credit score. A diverse credit mix, including credit cards, auto loans, and mortgages, can positively influence your credit score. A good mix of credit types shows lenders you can responsibly manage different forms of debt.

Diversifying your credit mix is not an overnight process and generally takes several years. Successfully managing new credit can enhance your credit mix, benefiting your overall score. Paying off a debt might decrease the diversity of your credit mix if it was your only loan.

The Effects of High Credit Card Balances

High credit card balances can significantly negatively impact your credit score. Maxing out your credit cards can lower your credit score, making it harder to obtain new credit or loans. High credit card debt is a major factor that adversely affects your credit score. This can lead to higher interest rates on loans and credit cards and negatively affect rental and phone applications.

Managing high credit card balances is vital for financial health. Consolidating credit card debt onto lower interest cards can simplify repayments. Monitoring your credit utilization rate and timely bill payments are crucial for maintaining a good credit score and managing credit card accounts, including your credit card balance.

How New Credit Accounts Affect Your Credit Profile

Opening new credit accounts can affect your credit profile both positively and negatively. New credit inquiries account for approximately 10% of your FICO Score. Becoming an authorized user on someone else’s credit card can immediately positively impact your credit score if the primary user’s payment history is good. This can help improve your credit mix and utilization.

However, opening new credit accounts might lower the average age of your credit history, negatively impacting your score. Apply for new credit only when necessary to minimize the negative effects of hard inquiries.

The Benefits of Credit Monitoring Services

Credit monitoring services provide significant advantages for maintaining or improving credit scores. They provide automated updates about changes in your credit report, saving you from manually checking each credit bureaus. They include features like public records monitoring and alerts for possible fraudulent activities, helping protect your identity and financial health.

Many services offer dark web monitoring to alert users about potential identity theft. Using these services helps individuals proactively improve their credit scores by staying informed and addressing issues promptly.

How to Dispute Inaccurate Information on Your Credit Report

Inaccurate information on your credit report can seriously harm your credit score. Errors may include incorrect personal information or accounts that don’t belong to you. To dispute inaccuracies, send a letter with supporting documents to both the credit reporting agency and the entity that provided the incorrect data.

Credit monitoring can help you quickly identify and correct errors on your credit report. If a dispute doesn’t result in a correction, you can file a complaint with the Consumer Financial Protection credit bureau.

Long-Term Debt Management Strategies for Better Credit

Effective long-term debt management improves your credit score and ensures financial stability. Consolidating debts through a transfer credit card or a debt consolidation loan is an effective strategy. This helps manage credit utilization more effectively and reduces the overall interest on outstanding debts.

Creating a realistic budget helps in tracking expenses and managing debt payments. Calculate your debt-to-income ratio to ensure you only take on debt you can afford to repay. Keeping a cash reserve provides financial security and prevents deeper debt due to unexpected expenses.

Summary

Mastering the relationship between debt and credit is a cornerstone of financial health. By understanding how credit utilization, payment history, and different types of debt affect your credit score, you can make informed decisions to improve your financial standing. Implementing strategies for on-time payments, managing credit utilization, and using credit monitoring services can significantly enhance your credit profile.

Taking control of your financial future requires diligence and a proactive approach. By following the tips and strategies outlined in this guide, you can improve your credit score, secure better loan rates, and achieve your financial goals. Remember, it’s never too late to start building a healthier financial future.

Frequently Asked Questions

How can I effectively manage my credit utilization ratio?

To effectively manage your credit utilization ratio, pay down your revolving credit balances in full each month and consider requesting increases to your credit limits, aiming to maintain your utilization below 30%. This practice will help bolster your credit health.

What is the most crucial factor in my credit score?

Payment history is the most crucial factor in your credit score, comprising at least 35% of it in most models. Ensuring timely payments will significantly enhance your credit standing.

How do high credit card balances affect my credit score?

High credit card balances can negatively impact your credit score by increasing your credit utilization ratio, which may lead to higher interest rates on loans and credit cards. It's essential to manage your balances effectively to maintain a healthy credit profile.

What are the benefits of using credit monitoring services?

Using credit monitoring services allows you to receive real-time updates on changes to your credit report and alerts for potential fraud, helping you proactively manage your credit health. This heightened awareness can protect you from identity theft and assist in making informed financial decisions.

How can I dispute inaccurate information on my credit report?

To dispute inaccurate information on your credit report, send a dispute letter with supporting documents to both the credit reporting agency and the creditor that provided the incorrect data. Taking these steps will help you rectify the errors effectively.