Top Tips to Rebuild Credit After Defaulting on Loans

Defaulting on a loan hurts your credit score, but you can rebuild credit after defaulting on loans. This article offers practical steps to improve your credit, including assessing your credit, resolving default status, and using credit-building tools.

Key Takeaways

Understanding the long-term impact of loan defaults on credit scores is crucial for developing an effective rebuilding strategy.

Regularly reviewing and correcting credit reports, evaluating outstanding debts, and creating a practical repayment budget are essential steps to improve credit health.

Using secured credit cards and credit-builder loans, while maintaining low credit utilization, helps re-establish positive credit history and improve overall credit scores.

Understand the Impact of Loan Default

Defaulting on a loan is like setting off a chain reaction that can significantly alter your financial landscape. When you miss payments for an extended period, typically around 90 days, your loan enters default status. This not only plummets your credit score but can also remain on your credit report for up to seven years, drastically affecting your ability to secure new loans or even employment opportunities.

The negative impact of a loan default doesn’t stop there. Higher interest rates and stricter terms become the norm when trying to obtain new credit. Understanding the full extent of how defaulting on loans affects your financial opportunities underscores the importance of maintaining a positive payment history.

Grasping these consequences allows you to better appreciate the steps needed to rebuild your credit.

Assess Your Current Credit Situation

Before you can rebuild your credit, you need to know where you stand. Reviewing your credit reports and understanding your credit profile post-default is crucial for pinpointing areas that need improvement and making informed financial decisions moving forward.

Begin by obtaining your free credit report from each of the three major credit bureaus. You can receive these reports from Equifax, Experian, and TransUnion once every 12 months. Reviewing these reports helps you identify inaccuracies and understand your credit history, enabling you to take targeted actions to rebuild your credit.

Check Your Credit Report for Errors

A critical step in rebuilding credit is ensuring that your credit reports are accurate. Errors in your credit report, such as incorrect balances or late payments, can negatively affect your credit score. Regularly checking your credit report can help you spot and dispute these inaccuracies.

If you discover any errors, be sure to address them. You can file a dispute with the credit bureaus. Include your personal information and a clear explanation of the discrepancy. Credit reporting companies are required to investigate disputes unless they consider them frivolous.

Correcting these errors can significantly improve your credit score and set a solid foundation for rebuilding your credit.

Evaluate Outstanding Debts

After ensuring your credit reports are accurate, the next step is to evaluate your outstanding debts. Prioritize your debts based on their interest rates; tackling high-interest debts first can save you money in the long run. This strategic approach helps in managing repayment effectively.

Consider seeking help from a credit counseling agency, which can provide free guidance and recommend a debt management plan. Typically, these plans last three to five years, helping you systematically pay off your debts.

Understanding and prioritizing your debts helps you set realistic goals and make consistent progress towards rebuilding your credit.

Create a Practical Budget for Repayment

A practical budget helps manage financial commitments and allocate funds for debt repayment. A realistic budget helps allocate resources effectively, ensuring that you can meet your debt obligations while covering essential living expenses.

One effective strategy is the 50/30/20 budgeting rule, which divides your income into three segments: 50% for essentials, 30% for discretionary spending, and 20% for savings and debt repayment. Allocating funds regularly for debt repayment maintains a steady payment schedule and can significantly improve your credit score over time.

Track Monthly Payments

Tracking monthly payments helps avoid missed deadlines and maintain a positive payment history. Consistent monitoring of on time payments prevents late fees and contributes to a favorable repayment record.

Utilize payment tracking tools or systems to ensure that deadlines are met. Setting up autopay or reminders can also help prevent missed payments, thereby avoiding potential negative impacts on your credit. This disciplined approach to managing payments is fundamental in rebuilding your credit.

Limit Discretionary Spending

Limiting discretionary spending is a vital part of a realistic budget. Identifying and cutting back on non-essential expenses can significantly increase the funds available for debt repayment. Analyzing your spending habits helps curb unnecessary expenses and direct more funds towards debt management.

Cutting back on discretionary spending aids in debt management and improves overall financial well-being. By practicing disciplined financial habits, you can create a more manageable budget that supports your goal of rebuilding credit.

Explore Options to Resolve Default Status

Resolving your loan’s default status is a critical step in rebuilding credit. When you default on a loan, you will be sent to collections and notified by mail. This status can remain on your credit report for seven years, negatively affecting your credit score.

Contact your lender to discuss options for resolving the default status, such as arranging payments or negotiating to settle the debt. Exploring these options helps you take actionable steps towards improving your financial situation.

Federal Student Loans

For federal student loans, loan rehabilitation is a viable option. This process involves agreeing to make nine monthly payments within ten consecutive months to remove the default status from your credit history. Timely payments through rehabilitation can significantly improve your credit score.

Another option is consolidating your federal student loans into a direct consolidation loan, which combines multiple federal loans into a new loan. This can potentially lower your payments or grant access to forgiveness programs. These strategies provide a structured path to managing and improving your credit situation.

Private Student Loans

Managing private student loans post-default can be challenging due to the lack of standardized options. Refinancing these loans may lower interest rates and monthly payments, making repayment more manageable.

Private lenders may offer options such as loan negotiation or alternative repayment plans. Involving a co-signer can also help secure more favorable loan terms. Exploring these options is crucial to finding a manageable repayment plan and improving your financial situation.

Personal Loans

For personal loans, negotiating with lenders can lead to settlements where you pay less than the total owed, often involving a one-time payment to resolve outstanding dues. Such settlements can significantly reduce financial burdens and aid in restoring your credit health.

Credit counselors can provide valuable support and guidance during negotiations, helping you achieve better outcomes and create a plan to rebuild your credit.

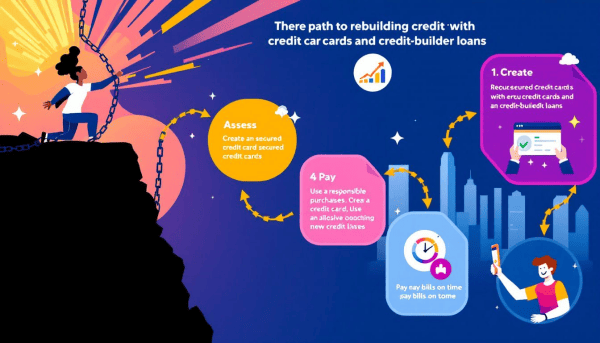

Rebuild Credit with Secured Credit Cards and Credit-Builder Loans

Secured credit cards and credit-builder loans are effective tools for rebuilding credit, adding positive elements to overshadow negative history on your credit report. Secured credit cards can be particularly beneficial for those with fair or bad credit.

A secured credit card requires a deposit as collateral equal to your credit limit. Consistent use and timely payments can improve your credit score. Similarly, credit-builder loans are designed specifically to help individuals improve their credit scores through regular payments.

Benefits of Secured Credit Cards

A secured credit card involves a fixed deposit as collateral, which lenders use instead of considering your credit score. Unlike traditional credit cards, responsible use of secured credit cards helps establish good credit habits and leads to long-term benefits.

Look for secured credit cards with no annual fee and additional rewards or benefits. By making timely payments, you can enhance your credit score and rebuild your credit profile effectively.

Using Credit-Builder Loans

Credit-builder loans are designed to aid individuals in improving their credit scores by reporting consistent repayment activity to credit agencies. These loans provide a structured way to demonstrate responsible financial behavior.

Regular payments on a credit-builder loan can positively change your credit rating over time. This approach helps in establishing a solid credit history and improving your overall credit profile.

Maintain Low Credit Utilization Ratio

A low credit utilization ratio is key to positively influencing your credit scores. Ideally, your credit utilization should be kept under 30%. This means using no more than 30% of your available credit at any given time.

To achieve this, consider making more frequent payments on your credit cards to keep your balances low. You can also request an increase in your credit limit or distribute large purchases across multiple credit cards to maintain a lower utilization ratio.

Become an Authorized User on a Good Account

Becoming an authorized user on a good account can significantly enhance your credit history. This involves adding the account’s entire history to your credit reports, which can help boost your credit score.

Make sure the primary account holder has good credit habits, as their behavior will directly impact your credit score. Be careful when it comes to purchasing tradelines. It’s best to avoid buying them from strangers. This approach can enhance your credit profile without obligating you to make payments on the account.

Avoid Multiple Credit Inquiries

Applying for many loans at once can lead to multiple hard inquiries, which may negatively impact your credit score. One hard inquiry usually has a minimal effect, but several inquiries in a short period can significantly lower your credit score.

Credit scoring models consider multiple inquiries for the same type of loan within a specific period as a single inquiry. Apply for new credit selectively to prevent a potential drop in your credit score.

Pay All Bills on Time

Your payment history is the most significant factor in determining your credit score and plays a crucial role in how your creditworthiness is assessed. Late payments can lead to penalties, legal fees, and other charges, further damaging your financial situation.

Setting up autopay or reminders can help avoid late payments and ensure bills are paid on time. Using secured credit cards responsibly by paying bills on time can significantly improve your credit score. If behind on payments, get caught up as quickly as possible to mitigate damage to your credit score.

Monitor Your Credit Regularly

Regularly monitoring your credit is crucial for tracking progress and ensuring that your credit rebuilding efforts are on the right path. Regular monitoring helps catch errors on your credit report and spot issues early, which can hinder your credit rebuilding efforts.

Services like Experian provide access to credit reports and FICO scores, making it easier to keep an eye on your credit health. Keeping tabs on your credit report regularly allows you to address discrepancies promptly and make informed decisions to improve your credit score.

Summary

Rebuilding credit after a loan default is a challenging but achievable goal. By understanding the impact of loan defaults, assessing your credit situation, creating a practical budget, and exploring options to resolve default status, you can set a strong foundation for financial recovery. Utilizing tools like secured credit cards and credit-builder loans, maintaining a low credit utilization ratio, and becoming an authorized user on a good account can further enhance your credit profile.

Remember, paying all bills on time and monitoring your credit regularly are essential habits for maintaining and improving your credit score. Rebuilding credit is a gradual process, but with consistent effort and disciplined financial habits, you can achieve good credit and unlock better financial opportunities. Take these steps seriously and watch your credit score climb, opening doors to a brighter financial future.

Frequently Asked Questions

How long does a loan default remain on my credit report?

A loan default can remain on your credit report for up to seven years, significantly impacting your credit score and financial options during that time.

What is the best way to check my credit report for errors?

The best way to check your credit report for errors is to obtain your free report from Equifax, Experian, and TransUnion annually. Carefully review it for inaccuracies like incorrect balances or late payments, and promptly file a dispute if needed.

How can I effectively manage my outstanding debts?

To effectively manage your outstanding debts, prioritize them by interest rates, focusing on high-interest debts first. Additionally, consider consulting a credit counseling agency for guidance on a debt management plan.

What are secured credit cards, and how do they help rebuild credit?

Secured credit cards are backed by a cash deposit that acts as collateral, typically matching your credit limit. By using them responsibly and making timely payments, you can effectively rebuild your credit score and establish positive credit habits.

Why is it important to monitor my credit regularly?

Monitoring your credit regularly is essential as it allows you to track your progress, identify errors promptly, and make informed decisions to enhance your credit score. Utilizing services like Experian can aid in accessing your credit reports and FICO scores effectively.