How to Apply for a Credit Card First Time: Essential Tips

Applying for a credit card for the first time doesn’t have to be confusing. This guide will help you through the process step-by-step, including how to apply for a credit card first time. Learn about evaluating your finances, understanding credit card basics, and choosing the right card for you.

Key Takeaways

Assess your financial readiness by evaluating age, income, and budgeting skills before applying for a credit card.

Understand credit card basics, including fees, interest rates, and payment responsibilities to manage credit effectively.

Research different types of credit cards, such as student and secured cards, and compare offers to find one that aligns with your financial situation.

Assess Your Financial Readiness

Before entering the world of credit cards, evaluate your financial readiness. This step confirms your ability to handle the responsibilities of owning a credit card. Key factors to consider include your age, income, and budgeting skills. If you’ve successfully managed your budget and savings for at least six months, you might be ready to take on the responsibility of a credit card.

Financial preparedness also entails managing your finances responsibly. This includes making on-time payments and not overspending. A good grasp of personal finance moves you closer to applying for your first credit card.

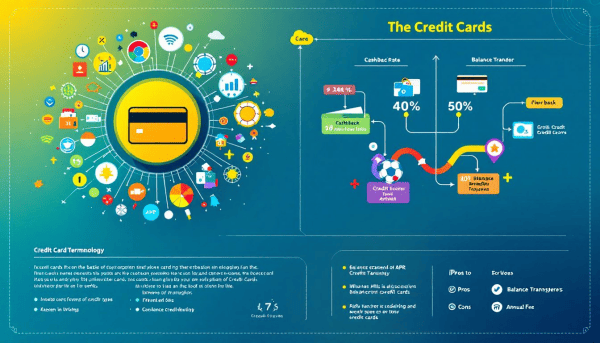

Understand Credit Card Basics

Before applying, grasp the basics of credit cards. Credit cards come with various terms and conditions, including interest rates, rewards, and fees. The average credit card APR, for instance, was reported to be 24.74% as of September 2024. Interest is charged based on the APR, which can be either fixed or variable. Higher credit scores typically result in better interest rates, so maintaining a good score is important.

Avoid interest charges by paying your total balance before the due date each month. Paying only the minimum amount will still incur interest on the remaining balance. Understanding these terms helps you manage your credit card responsibly and avoid unnecessary debt.

Reviewing credit card terms, including fees and interest rates, promotes responsible usage. Credit card companies often have multiple interest rates for different types of transactions, such as purchases versus cash advances. Awareness of these details helps you use your credit card wisely and avoid pitfalls with your credit card company.

Research Different Types of Credit Cards

When choosing your first credit card, research the different types available. Various options are suitable for first-time applicants, including student credit cards and secured credit cards.

Knowing these types aids in selecting the right card and managing your credit responsibly.

Student Credit Cards

Student credit cards are designed specifically for individuals with limited credit history. These cards frequently offer rewards related to entertainment and streaming. Additionally, they may include benefits for meal delivery and travel. When applying, students over 21 can even include their spouse’s income to strengthen their application. To open a student credit card, you’ll need to provide your college name, state, city, and proof of enrollment.

An example of a cash-back rewards credit card is the Wells Fargo Active Cash® Card, which offers benefits that can be particularly appealing to students. On-time payments and responsible card use help students build a positive credit history.

Secured Credit Cards

Secured credit cards are another excellent option for first-time applicants, especially those with no or low credit scores. These cards require a security deposit as collateral, which typically equals your credit limit. The purpose of secured credit cards is to help individuals build their credit history.

To open a secured credit card, you’ll need to put down a security deposit, usually around $200. Responsible usage can lead to lenders refunding your security deposit and upgrading your card. Credit card companies report your activity to credit bureaus, helping you build a positive credit history.

The Discover it Secured Credit Card is a popular option for those looking to build their credit responsibly, especially when offered by a credit card issuer.

Compare Credit Card Offers

Once you understand the types of credit cards available, the next step is to compare different offers. Look for cards with lower fees and flexible payment options. Many credit cards for beginners offer rewards like cash back or points for purchases.

Comparison tools like Bankrate’s CardMatchTM assist in finding the right credit card based on your spending habits and preferences. These tools allow you to evaluate multiple cards simultaneously, making it easier to choose the best offer.

Ensure the card you select aligns with your current credit score to boost approval chances.

Check Your Credit Score and Report

Check your credit score and credit reports before applying for a credit card. This will help you understand your financial standing. Building good credit is crucial as it impacts your ability to obtain credit cards and loans. You can check your credit report for free at AnnualCreditReport.com, and it’s also important to consider the information from the three major credit bureaus.

Errors on your credit report can hinder your credit card application process, so it’s important to correct any inaccuracies. An accurate credit report smooths the application process and boosts approval chances.

Apply for Pre-Approval

Pre-approval gives you an idea of which credit cards you might be accepted for without affecting your credit score. The pre-approval process typically requires basic information such as your name, address, and income. Results are usually available within about 90 seconds.

Soft inquiries used in pre-approval checks do not negatively impact your credit score. If pre-approved for a card, you can directly accept the offer, streamlining the application process.

Submit Your Application

Once you’ve chosen the right credit card, it’s time to submit your application. Choosing credit cards that match your credit score improves your chances of approval. You can apply online or by mailing an application.

Credit card issuers typically require information about your credit history and income before approving an application. They may also ask for details about your housing expenses to estimate overall financial stability. Having a co-signer can significantly improve your chances of getting approved.

What to Expect After Applying

After submitting your application, the approval process can happen almost instantly, especially when applying online. By law, credit card issuers must notify you of your approval or denial status within 30 days. Once approved, you can expect to receive your physical credit card within one to two weeks, though some issuers provide immediate access to a virtual card number.

First-time credit card applicants typically receive a lower initial credit limit, which commonly ranges from $500 to $1,000. This cautious credit line is designed to help you build credit and establish responsible habits. To increase your credit limit over time, make on-time payments and consider requesting increases.

If denied, you will receive a notice explaining the reasons along with your credit score. Denial factors may include insufficient proof of being a good borrower.

Tips for Using Your First Credit Card Responsibly

Responsible use of your first credit card is crucial for building a positive credit history. Timely payments are essential, as your payment history significantly impacts your credit score. Automatic payments help ensure you never miss a due date.

Pay off your account in full each month to avoid interest charges. If unable to pay in full, pay as much as possible and make at least the minimum payment by the due date. Keeping your credit utilization low, ideally under 30%, positively affects your credit score.

Only charge what you can afford to pay off to avoid overspending. A low credit utilization rate can boost your credit score and lead to financial stability. Remember, carrying a balance on your credit card can lead to expensive interest payments, so use your card wisely like cash to avoid excessive debt.

Alternatives to Getting Your First Credit Card

If you’re not ready to get your own credit card, consider becoming an authorized user on someone else’s credit card account. This lets you benefit from the primary cardholder’s credit history and creditworthiness if they make on-time payments.

However, there are risks involved. If the primary cardholder misses payments, it could negatively affect your credit score. Despite the risks, being an authorized user can be a valuable step in building your credit history without the full responsibility of managing your own card.

Summary

Applying for your first credit card is a significant step towards financial independence. By assessing your financial readiness, understanding credit card basics, researching different types of cards, and comparing offers, you can make an informed decision. Checking your credit score and applying for pre-approval can further streamline the process.

Once you have your first card, using it responsibly and exploring alternatives like becoming an authorized user can help build a strong credit history. Remember, the goal is not just to get a credit card, but to use it as a tool for financial growth and stability.

Frequently Asked Questions

What factors should I consider to determine my financial readiness for a credit card?

To determine your financial readiness for a credit card, consider your age, income, and budgeting skills. Effective budget management and having savings to cover at least six months of expenses are critical indicators of readiness.

How can I avoid interest charges on my credit card?

To avoid interest charges on your credit card, ensure you pay your total balance before the due date each month. Paying only the minimum amount will result in interest on the remaining balance.

What are the benefits of student credit cards?

Student credit cards provide the dual benefit of building a credit history while offering rewards for everyday expenses such as entertainment and dining. This can be a valuable financial stepping stone for young adults.

What is a secured credit card and how does it work?

A secured credit card is a type of credit card that requires a security deposit to serve as collateral, typically matching your credit limit. This arrangement allows individuals with no or low credit scores to establish or improve their credit history.

What should I do if my credit card application is denied?

If your credit card application is denied, review the notice provided to understand the reasons and your credit score. Taking steps to address the factors that led to the denial, such as correcting errors on your credit report, can enhance your chances for future applications.