Best Credit Cards to Rebuild Bad Credit in 2024

Trying to rebuild bad credit? Here are the best credit cards to rebuild bad credit to help you improve your score in 2024. We’ll explain your options and what to consider when choosing a card.

Key Takeaways

Secured and unsecured credit cards are key options for rebuilding credit, each with unique features, benefits, and drawbacks.

Responsible use of credit cards, such as making on-time payments and maintaining low credit utilization, is essential for improving credit scores.

Alternatives to credit cards, like credit-builder loans and being an authorized user, can also effectively contribute to a positive credit profile.

Understanding Credit Cards for Bad Credit

Credit cards for bad credit help individuals improve their credit over time by providing a pathway to establish a solid credit history, leading to better financial opportunities. Not all credit cards for bad credit are prohibitively expensive; various options cater to different financial needs and goals.

Credit cards for bad credit fall into two main categories: secured and unsecured. Each has distinct features, benefits, and drawbacks, making it important to understand these differences when selecting the right card to rebuild your credit.

Secured Credit Cards

Secured credit cards require a refundable security deposit, which acts as collateral and typically matches your credit limit. This deposit reduces the risk for the credit card issuer, making it easier for individuals with poor credit scores to get approved. The minimum deposit is often around $200, but some cards offer flexible deposit requirements.

Responsible use of a secured credit card can lead to significant benefits. Many secured cards report your payment activity to all three major credit bureaus, helping build a positive credit history. Over time, this can result in qualifying for an unsecured credit card with more favorable terms and higher credit limits.

Unsecured Credit Cards

Unsecured credit cards do not require a security deposit, making them convenient for those without deposit funds. However, this often comes with higher APRs and annual fees. Applicants should be cautious and read the terms carefully to avoid excessive fees.

Despite higher costs, unsecured credit cards can still help rebuild credit if used responsibly. They offer the chance to establish a positive payment history without an upfront deposit, but it’s important to choose a card with reasonable terms and fees.

How to Choose the Right Credit Card for Rebuilding Credit

Choosing the right credit card for rebuilding credit is crucial. Select a card that aligns with your financial goals by considering fees, interest rates, credit limits, and additional benefits.

Various credit cards are available for individuals with bad credit, including secured and unsecured options. Each type has unique features and costs, so compare your options carefully to choose a card that aids in rebuilding credit and fits your financial situation.

Assessing Fees and Interest Rates

Individuals with bad credit often face higher fees and interest rates on credit cards, so choose wisely. Common fees include annual, monthly maintenance, and activation fees. Look for cards with low or no annual fees and reasonable interest rates.

Pay close attention to the APR, annual fees, and clauses about changes to account terms. Avoid cards with excessive fees, as they can increase the overall cost of borrowing.

Instead, opt for cards that offer a balance between affordability and benefits.

Considering Credit Limit Increases

Increasing your credit limit can positively impact your credit score by lowering your credit utilization ratio. Many secured credit cards conduct automatic reviews every six months for credit limit increases, gradually increasing your available credit and benefiting your credit profile.

As your credit score improves, consider upgrading to an unsecured card from the same issuer to preserve your credit history and potentially refund your security deposit.

Always aim for cards that offer the possibility of high credit limit increases as part of their terms.

Reviewing Rewards and Benefits

While rebuilding credit is the primary goal, some credit cards offer additional perks like cash back, travel rewards, or no foreign transaction fees, enhancing the card’s overall value and making spending more rewarding.

Choosing a card with cash back rewards can provide additional value as you rebuild your credit. Consider cards offering customized cash rewards or perks that align with your spending habits, making the process more enjoyable and financially beneficial.

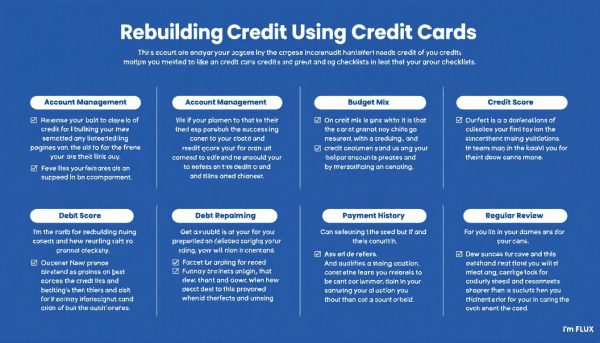

Best Practices for Using Credit Cards to Rebuild Credit

Using a credit card correctly can strengthen your credit history over time. Demonstrate responsible use by making timely payments, keeping credit utilization low, and regularly monitoring your credit report to improve your credit score and show lenders you can manage credit effectively.

Good financial habits and patience are crucial for improving your credit score, especially for those with bad credit. Following best practices can gradually rebuild your credit and open the door to better financial opportunities.

Making On-Time Payments

Payment history significantly impacts your credit score, making timely payments crucial. Missing a payment can incur fees and raise interest rates. Setting up automatic payments or reminders can ensure timely payments.

Pay your balance in full by the due date to avoid accruing interest. Timely payments demonstrate responsible use and can improve your credit.

Consistently making on-time payments is one of the best ways to establish credit and build a positive credit history.

Keeping Credit Utilization Low

Credit utilization, the percentage of your credit limit used, is critical for determining your credit score. Maintaining a ratio below 30% is crucial for protecting your credit scores, with a target of below 10% for optimal scores.

Increasing your credit limit can positively impact your credit score by reducing your credit utilization ratio. Low balances on credit cards help improve this ratio, maintaining or boosting your credit scores. Always aim to stay well below your credit limit.

Regularly Monitoring Your Credit Report

Regularly checking your credit report helps catch errors and ensure accuracy. You are entitled to a free credit report once a year, allowing you to stay informed about your credit status and take corrective actions if necessary.

Top Credit Cards to Rebuild Bad Credit in 2024

Selecting the right credit card is crucial for rebuilding credit. Secured cards are often the best option for bad credit, though unsecured cards also offer opportunities for credit improvement without a security deposit.

In 2024, several top picks for both secured and unsecured credit cards can help rebuild your credit. These cards offer various features and benefits, suitable for different financial needs and goals. Evaluating these options can help you choose the best card for your situation.

Best Secured Credit Cards

Secured credit cards typically report to the three major credit bureaus and may offer automatic reviews every six months. Some allow for a low security deposit of as little as $49, making them accessible. These cards help build a positive credit history through responsible use.

After improving your credit with a secured card, you can upgrade to another card, keep the existing card while applying for a new one, or close the card. The goal is to use the secured card as a stepping stone to better credit terms and higher limits.

Best Unsecured Credit Cards

Unsecured credit cards for bad credit do not require a security deposit. Notably, some don’t require a Social Security number or credit check, making them accessible for those without deposit funds or preferring to avoid a credit check.

While unsecured credit cards can help rebuild credit through responsible use, they often come with higher fees and interest rates. Consider these costs and choose a card with reasonable terms to help improve your credit score.

Alternatives to Credit Cards for Rebuilding Credit

Credit cards are not the only option for rebuilding credit. Alternatives like credit builder loans and becoming an authorized user on another’s card can also help improve your credit profile.

Regular payments for rent, utilities, cellphones, and streaming services can also contribute to building credit. Exploring these alternatives provides additional tools to enhance your credit score.

Credit Builder Loans

Credit-builder loans are designed to help build credit by allowing you to borrow a small amount, held in a bank account while you make regular payments.

Each payment is reported to the major credit bureaus, helping establish a positive credit history and ensuring accurate credit reports.

Authorized User Status

Being added as an authorized user on a credit card can enhance your credit score based on the account’s payment history. You can get your own card without applying, typically with no credit check.

However, both the authorized user and primary cardholder must use the card responsibly to avoid negative credit impacts on the authorized user.

Common Pitfalls to Avoid When Rebuilding Credit

Rebuilding credit requires careful management and awareness of potential pitfalls. Overusing credit cards, missing payments, and applying for too many cards in a short timeframe are common mistakes that can hinder your progress. Understanding and avoiding these pitfalls ensures a smoother credit rebuilding journey.

By being mindful of these common errors, you can take proactive steps to maintain a positive credit profile and improve your scores over time. Here are some pitfalls and tips to navigate around them.

Overusing Credit Cards

Using nearly all of your available credit can reflect poorly on your credit utilization ratio, leading to a lower score. A high ratio signals to lenders that you are over-relying on credit, making it more difficult to obtain favorable terms in the future.

To avoid this, aim to keep your credit utilization ratio low by not maxing out your cards and maintaining a healthy balance between your credit limit and spending. This practice will help build a solid credit history and improve your scores over time.

Missing Payments

Missing a credit card payment can have severe consequences, including fees and losing promotional interest rates. A late payment can stay on your credit report for up to seven years, significantly impacting your score and making it harder to secure favorable terms on future accounts.

To avoid missing payments, set up automatic payments or reminders to ensure timely payments. Paying more than the minimum balance can reduce interest costs and demonstrate responsible credit management.

Applying for Too Many Cards

Submitting multiple credit card applications in a short timeframe can lead to a decline in your credit score due to hard inquiries. Lenders may view excessive applications as a sign of financial distress, which can decrease their willingness to lend.

It’s advisable to limit the number of credit cards you apply for to maintain a manageable credit profile and ensure timely payments. Before applying for a new card, consider your current financial situation and ensure that you can handle the responsibility of additional credit.

This careful approach will help you avoid unnecessary hits to your credit score and maintain a healthy credit profile.

Summary

Rebuilding bad credit is a journey that requires patience, diligence, and the right tools. By understanding the different types of credit cards available for bad credit, choosing the right one, and using it responsibly, you can gradually improve your credit scores. Remember, making on-time payments, keeping your credit utilization low, and regularly monitoring your credit report are key practices that will aid in this process.

Whether you opt for a secured or unsecured credit card, or even explore alternatives like credit builder loans and authorized user status, the goal remains the same: to build a solid credit history and open the door to better financial opportunities. Stay committed to your credit journey, avoid common pitfalls, and you’ll be well on your way to a healthier financial future.

Frequently Asked Questions

What is the difference between secured and unsecured credit cards?

The key difference between secured and unsecured credit cards is that secured cards require a refundable security deposit, whereas unsecured cards do not but may have higher fees and interest rates. Choosing the right type depends on your financial situation and credit needs.

How can I choose the best credit card to rebuild my credit?

To choose the best credit card for rebuilding your credit, focus on factors such as fees, interest rates, potential for credit limit increases, and any rewards offered. Ensure the card aligns with your financial goals for optimal benefits.

Why is making on-time payments so important?

Making on-time payments is crucial because they directly impact your credit score and help establish a positive credit history. This can lead to better loan terms and financial opportunities in the future.

What are some alternatives to using credit cards for rebuilding credit?

To rebuild credit, consider using credit builder loans or becoming an authorized user on a trusted individual's credit card. These alternatives can effectively enhance your credit profile without relying solely on credit cards.

What common mistakes should I avoid when trying to rebuild my credit?

To effectively rebuild your credit, refrain from overusing credit cards, missing payments, and applying for multiple cards within a short span. These mistakes can significantly hinder your efforts.