Does a Debt Management Plan Hurt Your Credit? Here's What You Need to Know

Wondering if a debt management plan hurts your credit? This article breaks down how a DMP impacts your credit score immediately and in the long run, specifically addressing the question: does a debt management plan hurt your credit?

Key Takeaways

Enrolling in a Debt Management Plan (DMP) may initially decrease your credit score due to closed credit accounts and increased credit utilization, but proactive enrollment can mitigate negative impacts.

Long-term, consistent payments in a DMP can improve your credit score by establishing a positive payment history and re-aging accounts to current status after completion.

A DMP will be noted on your credit report, which can affect future borrowing opportunities and lender perceptions, though it does not directly lower your FICO Score.

Immediate Impact on Credit Scores

When you first enroll in a debt management plan, the immediate impact on your credit score can be unsettling. One of the first things that might happen is an initial dip in your credit score. This dip occurs because creditors often close your credit card accounts, which reduces your available credit and increases your credit utilization ratio. This change can make it seem like you’re using a larger portion of your available credit, which is viewed negatively by credit scoring models. Understanding how a debt management plan affect your credit score is crucial for managing your financial health.

However, not all hope is lost. If you enroll in a DMP before missing payments, you can mitigate some of this initial impact. Acting proactively helps you avoid the severe penalties linked with missed or late payments, which can severely impact your credit score.

While the initial dip can be disheartening, remember this is just the start of your financial recovery journey. Managing your debt responsibly now lays the foundation for improved credit and financial health in the future.

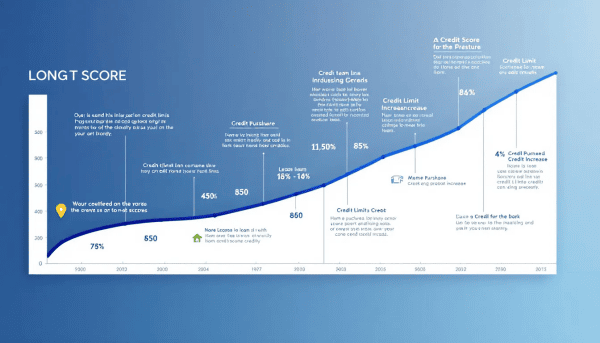

Long-Term Effects on Credit Scores

The immediate impact of a DMP can be daunting, but the long-term effects are often more positive. Consistent, on-time payments through a DMP can lead to significant improvements in your credit score over time. This is because creditors often report your accounts as current, which helps to build a positive payment history.

Completing a DMP can establish a track record of responsible financial behavior. As you consistently make payments and manage your debt effectively, your credit history reflects this positive behavior. Over time, this can enhance your credit score and improve your credit file, making you a more attractive candidate for future credit opportunities.

Successfully completing a DMP usually means your accounts are paid in full. This full repayment is a significant mark of financial responsibility, which can further bolster your credit health. Though it takes time and dedication, the long-term benefits of a DMP often outweigh the initial setbacks.

How Payment History is Affected

Your payment history is a critical component of your credit score, and a DMP can have a profound impact on it. By joining a DMP, you commit to making more manageable payments, which can help restore a positive payment history. This is crucial because a consistent history of on-time payments is one of the most significant factors in determining your credit score.

Creditors might also re-age your accounts, changing the status from overdue to current. This change can enhance your credit score by removing the negative mark of missed payments from your credit report. This gives you a clean slate to start rebuilding your credit.

However, while the notation of being in a DMP may not directly impact your FICO Score, it can influence credit decisions by lenders. Lenders may view this notation as a sign that you required assistance to manage your debt, which could affect their trust in your financial stability.

Changes in Credit Utilization Ratio

A key factor in your credit score is your credit utilization ratio, which measures the amount of credit you are using relative to your total available credit. Entering a DMP might cause some creditors to close your current credit card accounts. This can impact your overall credit situation. This action reduces your total available credit and can temporarily increase your credit utilization ratio.

As you make consistent payments and reduce your credit card balances through the DMP, your credit utilization ratio will improve. A lower credit utilization ratio benefits your credit score as it shows you are not heavily reliant on credit.

In the long run, consistent debt payments can stabilize and eventually enhance your credit score despite the initial negative impacts on your credit utilization. As your debts decrease, your credit profile gradually becomes healthier.

Credit Report Notations and Their Implications

Enrolling in a DMP places a notation indicating your participation on your credit reports. Creditors may annotate your report to show your enrollment in a debt management program. While this notation does not directly lower your credit score, it can have other implications.

The presence of a DMP notation could result in higher interest rates for future loans. Lenders might perceive you as a higher risk because you needed assistance to manage your debts. This perception can also impact your eligibility for loans, making it more challenging to secure favorable terms.

Obtaining a mortgage while enrolled in a DMP can be particularly difficult. While the DMP notation itself isn’t considered negative in the FICO Score calculation, it can affect how future creditors perceive your creditworthiness.

The Role of Credit Counseling Agencies

Credit counseling agencies are pivotal in administering debt management plans. Typically operating as nonprofit entities, these agencies help clients manage their finances and create structured repayment plans. A debt relief company may assist credit counselors in aiming to lower your monthly payments but usually don’t negotiate reductions in the total debt amount.

These agencies offer valuable tools to help you create budgets and set up repayment structures with creditors. They can secure agreements that prevent creditors from pursuing collection actions during your DMP, providing peace of mind as you work towards financial stability.

Choosing a reputable credit counseling agency is crucial. While some services charge fees, many also offer free educational resources to help you manage your debt effectively. Working with a trusted agency can make a significant difference in your financial journey.

Alternatives to Debt Management Plans

If a debt management plan isn’t right for you, consider several alternatives. Debt consolidation can streamline multiple debts into a single payment, potentially lowering your interest costs if you secure a better rate. Home equity products like loans and lines of credit allow you to borrow against your home equity at typically lower interest rates.

Debt settlement might be an option if you’re unable to manage your debt, but it can significantly impact your credit score. Negotiating directly with creditors can also result in lower payments and prevent severe credit damage. Consulting a financial advisor or nonprofit credit counselor can offer personalized advice to manage your debt effectively.

Evaluate all your options and choose the one that aligns best with your financial situation and goals. Each alternative has its pros and cons, and what works for one person might not suit another.

When to Consider a Debt Management Plan

A debt management plan often suits individuals with high credit card debt who struggle with multiple monthly payments. If making regular bill payments or reducing debt balances is challenging, a monthly payment debt management plan hurt might be beneficial.

A DMP also benefits those with high-interest rates on unsecured debts, making them difficult to pay down. If you feel overwhelmed by debt and seek a structured repayment approach, a DMP could be the right choice.

Considering your financial situation and specific challenges will help you determine if a DMP is the best step towards achieving financial stability and peace of mind.

Summary

In conclusion, while a debt management plan can initially hurt your credit score, it offers a pathway to long-term financial health. The immediate dip in your score can be mitigated by enrolling before missing payments, and consistent, on-time payments can improve your credit score over time. Understanding the implications of credit report notations and working with reputable credit counseling agencies can further support your financial recovery.

Ultimately, whether you choose a DMP or an alternative debt relief option, the goal is to regain control of your finances and build a stronger financial future. Take the time to evaluate your options, seek professional advice, and make informed decisions that align with your financial goals.

Frequently Asked Questions

How does enrolling in a debt management plan immediately affect my credit score?

Enrolling in a debt management plan may cause an initial dip in your credit score due to closed accounts and increased credit utilization. To mitigate this impact, it's advisable to enroll before missing any payments.

Will a debt management plan improve my credit score in the long run?

Yes, a debt management plan can improve your credit score in the long run by promoting consistent on-time payments and helping you pay off debts completely. This fosters a positive payment history, which is crucial for your creditworthiness.

How does a DMP affect my payment history?

A DMP can positively impact your payment history by enabling you to make consistent payments, which helps prevent further damage. Additionally, it may lead creditors to re-age your accounts, reflecting them as current.

What are the alternatives to a debt management plan?

You can consider debt consolidation, debt settlement, personal loans, or directly negotiating with creditors as alternatives to a debt management plan. Each option presents different advantages and drawbacks based on your unique financial circumstances.

When should I consider enrolling in a debt management plan?

You should consider enrolling in a debt management plan if you're facing high credit card debt, multiple payments, or dealing with high-interest rates that hinder your ability to make progress on your debts. Taking this step can help simplify your financial situation and improve your chances of becoming debt-free.