The Evolution of Credit Monitoring Tools: Top Innovations Shaping the Future

Credit monitoring tools have evolved to help us better manage credit and detect fraud, showcasing the evolution of credit monitoring tools. This article highlights key milestones and innovations in their development.

Key Takeaways

Credit monitoring has evolved from local merchant practices in the 19th century to a comprehensive system aided by major credit bureaus, which assess credit risk and prevent fraud.

The integration of AI and advanced digital tools in credit monitoring enhances accuracy, personalization, and real-time fraud detection, significantly improving the overall efficiency of risk management.

Regulatory compliance and data privacy remain critical in the credit monitoring sector, with ongoing advancements in technology aimed at building consumer trust and ensuring safe handling of personal data.

The Birth of Credit Monitoring

Credit monitoring originated in the 19th century when local merchants began collecting and sharing financial details about their clientele to assess creditworthiness. This practice marked the beginning of a formal system to monitor and evaluate credit risk. The establishment of the first commercial credit reporting agency in America by Lewis Tappan in 1841 was a significant milestone, setting the stage for modern credit monitoring practices.

Following the Civil War, credit bureaus expanded their focus from businesses to individual consumers, broadening the scope of credit monitoring. In the early 20th century, local credit bureaus began examining consumers’ personal affairs, establishing the foundation for a comprehensive consumer credit surveillance system. This development paralleled the growth of modern capitalism and evolving societal surveillance practices.

Initially, credit reports consisted mainly of negative information and lifestyle data, which raised privacy concerns among consumers regarding their financial profiles. The commodification of personal information in the 19th century transformed individual histories into standardized financial profiles, a trend that continues to influence credit monitoring today.

The Role of Major Credit Bureaus

The emergence of credit reporting agencies in the 19th century played a crucial role in helping lenders assess credit risk by collecting information on borrowers. By the 1960s, the industry had grown significantly, with over 2,000 credit bureaus operating in the U.S. alone. These major credit bureaus have since become central to the credit monitoring ecosystem, providing valuable data that lenders use to make informed credit decisions.

Credit bureaus compile credit reports that include detailed information about an individual’s credit history, payment behavior, and financial obligations. This data is critical for financial institutions to assess credit risk and make lending decisions. The accuracy and comprehensiveness of consumer credit reporting help institutions manage credit risk effectively and ensure the financial health of both lenders and borrowers.

Additionally, major credit bureaus play a significant role in fraud prevention and detection. They monitor credit reports for unusual activities and discrepancies, helping to protect consumers from identity theft and financial fraud. The integration of advanced technologies and data analytics has further enhanced their ability to detect emerging fraud patterns and improve the overall security of the credit monitoring process.

Digital Transformation in Credit Monitoring

Technological advancements in computing and communication during the late 20th century significantly transformed the credit reporting industry. The automation of credit data extraction from over 40 credit agencies and bureaus has streamlined the process, reducing the workload on human analysts by up to 70%. This digital transformation has made credit monitoring more efficient, cost-effective, and accurate.

One of the key innovations in this space is the HighRadius Credit Cloud, which provides a centralized repository for all credit information, improving data accessibility for credit teams. Automated solutions like Cascade Alerts and Cascade VOE further optimize productivity by solving workflow inefficiencies and streamlining operations from start to finish. These tools enable real-time credit risk monitoring, allowing financial institutions to stay on top of risks and manage their credit portfolios more effectively.

Real-time alerts and predictive analytics have become essential components of digital credit monitoring, helping institutions detect potential financial fraud and emerging fraud patterns swiftly. This proactive approach not only enhances credit risk management but also significantly reduces the likelihood of bad debt, ensuring a more secure financial environment for both lenders and borrowers.

AI-Powered Credit Monitoring

Artificial intelligence (AI) is revolutionizing credit monitoring by providing real-time insights, predictive analytics, and personalized recommendations. AI-powered systems enhance the accuracy of credit monitoring, reducing human error by up to 40% and enabling faster, more reliable credit risk assessments. The continuous learning capability of AI allows these systems to adapt to new data inputs, improving their predictive capabilities over time.

Machine learning algorithms play a crucial role in this transformation, enabling faster and more accurate decision-making in credit scoring processes. By analyzing vast amounts of data, AI can identify patterns and trends that human analysts might miss, leading to more objective and consistent credit decisions. This not only improves the overall accuracy of credit monitoring but also helps in predicting potential future risks based on historical data.

The automation of credit risk assessments through AI-driven systems leads to significant improvements in portfolio performance and a reduction in the likelihood of defaults. AI-powered credit monitoring tools offer a proactive approach to managing credit risk by continuously analyzing data and learning from patterns, ensuring better credit health for both consumers and financial institutions.

Real-Time Fraud Detection

AI significantly enhances fraud detection in credit monitoring by detecting anomalies and fraud patterns through real-time analysis. Machine learning algorithms flag transactions as suspicious when they detect unusual spending patterns, such as rapid purchases in different locations or multiple foreign currency transactions. These real-time fraud detection systems continuously learn from user behavior, adapting to new fraud tactics and minimizing false positives.

For instance, if a credit card is used in multiple locations within a short period, AI can instantly freeze the account and notify the cardholder of the suspicious activity. This immediate response is crucial in preventing financial fraud and protecting consumers from potential losses. AI’s ability to analyze transactions in real-time and flag high-risk activities shortly after account creation also helps in identifying and mitigating money laundering risks.

The integration of natural language processing and machine learning algorithms into credit monitoring systems enables more accurate risk assessments and fraud prevention. AI-powered systems offer a robust defense against fraudulent transactions by continuously analyzing transaction data and identifying emerging fraud patterns, ensuring a more secure financial environment for all stakeholders.

Personalized Financial Insights

AI-driven systems offer personalized financial insights by analyzing users’ credit reports, spending patterns, and financial data. These systems provide tailored recommendations for credit improvement based on a detailed analysis of users’ financial situations, helping individuals enhance their credit scores and overall financial health. By identifying patterns in spending habits and credit history, AI can suggest specific actions to improve creditworthiness.

For example, AI models analyze factors such as payment history and debt-to-income ratio to determine credit score, approval decisions, and interest rates. This analysis also helps financial institutions tailor credit offers to individual consumers, enhancing customer satisfaction and loyalty. Personalized recommendations improve through predictive analytics, which are tailored to individual consumer behavior, ensuring that the advice provided is relevant and actionable.

The ultimate goal of personalized financial insights is to empower consumers to make informed decisions about their credit and financial health. Leveraging AI’s capacity to analyze vast amounts of data, these systems help individuals identify financial opportunities and avoid potential risks, resulting in better financial outcomes and increased customer satisfaction.

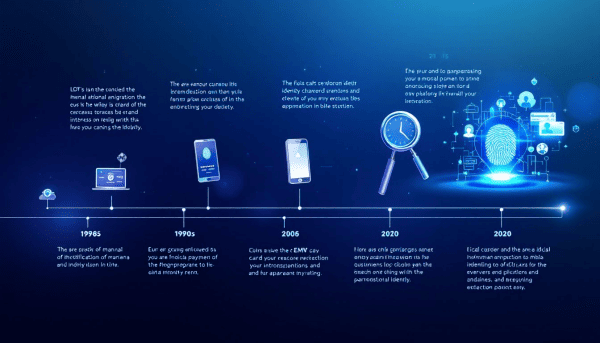

Advancements in Identity Verification

Recent advancements in identity verification technologies have significantly enhanced the security and accuracy of credit monitoring systems. Many countries are launching national eID programs that integrate biometric features, such as fingerprints, to authenticate consumers’ identities. Digital driver’s licenses are also gaining traction, representing a shift towards mobile digital identity solutions.

Blockchain technology is being explored for its potential to facilitate efficient welfare payments and establish self-sovereign identities. In the context of credit monitoring, blockchain provides a secure and transparent platform for sharing financial data, reducing the risk of fraud and identity theft. The combination of biometric authentication and blockchain technology offers a robust solution for preventing identity theft and ensuring the integrity of credit monitoring processes.

These advancements in identity verification not only enhance fraud detection but also contribute to an improved customer experience. Accurate verification and protection of consumers’ identities enable credit monitoring tools to offer more reliable and secure services. This, in turn, helps build trust and confidence among consumers, promoting greater engagement with credit monitoring systems.

Enhanced Customer Experience

Modern credit monitoring tools are designed with the user in mind, offering enhanced customer experiences through user-friendly interfaces and personalized features. Easy navigation within credit monitoring applications reduces frustration and improves user satisfaction, encouraging more frequent and meaningful interactions. Personalized dashboards allow users to quickly access relevant information, making it easier to manage their credit health.

Proactive alerts are another key feature that enhances the customer experience. These alerts inform users about significant changes in their credit status, such as new accounts opened in their name or unusual spending patterns. These alerts help prevent identity theft and fraud by keeping users informed and engaged, providing peace of mind and promoting customer loyalty.

Automated credit management tools streamline the customer onboarding process, significantly decreasing the time taken for credit evaluations. These tools also enhance communication efficiency regarding credit decisions and overdue payments, ensuring that customers receive timely and accurate information. By leveraging predictive analytics and automated workflows, businesses can provide a seamless and satisfying customer experience, fostering long-term loyalty and trust.

Regulatory Compliance and Data Privacy

Regulatory compliance and data privacy are paramount in the credit monitoring industry. The Fair Credit Reporting Act of 1971 was a landmark regulation that enhanced consumer rights and improved the accuracy of credit reporting. Subsequent regulations, such as the California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR), further strengthened consumer protections by granting individuals greater control over their personal data.

Organizations must adhere to strict data minimization principles under GDPR, ensuring that personal data collection is limited to what is necessary for a defined purpose. The principle of ‘Privacy by Design’ emphasizes integrating privacy protection into system design and business practices from the outset, ensuring that consumer data is safeguarded at every stage. Non-compliance with these regulations can result in significant fines, underscoring the importance of adhering to regulatory requirements.

Automated systems play a crucial role in maintaining regulatory compliance by organizing records and improving data security. These systems help organizations manage vast datasets effectively, ensuring that customer data is handled in accordance with legal requirements. Prioritizing data privacy and regulatory compliance allows credit monitoring tools to build trust with consumers and offer a secure environment for managing financial information.

Future Trends in Credit Monitoring Tools

The future of credit monitoring is shaped by continuous advancements in technology and data analytics. The United Nations has initiated discussions on creating a universal digital identity using blockchain and cryptographic technologies, which could revolutionize identity verification and credit monitoring. The integration of blockchain technology into credit monitoring systems promises greater security and transparency, reducing the risk of fraud and identity theft.

The impact of Buy Now Pay Later (BNPL) financing is also expected to influence credit scores and monitoring practices. As BNPL transactions become more prevalent, they will begin affecting borrowers’ credit scores, necessitating updates in credit scoring processes to account for these new financial behaviors. Modern borrowers expect real-time decisions regarding loan applications, driving the demand for faster and more efficient credit monitoring tools.

Advancements in AI and machine learning models continue to enhance predictive analytics and credit risk management. These technologies enable credit monitoring systems to provide more accurate and timely assessments, helping financial institutions make better-informed decisions. The ongoing development of fintech applications and advanced credit scoring algorithms will further revolutionize the credit monitoring landscape, ensuring that it remains adaptable and responsive to emerging financial trends.

Summary

The evolution of credit monitoring tools has been marked by significant innovations, from the early days of local merchants assessing creditworthiness to the advanced AI-powered systems of today. Major credit bureaus and technological advancements have played pivotal roles in shaping the industry, enhancing the accuracy, efficiency, and security of credit monitoring processes. AI-driven tools now offer real-time fraud detection and personalized financial insights, providing consumers and financial institutions with valuable resources to manage credit risk effectively.

As we look to the future, the integration of blockchain technology, advancements in identity verification, and the continuous development of AI and machine learning models promise to further transform credit monitoring. By staying informed about these trends and leveraging the latest tools, individuals and institutions can navigate the financial landscape with greater confidence and security.

Frequently Asked Questions

What is the historical origin of credit monitoring?

Credit monitoring originated in the 19th century, with local merchants sharing financial information to evaluate creditworthiness, leading to the establishment of the first commercial credit reporting agency by Lewis Tappan in 1841. This laid the groundwork for modern credit assessment practices.

How do major credit bureaus contribute to credit monitoring?

Major credit bureaus are vital for credit monitoring as they collect and supply crucial data that lenders rely on to make informed credit decisions. Their involvement enhances credit scoring, aids in fraud prevention, and maintains the financial well-being of all parties involved.

What role does AI play in modern credit monitoring?

AI plays a crucial role in modern credit monitoring by delivering real-time insights and predictive analytics, which significantly improve accuracy and reduce human error. This leads to faster, more reliable credit risk assessments and personalized recommendations for users.

How has digital transformation impacted credit monitoring?

Digital transformation has significantly enhanced credit monitoring by automating data extraction and improving efficiency and accuracy through real-time alerts and predictive analytics. This allows for proactive credit risk management, ultimately benefiting both consumers and financial institutions.

What advancements are being made in identity verification for credit monitoring?

Significant advancements in identity verification for credit monitoring involve the integration of biometric features in national eID programs and the use of blockchain technology for secure data sharing. These innovations notably improve fraud detection and safeguard against identity theft.