Top 7 Benefits of Financial Coaching for Building Credit

Want to boost your credit score? Financial coaching for building credit helps you understand your credit scores, create a credit improvement plan, and monitor your progress. This article explains how coaching can give you the guidance and tools needed to build a better financial future.

Key Takeaways

Understanding credit scores and their components is essential for making informed financial decisions, as they significantly affect borrowing terms and opportunities.

Financial coaching provides personalized strategies and ongoing support, which are crucial for effectively improving credit scores and cultivating healthy financial habits.

Investing in financial coaching can yield substantial long-term savings and better financial opportunities, outweighing the initial costs associated with coaching services.

Understanding Credit Scores

At the heart of financial wellness lies the understanding of credit scores. A credit score is more than just a number; it’s a numerical representation of your creditworthiness, influenced by various financial behaviors and factors. Grasping credit scores is key to making informed decisions regarding borrowing, spending, and managing finances.

Financial literacy includes understanding how credit scores are calculated and what influences them. This knowledge allows you to handle various financial situations confidently, making decisions that enhance your financial education.

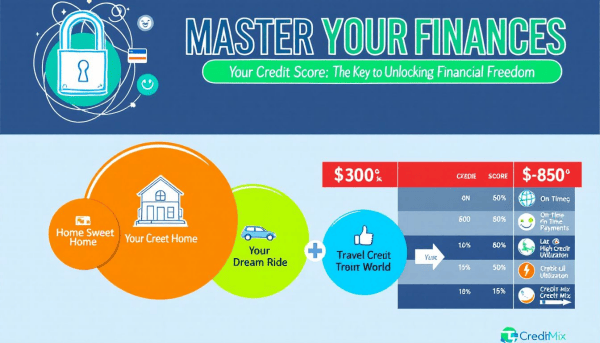

Components of a Credit Score

A credit score is built from several components, each playing a significant role in determining your overall creditworthiness. The most substantial component is payment history, which accounts for 35% of your credit score. This reflects whether you’ve made timely payments on your credit accounts.

Next is the amount owed, which makes up 30% of your score. It indicates the ratio of credit used to credit available, highlighting potential overextension. The length of your credit history contributes 15%, with longer histories generally being more favorable.

The credit mix, representing 10%, evaluates the variety of credit types, like credit cards and loans. Lastly, new credit accounts for 10%, as multiple recent applications can signal risk to lenders. Understanding these components helps in developing better financial habits.

Impact of Credit Scores on Financial Life

Credit scores cast a wide net of influence over various aspects of our lives. For instance, landlords often review credit scores to gauge the reliability of potential tenants. Even employers may check credit scores during the hiring process, especially for positions with financial responsibilities.

Moreover, a higher credit score significantly boosts your chances of loan approval and can secure you lower interest rates on loans and credit cards, leading to substantial savings over time. Therefore, improving your credit score is not just about better borrowing terms; it’s about enhancing your overall financial life and well-being.

Role of Financial Coaching in Building Credit

Financial coaching plays a pivotal role in improving credit scores and overall financial health. Financial coaches are dedicated professionals who assist individuals in enhancing their financial situation and achieving their financial goals. They focus on fostering behavior change and cultivating healthy financial habits, which are essential for long-term financial wellness.

Financial coaches identify areas needing improvement and set realistic goals, offering tailored strategies and actionable advice. This personalized guidance builds confidence and equips clients to navigate their financial journey effectively with the help of financial advisors and a financial advisor.

Personalized Credit Analysis

One of the core functions of financial coaches is to conduct a personalized credit analysis. They meticulously evaluate clients’ credit reports to identify areas that require improvement. This targeted analysis is crucial for enhancing overall credit health, as it allows for tailored strategies that address the unique financial situations of each client.

Developing a Credit Improvement Plan

Developing a credit improvement plan is another critical service provided by financial coaches. These plans are designed with tailored action steps that focus on achieving gradual enhancements in credit scores. Coaches guide clients in structuring a budget that prioritizes debt repayment, often focusing on high-interest debts first to reduce the overall financial burden.

The ongoing support and accountability provided by financial coaching ensure that clients are more likely to adhere to their financial plans and achieve their goals. This personalized and structured approach helps clients navigate complex financial situations with expert advice, significantly improving their financial future.

Monitoring Progress

Regular monitoring of progress is essential in financial coaching. Financial coaches conduct frequent evaluations to help clients stay accountable and allow for strategy adjustments as progress is made. This continuous oversight and the use of advanced tools and resources provided by professional coaches ensure that clients have the clarity and guidance needed to make informed financial decisions.

Strategies for Improving Credit with Financial Coaching

Financial coaching offers various strategies to improve credit scores effectively. Financial coaches educate clients on managing credit cards to avoid overspending and improve credit scores. By teaching clients how to leverage positive credit usage, financial coaches help develop more informed credit habits, leading to significant improvements in credit scores over time.

The tailored strategies provided by financial coaches ensure that clients receive personalized guidance that addresses their unique financial situations. This individualized approach is key to achieving long-term financial success and stability.

Managing Debt Effectively

Managing debt effectively is vital for financial stability and credit score improvement. Coaches assist clients in selecting debt repayment methods like the snowball or avalanche strategies, prioritizing high-interest debts for a structured approach to debt reduction.

By asking financial coaches about their specific strategies, clients can gain insights into effective debt management and improve their money management skills. This tailored approach to managing debt enhances the likelihood of reaching financial goals and achieving a better credit score.

Establishing Positive Credit Habits

Building positive credit habits is essential for improving credit scores and long-term financial health. Financial coaches encourage timely payment of bills, which is a crucial habit for enhancing credit ratings. Setting up automatic payments can ensure bills are paid on time, positively impacting credit scores.

Additionally, maintaining low credit card balances and making consistent on-time payments are critical habits that coaches emphasize for building good credit. These practices help create a solid foundation for long-term financial well-being.

Correcting Errors on Credit Reports

Coaches help clients identify and correct errors on credit reports, which can hinder credit improvement. They guide clients in obtaining reports and spotting discrepancies for timely resolution.

Guiding clients on disputing inaccuracies, financial coaches empower them to correct their credit history proactively, effectively improving credit scores.

Benefits of Improved Credit Scores

A higher credit score unlocks numerous financial opportunities, including better loan terms and lower interest rates, enhancing overall financial well-being. Financial coaching is pivotal for those aiming to boost their credit scores and financial health.

Successful outcome stories often illustrate a coach’s ability to improve clients’ financial situations, showcasing the tangible benefits of improved credit scores.

Lower Interest Rates

One of the most significant benefits of an improved credit score is the ability to qualify for lower interest rates on loans and credit cards. Individuals with superior credit ratings often receive significantly reduced interest rates compared to those with lower scores.

Enhanced credit scores can lead to more favorable loan rates, resulting in lower monthly payments and substantial financial savings over time. This benefit alone underscores the value of investing in financial coaching for credit improvement.

Increased Loan Approval Chances

Improved credit scores substantially boost the odds of being approved for loans. A strong credit score increases the likelihood of loan approvals from lenders, providing greater financial confidence and stability.

Hiring a financial coach can result in long-term savings by improving credit scores and securing lower interest rates on loans. Improved credit scores also increase loan approval chances and lead to more favorable borrowing terms.

Better Financial Opportunities

Better credit scores can secure improved insurance rates and enhance negotiating power in financial dealings.

Investing in improving your credit score yields better financial opportunities, including improved rates in various financial engagements. These opportunities enhance your overall financial well-being and future prospects.

Choosing the Right Financial Coach for Credit Building

Choosing the right financial coach is crucial for effective credit building. Before hiring a financial coach, it is essential to research and ensure the coach meets your needs and budget. Typically, there are no asset requirements for working with financial coaches, making their services accessible to a wide range of clients.

Coaches should clearly communicate their offerings and unique services. This transparency aids clients in making informed decisions and selecting a coach aligned with their financial goals.

Qualifications to Look For

Consider the coach’s qualifications to ensure effective guidance in building credit.

Look for credentials such as Certified Financial Planner (CFP) or Accredited Financial Counselor (AFC), which indicate a qualified certified financial coach.

Questions to Ask Potential Coaches

Asking questions during initial consultations helps ensure the coach is a good fit for your financial needs. Understanding costs associated with hiring a financial coach is crucial to avoid unexpected financial challenges.

Emphasizing transparency in coaching fees is key to building a trusting relationship with your financial coach.

Evaluating Success Stories

Assess a coach’s effectiveness by reviewing testimonials and success stories, ensuring they meet client financial goals.

Selecting a financial coach with proven success stories can lead to better outcomes for clients.

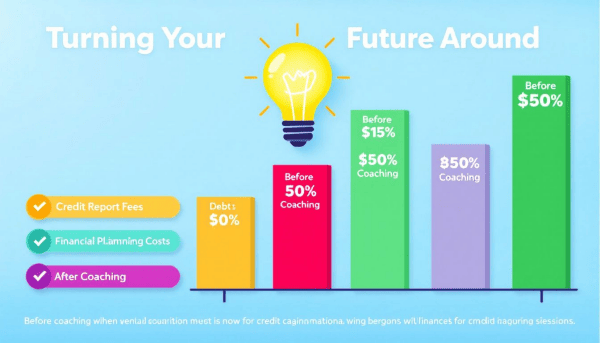

Cost of Financial Coaching for Credit Improvement

The cost of financial coaching for credit improvement can vary significantly based on the coach’s specialization and the services provided. Financial coaching packages can range from several hundred dollars to up to $5,900 annually, depending on the complexity and frequency of the services offered.

Investing in financial coaching can yield significant returns through improved credit scores, leading to financial savings and better financial opportunities. The benefits of financial coaching often outweigh the costs, making it a worthwhile investment for those serious about improving their financial health.

Fee Structures

Financial coaching services typically come with various fee structures, including hourly rates, packages, and ongoing monthly fees. Hourly rates for financial coaching usually range from $100 to $300 or more per hour. Some financial coaching packages can cost thousands of dollars per year, depending on the level of service and expertise provided by the coach.

Factors affecting the financial coach cost of financial coaching include the coach’s experience, level of service, and location. Some coaches may offer a one-time fee for a complete financial plan, generally costing between $1,000 and $3,000.

There are also free coaching services available, such as those provided by Canopy CU.

Value for Money

Improved credit scores often lead to significant financial savings by qualifying individuals for lower interest rates on loans and credit cards. For instance, a higher credit score can decrease monthly mortgage payments and reduce the total amount paid over time due to lower interest rates.

The investment in financial coaching can yield an impressive return through both tangible financial savings and enhanced financial prospects.

DIY vs. Professional Financial Coaching

Choosing between DIY credit improvement efforts and professional financial coaching depends on individual preferences and circumstances. DIY efforts can be overwhelming without the right knowledge and experience, risking mistakes that could further damage credit scores. Professional financial coaching provides personalized strategies and ongoing support to effectively improve credit scores.

While self-help resources offer valuable guidance, the expertise and accountability provided by professional financial coaches are often unmatched. Weighing the benefits of professional guidance against the cost of their services is essential in making an informed decision.

Self-Help Resources

There are numerous resources available for those looking to manage their credit independently. Online platforms offer courses designed to guide individuals through personal finance planning over a structured timeline. Many resources focus on key areas like budgeting, credit improvement, and debt elimination to support self-directed financial management.

Community forums and online platforms provide guidance and tools for managing credit effectively.

Benefits of Professional Guidance

Engaging a financial coach significantly enhances accountability, ensuring clients consistently work towards their financial goals. Professional financial coaches demystify complex financial topics, making them more accessible and easier to understand for clients.

The tailored strategies and expert advice provided by financial coaches make a substantial difference in achieving long-term financial success.

Summary

Financial coaching offers a comprehensive approach to improving credit scores and overall financial health. By understanding the components of credit scores and their impact on financial life, individuals can make informed financial decisions. Financial coaches provide personalized credit analysis, develop actionable improvement plans, and monitor progress, ensuring clients achieve their financial goals.

The benefits of improved credit scores are substantial, including lower interest rates, increased loan approval chances, and better financial opportunities. Choosing the right financial coach involves evaluating qualifications, asking the right questions, and reviewing success stories. Although financial coaching has associated costs, the value for money is evident in the financial savings and enhanced opportunities it brings. Ultimately, whether through DIY efforts or professional guidance, the journey to better credit and financial wellness is within reach.

Frequently Asked Questions

How does financial coaching help improve credit scores?

Financial coaching significantly improves credit scores by offering personalized credit analysis and tailored improvement plans while continuously monitoring progress to help clients achieve their financial objectives. This structured support empowers individuals to make informed financial decisions and enhance their creditworthiness.

What are the components of a credit score?

The components of a credit score are payment history (35%), amounts owed (30%), length of credit history (15%), credit mix (10%), and new credit (10%). Understanding these factors can help you make informed decisions to improve your credit score.

What are the benefits of having a higher credit score?

Having a higher credit score significantly benefits you by securing lower interest rates on loans and credit cards, increasing your chances of loan approval, and providing better insurance premiums. This improved financial standing also enhances your leverage in negotiations.

How much does financial coaching cost?

Financial coaching typically costs between $100 and $300 per hour, with annual packages reaching up to $5,900 based on the coach's experience and services offered.

What qualifications should I look for in a financial coach?

The most reliable qualifications to seek in a financial coach are recognized certifications such as Certified Financial Planner (CFP) or Accredited Financial Counselor (AFC), which indicate a depth of knowledge and expertise in financial planning. Ensuring your coach has these credentials will enhance your confidence in their guidance.