How to Freeze Your Credit: A Simple Step-by-Step Guide

In an era of frequent data breaches and identity theft, knowing how to freeze your credit is more important than ever. This guide will show you step-by-step how to freeze your credit with Experian, Equifax, and TransUnion to protect your financial identity. Let’s get started and secure your credit report.

Key Takeaways

A credit freeze is a free service that prevents unauthorized access to your credit report, significantly reducing the risk of identity theft.

To initiate a credit freeze, you must contact each of the three major credit bureaus separately, providing necessary personal information and identification.

While a credit freeze enhances protection against new account fraud, it does not prevent all forms of identity theft, making monitoring of existing accounts essential.

Understanding Credit Freezes

At its core, a credit freeze is a powerful tool designed to protect your financial identity by restricting access to your credit reports. Also known as a security freeze, this measure serves the crucial purpose of preventing unauthorized individuals from opening new credit accounts in your name.

When a credit freeze is in place, creditors cannot access your credit report for new credit applications. This restriction is vital for preventing identity theft, as it stops hackers and scammers from opening new lines of credit by masquerading as you. Essentially, a credit freeze acts as a barrier, shielding your financial identity from potential threats.

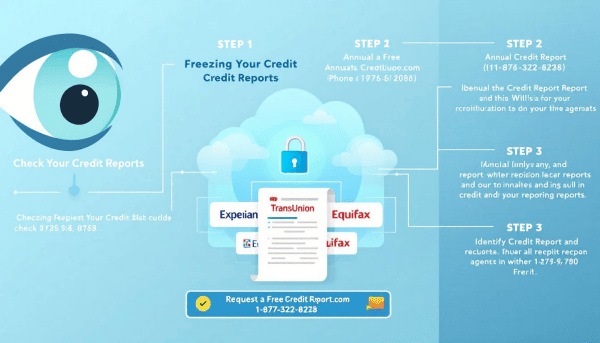

You must request a credit freeze separately from each of the three major credit bureaus: Experian, Equifax, and TransUnion. This can be done online, over the phone, or by mail. The credit bureaus are required to process your request within one business day if made online or by phone, and within three business days if made by mail. Importantly, freezing your credit is a free service provided by the credit bureaus to help consumers protect themselves from fraud.

Limiting access to your credit reports with a freeze enhances security and offers peace of mind. A credit freeze restricts access to your credit files, which is especially reassuring in an era of frequent data breaches and identity theft.

What You Need to Freeze Your Credit

Freezing your credit is a straightforward process, but it requires specific information and documentation to confirm your identity. To initiate a credit freeze, you will need your Social Security number, date of birth, and current address. Additionally, valid identification such as a driver’s license, passport, or military ID may be required to verify your identity. In some cases, the credit bureau may request additional documents like tax returns, bank statements, or utility bills to further confirm your identity and address.

Requesting a credit freeze over the phone requires answering security questions for verification, adding an extra layer of security.

With these documents and information at hand, you can confidently proceed to freeze your credit and protect your financial future.

How to Freeze Your Credit with Major Credit Bureaus

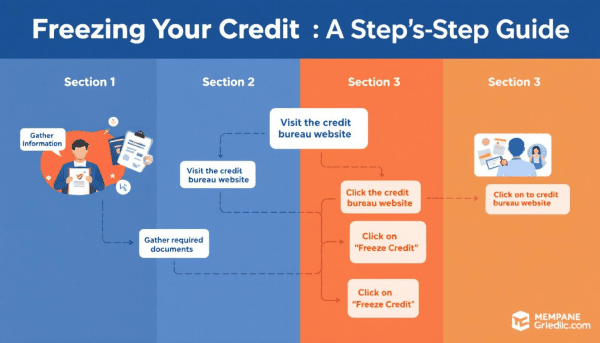

Freezing your credit involves contacting each of the three major credit bureaus and major credit reporting agencies: Experian, Equifax, and TransUnion. Requests can be made online, by phone, or through mail. The fastest and most convenient way to freeze your credit is online, where you can access your profile and initiate the freeze.

When you initiate a credit freeze, you generally need to provide your Social Security number, date of birth, and current address. You may also need a valid identification document, such as a driver’s license or passport, to verify your identity. In some cases, additional documents like tax returns, bank statements, or utility bills may be required.

Once a credit bureau receives a mailed request, they have three business days to freeze your credit. This ensures that your credit is protected in a timely manner.

Experian

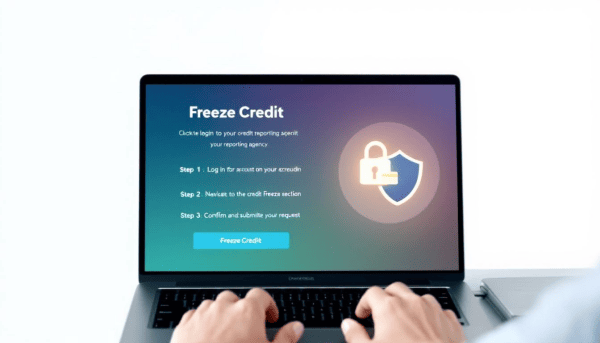

Experian offers several methods to freeze your credit, including their online Freeze Center and a dedicated phone number. You can request an Experian credit freeze online by logging into your account and accessing the credit freeze management center, or by calling 888-397-3742.

If you choose to freeze your credit by phone, you will need to verify your identity by entering information or answering security questions. Online and phone requests are usually processed immediately, taking up to one business day.

If you send a letter to freeze your credit, it may take up to three days after Experian receives it to process your request. When sending a request by mail, you may need to provide copies of documents to verify your identity and address.

Equifax

To freeze your credit with Equifax, you can use online, phone, or mail methods. Placing an online request to freeze your credit can be done by visiting the Equifax website. Alternatively, you can call Equifax at 888-298-0045 to initiate the freeze.

Equifax also provides an automated phone line for freezing credit, which offers a convenient alternative to online requests. This automated system simplifies the process, allowing you to freeze your credit quickly and efficiently.

TransUnion

TransUnion allows credit freezes to be initiated either online or via an automated phone system. Freezing your credit online is simple by visiting the TransUnion website.

Alternatively, the automated phone system provides a quick and convenient way to initiate the freeze without needing to speak to a representative.

Managing Your Credit Freeze

Managing your credit freeze involves contacting the credit bureaus to either lift the freeze temporarily or permanently. You can lift a credit freeze online, by phone, or via mail. If you plan to apply for new credit after freezing your credit, you can choose specific dates to start and end the credit freeze.

Typically, unfreezing your credit is quick and can happen nearly instantaneously, but legally, it can take up to an hour. To unfreeze your credit by phone, you must provide specific verifying information. This information is necessary for the process.

When lifting a freeze by mail, you must provide documents to verify your identity. Importantly, lifting a security freeze is free of charge.

Special Cases: Freezing Credit for Others

Freezing credit for others, such as children or incapacitated adults, is an essential step to protect them from identity theft, especially since they may not be aware of potential fraud.

When freezing the credit of another adult, such as a spouse or an incapacitated person, you may need to provide legal documentation such as a power of attorney or guardianship papers.

Freezing Your Child's Credit

Parents need to provide verification documents, such as a birth certificate or court order, to freeze a child’s credit. Proof of standing is also required.

The age limit for freezing a child’s credit is under 16. A credit bureau can create a report for a child who does not have one. This can be done prior to freezing the report.

Freezing Another Adult's Credit

When freezing the credit of an incapacitated adult, legal documents like a signed power of attorney are necessary to proceed. If a spouse’s credit is frozen, they will not be able to obtain new credit until the freeze is lifted, preventing potential misuse.

Monitoring Your Credit Reports

While a credit freeze prevents unauthorized access to your credit report, monitoring is essential to detect any errors or fraudulent activities that may occur. A credit freeze does not eliminate the risk of fraud from existing accounts; careful monitoring of statements remains necessary.

Credit monitoring services alert users to significant changes in their credit report, aiding in the early detection of potential identity theft. Freezing your credit provides a level of protection that credit monitoring cannot, specifically against the fraudulent opening of new accounts.

Credit Freeze vs. Other Protective Measures

Freezing your credit is more tedious than signing up for credit monitoring services, but it provides protection against accounts being opened fraudulently, which credit monitoring cannot do. Credit freezes are unable to protect you from other forms of fraud, like stolen credit card numbers.

Credit freezes are mandated by law and free, while credit locks are voluntary and may charge fees. Individuals can freeze another person’s credit to safeguard against identity theft, requiring proper legal documentation to do so.

Credit Monitoring Services

Credit monitoring services alert you to activities like hard inquiries, new account openings, and changes to existing accounts. However, they cannot prevent accounts from being opened in your name as they do not lock your credit file. A credit monitoring service can be a valuable tool for early detection of identity theft, but they do come at a cost. Paid credit monitoring services can cost between $9 and $40 per month, depending on coverage options. Family credit monitoring services are typically priced at around $34.99 per month after an initial 7-day trial.

Most credit monitoring services include identity theft insurance, often covering up to $1 million. Different monitoring plans may offer varied coverage: Basic plans monitor Experian only, while Advanced and Premier plans cover all three bureaus: Experian, Equifax, and TransUnion.

While these services provide alerts and identity theft support, they do not offer the protective capabilities of a credit freeze.

Fraud Alerts and Credit Locks

Fraud alerts notify potential creditors to take extra steps for identity verification before extending credit. This can be a useful measure to protect against identity theft, but unlike a credit freeze, it does not completely restrict access to your credit reports.

Credit locks, on the other hand, offer easier management through apps and technological solutions. However, they might involve fees, making them distinct from traditional credit freezes which are mandated by law and free. A credit lock can provide a flexible alternative to credit freezes.

While fraud alerts and credit locks provide additional layers of security, they do not offer the comprehensive protection of a credit freeze. Understanding the differences and choosing the right combination of protective measures can help you effectively safeguard your financial identity.

Common Misconceptions About Credit Freezes

A common misconception about credit freezes is that they restrict the use of existing account credit accounts, such as credit cards. In reality, current creditors can still view your credit report for certain purposes even when a credit freeze is in place.

Another misconception is that a credit freeze prevents all forms of identity theft. It does not protect against fraud if a thief has access to your existing credit account information. Freezing credit might create a misleading sense of safety, as it does not prevent all forms of identity theft.

Many people misunderstand what a credit freeze entails and its role in protecting against fraud. It is crucial to understand the limitations of a credit freeze to effectively protect yourself from identity theft.

Pros and Cons of Freezing Your Credit

Freezing your credit prevents unauthorized accounts from being opened in your name, offering reassurance. It is an effective way to safeguard sensitive information in your credit reports. Additionally, it does not impact your credit scores and can indirectly improve them by limiting hard inquiries. Security freezes are free, making them an accessible option for many consumers.

However, there are potential drawbacks to consider. Freezing your credit can create a false sense of security and the inconvenience of lifting the freeze when necessary. It can also complicate the process of creating a mySocialSecurity account. While a credit freeze provides strong protection against fraud, consumers should weigh the trade-offs, including potential inconveniences.

Summary

In conclusion, freezing your credit is a powerful tool to protect against unauthorized access and identity theft. By understanding the process, requirements, and limitations of a credit freeze, you can take proactive steps to safeguard your financial identity. While credit freezes provide robust protection, it is essential to complement them with credit monitoring and other protective measures to ensure comprehensive security. Stay vigilant and take control of your financial future today.

Frequently Asked Questions

What is a credit freeze?

A credit freeze restricts access to your credit reports, effectively preventing unauthorized individuals from opening new credit accounts in your name. This provides an essential layer of protection for your financial identity.

What do I need to freeze my credit?

To freeze your credit, you will need your Social Security number, date of birth, current address, and a valid form of identification such as a driver's license or passport. This information is essential for the credit bureaus to process your request securely.

How do I lift a credit freeze?

To lift a credit freeze, contact the credit bureaus online, by phone, or by mail, and you can do so either temporarily or permanently. This process is typically quick and free of charge.

Can I freeze my child's credit?

Yes, parents can freeze their child's credit by submitting verification documents, such as a birth certificate or court order, as long as the child is under 16 years old.

What is the difference between a credit freeze and a fraud alert?

A credit freeze restricts access to your credit reports to prevent new accounts from being opened, while a fraud alert prompts creditors to take additional verification steps before granting credit. Ultimately, a credit freeze provides stronger protection against identity theft than a fraud alert.