Beat Debt Fast: Master the Snowball Method for Debt Repayment

The snowball method for debt involves paying off your smallest debts first to gain quick wins and build momentum. This article explains how the snowball method works, provides a step-by-step guide to implement it, and discusses its pros and cons. Let’s explore how you can use this strategy to become debt-free.

Key Takeaways

The debt snowball method focuses on paying off smaller debts first to build momentum and motivation, contrasting with the debt avalanche method that prioritizes high-interest debts.

Key steps to implement the snowball method include listing debts from smallest to largest, making minimum payments on all debts except the smallest, and rolling payments into subsequent debts once the smallest is paid off.

While the snowball method offers psychological benefits and quick wins, it may lead to higher overall interest costs and prolonged repayment periods compared to alternatives like the avalanche method or debt consolidation.

Understanding the Snowball Method for Debt Repayment

The debt snowball method is a debt repayment strategy that focuses on eliminating smaller debts first to build momentum. Popularized by Dave Ramsey, this method is designed to give you quick wins early on, which can boost your motivation and keep you committed to the process. Unlike the debt avalanche method, which prioritizes paying off debts with the highest interest rates first, the debt snowball method centers on the psychological benefits of seeing debts disappear quickly.

Choosing between these methods often comes down to personal preference. If you thrive on small victories that build your confidence, the debt snowball method might be the perfect fit. The key is to stay disciplined and follow the steps closely to ensure success.

Now, explore how this method works with a real-world example.

How It Works

The snowball method involves ranking your outstanding debts from the smallest to the largest balance. Start by making minimum payments on all your debts except the smallest one. This ensures that you remain in good standing with all your creditors while focusing your efforts on eliminating the smallest debt first.

Next, direct any extra money you have towards this smallest debt or any small debts. It could be additional funds from a side hustle, a bonus at work, or any other windfall. The first debt to tackle is the one with the lowest balance, no matter its interest rate.

Once this debt is paid off, move on to the next smallest debt, using the same strategy.

Example of the Snowball Method

Let’s look at Lindsey, who has multiple debts but decides to use the snowball method to regain control. She starts by identifying her smallest debt, which is a $700 credit card balance. Lindsey makes minimum payments on all her other debts and directs any extra money towards paying off this $700 balance first.

After paying off the smallest debt, Lindsey takes the amount she was paying and rolls it into the next small debt—an auto loan debt of $1,500. This approach allows her to build momentum and stay motivated, as each paid-off debt provides a psychological boost and a sense of accomplishment, contributing to her overall debt payoff strategy.

Steps to Implement the Snowball Method

Successfully implementing the debt snowball method requires discipline and a step-by-step approach. Start by identifying the right debt repayment strategy and creating a solid plan. Adhering to these steps will keep you on track and ensure consistent progress towards becoming debt-free. Utilizing tools like a debt repayment calculator can also help manage your finances effectively and keep you motivated.

The snowball method focuses on paying off smaller debts first, and the debt snowball method focuses on building momentum as you go. This systematic approach can transform your financial situation, helping you to pay off your debt faster and more efficiently.

Let’s break down the steps to get started.

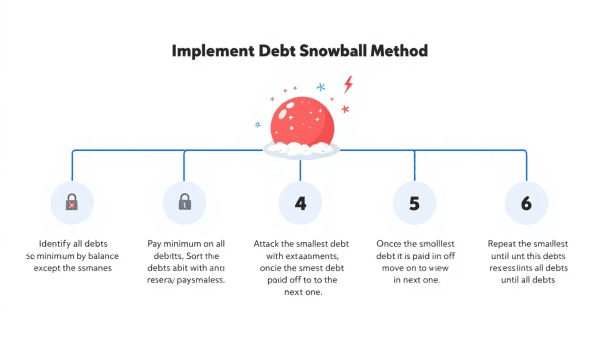

Step 1: List Your Debts

Begin by making a list of all your debts. Be sure to exclude your mortgage from this list. This list should include all outstanding debts such as credit cards, personal loans, auto loans, and student loans. Organize these debts from smallest to largest balance, as this order is crucial for the snowball method to work effectively.

Once your debts are listed, review them carefully. Understanding the total amount owed can be daunting, but this clarity is essential for creating a realistic and effective debt repayment plan. The next step will involve allocating your payments strategically to focus on the smallest debt first.

Step 2: Allocate Payments

With your debts listed, it’s time to allocate your payments. Make minimum payments on all your debts to avoid late fees and penalties. This keeps your accounts in good standing while you focus on the smallest debt.

Any extra money you have should be directed towards paying off the smallest debt as quickly as possible. This could be from cutting back on non-essential expenses, picking up a side job, or using bonuses and tax refunds. The goal is to accelerate the repayment process of this smallest debt.

Step 3: Snowball Effect

Once the smallest debt is paid off, take the amount you were paying towards it and roll it into the next smallest debt. This creates a snowball effect, where the amount you can allocate towards each subsequent debt grows larger and larger.

By the time you reach your larger debts, you’ll have a significant amount of money to throw at them, reducing the time it takes to pay them off. This momentum is key to the snowball method’s success and keeps you motivated throughout your debt repayment journey.

Benefits of the Snowball Method

One of the most significant benefits of the debt snowball method is the psychological boost it provides. By focusing on paying off smaller debts first, you can see quick results, which can be incredibly motivating. Each debt you pay off is a win, reinforcing your commitment to the process and making the task of becoming debt-free feel achievable.

This sense of progress can help you stay disciplined and focused on your goals. The snowball method leverages these small successes to keep you moving forward, ensuring that each paid-off debt fuels your motivation to tackle the next one.

Drawbacks of the Snowball Method

While the debt snowball method has its advantages, it also comes with some drawbacks. Here are some of the main criticisms:

It may lead to increased overall interest costs. By focusing on smaller debts first, you might delay payments on higher-interest debts, resulting in more interest accumulating over time.

This approach can prolong the overall debt repayment period.

It can increase the total amount of interest paid.

It’s essential to weigh these potential costs against the psychological benefits when choosing the right debt repayment strategy for your situation.

Alternatives to the Snowball Method

If you’re looking to minimize interest costs, the debt avalanche method might be a better fit. This strategy prioritizes paying off debts with the highest interest rates first, including higher interest debt, which can save you money over time. While it may not provide the same quick wins as the snowball method, it is more cost-effective in the long run.

Debt consolidation is another alternative, simplifying debt management by merging multiple debts into a single loan, often at a reduced interest rate. This can result in lower monthly payments and overall interest savings, making it an attractive option for many.

Tips for Maximizing the Snowball Method

Maximize the debt snowball method by automating your monthly payment for consistency and avoiding late fees. Negotiating bills or service fees can also help lower your monthly expenses, freeing up more money to pay off debt towards your debts.

Monitor your spending to find areas to cut back and reallocate funds to debt repayment. Use any windfalls, like bonuses or tax refunds, to make extra payments. Picking up side hustles can also improve your income and accelerate the repayment process.

Engage in financial education to better understand budgeting and debt management. This knowledge can empower you to make informed decisions and stay committed to your debt repayment plan. If you’re having difficulties, think about looking into debt relief options. This is particularly important if your unsecured consumer debts will require more than five years to repay.

Monitoring Progress

Tracking your progress is crucial for maintaining motivation and ensuring you stay on course. Regularly check your credit scores to monitor improvements and catch any errors or fraudulent activities that could derail your efforts.

Set specific financial goals and celebrate milestones along the way. These celebrations can boost morale and provide the encouragement needed to continue your debt repayment journey.

Combining Strategies

Combining the snowball method with other strategies can create a more personalized and effective debt repayment plan. For instance, integrating the snowball method with debt consolidation loans can streamline multiple high-interest debts into a single, lower-rate payment.

Balance transfers during promotional low-rate periods, combined with the snowball method, can help manage debts more effectively. This hybrid approach can provide the psychological benefits of the snowball method while also addressing high-interest debts strategically.

Summary

The debt snowball method offers a structured and motivating approach to paying off debt. By focusing on smaller debts first, you can achieve quick wins that build momentum and keep you motivated. While it may not be the most cost-effective method in terms of interest savings, its psychological benefits can be powerful.

Ultimately, the best debt repayment strategy is the one that works for you. Whether you choose the snowball method, the avalanche method, or a combination of strategies, the goal is to become debt-free and regain control of your financial future. Start today, stay committed, and watch as your debts disappear one by one.

Frequently Asked Questions

What is the debt snowball method?

The debt snowball method is an effective strategy that prioritizes paying off your smallest debts first, creating momentum and motivation as you achieve each payoff. This approach can lead to increased confidence and a greater likelihood of becoming debt-free.

How does the debt snowball method differ from the debt avalanche method?

The debt snowball method focuses on paying off smaller debts first to build momentum, while the debt avalanche method targets debts with the highest interest rates to minimize total interest paid. Both strategies help in reducing debt, but they do so in fundamentally different ways.

Can I combine the debt snowball method with other strategies?

You can effectively combine the debt snowball method with strategies like debt consolidation or balance transfers to create a more tailored repayment plan. This approach allows you to benefit from the psychological wins of the snowball method while optimizing your overall debt management.

What are the main benefits of the debt snowball method?

The debt snowball method offers quick wins that boost motivation and provide a structured approach to debt repayment. This method empowers you to tackle smaller debts first, creating a sense of accomplishment that can drive you to eliminate larger debts more effectively.

Are there any drawbacks to the debt snowball method?

Yes, the debt snowball method can lead to higher overall interest costs since it focuses on paying off smaller debts first rather than prioritizing high-interest debts. Consequently, it may prolong the repayment period and increase the total amount paid.