Top Tips for Choosing an Identity Protection Plan in 2024

Choosing an identity protection plan is essential to safeguard your personal information. This article covers the key features to consider, how to assess your risk, and compares top providers to help you make an informed decision.

Key Takeaways

Identity theft protection services monitor sensitive personal information and provide alerts for suspicious activity, essential for early detection of potential fraud.

Evaluate your risk level and choose a plan that offers comprehensive monitoring, dark web surveillance, and identity theft insurance to effectively mitigate risks.

Compare different providers based on features, pricing, customer support, and ease of use to find the most suitable identity protection plan for your needs.

Understanding Identity Theft Protection Services

Identity theft protection services are designed to safeguard your personal information and minimize the risk of identity fraud. These services primarily focus on monitoring sensitive information, alerting you to suspicious activities, and aiding in recovery if your identity is compromised. They monitor a range of personal data, including social security numbers, driver’s licenses, medical IDs, bank account numbers, and identity and credit protection. Many individuals turn to identity theft protection companies for added security.

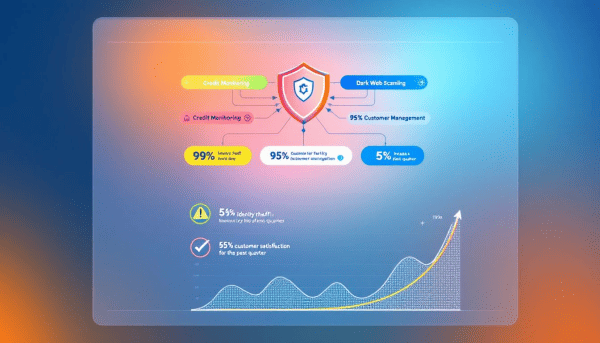

One of the critical features of these services is credit monitoring. These services monitor your credit history for changes, helping you spot potential fraud early and take action before significant damage occurs. Dark web monitoring is another essential component, as it involves searching for leaked information that may compromise your personal data. If your information appears on the dark web, these services send alerts so you can take immediate steps to protect yourself.

Many identity theft protection services offer identity theft insurance. This insurance can assist in recovering costs related to identity theft. This insurance often covers costs such as legal fees, lost wages, and other expenses related to restoring your identity. With high insurance coverage, you can recover lost funds resulting from identity fraud more effectively.

Assessing Your Risk Level

Understanding your risk level for identity theft is crucial in selecting the right protection plan. Conducting a personal self-assessment can help gauge your vulnerability based on your security habits. Regularly checking your credit reports and monitoring financial statements are essential practices to detect identity theft early.

Even those who take precautions can fall victim to identity theft due to data breaches, which can expose personal information on a large scale. Using secondary phone numbers for online interactions and strict password policies can further protect your primary information from being compromised.

If you engage in high-risk transactions or have a significant online presence, you may benefit from personalized support and identity theft insurance to mitigate these risks.

Key Features to Look for in an Identity Protection Plan

Choosing the right identity protection plan involves understanding the key features that can enhance your security and peace of mind. Monitoring is a crucial component, as it helps detect unusual activities and potential fraud early. Comprehensive monitoring, dark web monitoring, and identity theft insurance coverage are three essential features to consider.

Each of these features plays a significant role in a solid identity theft protection plan. Comprehensive monitoring keeps an eye on your credit, financial transactions, and dark web activity. Dark web monitoring alerts you if your personal information appears in data breaches or on illicit websites. Identity theft insurance provides financial coverage to help you recover from identity fraud.

Comprehensive Monitoring

A comprehensive identity protection plan should include monitoring for credit, financial transactions, and dark web activity. Bank accounts and card account monitoring is essential to identify unauthorized transactions promptly. These services often provide alerts for significant changes in credit reports, which help users act quickly to potential issues. Notifications can cover substantial account or transaction changes, which may indicate fraudulent activity.

Some plans offer monitoring features for social media accounts to detect potential identity theft. Additionally, monitoring multiple bank and investment accounts can enhance financial security. Effective identity protection services typically feature tri-bureau credit monitoring to track changes across major credit reporting agencies.

Dark Web Monitoring

Dark web monitoring involves tracking and alerting users if their personal information appears in data breaches or on illicit websites. This feature is crucial as it helps you take immediate steps to protect your identity if your data breach is compromised. For instance, Experian IdentityWorks provides Dark Web surveillance as part of its identity theft protection services.

Identity Guard offers dark web monitoring with all its plans. Other providers like PrivacyGuard include dark web surveillance, SSN monitoring, and ID verification scanning, making it a comprehensive solution for monitoring your personal information on the identity guard’s dark web.

Identity Theft Insurance Coverage

Identity theft insurance coverage is a vital feature of identity theft protection services. It provides financial reimbursement for expenses incurred due to identity theft, such as legal fees, lost wages, and other costs associated with restoring your identity. ProtectMyID offers $1 million insurance coverage for eligible losses, while Zander’s identity theft insurance provides coverage up to $1 million.

Some providers offer even higher coverage amounts. For example:

Aura provides $5 million in identity theft insurance coverage

Bitdefender Ultimate Security offers $2 million in coverage for identity theft recovery, including lost pay and travel expenses

LifeLock provides up to $3 million in identity theft insurance coverage for individuals, making it a robust option for those seeking extensive protection.

The range of identity theft insurance coverage can vary significantly, with some plans offering up to $1 million in coverage depending on the provider. This insurance not only helps in recovering stolen funds but also provides peace of mind knowing that you have financial support in case of identity fraud.

Comparing Top Identity Theft Protection Providers

When choosing an identity theft protection plan, it’s essential to compare top providers to find the best fit for your needs. Different providers offer varying features, credit capabilities, insurance reimbursement policies, and annual plan prices. Understanding these differences allows you to make a more informed decision.

We’ll compare some of the leading identity theft protection providers, including Identity Guard, Aura, Experian IdentityWorks, and LifeLock. Each of these providers offers unique benefits and features that cater to different security needs and budgets.

Identity Guard

Since 1996, Identity Guard has provided identity theft protection services. It has successfully protected over 38 million customers. The pricing for Identity Guard’s plans ranges from $6.67 to $39.99 per month, with the starting price at $6.67/month. One of the standout features of Identity Guard is its $1 million identity theft insurance coverage included in its plans.

In addition to identity theft insurance, Identity Guard includes features like social media monitoring. It utilizes artificial intelligence for its identity monitoring technology, enabling comprehensive surveillance of personal information.

The identity watchlist feature allows monitoring of over 70 unique pieces of identity, and advanced technology ensures efficient identity monitoring and protection.

Aura

Aura’s identity theft protection includes comprehensive protection with three-bureau credit monitoring and digital security tools. This makes Aura a strong contender for those seeking all-encompassing protection. Aura offers identity theft and credit protection for both individuals and families, providing a versatile solution for different needs.

One of Aura’s distinguishing features is its 24/7/365 U.S.-based White Glove Fraud Resolution support. Additionally, Aura provides the fastest fraud alerts in the industry, ensuring prompt action against potential threats.

New users can also take advantage of a 14-day free trial period to explore their services before committing.

Experian IdentityWorks

Experian IdentityWorks primarily offers credit monitoring and fraud alert assistance. The service offers alerts for credit and identity theft in near real-time. It also includes Social Security number monitoring and surveillance of the Dark Web. With a starting price of $24.99 per month, Experian IdentityWorks offers a robust package for those seeking reliable credit monitoring.

A unique feature of Experian IdentityWorks is its CreditLock functionality, allowing users to lock and unlock their Experian credit report. This feature adds an extra layer of security, enabling users to prevent unauthorized access to their credit information.

LifeLock

LifeLock integrates with Norton 360 to provide additional digital security tools. This integration enhances the overall protection offered by LifeLock. The service offers extensive monitoring, including phone takeover monitoring, SSN scanning, and dark web surveillance.

LifeLock’s identity theft protection service ranges from $8.29 to $34.99 per month, with a complicated set of plans and higher renewal rates. However, LifeLock provides prioritized support for higher-tier subscribers, enhancing the customer service experience.

Evaluating Costs and Value

Evaluating the costs and value of identity protection plans is crucial for effective financial planning. Monthly subscription plans can vary significantly among different providers, impacting overall costs. It’s essential to balance the cost of a plan with the coverage it provides to ensure it meets your specific identity protection needs.

Many identity protection services offer free trials and money-back guarantees, providing an opportunity to test their features without financial commitment. This allows you to assess the value of the service before making a long-term commitment.

Monthly Subscription Plans

Monthly subscription plans for identity protection services cater to both individuals and families. For instance, the Ultra plan of Identity Guard is priced at $39.99 per month for families and $29.99 for individuals. When evaluating different plans, it’s crucial to consider both the cost and the coverage features offered.

Experian IdentityWorks provides a free plan. This plan includes basic credit monitoring for one bureau. Many services also provide flexible subscription options, allowing you to choose a plan that fits your budget and coverage needs.

Free Trials and Money-Back Guarantees

Free trials and money-back guarantees are crucial benefits to consider when selecting an identity protection plan. Aura offers a 14-day free trial, allowing users to evaluate the plan before committing. This trial period provides a risk-free way to test the service’s features and benefits.

Several providers, such as Identity Guard and ID Watchdog, do not offer free trials but provide flexible subscription options instead. Money-back guarantees allow subscribers to cancel their plans and receive a refund within a certain period, reducing financial risk.

Balancing Cost with Coverage

Balancing the cost of an identity protection plan with the coverage it provides is essential for getting the best value. For example, the Ultimate plan of McAfee+ includes a $25,000 coverage for ransomware fallout. Evaluating the range of coverage options and understanding the costs associated with each plan can help you make a more informed decision.

Consider what specific features and coverage you need based on your risk level and personal circumstances. This approach ensures that you select a plan that offers the best protection for your investment.

Additional Considerations When Choosing a Plan

When selecting an identity protection plan, it’s important to look beyond the primary features and consider additional aspects that enhance overall value. These considerations can significantly impact the effectiveness and user satisfaction of the service. Family plans, customer support quality, and ease of use are some of the critical factors to keep in mind.

Each of these elements can contribute to a more comprehensive and user-friendly identity protection experience. Considering these additional factors allows you to choose a plan that offers robust security features while meeting your specific needs and preferences.

Family Plans and Multi-Person Coverage

Family plans offer protection for multiple individuals under one policy, making them a cost-effective option for households. Providers like Aura and Identity Guard offer flexible family plans suitable for all household members. For instance, Experian IdentityWorks allows up to ten minors to be included in their family plans without additional charges.

Aura offers extensive coverage with up to $5 million in identity theft insurance for family plans. LifeLock’s family plans can include children for an additional fee of $5.99 each, while Identity Guard covers all adults and minors in the household for just $12.50 per month.

Customer Support and Service Quality

Quality customer support is critical in identity theft protection as it ensures prompt assistance in case of issues or queries. For example, LifeLock offers 24/7 live member support along with priority support for its high-priced plan. Having reliable customer support can make a significant difference in effectively managing and resolving identity theft incidents.

When choosing a plan, consider the availability and quality of customer support services. This can include telephone assistance, live chat, and email support. Superior customer service can enhance your overall experience and provide peace of mind knowing help is readily available.

Ease of Use and User Experience

Ease of use is a critical factor in identity protection services, as it influences how effectively users can manage their identity and respond to potential threats. Aura allows users to set up a transaction limit for monitoring, helping to avoid being overwhelmed by alerts and enhancing the user experience.

Services like IDShield include extra security features such as malware defenses, a VPN, and a password manager, which provide reassurance and make the service easier to use effectively.

The combination of a user-friendly interface and robust security features significantly enhances overall user satisfaction and experience with identity protection services.

How to Get Started with an Identity Protection Plan

Getting started with an identity protection plan is a straightforward process. First, select a suitable protection plan that meets your needs. This typically takes just a few minutes. After choosing a plan, establish identity monitoring to receive notifications if your data is compromised. Many services offer mobile apps that help you stay informed and link your financial accounts for better monitoring.

These services should provide alerts for any suspicious activities that could suggest potential credit fraud. Continuous monitoring services can alert you to unusual activities, helping to prevent identity theft before significant damage occurs.

Additionally, identity theft protection services often provide 24/7 call support for immediate assistance. Employing personal information removal services can help minimize the risk of identity theft by eliminating your data from online sources.

Maintaining Ongoing Vigilance

Maintaining ongoing vigilance is crucial in protecting against identity theft. Practicing good cyber hygiene, such as using strong passwords and monitoring personal information, can help mitigate identity theft risks. Enabling two-factor authentication on accounts adds an essential layer of security against unauthorized access.

Regularly reviewing privacy settings on social media is crucial to ensuring that personal information is not overly exposed. Being proactive and safeguarding personal information is key to maintaining ongoing vigilance against identity theft.

Staying alert and taking preventive measures significantly reduces the risk of identity theft and helps protect your personal information.

Summary

Choosing the right identity protection plan is essential in safeguarding your personal information and mitigating the risk of identity theft. By understanding your risk level, evaluating key features, comparing top providers, and considering additional factors such as family plans and customer support, you can make an informed decision that meets your specific needs.

Remember, maintaining ongoing vigilance and practicing good cyber hygiene are crucial in protecting against identity theft. With the right tools and proactive security measures, you can ensure the safety of your identity and financial well-being.

Frequently Asked Questions

What are the key features to look for in an identity protection plan?

Look for comprehensive monitoring, dark web monitoring, and identity theft insurance coverage in an identity protection plan, as these features significantly enhance your security and offer financial reimbursement if identity fraud occurs.

How do I assess my risk level for identity theft?

To assess your risk level for identity theft, regularly check your credit reports, monitor your financial statements, and evaluate your online security practices, including awareness of data breaches and high-risk transactions. This proactive approach will help you understand and mitigate your identity theft risk effectively.

What are the benefits of family plans for identity theft protection?

Family plans for identity theft protection provide cost-effective coverage for multiple individuals, ensuring that all household members are protected under one policy. This approach not only simplifies management but also offers extensive and flexible coverage options tailored to the family's needs.

How important is customer support in identity theft protection services?

Customer support is essential in identity theft protection services, as it offers timely assistance and enhances the overall protection experience. Efficient support provides peace of mind, ensuring customers feel secure in managing their identity.

How can I maintain ongoing vigilance against identity theft?

To maintain ongoing vigilance against identity theft, practice good cyber hygiene by using strong passwords and enabling two-factor authentication, while regularly reviewing your privacy settings on social media. Proactively safeguarding your personal information is essential.