Is Identity Theft Insurance Worth It? What You Need to Know

Are you worried about the risks of identity theft and wondering if identity theft insurance is worth it? Identity theft insurance helps cover the costs associated with reclaiming your identity and recovering from fraud. This article will explore what identity theft insurance is, how it works, and whether it’s a smart investment for your financial security.

Key Takeaways

Identity theft insurance primarily covers recovery-related costs, such as legal fees and lost wages, rather than direct financial losses from fraudulent activities.

Several factors influence the cost of identity theft insurance, with standalone policies typically ranging from $25 to $60 annually, while comprehensive protection may cost more.

Evaluating the need for identity theft insurance requires assessing personal risk levels and understanding existing protections, as many banks and credit card companies offer identity theft protection services.

Understanding Identity Theft Insurance

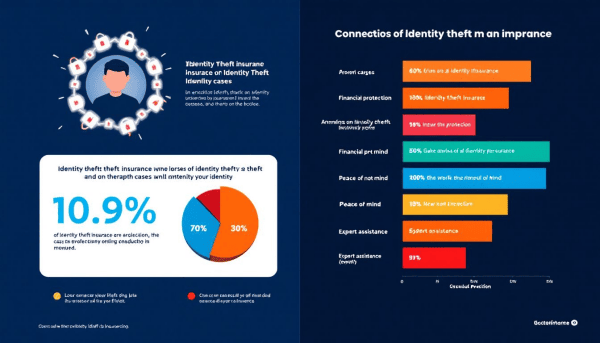

Identity theft insurance is designed to offer financial protection to victims by covering recovery-related costs after their identity has been stolen. Unlike traditional theft insurance, which may cover the loss of physical items, identity theft insurance focuses on the aftermath of identity fraud. This includes assisting with the financial burden of reclaiming your identity and restoring your credit.

The process of recovery from identity theft is not only time-consuming but can also be financially draining. Legal fees, lost wages, and other expenses can quickly add up, making identity theft insurance worth a valuable safety net.

How does this type of insurance work, and what exactly does it cover? Let’s explore the specifics of identity theft insurance policies and their operation.

Identity theft insurance encompasses various policies, coverage options, and functional mechanisms. This section breaks down these elements for a clearer picture of what the insurance entails.

What Is Identity Theft Insurance?

Identity theft insurance aims to alert users to identity theft issues and assist in resolving them. Its primary function is to cover expenses related to restoring one’s identity after theft. Although it doesn’t typically reimburse direct monetary losses, it covers recovery costs like legal fees and lost wages.

Common coverages under identity theft insurance include fixing credit issues, expenses from unauthorized use of credit or loans, and costs related to identity restoration, such as replacing stolen identification documents and legal services. It also often includes services like comprehensive credit monitoring, which can alert you to suspicious activity early on.

How Does Identity Theft Insurance Work?

Identity theft insurance usually covers costs associated with recovery from identity fraud. It also includes expenses related to reporting such incidents. Standard identity theft protection includes a range of services, from prevention measures to recovery support, ensuring that victims receive comprehensive assistance throughout the process.

The claims process requires prompt reporting and submission of necessary documentation within a specified timeframe. Coverage can be obtained as a rider on homeowners insurance, an add-on to an existing policy, or a standalone policy. Knowing the specifics of your policy, including inclusions and exclusions, ensures effective coverage.

Coverage Details of Identity Theft Insurance

Identity theft insurance helps manage expenses that arise during the recovery process, rather than covering direct financial losses. Identity theft can cause extensive financial damage, requiring legal assistance and other recovery efforts. Knowing what identity theft insurance covers can help determine its value.

Identity theft insurance cover provides critical support during the recovery process, but it’s essential to know its scope and limitations. Common coverages and limitations of these policies, including identity theft coverage, will be explored here.

Common Coverages

Before: Costs often covered by identity theft insurance include fees for case managers, legal services, and replacing stolen documents. Legal fees, lost wages, and various restoration costs are typical expenses that identity theft insurance covers. Additionally, fees for identity restoration specialists who assist in the recovery process are included in the coverage.

After: Costs often covered by identity theft insurance include:

Fees for case managers

Legal services

Replacing stolen documents

Legal fees

Lost wages

Various restoration costs

Fees for identity restoration specialists who assist in the recovery process

Identity theft insurance may also cover the costs of replacing lost identification documents such as a driver’s license. Other covered expenses include notary fees and the costs of placing fraud alerts on credit reports, providing a comprehensive support system during the recovery phase.

What’s Not Covered

Identity theft insurance typically focuses on reimbursing for costs associated with reporting and recovering from identity theft rather than compensating for lost money. Direct monetary losses from fraudulent purchases are generally not covered by buying identity theft insurance.

Potential policyholders should be aware that identity theft insurance will not reimburse them for direct financial losses, which could lead to misconceptions about its protections.

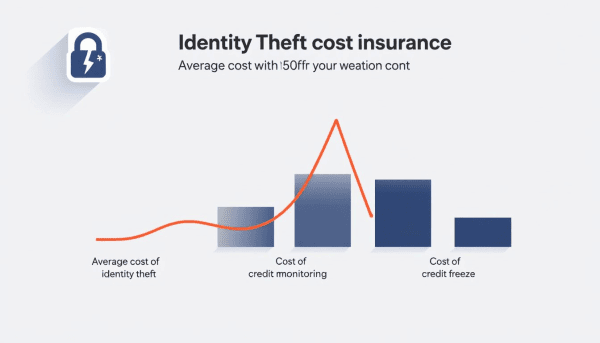

Costs Associated with Identity Theft Insurance

Knowing the costs associated with identity theft insurance is crucial for making an informed purchasing decision. This financial product covers specific costs incurred due to identity theft. Understanding its general cost structure can assist in budgeting for this protection.

Identity theft insurance costs can vary widely due to several factors. This section discusses typical cost ranges and the elements influencing these costs.

How Much Does It Cost?

The typical monthly cost range for identity theft insurance is between $1 to $90. Typically, standalone identity theft insurance costs between $25 and $60 annually. This range reflects the average pricing for such coverage. For more comprehensive protection, including family plans, the costs can be higher, often starting at $50 per month.

Including identity theft insurance in a homeowners policy typically costs less than $50 per year. Full identity protection services tend to be significantly more expensive than standalone insurance, reflecting the breadth of services provided.

Factors Influencing Cost

Various factors can influence the cost of identity theft insurance, impacting overall premiums and out-of-pocket expenses. The premiums may vary based on how the insurance is purchased, whether as a standalone policy or as an add-on to an existing plan.

Additionally, an out-of-pocket deductible may be required before reimbursement is granted for identity theft insurance claims.

Evaluating the Need for Identity Theft Insurance

Evaluating the need for identity theft insurance involves assessing your risk level and understanding existing protections. Personal financial habits and lifestyle choices significantly influence the necessity of this coverage.

Individuals who frequently engage in online activities, have valuable personal information, or have previously encountered identity theft incidents may find identity theft insurance particularly beneficial. Learn how to assess your risk and explore existing protections.

Assessing Your Risk

Individuals who frequently shop online or use public Wi-Fi are more susceptible to identity theft. People who conduct business online and those who do not monitor their credit reports regularly are at increased risk of identity theft. Engaging in careless online activity can heighten one’s vulnerability to identity theft.

Those who have previously encountered identity theft incidents may exhibit a higher risk level for future occurrences. Recognizing these risk factors can help determine whether identity theft insurance is a necessary safeguard.

Existing Protections

Many credit card companies and banks offer identity theft protection services as part of their customer benefits. These services often include monitoring for suspicious activity, providing alerts for unauthorized transactions, and assisting with recovery efforts from a credit card company.

Some employers provide complimentary identity theft protection as an employee benefit. Regularly checking credit reports, setting up alerts for unauthorized transactions, and reviewing bank and credit statements help spot unauthorized activity early. These existing protections can significantly reduce the risk of identity theft prevention.

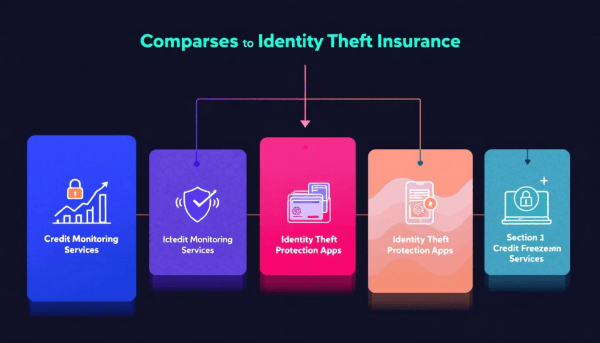

Alternatives to Identity Theft Insurance

While identity theft insurance offers valuable protection, there are alternative measures to consider. Proactively monitoring financial statements and credit reports is essential to safeguarding against identity theft.

Explore DIY monitoring and prevention techniques alongside professional identity theft protection services.

DIY Monitoring and Prevention

Monitoring credit reports regularly can help identify potential signs of identity theft early. Preventive measures include freezing credit, checking your credit report, and using strong, randomized passwords with two-factor authentication to protect your identity.

Additionally, utilizing resources such as fraud alerts, an identity protection PIN from the IRS, and a credit freeze strengthens prevention efforts. Regularly checking financial statements and avoiding sharing personal information with suspicious parties are effective steps to prevent identity fraud.

Identity Theft Protection Services

Services such as Discover® Identity Theft Protection offer alerts when there are changes in credit reports and bank accounts. They also include dark web monitoring features. Third-party identity theft protection services offer specialized monitoring tools designed to protect individuals from identity theft.

Identity theft insurance covers financial losses post-theft, whereas third-party monitoring services focus on prevention and early detection. Reputable services like LifeLock and IDShield offer comprehensive identity theft protection plans and effective responses to identity theft incidents, including an identity theft protection service.

Where to Purchase Identity Theft Insurance

Identity theft insurance can be obtained from major insurers, employers, and specialized companies like LifeLock and IDShield. Major insurers offer identity theft insurance as part of their portfolio of products, sometimes included in homeowners or renters insurance policies. Some employers also provide identity theft insurance as a benefit for their employees.

Specialized providers such as LifeLock and IDShield focus specifically on identity theft protection services and insurance. Find out where to purchase identity theft insurance, with highlights on major insurance providers and specialized companies.

Major Insurance Providers

Most major home insurance companies provide optional identity theft protection. This service can be added to your existing policy. State Farm offers coverage for fraud losses, identity restoration, cyberattacks, and cyber extortion. Amica Mutual offers assistance with identity theft. They also provide credit monitoring services.

GEICO offers identity theft protection through a partnership with Iris Powered by Generali, which includes extensive coverage and monitoring services. Identity theft insurance can be incorporated into homeowners policies as a rider or as a standalone policy.

Specialized Providers

LifeLock and IDShield are well-known companies that offer tailored identity theft protection services. These specialized providers focus on identity theft protection by offering tailored services to protect against identity theft. They offer various services such as credit monitoring, identity restoration, and alert systems to help mitigate the effects of identity theft.

Choosing reputable specialized providers is crucial to ensure comprehensive protection and effective response to potential identity theft incidents.

Summary

Navigating the world of identity theft insurance can be complex, but understanding its purpose and benefits is crucial in today’s digital age. Identity theft insurance offers a safety net that covers various recovery-related costs, providing much-needed financial relief and support during the challenging process of reclaiming your identity. While it doesn’t cover direct financial losses, the assistance it provides in legal fees, lost wages, and identity restoration is invaluable.

By evaluating your personal risk factors and existing protections, you can make a well-informed decision about whether to invest in identity theft insurance. Whether you choose this route or opt for proactive monitoring and prevention measures, the key is to stay vigilant and protect your personal information. Remember, identity theft insurance is just one part of a comprehensive strategy to guard against identity theft. Stay informed, stay protected, and take control of your digital identity.

Frequently Asked Questions

What exactly does identity theft insurance cover?** **?

Identity theft insurance typically covers expenses incurred during the recovery process, including legal fees, lost wages, and costs for identity restoration specialists, but it usually does not reimburse direct monetary losses from fraudulent activities.

How much does identity theft insurance cost?** **?

Identity theft insurance generally costs between $25 and $60 each year for standalone policies, while comprehensive plans that include family coverage can begin at approximately $50 per month. It is advisable to compare options to find the best coverage for your needs.

Is identity theft insurance worth it?** **?

Identity theft insurance can be worthwhile if you frequently engage in online activities or possess sensitive personal information, as it offers financial protection and assistance during recovery. Assess your personal risk factors and existing protections to determine if it suits your needs.

Can I get identity theft insurance through my existing insurance provider?** **?

Yes, it is possible to obtain identity theft insurance through your existing insurance provider, as many offer it as an add-on to homeowners or renters insurance policies. Additionally, some employers may provide this coverage as a benefit.

Are there alternatives to identity theft insurance?** **?

Yes, alternatives to identity theft insurance involve proactive measures like monitoring financial statements and credit reports, utilizing strong passwords, setting up fraud alerts, and opting for third-party identity theft protection services. These strategies can effectively enhance your security against identity theft.