Top Cash Rewards Secured Credit Card for Building Credit This Year

Are you aiming to build your credit and earn cash back? A cash rewards secured credit card might be the perfect solution. These cards require a security deposit but reward you with cash back on purchases. This article highlights the top cash rewards secured credit cards this year and explains the benefits each one offers.

Key Takeaways

Secured credit cards like Discover it® and Capital One Quicksilver Secured offer cash back options while helping users build or rebuild their credit through responsible use.

Earning cash back from secured cards is structured around specific categories, with options for customizing cash rewards according to spending habits, as seen with the Bank of America® Customized Cash Rewards Secured Credit Card.

To maximize benefits, users should maintain a low credit utilization ratio, select appropriate cash back categories, and ensure timely payments to build a positive credit history.

Best Cash Rewards Secured Credit Cards

Secured credit cards are an excellent tool for individuals looking to build or rebuild their credit while earning cash back on their purchases. These cards require a security deposit, which acts as collateral and often determines your credit limit. Here are some of the top cash rewards secured credit cards that can help you achieve your financial goals.

Choosing the right secured credit card involves considering factors like cash back rates, annual fees, and additional benefits. Among the best secured credit cards this year are the Discover it® Secured Credit Card, Capital One Quicksilver Secured Cash Rewards Credit Card, and the Bank of America® Customized Cash Rewards Secured Credit Card. Here’s a breakdown of what each card offers.

Discover it® Secured Credit Card

The Discover it® Secured Credit Card is a standout option for anyone looking to build credit while enjoying generous cash back rewards. This card offers 2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter, and 1% on all other purchases. Additionally, Discover matches all the cash back you’ve earned at the end of your first year, effectively doubling your rewards for the first year of card ownership.

One of the significant advantages of the Discover it® Secured Credit Card is that it reports your payment history to all three major credit bureaus, helping you build a positive credit history. With responsible use, this card can be a stepping stone to qualifying for an unsecured credit card in the future, potentially leading to statement credit opportunities.

Capital One Quicksilver Secured Cash Rewards Credit Card

The Capital One Quicksilver Secured Cash Rewards Credit Card is another excellent choice for those seeking to earn cash back while building credit. This card comes with no annual fee, making it a cost-effective option for cardholders. You earn a straightforward 1.5% cash back on every purchase, which means you don’t have to worry about rotating categories or spending limits.

Like the Discover it® Secured Credit Card, the Capital One Quicksilver Secured Cash Rewards Credit Card reports to the major credit bureaus, aiding in the improvement of your credit score. Additionally, with responsible use, you might be eligible for a higher credit line without needing to make an additional deposit.

Bank of America® Customized Cash Rewards Secured Credit Card

The Bank of America® Customized Cash Rewards Secured Credit Card offers a unique and flexible rewards program that can be tailored to your spending habits. You earn 3% cash back in a category of your choice, which could include gas, online shopping, dining, travel, drug stores, or home improvement/furnishings. Additionally, you get 2% cash back at grocery stores and wholesale clubs, and 1% on all other purchases.

This card is designed not only to help you build credit but also to maximize your rewards based on your spending patterns. Selecting a cash back category that matches your regular expenses can significantly boost your earnings.

Furthermore, like other top secured credit cards, it reports to all three major credit bureaus, helping you build a solid credit history.

How Cash Rewards Secured Credit Cards Work

Knowing how cash rewards secured credit cards operate helps maximize their benefits. These cards help build or rebuild credit by requiring a security deposit that serves as collateral for the credit limit. This makes them more accessible than unsecured credit cards, especially for those with less-than-perfect credit histories.

Cash rewards secured credit cards offer cash back on purchases, which can be redeemed in various ways. They typically come with lower APRs compared to unsecured cards aimed at consumers with poor credit. However, understanding the terms and conditions helps avoid unexpected fees or charges.

Security Deposit Requirements

Secured credit cards often require a refundable security deposit that typically acts as your credit limit. For instance, the Bank of America Cash Rewards Secured Credit Card requires a minimum security deposit of $200. The deposit is typically refundable after responsible use and maintaining the account in good standing. Additionally, security deposits can help establish or improve your credit history.

The standard deposit for opening a secured credit card is usually a minimum of $200, but it can vary depending on the card. Some cards, like the Capital One Platinum Secured Credit Card, have lower minimum deposits, starting at $49. This allows users to choose a card that best fits their financial situation.

Earning Cash Back

Earning cash back with secured credit cards typically involves making purchases in specific categories chosen by the cardholder. For instance, the Bank of America Cash Rewards Secured Card offers 3% cash back in a selected category such as gas or online shopping, and 2% at grocery stores and wholesale clubs.

Other cards, like the Capital One Quicksilver Secured, provide a flat rate of 1.5% cash back on all purchases, making it easier to earn rewards without worrying about specific spending categories. While the cash back rates might not be as high as some unsecured cards, they still offer a valuable way to earn rewards while building credit.

Redeeming Cash Rewards

Redeeming cash rewards from secured credit cards is straightforward and offers flexibility. Many cards allow you to redeem your rewards as statement credits, which can directly reduce your credit card balance. This method is simple and helps manage your credit card bill effectively.

Alternatively, some cards offer the option to transfer cash rewards directly into your bank account, providing immediate access to funds. This flexibility ensures that you can make the most out of your earned rewards, whether you prefer to reduce your debt or increase your savings.

Benefits of Using Cash Rewards Secured Credit Cards

Using cash rewards secured credit cards offers numerous benefits beyond just earning cash back. These cards are designed to help users build or rebuild their credit while forming healthy financial habits. Responsible use can lead to improved credit scores and potentially qualifying for unsecured credit cards with better rewards and lower fees.

Moreover, cash rewards secured credit cards provide a structured way to manage spending, as the credit limit is tied to the security deposit. This feature helps prevent overspending and encourages disciplined financial behavior, which is crucial for long-term credit health.

Building Credit History

Secured credit cards are excellent tools for building credit history, as they report your payment activities to the major credit bureaus. Timely payments are crucial to avoid interest charges and build a positive credit history, which can lead to a higher credit score over time.

It’s essential to practice good habits, such as keeping your credit utilization low and paying at least the minimum due every month. These actions demonstrate responsible use of credit and can significantly improve your credit scores.

Controlled Spending

Secured credit cards help control spending by tying the credit limit to the security deposit. This creates a clear boundary for spending and encourages disciplined financial habits.

Responsible use of a secured credit card can lead to better credit scores and financial management. Disciplined spending habits fostered by credit limits can improve long-term financial health.

Potential for Upgrades

A significant benefit of using a cash rewards secured credit card is the potential for upgrades. After demonstrating responsible use, such as making timely payments and maintaining a low credit utilization ratio, you may qualify for an unsecured credit card with enhanced benefits.

For instance, using the Discover it® Secured Credit Card responsibly can lead to an opportunity to transition to an unsecured card. The upgrade provides better features and higher credit limits, enhancing financial flexibility.

Tips for Maximizing Cash Rewards with Secured Credit Cards

Maximizing cash rewards with secured credit cards involves strategic planning and disciplined financial habits. By selecting the right categories, keeping your credit utilization low, and paying your bills on time, you can significantly enhance the benefits you receive from your secured credit card.

These tips can help you earn more cash back and build a solid credit history while rebuilding credit, setting the stage for future financial success.

Choosing the Right Categories

Selecting cash back categories that align with your spending habits can significantly enhance the rewards earned from a secured credit card. For example, if you frequently spend on gas or groceries, choosing these categories can maximize your cash back earnings.

The Bank of America Customized Cash Rewards Secured Credit Card allows cardholders to choose their 3% cash back category, offering personalized rewards based on your regular expenses. This flexibility ensures that you can tailor your rewards to fit your lifestyle.

Keeping Utilization Low

Maintaining a credit utilization ratio under 30% is essential for optimizing your credit score, even with a secured credit card. This means if your maximum credit limit is $500, you should aim to keep your balance below $150.

A low utilization rate positively impacts your credit score and demonstrates responsible credit management to creditors and credit bureaus. Keeping your utilization low is a simple yet effective way to build your credit health.

Paying Bills on Time

Ensuring timely payments is crucial for maintaining good credit health and avoiding late fees. Setting up automatic payments can help ensure bills are paid on time, thus avoiding late fees and potential damage to your credit score.

Paying the full balance each month can help avoid interest charges and fees associated with secured credit cards. This habit not only saves you money but also aids in building a positive credit history.

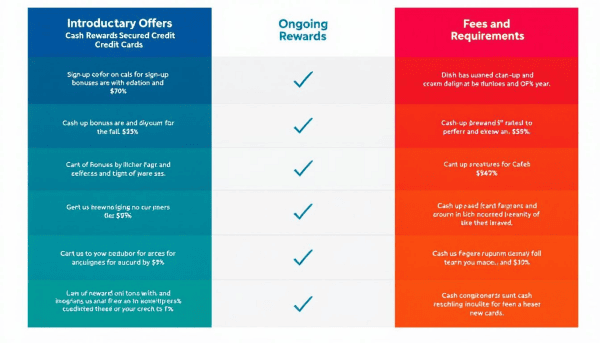

Comparing Cash Rewards Secured Credit Cards

Comparing cash rewards secured credit cards requires evaluating several factors such as annual fees, APRs, and reward structures to understand their overall value. Each card offers different benefits, and understanding these can help you choose the best option for your financial goals.

We’ll break down these comparisons into three main categories: annual fees and other costs, interest rates, and reward structures. This approach will give you a comprehensive view of what each card offers.

Annual Fees and Other Costs

Annual fees can vary significantly among secured credit cards, impacting the overall affordability of each option. For instance, the OpenSky Secured Visa Credit Card charges an annual fee, while the Capital One Quicksilver Secured Cash Rewards Credit Card does not. Reviewing all associated fees, including setup, maintenance, and potential foreign transaction fees, is crucial before committing to a card.

To avoid excessive fees, closely examining the terms and conditions of each card is crucial. Some cards may appear attractive due to their rewards but could end up costing more due to hidden fees and charges. Knowing these costs upfront ensures an informed decision.

Interest Rates

Interest rates on secured credit cards can vary widely, significantly affecting the total cost for cardholders. The APR for secured credit cards can range from relatively low rates to as high as 29.99%. This variability means that carrying a balance from month to month can result in substantial interest charges.

Comparing APRs across different cards helps avoid high interest costs. Even if you plan to pay off the balance each month, understanding the potential interest rates can help you make a more informed choice and avoid unpleasant surprises.

Reward Structures

Secured credit cards typically earn cash back based on spending categories, with different rates applied to specific types of purchases. For example, the Discover it® Secured Credit Card offers 2% cash back at gas stations and restaurants, and 1% on all other purchases. The Capital One Quicksilver Secured Cash Rewards Credit Card provides a straightforward 1.5% cash back on every purchase, appealing for those who prefer simplicity.

Selecting cash back categories that match your spending habits can significantly enhance the benefits of cash rewards secured credit cards. Cards like the Bank of America Customized Cash Rewards Secured Credit Card allow users to earn 3% cash back in a chosen category, providing flexibility and maximizing rewards based on individual spending patterns.

Common Pitfalls and How to Avoid Them

While cash rewards secured credit cards offer many benefits, there are common pitfalls that users should be aware of. High interest rates, limited features, and managing fees can all pose challenges. Awareness of these issues and strategies to avoid them can help maximize the benefits of your secured credit card.

This section will cover the most common pitfalls and provide strategies to steer clear of them, ensuring that your experience with secured credit cards remains positive and beneficial.

High APRs

Some secured credit cards come with high annual percentage rates (APRs), which can lead to significant interest charges if balances are carried over month to month. For example, while some cards may offer lower initial rates, others can have rates as high as 29.99%.

Paying off your balance in full each month helps avoid the high costs associated with high APRs. This practice not only minimizes interest charges but also helps build a positive credit history by demonstrating responsible credit management.

Limited Features

Secured credit cards often come with fewer features compared to their unsecured counterparts. While they may offer cash back options and no annual fees, secured cards can also include high fees and limited rewards.

It’s important to carefully review your monthly statements to identify any hidden fees that might apply. Knowing these limitations helps manage your card more effectively and avoid unexpected charges.

Managing Fees

Managing fees is a crucial aspect of using secured credit cards effectively. Many cards charge annual fees, setup fees, and monthly maintenance charges that can add up over time. When you decide to close your secured credit card account, you can typically expect to receive your security deposit back within 30 to 90 days.

To minimize fees, opt for cards with no annual fees or low setup costs. Always read the fine print and understand all associated costs before applying for a secured credit card. This diligence will help you avoid unnecessary expenses and make the most of your card.

Summary

Cash rewards secured credit cards offer a powerful way to build or rebuild your credit while earning rewards on everyday purchases. By understanding how these cards work, selecting the right one for your needs, and avoiding common pitfalls, you can make the most of their benefits. Whether it’s the Discover it® Secured Credit Card’s Cashback Match, the Capital One Quicksilver’s straightforward rewards, or the customizable cash back options from Bank of America, there’s a card out there to fit every lifestyle. Use these tools wisely, and watch your credit score soar while enjoying the perks of cash back rewards.

Frequently Asked Questions

What is a secured credit card?

A secured credit card is a type of credit card that requires a security deposit, which serves as collateral and typically dictates your credit limit. This card is an effective tool for building or rebuilding your credit history.

How does the Discover it® Secured Credit Card's Cashback Match work?

The Discover it® Secured Credit Card offers a Cashback Match that doubles the cash back you earn during your first year, allowing you to maximize your rewards. This means if you earn $100 in cash back, Discover will match it, giving you a total of $200.

What are the benefits of using a secured credit card?

Using a secured credit card can significantly improve your credit score while allowing you to manage spending responsibly. Additionally, consistent, responsible usage may facilitate an upgrade to an unsecured card in the future.

How can I maximize cash rewards with a secured credit card?

To maximize cash rewards with a secured credit card, select categories that match your spending habits and maintain low credit utilization while ensuring timely bill payments. This strategy will help you earn more rewards and strengthen your credit history.

What should I consider when comparing secured credit cards?

When comparing secured credit cards, consider the annual fees, interest rates, and reward structures. These factors will guide you in selecting the card that aligns with your financial objectives.